One of the biggest takeaways from the energy industry’s 2017 trade show season has to be the penetration of “smart” technology into virtually every segment of the field: manufacturing, delivery, service, training, sales, marketing and everywhere in between.

Today’s connected consumer uses mobile technology to order fuel, schedule equipment services, enroll in a service agreement or budget plan, adjust the thermostat, check the status of a heating and air conditioning system, and perhaps most importantly, to explore the countless home comfort products and providers that are now just a tap away.

The Pew Research Center finds that more than three-quarters of Americans (77%) own smartphones, so it’s no wonder that more and more comfort providers are exploring new ways to connect with customers via mobile technology.

Smartphones already link homeowners to their fuel providers (via mobile websites) and their heating equipment (via wireless thermostats), but now some companies are stepping up to close the gap between the two, connecting homeowners directly to their fuel supply via consumer-facing, mobile-friendly tank monitoring systems.

“Right in Line…”

Bergquist, maker of the wildly popular Gaslog tank monitor, recently added the LPG TankCheck sensor from Mopeka Products to its expanding tank monitor portfolio. A magnetic monitor built for use with RV cylinders, gas grills, residential LP tanks and even steel forklift cylinders, the LPG TankCheck sensor works in conjunction with the Tank Check mobile app to show consumers how much propane is left in their tanks.

Asked why the company, which already boasts over 200,000 Gaslog devices in service, decided to add a consumer-facing tank monitor to its product line, Bergquist Tank Monitor Sales Specialist Mike Vigliotti noted that people now use mobile devices for a wide range of tasks around the home.

“Consumers are doing more and more from their smartphones these days, adjusting their thermostats, security systems, garage door openers, etc. Having access to tank levels falls right in line with that,” Vigliotti says. “It gives them peace of mind to not worry about a runout, and helps them to better manage their heating costs.”

Indeed, consumer-facing tank monitors seem tailor-made for those will-call delivery customers who stay off of automatic delivery because they want to retain control over their fuel costs and supply. With a mobile app like TankCheck, independent minded will-call customers can now enjoy the same convenience and peace of mind that many automatic delivery customers have come to appreciate, without sacrificing control of their delivery schedules.

But what about automatic delivery customers?

They too can benefit from tank monitors, Vigliotti says, pointing out that no automatic delivery system is perfect, especially in variable-use cases where a homeowner requires propane for numerous applications, like a space heater, a water heater, a generator, an outdoor kitchen, a dishwasher and a clothing washer-dryer.

“It is impossible for the fuel dealer to know when the customer’s generator has been running due to a power outage, or how often they may be using their outdoor kitchen or pool heater,” Vigliotti says. “Perhaps they had company in town and have used more hot water than usual. All of these things can contribute to a higher consumption rate than planned and can lead to an out-of-gas delivery.

“With the tank monitor, there is no guessing. The supplier gets regular updates on fuel levels and notifications when the tank drops to a predetermined alarm level. The homeowner can also have access to view the level and get peace of mind.”

Christian Staats, general manager/technical director of Schmitt Industries, makers of Xact® Tank Monitoring Systems, agrees with that assessment. “Automatic delivery is great when a set pattern has been established,” he says, “but what about changes in weather, like when it’s colder than forecast?”

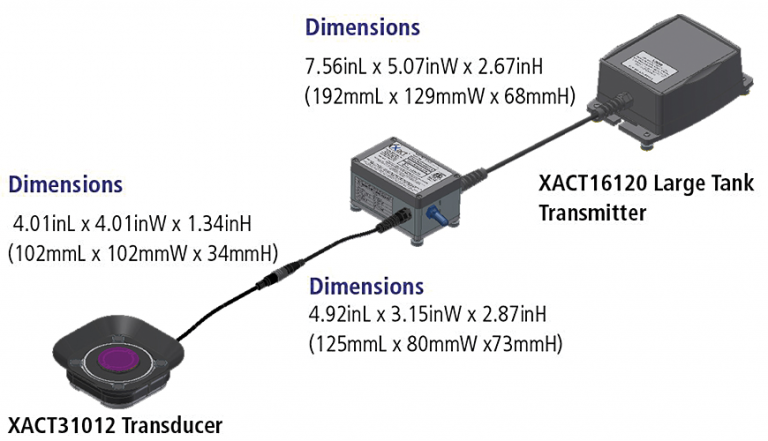

Xact® monitors calculate a tank’s fill level using ultrasonic technology and transmit that data via the Globalstar® satellite network to a secure website for display. The company will “introduce new products in the near future that incorporate two-way satellite communications, allowing customers to get real-time snapshots of their inventory, as well as cellular and other lower-cost telemetry versions of our products,” Staats says.

