All

Winter Weather Forecast 2018-2019

For heating fuel delivery companies in the Northeast, a normal winter is good. Normal means cold. Cold means business.

After the non-winter winter that was the 2016-2017 heating season, the industry welcomed the extreme cold stretch that froze the Northeast from late December 2017 through early January 2018 … even if it happened to come with a blizzard that blanketed New England in anywhere between eight and 18 inches of snow.

You know it’s an extreme weather event when the publisher of the magazine that covers the heating fuels industry pushes back the cover story on said publisher’s new president and chief executive officer in order to feature the industry’s response to said weather event in his stead. (See our January/February 2018 and March 2018 issues.)

Nevertheless, last year’s overall temperatures were in fact a little bit higher than normal. Oil & Energyreaders need look no further than our monthly Weather Summary (page 46) to see that although it was 15 percent colder than the previous year, it was also 6 percent warmer than the cumulative norm, as measured by population-weighted heating degree days (HDDs).

And while a couple of Northeast cities’ HDD totals hovered right around normal — see 5,415 in Boston and 6,343 in Albany, NY — several others, such as Burlington, VT (6,760) and Concord, NH (6,743), had significantly fewer than normal. Indeed, every city in our Weather Summary ended the yearly period with fewer HDDs than normal, and this held true if you were to look at just the winter as well.

So, as we said at the start, normal would be good — welcomed even.

Onto good news then: Fax Weather Alert Service Meteorologist John Bagioni tells Oil & Energy, “Currently, a general and conservative temperature forecast for the Northeast would be for near normal to 1.5 degrees colder on average, with HDD totals generally 1% to 3% above normal.”

Thank You, Modoki!

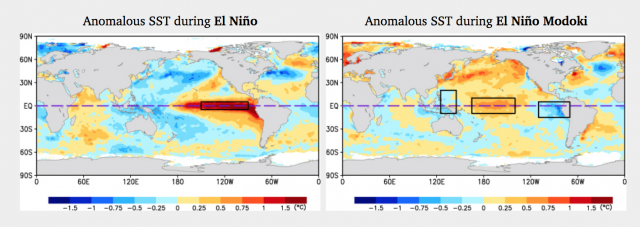

The normal to colder-than-normal temperatures coincide with forecasts for a centrally based El Niño commonly referred to as a Modoki El Niño (Modoki being the Japanese word for momentum). This kind of weather pattern is characterized by oceanic conditions wherein “the equatorial Pacific will be running warmer than normal, and the warmest waters will be in the central Pacific with somewhat cooler water west and east,” Bagioni explains.

As of press time, forecasts call for a “weak to moderate” Modoki El Niño, which could mean more good news for the Northeast. “History points toward similar Modoki El Niño events producing normal to colder than normal winter conditions across the eastern half of the U.S. and a warmer and drier than normal western U.S.,” notes Bagioni.

Looking closely at the different possible projections for cold fronts, Bagioni sees that “many of the analogs keep the Northeast near normal with the core of the cold anomaly off to the southwest across the Ohio Valley on into the Tennessee Valley regions.” Yet, he adds, “There are some analogs that are quite a bit colder for New England than I am currently willing to forecast, but it would only take a slight change to move us into a solidly colder than normal winter.” Bagioni continues, “Right now I think staying close to ‘normal’ winter cold is the way to go.” And remember, normal is good.

NAO’s Wild

How is it that some projections call for New England’s winter to be significantly colder than normal while more of them see the core cold spread southwest? “The wild card, as is usually the case, is the amount of High Latitude Blocking and the state of the North Atlantic Oscillation (NAO),” Bagioni says. “Weak El Niños do often, though not always, promote high latitude blocking periods and a tendency for the NAO to average negative; both of which are favorable for moving the forecast into a colder call,” he explains.

Why then is Bagioni in the normal camp rather than the much-colder-than-normal camp? “Normally I would jump on the negative NAO call given a weak El Niño,” says the meteorologist, who’s been monitoring New England weather patterns for virtually his entire life. “But we have been in a negative NAO drought for the past several years, and I am wary.” He adds, “If confidence grows about the NAO averaging negative, I will be more bullish on cold.”

Storms-A-Coming

Fuel retailers should look to have their tire chains, clear-a-path communications, and delivery schedules ready for snowy conditions, as Bagioni notes that weak Modoki El Niños are famously likely to produce very active storm seasons. “I would bet on more than normal nor’easters,” he says, “which implies at least normal snow amounts, if not above normal snowfall.”

Unfortunately, these conditions could also bring disruptions somewhat similar to that which we experienced last heating season. Bagioni explains, “If we do see a negative NAO winter, we could see a couple of slow-moving powerful nor’easters with significant disruptive effects especially from the Mid-Atlantic northward into the NYC to Hartford to Boston corridor.” Remember, the negative NAO could also mean a very cold winter for the Northeast, so, with a possibility for both below-freezing temperatures and slow-moving blizzards on the horizon, iciness might be of greater concern than usual.

“Given the fact that history indicates high latitude blocking and a negative NAO are more likely during Modoki El Niño events, we will have to be on the lookout for such extremes, but will not likely see them coming until within about three weeks of the occurrence,” Bagioni cautions. “If readers start consistently hearing that we will definitely see a weak Modoki El Niño and/or growing confidence of a negative NAO, from myself or other forecasting outlets, they should infer some enhanced cold periods might occur.”

Volatile-Normal or Stable-Normal?

Speaking with Oil & Energy for an October 2017 feature on last year’s active hurricane season, Bagioni said, “Mother Nature finds a way to even things out over a period of years, not only with temperatures but with hurricanes and snowstorms.” Out of curiosity, we asked the meteorologist if and how he sees that truism playing out this coming winter in relation to winters past.

“We have seen several winters recently that have featured extreme flips within the season,” Bagioni replies. “For example, last year we saw brutal cold followed by an incredibly warm February,” which helps explain why overall HDDs ended up being above normal rather than below normal. “I think we are due for a more ‘stable’ winter season that manages to produce a fairly uniform pattern for 6 to 8 weeks without a major flip after 2 or 3 weeks,” Bagioni says.

Volatility is, of course, something of a fact-of-life for the heating fuel dealer, be it in relation to the weekly weather forecast or the daily price at the supply terminal. Thus, all readers’ eyes should alight upon reading the word “stable” in that last quote.

Still, Bagioni will be the first to concede, “Whether or not we could or will see the type of extreme cold stretch experienced last winter during the late December to mid-January period is always an almost-impossible call. Most extreme temperature periods, be it warmer or colder, are usually not detectable until at minimum 3 weeks in advance, if not 2 weeks to 10 days.”

Which is why receiving regularly updated, comprehensive weather forecasts tailored for the fuel delivery industry is a must for every marketer. These updates, provided weekly by Bagioni, are available to all NEFI members as a paid benefit. Click here to sign up.

Related Posts

U.S. Competing to Secure Critical Minerals

U.S. Competing to Secure Critical Minerals

Posted on June 16, 2025

The Clean Air Act, the EPA, and State Regulations

The Clean Air Act, the EPA, and State Regulations

Posted on May 14, 2025

Day Tanks Support Back-up Generators in Extreme Conditions

Day Tanks Support Back-up Generators in Extreme Conditions

Posted on March 10, 2025

Major Breakthrough in Lithium-Ion Batteries

Major Breakthrough in Lithium-Ion Batteries

Posted on February 12, 2025

Enter your email to receive important news and article updates.