All

Supply and Demand Report: Used Cooking Oil

Last Month, Clean Fuels Alliance America released a report, compiled on their behalf by GlobalData, on the worldwide supply of used cooking oil (UCO).

UCO is a low carbon intensive (CI) feedstock used for biodiesel and in high demand from producers and end users facing governmental policies related to carbon emissions. There was some concern that as a waste product, UCO supply might not grow at a pace equal to growing demand.

Supply: Collection

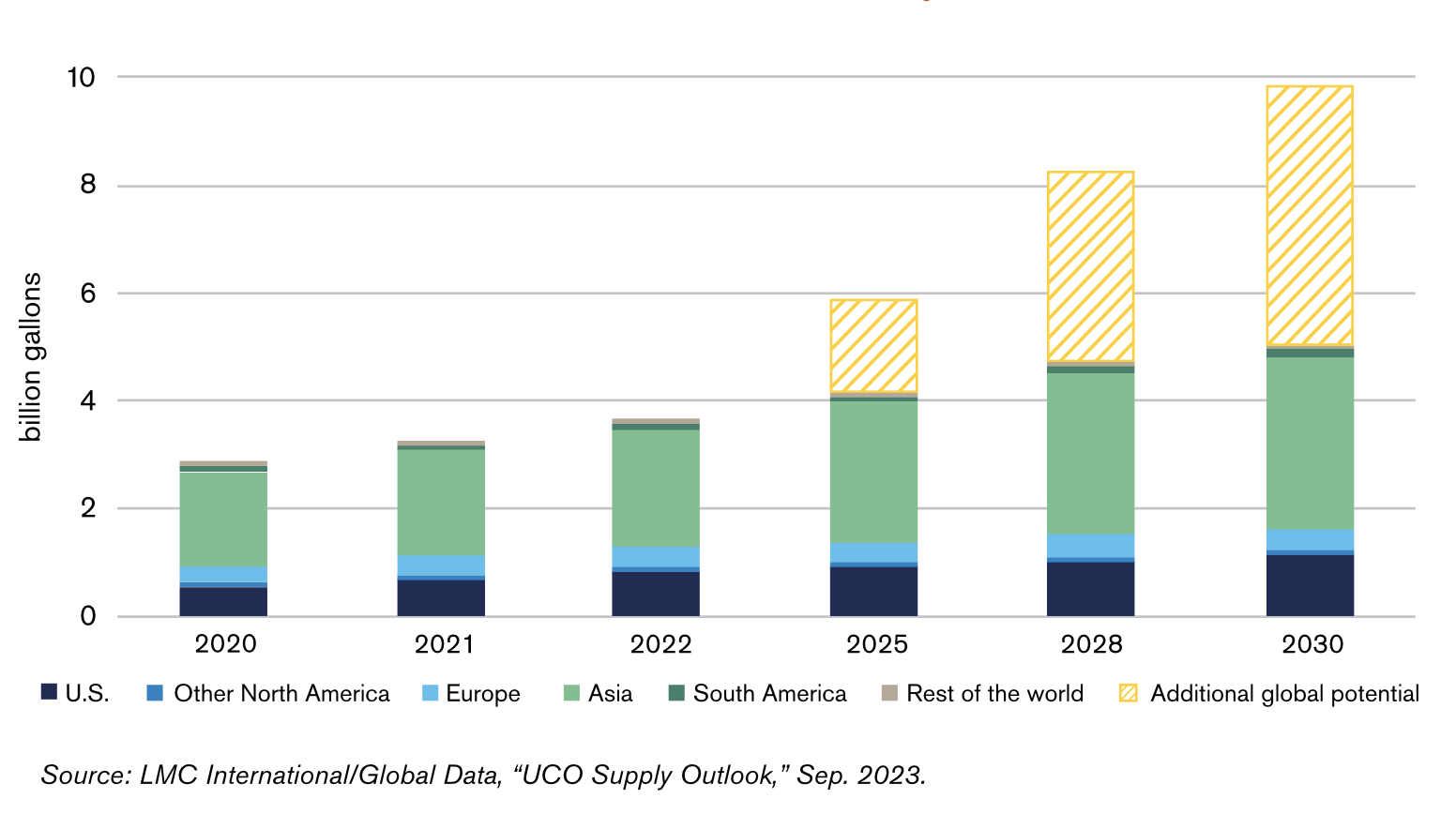

UCO is predominantly collected from restaurants and food preparation factories and linked directly to demand for cooking oil for frying. According to the report, in 2022, global supplies of UCO were estimated at 3.7 billion gallons, with U.S. collection reaching 0.85 billion gallons. Asia was the largest supplier of UCO, with most of its product exported either as UCO or biomass-based diesel. The largest consumer of UCO is the biofuels sector, with approximately 80 percent of the market used in biofuel production in 2022. Consumption in the non-biofuels sector has mostly been in animal feed, which is a shrinking market due to burgeoning regulations over the use of waste oils in animals.

In the U.S., approximately 25 percent of food-related oils were collected as UCO, whereas China collects only about 15 percent of oils. The U.S. has the strongest infrastructure in place for collection and distribution.

Future global supplies are expected to reach between 5 and 10 billion gallons by 2030, as much at 6.1 billion gallons more than in 2022. Global collection rates are forecast to reach 0.6 gallons per capita in 2030 but could reach as much as 1.25 gallons. GlobalData sees significant potential for increasing supply and collection from Asia and Latin America.

U.S. collection growth may be limited by its already high level of approximately 2.5 gallons per person, but could, by 2030, reach nearly 3.2 gallons per capita out of a total domestic supply of 1.1 billion gallons.

GlobalData further posits that if “all countries overcome the barriers to setting up collection networks,” the full global potential could reach 17 billion gallons.

Demand: Trade

GlobalData reports trade of UCO reaching 1.3 billion gallons in 2022, compared to 300 million gallons ten years ago.