“The networks for reporting tank data are evolving to lower cost and lower power requirements,” says Hank Smith, President and CEO of Independent Technologies, the parent company of WESROC Monitoring Solutions. “We have made a huge commitment to having all our monitoring on the LTE (Long Term Evolution),” Smith continues, referring to the 4G broadband technology standard for high-speed wireless communications. “We announced our first LTE monitoring product in April, and expect the full WESROC cellular monitoring product line to be converted this year.”

If it sounds like tank monitors have come a long way, it’s because they truly have. And that’s due in part to the same Wi-Fi technology that empowers consumer-facing apps like TankCheck and Angus Energy’s Paygo™.

A recent entrant into the tank monitor market, Angus Energybegan developing and selling Gremlin® tank monitors in order to incorporate actual-usage-based billing into Paygo, the company’s proprietary system which allows fuel dealers’ customers to pay for their propane or heating oil after it’s used rather than at the time of delivery.

“We never thought of getting into the tank monitoring business,” says Angus Energy CEO Phil Baratz. “One thing that really worked out for our benefit was the incredible proliferation of Wi-Fi.” Baratz and Angus Energy found in Wi-Fi technology a solution that made tank monitors not only more affordable but also more interactive. “Now a customer can go to the app store and download an app that comes up with the dealer’s logo and shows their tank level, their last delivery date and their anticipated delivery date,” Baratz says.

“Instead of just saying how much oil or propane is in the tank, we’re giving the customer something more. Our tank monitoring app really becomes a consumer communication app that happens to have tank monitoring on it.”

“To Know Anytime…”

While mobile apps help bring tank monitors (and by extension, fuel dealers) into consumers’ connected homes, they can also greatly advantage dealers in terms of delivery management. WESROC Monitoring Solutions, which produces tank monitors for both oil and propane storage, recently rolled out the WESROC mobile app for use by in-field personnel as well as office staff and managers.

“We are continually updating our software to accommodate new requests and to act on suggestions that our hundreds of customers offer us on a daily basis,” says CEO Hank Smith. “The WESROC app is used often by dealer management to know anytime, anyplace where inventory level stands, what deliveries have been made, if a delivery is required, and also to act as an audit tool.

By their very essence, tank monitors are tools for knowledge gathering. Used correctly, this knowledge can empower dealers to implement a number of key process improvements. “Tank monitors can aid the office staff in dispatching the drivers to make an optimal delivery,” says Vigliotti. “Drivers love the tank monitors as well, because it means fewer runouts and afterhours deliveries.”

Staats concurs. He sees “improved efficiencies, bigger deliveries, and fewer wasted trips for tanks that do not need fuel” as some of the most tangible benefits of tank monitors. “Drivers can route accordingly, not guess,” he adds.

The same goes for dispatchers, especially when tank monitors are connected with the dealer’s back-office software. According to Vigliotti, “Most systems already have the setup in place, so the tank readings automatically feed into the back-office system, which helps to make things run more efficiently.”

Just as tank monitors fit snugly into a consumer’s home automation package, so too do they round out the dealer’s business intelligence suite. “The benefits of e-logistics, combining forecasting, ticketing, tank monitoring, routing, and on-board truck computing can be dramatic, reducing trucks, minimizing customer losses and creating growth opportunities,” Vigliotti explains.

It’s not hard to imagine how. By increasing drop sizes, dealers can reduce delivery costs; by reducing delivery costs, dealers can expand their service area; and an expanded service area means more sales opportunities. Of course, it’s never as easy as sitting back and watching business boom.

“Realizing these benefits requires a detailed understanding of delivery performance, distribution processes and systems, truck and driver drops, and which class of accounts have the highest cost of distribution,” Vigliotti notes. “With a detailed analysis of distribution cost and truck productivity, one can identify initiatives that systematically reduce cost, potentially saving between 20%-40% of direct distribution costs.”

Some companies, including Angus and WESROC, offer data and software solutions to help dealers decide which of their customers should receive tank monitors in the first place. As tools like these continue to improve, more and more fuel consumers and dealers begin to realize the benefits of tank monitoring. “Every month we add a significant number of dealers to the WESROC family,” Smith says, “and we don’t see signs that that will change anytime soon.”