Last September in Algiers, the Organization of the Petroleum Exporting Countries (OPEC) reached a tentative agreement to cut oil production among its members to between 32.5 and 33.0 million barrels per day (mb/d). In November in Vienna, OPEC finalized the deal — the first such agreement since the 2008 financial crisis. Moreover, it was announced shortly afterward that non-OPEC Russia would join in reducing output — the first such cooperation since 2001.

OPEC committed to reduce production to the lower ceiling of 32.5mb/d beginning in January 2017, a reduction of over 1mb/d from the approximate 33.6mb/d it was producing in October (OPEC Monthly Oil Market Report, October, secondary sources). Saudi Arabia was to bear a large share, 0.5mb/d, of the cuts under the agreement, with Qatar, Kuwait, and the United Arab Emirates reducing output by a combined 0.3mb/d and Iraq by 0.2mb/d, while Iran is allowed to increase output slightly, to approximately 3.8mb/d, and Nigeria and Libya are exempt.

Looking to the Past

The big question now is: Will OPEC (and Russia) follow through on their commitment? History is one possible guide. OPEC first started behaving as a cartel in March of 1982, when it introduced mandatory quotas (“A Brief History of OPEC,” At A Glance, The Wall Street Journal), but prices crashed in 1986 due to stronger North Sea and Alaskan crude oil production.

As it did more recently (2014), OPEC responded by increasing production to take back market share, and prices stayed low. In 2008, when prices were still above $100 per barrel, OPEC agreed to cut output — but Saudi Arabia quickly changed its tune in private, with a senior OPEC delegate saying the kingdom would “not leave a customer without oil. The policy has not changed” (“Saudis Vow to Ignore OPEC Decision to Cut Production,” New York Times). More recently, in 20 of the 24 months before OPEC gave up on having a collective quota in 2014, production exceeded the target. Why is OPEC, as the Times put it, “notoriously bad at maintaining discipline in its ranks when prices fall?”

Game theory is one way to consider this question. In fact, this author’s undergraduate textbook on industrial organization specifically discussed OPEC in its chapter on collusion and cartels (Industrial Organization, Contemporary Theory & Practice, 2nd Edition, Peppall, Richards, and Norman). Along these lines, let’s consider a very simple setup of the “game”: An OPEC member is currently producing 10mb/d and generating $100bn in annual revenue. If this member, and everyone else cuts output by, say, 0.5mb/d, then its revenues will increase to $225bn due to price increases. It isn’t important to the game, but these numbers are of the appropriate scale: OPEC oil export revenues hit a record $920bn in 2012 and were $753bn in 2014 before prices tumbled. They are set to fall to about $341bn this year, according to the U.S. Energy Information Administration.

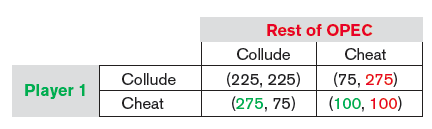

The problem is, each individual member has an incentive to cheat. In our simple game, we’ll say our player stands to earn $275bn if it keeps output steady while everybody else cuts production. On the other hand, if our player cuts output but everyone else cheats, revenues drop to $75bn. The table included here shows the payoff structure. To make this simple, we use this graphic to look at all the other OPEC members as a single unit with the same payoffs as our player (Player 1).

Each player considers their best move under the alternatives available to them. If the rest of OPEC colludes (first column), then Player 1 can either collude also and earn $225bn, or cheat and earn $275bn. Player 1 would choose the latter, highlighted in green.

Similarly, if the rest of OPEC cheats (second column), Player 1’s best choice is to cheat as well and earn $100bn rather than $75bn. And the reverse is true for the “rest of OPEC” player (choices in red). Thus, no matter what the other player does, the best strategy is to cheat — this is called a “dominant strategy” in game theory — and since all players under the “cheat, cheat” scenario (bottom-right corner of the table) have chosen their best strategy given the strategies that all other players have chosen, the game comes to rest at what is called a Nash equilibrium. (John Nash, the subject of the film

A Beautiful Mind, shared the 1994 Nobel prize in economics with two other game theorists.) So, in a simple, one-shot game it is clear that incentives dictate everybody cheats.

The real world for OPEC is not, of course, a simple, one-shot game, and there are many, more complicated game theory models (repeated games, mixed or probabilistic strategies, etc.) that could be applied, but the simple game gives us an idea of why cartels have a difficult time operating successfully. Without going into unnecessary detail on the more complicated models, we can say that repeated games with the ability to punish members for noncompliance can lead to better success for a cartel.

In order to tell if members are cheating, and then implement a punishment against them, however, monitoring is necessary. Indeed, OPEC is establishing a “high-level monitoring committee” to track compliance, but there is no mechanism within OPEC for punishing noncompliance.

In January, Saudi Arabia cut output by more than required under the output agreement (OPEC monthly report, secondary sources), helping to increase the compliance rate along with help from its Gulf allies. Compliance from the group’s second-largest member, Iraq, was estimated at just forty percent (BMI Research).

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.