Volatile oil markets reflect economic turmoil and geopolitical chaos

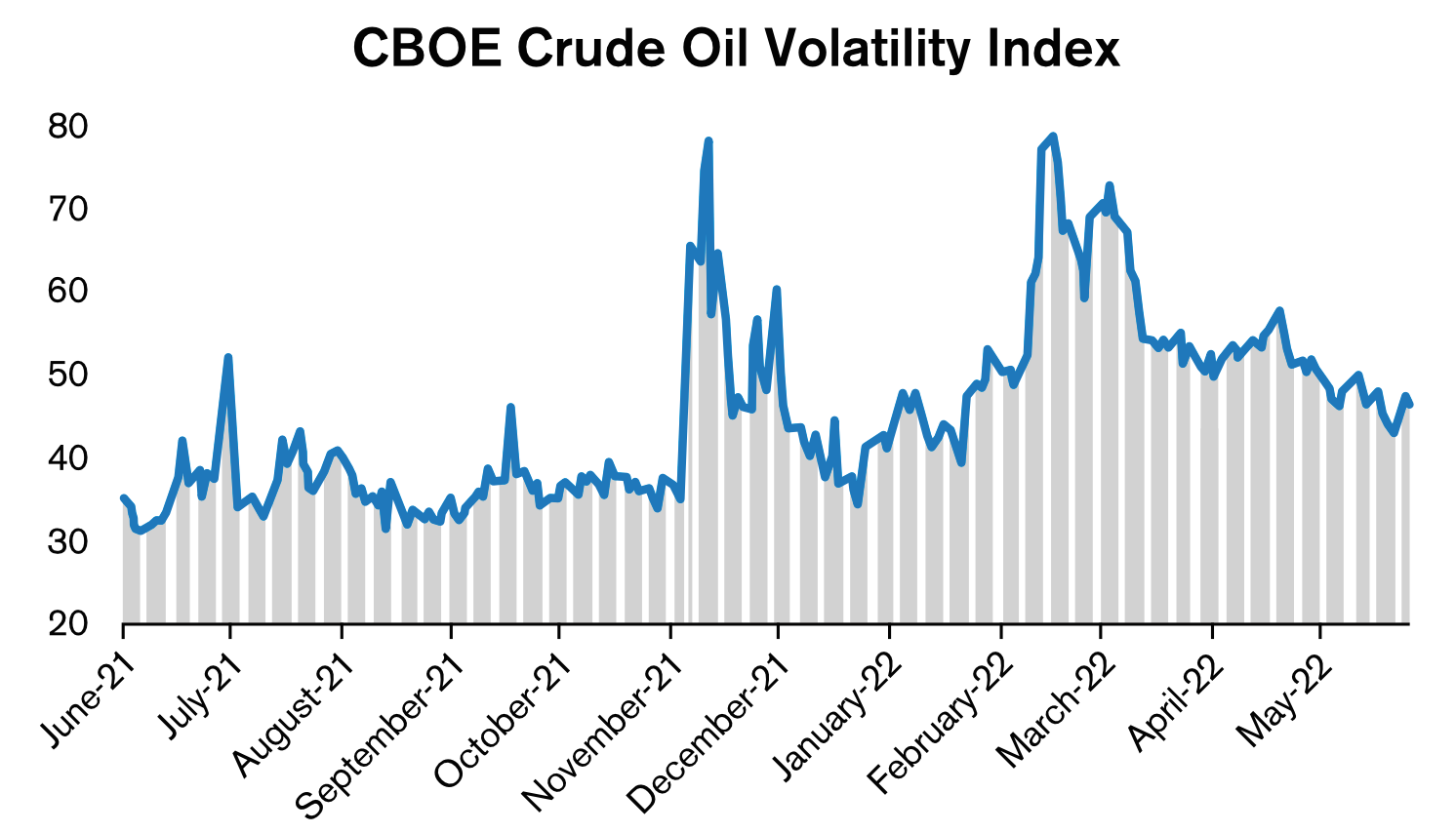

Crude oil and refined products options markets have been pricing in significantly higher and increasing implied volatilities over the past few months compared to the previous year. Implied volatility is one of the main inputs in option pricing models and represents the market’s forecast of the likelihood of movement in a futures price. When implied volatility is high, option premiums are also high.

