Innovations in telemetry technology open the door to consumption billing

Why don’t liquid heating fuel dealers charge their customers on a per-use basis, like the natural gas and electric utilities do? A heating equipment manufacturer’s sales representative once posed this question to Oil & Energy during a trade show. This was a few years ago – long before Russia invaded Ukraine, setting off a chain of events that would fuel a historic spike in energy prices.

In response to the manufacturer’s question, we first pointed out a few examples of companies adopting comparable tactics: there was at least one online business enabling its partnered heating oil dealers to market “low-price” deliveries on an “on-demand” basis, and of course, many more fuel retailers offer customers a range of flexible pricing programs – budget, fixed price, cap, etc.

However, we had to concede that the manufacturer’s basic premise was correct: whether selling via will-call or automatic delivery, whether accepting payments online or in-person, and whether billing up front or monthly, heating fuel dealers charge by gallons delivered, not gallons used. Why?

Practically speaking, the obvious answer is that unlike natural gas and electricity, heating oil and propane are stored independently by the customer. So, exact usage is harder to gauge, and further, any runout could result in an equipment shutdown requiring a technician to head out to the customer’s location to manually restart their system.

Of course, the manufacturer knew all of that. He also saw that tank monitoring platforms could help solve these problems. (Remember, this was just a few years ago.) So, he rephrased the question. If all the appropriate hardware and software were in place, what was preventing dealers from doing this?

Looking beyond storage, delivery, and equipment limitations, we turned the conversation to how heating fuels are bought by wholesalers and retailers. In terms of overall downstream marketing operations, we speculated that per-use billing would require a complete reinvention of existing supply contracts and hedging programs.

Heating fuel dealers would not only need to change the way they buy, price, and market their products — they’d also need to begin thinking about their businesses in a totally different light and planning their operations accordingly. Here, the manufacturer agreed wholeheartedly. Charging for heating fuels by gallons used, rather than gallons delivered, was not impossible, but it would demand nothing short of a paradigm shift.

In March 2022, Massachusetts heating oil dealers reported prices as high as $6.10 per gallon (see “Record-High Heating Oil Prices,” April 2022 issue).

How’s that for a paradigm shift?

Prices are up all across the board, not only at the rack but also costs of labor, equipment, transportation, and everything else.

“When you go to the grocery store, suddenly four or five bags cost $150,” relates Jim Schwartzfisher, telemetry unit manager at propane equipment wholesaler Bergquist, Inc. “That affects everyone regardless of income level.”

Faced with skyrocketing costs, many heating fuel dealers, like their customers, are looking for ways to do more with less. Today’s fuel marketers can use monitors in tandem with their existing back-office software and other technological solutions to improve both everyday delivery operations and overall inventory management. On this point, all telemetry providers can agree.

