The September Short-Term Energy Outlook assessed the factors that might influence crude oil and distillate prices. These included physical market factors as well as trading and financial markets.

Reflecting on the global market for crude, the EIA noted that despite differentials between lightweight, low-sulfur (light-sweet) grades and heavier, higher-sulfur (heavy-sour) crudes that are lower in quality, prices for crude oil tend to move closely together.

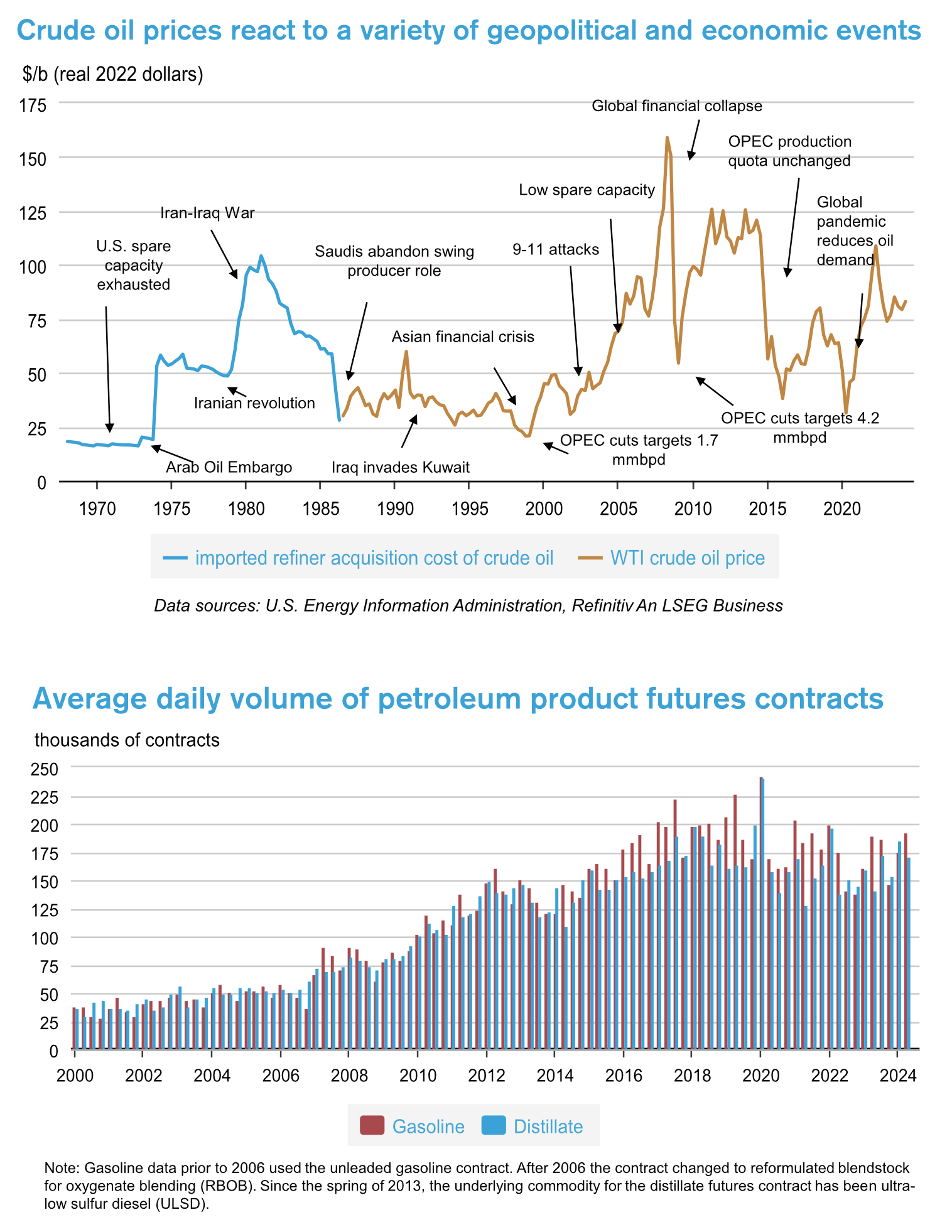

It will come as no surprise to Oil & Energy readers that distillate prices closely follow crude, and react to the same geopolitical and economic events that could lead to disruptions or create uncertainty about supply and demand. The volatility of oil prices is a result of the “inelasticity” of supply and demand in the short run, as production capacity and end-use equipment are relatively static. It takes years, or in some cases decades, to develop new supply sources or change production outcomes, and consumers cannot easily switch fuels or increase efficiency when prices rise. These factors are well known to anyone who experienced the Arab Oil Embargo in 1973-74, the Irani and Iraqi upheavals of the 1970s and 1980s, or more recent political events in Nigeria, Libya, and of course the current uncertainty in the Middle East. Existing supply levels are often a ballast. If the market has spare production capacity and inventory, global events have a lesser effect on prices, but if there are concerns about a potential disruption and inventories are unlikely to offset the loss in supply, prices can rise above normal supply-demand levels, and this forward-looking behavior adds a “risk-premium.”

Refineries and storage terminals can store crude oil and/or finished products like motor gasoline, heating oil, and diesel to prepare for seasonal fluctuations, refinery maintenance, or unexpected weather. Because inventories can satisfy either current or future demand, their level is sensitive to the relationship between the current price of oil and expectations of future prices. If market expectations indicate a change toward relatively stronger future demand or lower future supply, prices for futures contracts will tend to increase, encouraging inventory builds to satisfy the otherwise tightening future balance. On the other hand, a sharp loss of current production or unexpected increase in current consumption will tend to push up spot prices relative to futures prices and encourage inventory drawdowns to meet the current demand.

For decades, liquid fuel retailers have tried to explain to consumers that market volatility and rising prices were powered by the influx of money marketers trading futures on fuels they would never touch. The EIA provides a visual of the increase since the early 2000s.

Lastly, with significant increases in U.S. crude oil production and higher refinery runs, increased production of petroleum products reduced the reliance on oil imports to meet domestic demand. The U.S. has been a net exporter of gasoline since 2012, and a net exporter of distillate since Q4 2007.