Two-thirds of UCO was exported from Asia in 2022, with the bulk going to Europe. The U.S. exports UCO to Canada, Mexico and Asia. Some ports, such as Malaysia, see imports from smaller producers coming into port to be consolidated with others and exported in larger volumes.

U.S. exports have decreased as domestic demand increased. Imports have grown along with demand, and the report forecasts the U.S. to become a net importer in the near future. U.S. exports spiked to approximately 220 million gallons in 2020 and 2021, with imports those years hovering at 25 million and 40 million gallons. Extrapolating from first quarter data, 2023 exports are forecast to reach about 55 million gallons, and imports, 300 million.

Conclusion: Risks & Opportunities

Changes in tastes toward more healthfully prepared foods, and governmental limits on the UCO, could further reduce supply volumes.

Biofuel policies will continue to drive demand. Many states and countries are looking to follow the EU and California low carbon transportation policies. UCO’s low carbon intensity score will make it more valuable as a feedstock than crop-based fuels. Sustainable aviation fuel (SAF) policies, the U.S. SAF tax credit, and renewable fuel production credits are also linked to CI values; and there are negotiations in the EU on the ban or limit of crop-based fuels. While these policies do not call for the use of UCO, they promote the use of low carbon feedstocks.

The report sees potential to increase collection rates worldwide. Infrastructure is one of the largest obstacles to collection, and lower income countries may not have the logistics and infrastructure to develop a collection network. In the past, higher prices have led to increased UCO collection in some countries, but the greatest opportunity may come from governmental regulation of the disposal of waste oils.

All data sourced from “Global Supply and Trade of Used Cooking Oil,” GlobalData, 2023

Related Posts

Seeing Beyond Net-Zero

Seeing Beyond Net-Zero

Posted on June 3, 2024

Supporting Your Lower Carbon Journey at All Stages

Supporting Your Lower Carbon Journey at All Stages

Posted on May 31, 2024

What Is Renewable Diesel?

What Is Renewable Diesel?

Posted on May 20, 2024

All Eyes on Visions ‘24

All Eyes on Visions ‘24

Posted on May 20, 2024

Enter your email to receive important news and article updates.