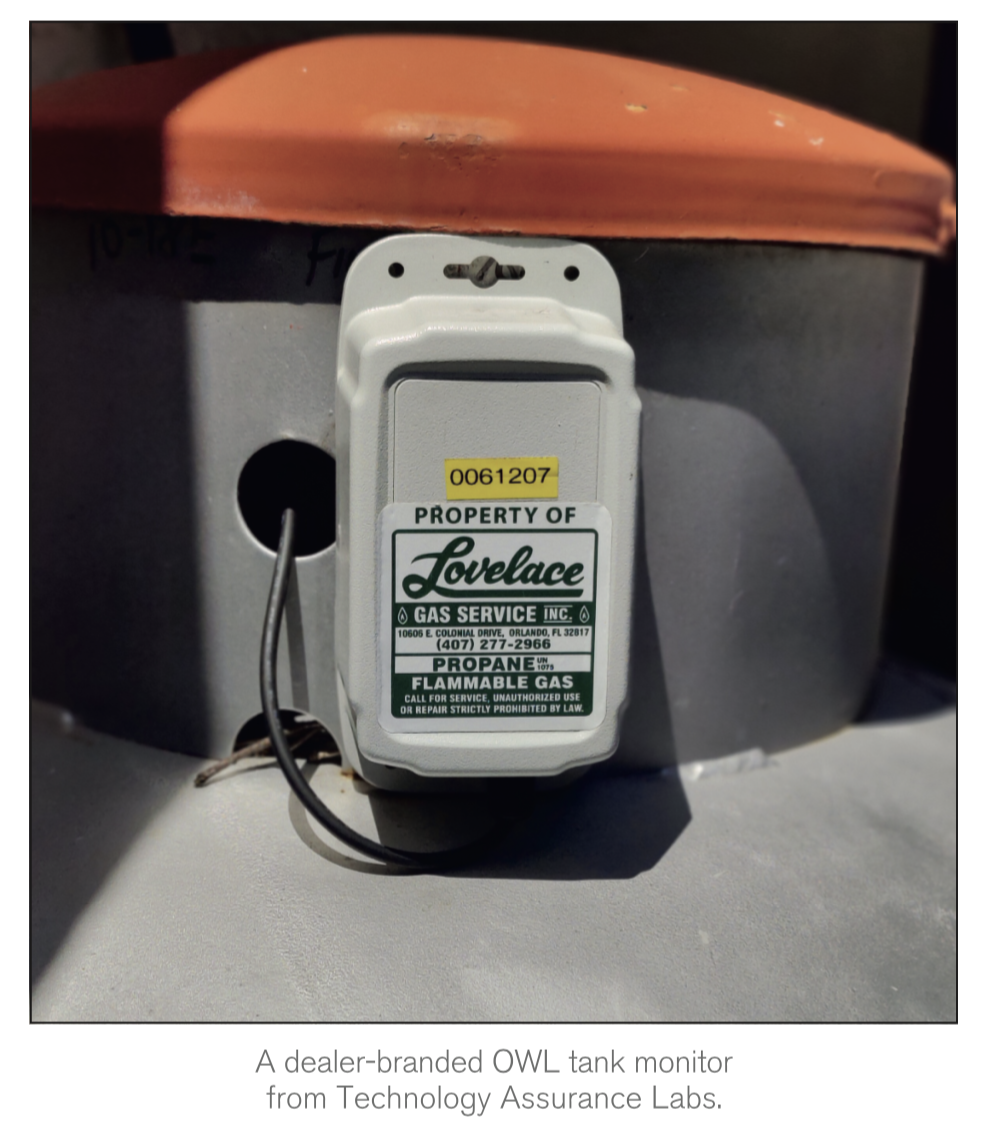

In addition to Bergquist, which offers both Cavagna gas meters and Anova tank monitors, Oil & Energy spoke with representatives from Otodata, makers of Nee-Vo®tank monitors; Angus Energy, makers of GREMLIN®monitors; and Technology Assurance Labs, makers of OWL©tank monitors. We’d like to thank them all for volunteering their insights on tank monitoring and related solutions.

Boosting operational efficiency, and thereby reducing operational costs, has been a longtime objective for tank monitoring platforms; see any article Oil & Energy has written on the subject over the past five years. But skyrocketing energy prices have made that mission critical for fuel marketers.

“Otodata’s mission has always been to increase efficiency and in turn, reduce costs associated with fuel consumption and labor,” reflects André Boulay, president of Montreal-based Otodata. “Savings from tank monitoring have skyrocketed due to rising fuel prices.”

How much? Boulay estimates that “effective fuel monitoring software like ours, increases efficiency by more than 30% as it allows fuel marketers to keep tabs on which customers are in need of fuel.” Using this knowledge, Boulay says, fuel marketers can “deliver when needed, reducing drop frequency.”

As reported in our June issue, the spike in fuel prices may also be contributing to a surge in acquisitions (see “The Future Is Your Choice” and “This Is Personal”). As businesses expand, so do their customer lists and areas of operation.

“As fuel dealers continue to expand their service territory, we are seeing a quick adoption of tank monitors at the more remote locations,” says Shane Owens, CEO of Technology Assurance Labs. “As territory extends outward, it stretches resources and increases the expense involved in traveling to those locations to perform tank fills. Our customers realize the value in ensuring the trip is needed and the efficiency is maximized by only filling the tank when it’s necessary.”