The CBOE Crude Oil Volatility Index (OVX), which measures the market’s expected 30-day volatility of crude oil prices by tracking the implied volatility of the at-the-money strike process for the U.S. Oil Fund ETF (USO), has been on the rise since last year. The index hit a two-year high of 78.91 on March 7 and has since come off to 46.63 on June 14, but still remains elevated compared to a year ago when it was around the 30 mark. Additionally, implied volatility for near the money options on the New York Harbor Ultra-Low-Sulfur Diesel futures contract (ULSD) was about 51% as of this writing in mid-June while implied volatility for the same options was about 29% in June 2021. This is a 76% jump in implied volatility year-on-year, which is being reflected in higher ULSD option premiums.

Recent economic and geopolitical events have led to higher volatility in oil markets, creating uncertainty about future supply and demand. Let’s take a look at some of these events.

Russia-Ukraine Conflict: The Russian invasion of Ukraine was followed by sanctions imposed by Western nations, which mainly targeted Russian oil and refined products. The U.S. has imposed a ban on purchases of Russian crude oil and products while the European Union has agreed in principle to phase out about 90% of Russian oil and refined products imports in six to eight months after the embargo takes full effect, which is expected to happen by the end of the year. Hungary, the Czech Republic, and Slovakia were given temporary exemptions from the embargo as these countries heavily rely on Russian crude oil imports, and imports along the Druzhba pipeline are allowed to continue.

As a result of these sanctions, Russian oil production fell by almost 9% month-to-month or 860 thousand barrels per day (kb/d) to 9.16 million barrels per day (mb/d) in April. The International Energy Agency (IEA) has said that Russian oil output could fall by as much as 17% in 2022 to 433.8 million tons, which would be its lowest level since 2003. Russia is the third largest oil producer in the world after the U.S. and Saudi Arabia, and the world’s largest exporter of crude oil, and this drop in production could cause a supply crunch and lead to even higher crude oil prices.

