What determines oil futures prices? We all know that prices are determined by supply and demand (Economics 101), so in the long run they are determined by global oil production and global oil demand. In the short run, however, a large variety of factors are associated with oil price movements. We at Hedge Solutions provide daily market intelligence, and this gives us a historical, experiential view of what many of these factors are. We outline these for our clients in our daily pre-market report (Pipeline) and post-settlement report (Evening Energy Report). Below is a broad, non-exhaustive outline of these items, including recent examples. The focus will largely be on factors impacting oil futures prices, as these determine the bulk of the variability in ULSD futures prices, but there will also be mention of items that affect the spread between crude oil and ULSD futures prices.

Weekly petroleum inventories from both the American Petroleum Institute and the U.S. Energy Information Administration (EIA). The impact of these is generally seen right upon their release, with futures prices quickly reacting to a bearish or bullish report, and the trade volume often thins out in the minutes leading up to the release of these reports as market participants are loathe to find themselves positioned incorrectly.

Weekly oil rig counts, which are released on Friday by one of the two main oil services firms, Baker Hughes and Schlumberger. As with the EIA inventory report above, the market often thins out ahead of release, and a large increase in the rig count is often associated with a turn lower in the futures price action (more rigs imply increased production), and vice versa for a decline in rig count. It should be noted that the U.S. oil rig count is currently far lower than it was at this time last year, yet U.S. oil production is greatly increased, meaning efficiency or per-rig oil production has been greatly increased, which may have dulled to some degree the impact of a reported dip in the rig count.

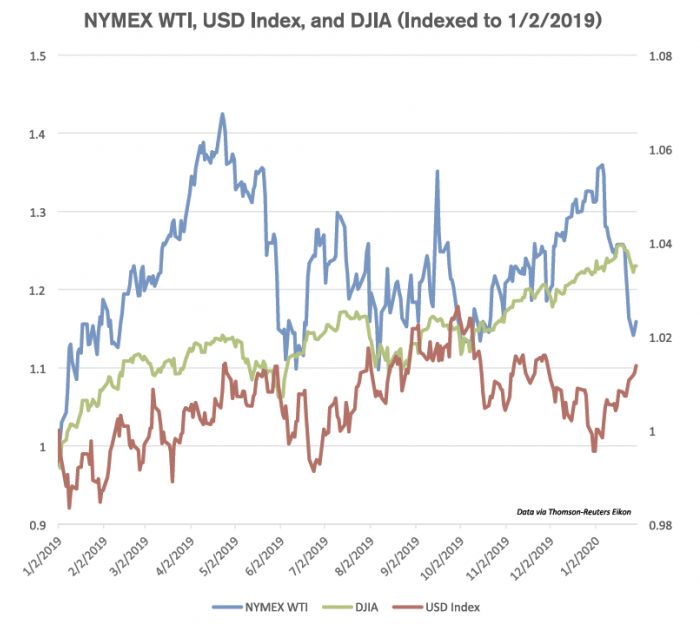

The value of the U.S. dollar is another strong covariate. As oil prices are denominated in U.S. dollars, any appreciation in the dollar would make a barrel of oil more expensive for non-dollar holders, meaning nominal oil prices must decrease in order to keep the price constant. Therefore, NYMEX WTI crude oil futures prices are often negatively correlated with the U.S. dollar index (an index of the value of the dollar against a basket of currencies). As can be seen in the first chart, this is not always the case, as WTI futures prices were strengthening even as the dollar was appreciating for much of the first half of last year. A negative correlation was evident at the very start of the year and then also from June through September, and the negative correlation was quite evident from mid-October through January.

U.S. stock market indexes, especially the Dow Jones Industrial Average. There are two reasons why oil prices and equities might be positively correlated. First, they are both risk assets, so a flight to or from safety (e.g., bonds) should impact them both. Second, they are both connected to economic growth — growth is associated with strength in equities, and with stronger oil demand and therefore oil prices. The positive correlation can be also seen in the first chart, with WTI and the Dow largely moving in the same direction, but with generally much greater volatility in WTI.

Economic indicators, which of course impact the stock market indexes discussed above. These are various, but a short list of some of the most impactful would include quarterly U.S. Gross Domestic Product growth, the monthly Employment Status Report from the Bureau of Labor Statistics, the ISM Manufacturing and non-Manufacturing indexes, Consumer Confidence (University of Michigan), and the Federal Open Market Committee policy decisions.

Disruptions to supply and/or refining, including weather events and geopolitics. Hurricane Harvey knocked out about 11% of U.S. refining output in August of 2017, which was supportive for refined products prices relative to crude futures prices (crack spreads). In September of 2018, Hurricane Nate had a relatively large impact on crude oil production compared to refining, which was supportive for narrower crack spreads. The same was true for Hurricane Barry, which caused over 1mb/d of U.S. oil production to be shut down. Whereas other market forces muted the impact of these events on futures prices, the impact of some recent geopolitical events has been much more evident. Brent and WTI crude oil futures each shot up by over 14.5% on September 16, 2019, following attacks on Saudi Aramco’s Abqaiq and Khurais facilities.

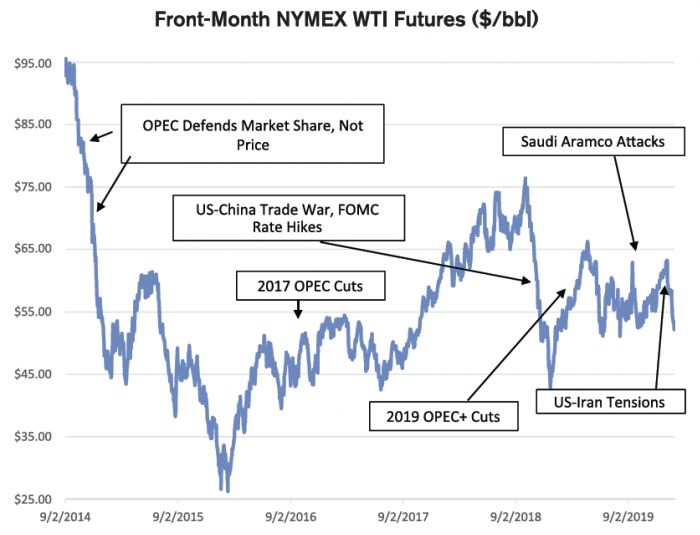

OPEC/OPEC+ Policy frequently makes headlines and is often impactful. The Organization of the Petroleum Exporting Countries (OPEC) surprised many in November of 2014, when the group announced it would be defending market share rather than oil prices.

As can be seen in the second chart, WTI futures prices fell sharply from October of that year through January 2015. OPEC changed tactics and imposed an output cap for many members effective in 2017, relative to October 2016 production. In late 2018, OPEC along with Russia and other allies — a group now known as OPEC+, which controls over 40% of global oil production — took the opposite tack, and over the past year the group has been working to support oil prices by imposing output cuts relative to October 2018 production levels.

Monthly oil market reports from the IEA, EIA, and OPEC. Three major reports on the oil market are published early in the month each month: one from the Paris-based International Energy Agency (IEA), one from the U.S. EIA, and one from OPEC. Focus is largely on any revisions to global oil demand growth and supply forecasts, along with the OPEC production figures based on secondary sources in the OPEC report.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.