Reducing drop frequency has some tertiary benefits as well. “Obviously you’re saving fuel on your trucks,” Schwartzfisher says. “You’re also saving miles, wear and tear on brakes and tires, and overall bobtail maintenance. If you have 5,000 accounts and can knock out one or two deliveries a piece, you’re probably talking about hundreds of thousands of dollars saved in just a year. We’ve had numerous clients who told us they were able to let a driver retire and didn’t have to hire a replacement. Likewise, a lot of companies have retired a bobtail and didn’t buy a new one, or pulled their oldest truck off the road to use only in cases of emergency.”

“Impacts of price movements can mean different things to different people depending upon whether they offer a pricing program and if they hedge against spiking prices,” notes Phil Baratz, CEO and founder of Angus Energy. “From the most basic perspective, a monitor can give a dealer confidence to push off a delivery, or to make a smaller delivery, if the dealer benefits by that deferral.”

However, Baratz cautions, this also raises some big-picture questions. “If the deferred delivery is simply because ‘prices are high,’ does the dealer KNOW that prices won’t go higher before making the deferred delivery?” he asks. “Is the dealer factoring in the costs to visit some customers twice instead of just once? On the other hand, many LP dealers use monitors to fill up tanks during the summer in order to get more favorable winter supply allocations.”

“Whether we’re talking about heating oil or propane, demand is typically lower in the summer,” Schwartzfisher reminds us. “Remote monitoring can enable dealers to buy those fuels at a cheaper cost and use them essentially as storage for the colder the months to come.”

Schwartzfisher is, of course, talking about peak shaving, a common practice among fuel dealers, especially propane marketers and hedgers. But with fuel prices irregularly high for summer, peak shaving and hedging have become extremely difficult.

Here’s where things get interesting.

Telemetry technology has advanced a great deal over the past few years, to the point that new devices and software integrations actually empower some fuel marketers to go beyond “shaving” or even “flattening” the curve. Now, with the right tools, they can essentially throw the curve out the window and adapt to changes on the fly.

The Cavagna Smart Meter system, for example, features an integrated digital portal that allows companies to measure exactly how much propane a customer is using and then bill out only that amount each month. “In effect, it allows you to bill similar to how you would for natural gas,” Schwartzfisher says.

Whereas a few years ago this concept might have sounded far-fetched, with prices as high as they are today, “it’s really starting to gain steam,” Schwartzfisher says. “Marketers are seeing the opportunity to take a little pressure off their customers and keep them happy.”

How does it work?

As it turns out, it’s very similar to existing tank monitoring platforms. One key difference is that the Smart Meter is installed not on the tank, but along the pipes leading out of it. Another important feature is the meter’s integrated software.

“The Smart Meter portal not only allows you to see consumption on a daily basis like any tank monitor software does, but also breaks it down so it can be easily billed out,” Schwartzfisher explains. “There’s an invoice function in the software itself so you can look at customers’ usage data, download it into a Excel or CSV file, and have all that data broken down into whatever time frame you’d like.”

Like conventional natural gas meters, the Smart Meter measures propane consumption in terms of cubic feet. Some customers — for example, those who have moved countryside and find themselves using propane for the first time — actually prefer this because their billing statement reads exactly like a natural gas bill would. But for those who don’t, the software allows the marketer to covert from cubic feet to gallons with just a couple clicks.

Another nifty feature: the ability to execute remote shutoffs. “That comes in with delinquent accounts or apartment complexes,” Schwartzfisher says. For example, if a tenant moves out or will be away for the season, the propane marketer can use the integrated software to stop gas from flowing to their unit.

Each of these built-in features is innovative in its own right, but it’s what happens behind the scenes, as a result of the meter, that could truly be game-changing.

Let’s say, for example, you have an automatic delivery customer who’s frustrated with the rising cost of fuel and asking why they’re paying for yet another delivery when it’s getting warmer outside. Consumption billing removes that question from the equation as the customer is no longer paying for deliveries.

