All

About that Basis Blowout…

by Richard Larkin, Hedge Solutions

Recent oil market advance poses significant challenges to hedging next winter

By now everyone is acutely aware of the oil price volatility that has invaded our end-of-winter space while spoiling what was turning out to be a decent heating season in the energy business. Yes, prices had been steadily (some might say relentlessly) rising but at least it was somewhat orderly. As we exit the 2021-2022 heating season and look toward the 2022-2023 heating season, we face two significant challenges to hedging next year aside from the price itself: dealing with the doubling of option premiums and managing basis extremes.

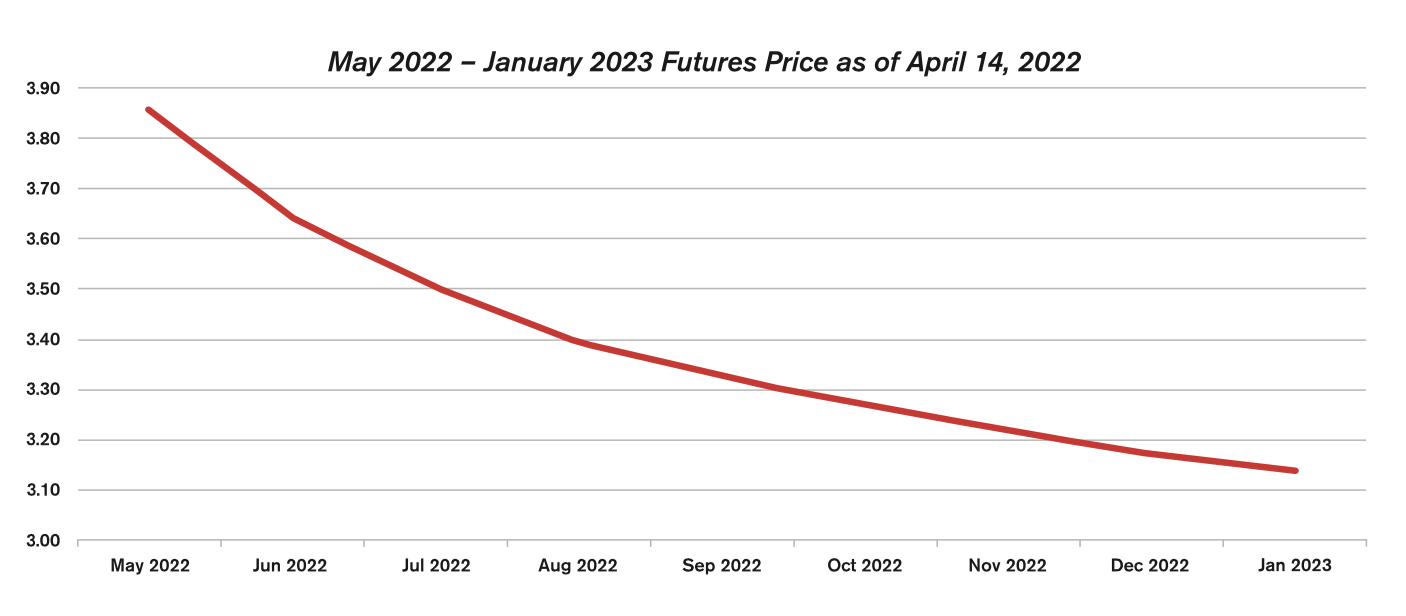

The Russian invasion of Ukraine has inserted “the fear of not enough” once again into an oil market that, by any measure, has had more than enough oil since the shale revolution emerged in 2014. Based on the shape of the futures curve, this fear will likely be short lived. Oil prices are significantly backwardated (see chart); the current spot price of ULSD is trading a whopping $.65 per gallon higher than the January futures contract! The good news here, if a bit optimistic, is that, when applying the same margin to the winter strip, the offers for next heating season’s cap prices will be $.65 per gallon under the current retail price. Who wouldn’t jump on that proposal?

The considerable challenge has been the increase (almost double the previous year) in the option premiums. This, of course, transfers to the fee to the customer; required to allow for access to lower pricing if that opportunity materializes next winter. The typical reaction to the higher option costs is to forego this tool and offer fixed pricing instead. I would offer a rather emphatic word of caution, especially since we’ve been here before. In 2008, prices spiked to similar levels and in similar fashion – quick and excessive. The panic, or fear of not enough, drove prices to over $4.00 per gallon and it was “certain” that they would never fall again. Seven short months later, the oil price retreated to $1.10 per gallon. Many an energy marketer opted out of spending that $.45 option premium and it cost them dearly. History offers painful but useful lessons. Important to know: Option premiums are priced using a ubiquitous model called Black-Sholes, which won a Nobel Prize in economic science. The reason premiums are priced at this level is because the model is telling you that your risk is commensurate with the premium. You don’t have to look over your shoulder very far to understand why. Since the invasion began, daily movement of oil prices has exceeded $.20 per gallon between the high and low more times than not over the past 45 days.

Let’s look at the second issue I mentioned: managing the extreme delta in basis.

In the January/February edition of this publication, I warned of an impending blowout in the basis (see “Major Blowout Imminent?”). I have been talking about this pending issue ad nauseum since late December. One client suggested I order t-shirts emblazoned with the term “basis blowout” as a therapeutic remedy to my obsession. But here we are in April and rack markets up and down the East Coast are pricing at a 30 to 60 cent premium to spot Nymex. Just one year ago, the same rack markets were pricing at a discount to the spot Nymex of between 5 and 20 cents.

This basis volatility presents significant challenges when hedging for next year’s sales programs to your customers. Most suppliers, understandably, have already adjusted to this new reality by raising their differentials for wet barrel purchases next winter. The lack of any contango structure in the forward curve acts as a deterrence to building inventories (contango is when futures months trade higher each consecutive month going forward). If one’s inventory is not appreciating, it doesn’t make sense to carry it forward. Much can happen between now and winter to change this dynamic. Therein lies the challenge when choosing whether to buy wet barrels or to hedge on paper. Why pay 6 cents over the futures price for a wet barrel when you might get the same oil for 10 cents under in that same delivery month? A $.16 per gallon swing in cost is a lot to leave on the table, particularly now! It is important to understand that, in a year when option premiums have doubled in price, finding $.16 per gallon by managing basis in certain months can lower your hedging costs significantly.

Rich Larkin is President of risk management consultancy Hedge Solutions. He can be reached at 800-709-2949 or rlarkin@hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.