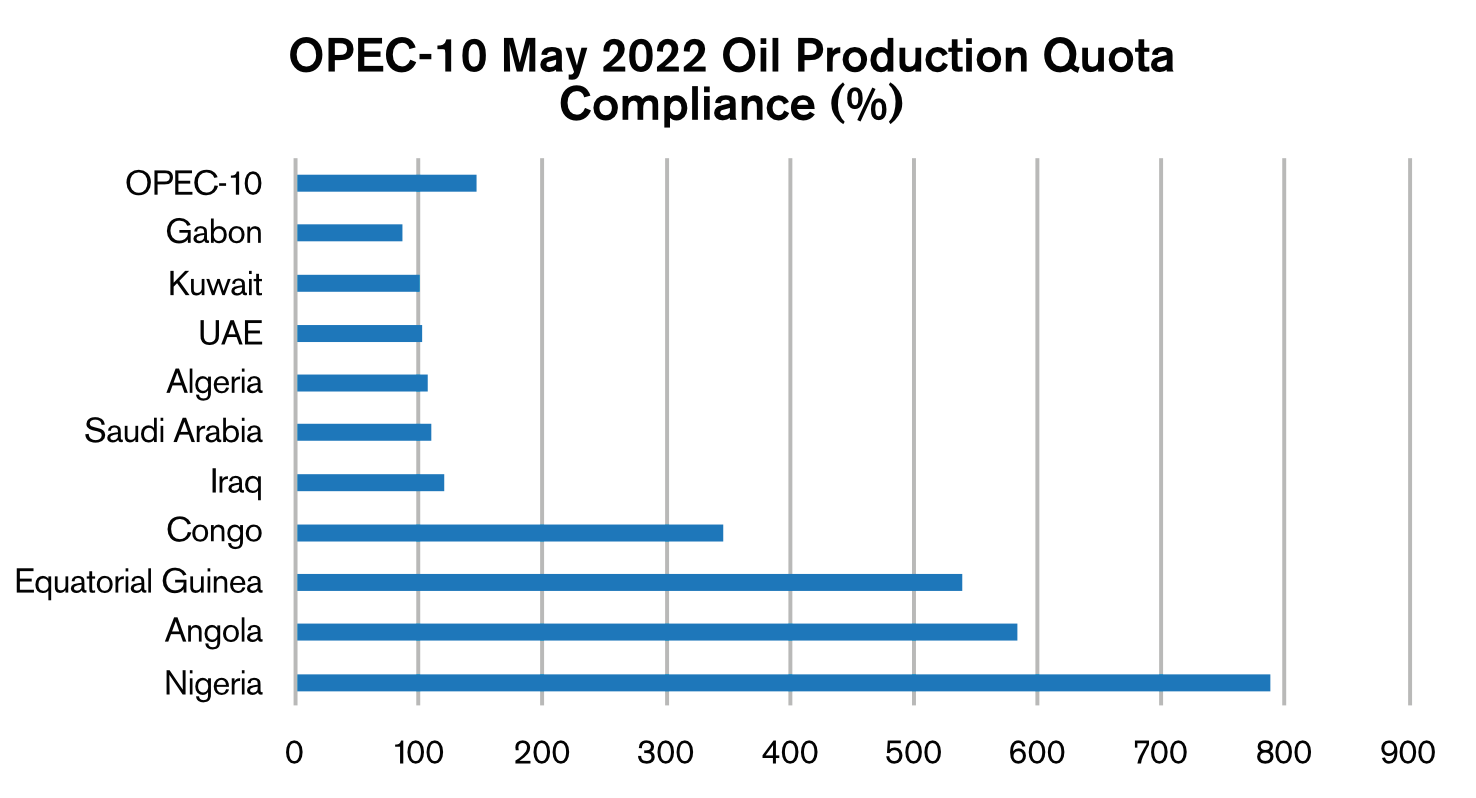

OPEC+ Under-Production: Another supply-related concern is that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) continue to under-produce despite another increase in oil output ceilings for July and August as a response to the drop in Russian oil production following Western sanctions. During their June meeting, OPEC+ nations agreed to increase the combined production limit by 648kb/d in both July and August, up from a 432kb/d increase the group previously agreed on, by shifting a planned output increase from September forward. Despite monthly increases in the production ceiling, which began in July 2021, OPEC+ countries continue to produce well below their set limits.

According to an S&P Global Commodity Insights survey, total OPEC+ compliance was 182.45% in May with OPEC-10 (members with quotas) compliance reaching 148.0%. Saudi Arabia and the United Arab Emirates still have significant spare production capacity and could be able to hit their targets while other countries are mostly maxed out, and Russia, Iran, and Venezuela remain under sanctions that are impacting their oil production. OPEC May output fell by 176kb/d to 28.51mb/d, which was mainly driven by a 186kb/d drop in Libyan oil production due to shutdowns of nearly all of its oil fields amid a political dispute over control of the government. Only the United Arab Emirates, Saudi Arabia, and Kuwait were able to increase output more than marginally, by 31kb/d, 60kb/d, and 27kb/d, respectively.