Whereas a customer with a conventional tank monitoring system can see when fuel was delivered, a customer with a consumption billing agreement in place doesn’t even have to look, because they’re simply paying for what they use.

Cavagna isn’t the only telemetry provider offering marketers and their customers a consumption billing option. Technology Assurance Labs was granted a U.S. patent for a “Pay as You Go” virtual metering system back in 2017 and had started offering the service about four years prior.

“OWL radios and software not only monitor tank usage, but also offer a ‘Pay As You Go’ service,” confirms Ken Stauffer, co-founder of Technology Assurance Labs. “It allows dealers to invoice customers monthly based on real usage, thereby increasing the dealers’ ROI and winning competitive bids.”

“Homeowners are able to view usage rate data that is updated twice a day and understand common behaviors that drive usage in their homes or businesses,” adds Owens. “This knowledge can lead to more energy efficient decisions and ultimately savings through reduced usage.”

Has that actually been playing out? It depends who you ask.

Angus Energy also offers its clients the ADEPT delivery planning tool.

“For those homeowners who purchase on a will-call/on-demand basis, monitors can give a tank level and in some cases can give ‘days till runout,’” says Baratz, the Angus Energy CEO. “However, using that to defer deliveries due to high prices puts the homeowner in the position of speculating that prices will fall. The truest way to save money is to consume less fuel – but most homeowners are not feeling enough of an inflation pinch to do that.”

Still, even if some customers aren’t feeling the pinch, some dealers certainly are.

“The other beauty of consumption billing is the dealer doesn’t have to worry about getting a $500 payment from somebody to provide fuel they don’t have in storage,” Schwartzfisher says. “Now they can fill up each tank at their leisure.”

One caveat there: they “don’t have the worry” so long as they’ve integrated telemetry and consumption billing into a greater overall plan to optimize their business operations. And here’s another point on which telemetry providers agree: meters or monitors alone can only accomplish so much.

“What needs to be understood and repeated about monitors is that they are of great value if used as part of an overall delivery optimization plan, but they are worthless — actually, they can be very costly — if just thrown on a tank without a plan to use the data to optimize operations,” says Baratz.

This explains why some tank monitoring providers don’t stop at hardware or software, but also offer dealers advice on how to utilize these solutions and incorporate them into their businesses.

Technology Assurance Labs is one such company moving deeper in that direction. “In addition to updated tank monitors, 2023 will see the launch of a new radio that supports multiple tanks and meters simultaneously, new offerings that are customized to a dealer’s business process as opposed to adapting the process to the monitoring solution, and consulting on solutions that work for a dealer’s business,” Owens says. “We are leveraging the experience gained over decades of technology consultation to help business owners who are unfamiliar with technology understand the differences and choose solutions they need and not the solution they are being sold.”

About that Supply Chain

Supply chain logjams have been affecting heating fuel dealers in a number of ways. So, we asked two tank monitoring providers how they’ve been impacted.

Otodata has a vertically integrated business model, meaning the company not only markets and sells tank monitors but also designs, develops, and assembles them, along with providing after-market support.

“Fortunately supply chain issues did not have a significant impact on our ability to deliver our monitors in a timely manner,” says Otodata President André Boulay. “With our new state-of-the-art Pittsburgh facility opening shortly, we will be able to support our customers even better in the face of these challenges!”

Andy Stearns, of Bergquist, Inc., talked to us earlier this year about how the propane equipment wholesaler has been “Unplugging Bottlenecks” in the supply chain. His colleague, Jim Schwartzfisher, cautions that all tank monitors could be subject to some of the supply chain issues impacting other equipment.

“We haven’t seen it on meters, because we brought a lot in all at one time, but on the monitors there have been some disruptions,” he says. “It hasn’t affected us immensely, because we have an open line of communication with all of our suppliers. However, you have to keep in mind that there are parts in all tank monitors, like semiconductors, which are not unique to these devices. When you have a product that has similar components to all cars, and there’s a global shortage, at some point I imagine it will catch up with you.”