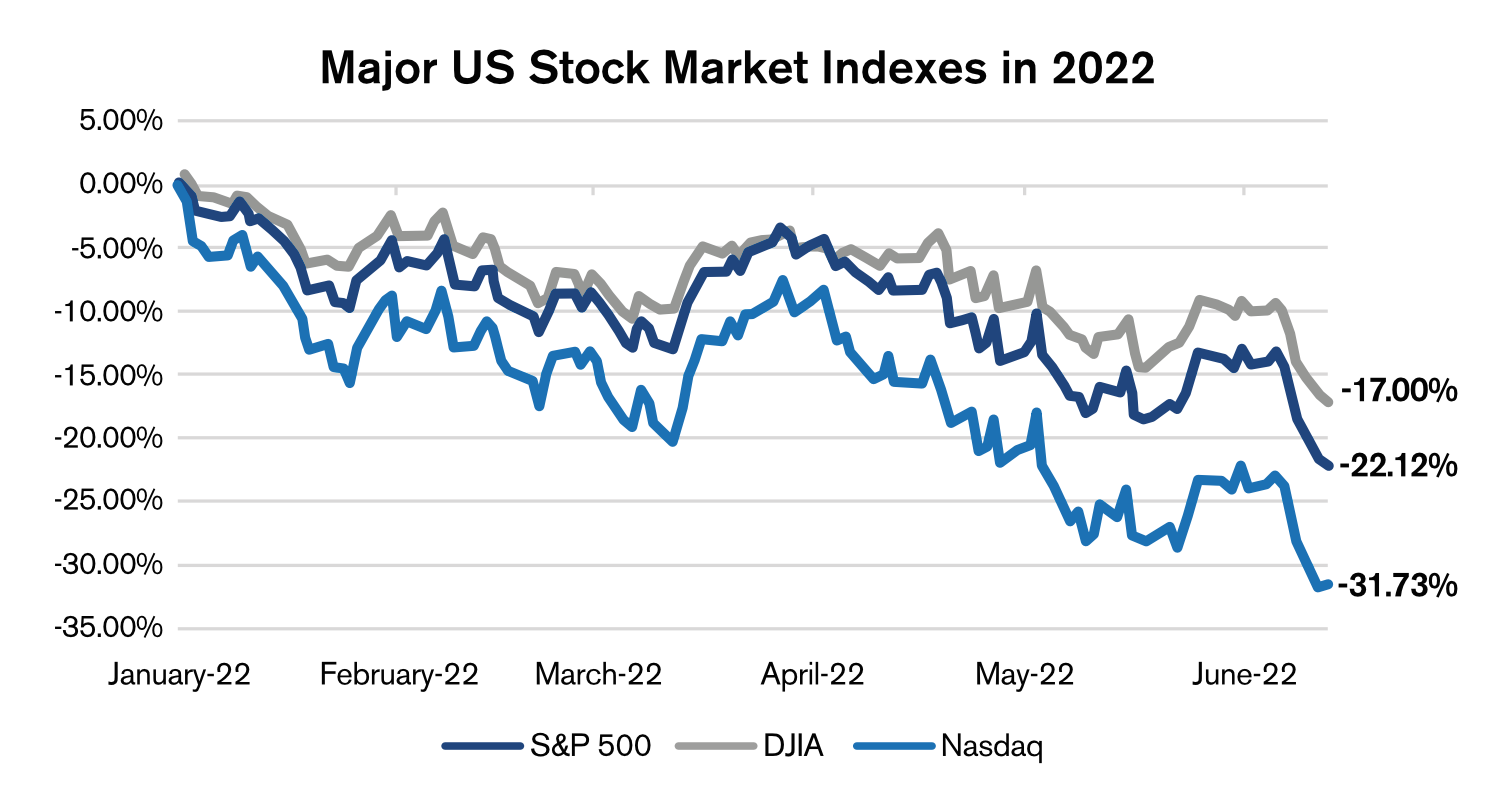

U.S. Inflation: Per the U.S. Consumer Price Index, U.S. inflation was up 8.6% year-on-year in May, its fastest pace since December 1981. Higher consumer prices were mainly led by surging energy, food, and housing prices. According to the AAA, a gallon of gas has hit an average of $5.00 nationwide for the first time in history and experts are forecasting that gas prices could average $6.00/gallon by August. In order to fight rising inflation, the Federal Reserve tightened its monetary policy and boosted interest rates by 75 basis points (bp) to the 1.50%-1.75% target range during their June meeting. The Wall Street Journal has forecasted another 75bp hike in July, which could be followed by a 50bp increase in September and 25bp moves in November and December, putting the range of the fed funds rate at 3.25%-3.50% by the end of the year.

On June 13, the S&P 500 index entered bear market territory for the first time since March 2020 after dropping more than 20% from the recent highs recorded in January 2022. The index closed 3.9% lower at 3,749.81 and fell to its lowest level since March 2021 as fears of recession continued to grow.

COVID-19 Lockdowns in China: Resurging COVID-19 cases in the two largest cities in China, Shanghai and Beijing, and a decision by the authorities to put these cities under lockdown, have greatly affected global oil demand and strongly affected supply chains. Shanghai was in lockdown for almost two months before it began gradually reopening on June 1. Schools have partially reopened on a voluntary basis and shopping malls, supermarkets, and drug stores are opening gradually with a 75% total capacity limit. Mass testing continues across many cities in China as the country tries to maintain its “zero covid” policy and avoid more lockdowns like the one that was enforced in Shanghai. As a result of these measures, demand for gasoline, diesel, and jet fuel in China fell by about 20% year-on-year in April and Chinese refineries cut their crude oil throughput by 10.9% annually from 14.25mb/d in May 2021 to 12.70mb/d, according to the National Bureau of Statistics. This is the second lowest refinery output recorded since the beginning of the pandemic, after April refinery production was recorded at 12.61mb/d.

Geopolitical events tend to have a relatively short-lived influence on oil prices, but today’s supply disruptions are also accompanied by lower crude oil stock levels, likely exacerbating the resulting volatility. Per the Energy Information Administration, U.S. commercial crude oil inventories were 13.63% below their five-year average for the week ended June 10 and 10.28% lower compared to last year. The WTI futures forward curve remains backwardated, providing no economic incentives for storage. On the demand side, the IEA said in its June oil market report that global oil demand could rise by more than 2% to a record-high 101.6mb/d in 2023, but this could be dampened by rising inflation and weakening economic forecasts, as well as lower Chinese demand for oil and refined products due to COVID-related restrictions. All of these uncertainties could cause implied volatility to remain elevated in the near future.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.