Last month my colleague over at Hedge Solutions, Rachel Luc, went over the basics of hedging a Capped Price Program. During that exposition, she noted that there are different consequences for basis protection from hedging with paper only versus hedging with a combination of paper and a fixed price agreement (wet barrel) with your supplier. Given the relatively weak distillate stock levels on the East Coast at the time of this writing — increasing the chances that we could have a basis blowout this winter, all else equal — we’ll dive deeper into that here.

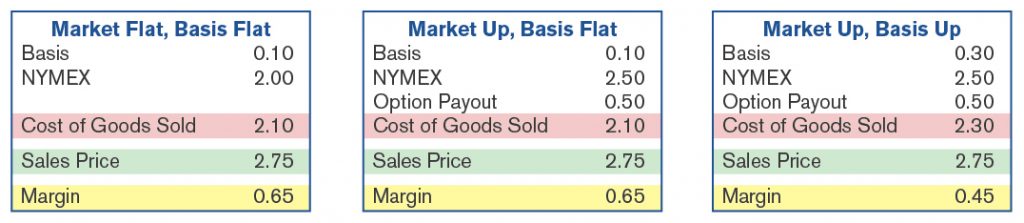

Call options on NYMEX ULSD (HO) futures can be used to hedge a Cap program, as they will compensate for increases in the market price of oil above and beyond the strike price. So long as your local rack price moves in step with NYMEX HO futures, any increase in the rack price that you pay when you fill up your trucks will be compensated for by an increase in the option payout. As we know, however, rack prices do not always move in lock-step with futures prices — and if they move upwards more quickly than futures do (basis increases), the call option payouts will not be able to make up for this. In short, a Call option strategy for hedging a Cap price program is inherently short basis (profitability improves if basis weakens, but worsens if basis strengthens), as illustrated below.

Call options on NYMEX ULSD (HO) futures can be used to hedge a Cap program, as they will compensate for increases in the market price of oil above and beyond the strike price. So long as your local rack price moves in step with NYMEX HO futures, any increase in the rack price that you pay when you fill up your trucks will be compensated for by an increase in the option payout. As we know, however, rack prices do not always move in lock-step with futures prices — and if they move upwards more quickly than futures do (basis increases), the call option payouts will not be able to make up for this. In short, a Call option strategy for hedging a Cap price program is inherently short basis (profitability improves if basis weakens, but worsens if basis strengthens), as illustrated below.

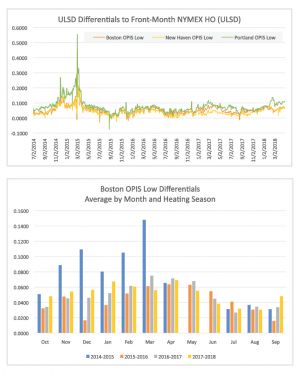

It has been some years since we had a large jump in basis, but conditions are similar to those seen in 2014, when differentials spiked. That winter, distillate inventories were relatively lean, in part because the futures forward curve was backwardated for an extended period. With nearby prices stronger than future prices, there was an economic disincentive to put product in storage. Additionally, the 2013-2014 winter got off to a cold start, with 3,865 heating degree days in New England through February 1, helping support differentials. In late January, the situation was exacerbated by a blowout in the spread between front-month February futures and March futures, and it took some time before cash market prices adjusted and basis came back down, only to spike again in early March.

This year, the futures curve was backwardated for much of the early building season, and the contango that has developed has not been very strong — about two and a half cents per gallon from the front month versus January/February futures. Additionally, strong economic activity has supported domestic demand from the manufacturing sector and for logistics. Relatively speaking, PADD 1 distillate inventories are quite weak, down by 24.00% or 11.78mb from their five-year average as of the July 27 reporting week, according to data from the Energy Information Administration. Product in storage serves as a cushion against heavy demand periods or supply disruptions, and that cushion looks like it could be thin this winter, increasing the likelihood that basis could blow out. To protect against this, we can use a wet barrel and Put option combination to hedge our Cap gallons.

If we secure a fixed price for physical product with a wet barrel, any increase in either the futures price or basis will be irrelevant, allowing us to meet our price ceiling obligation to customers. If prices were to fall, however, we would be missing out on either the lower futures price or the weaker differentials. We can protect the futures price portion with Put options, which give the option holder the right to sell at the strike price. A wet-plus-put combination is, then, inherently short basis; we benefit if differentials spike, but are unable to enjoy the benefits if basis weakens relative to where it stood when we locked in the hedge. Accordingly, this hedging strategy is more suited to months where basis blowouts are more likely, whereas the paper (Call option) strategy is better suited to months where basis is likely to weaken. As you can see from the charts on page 16, each season is different, but generally the latter portion of the heart of heating season (January through March or even April) tends to be a good candidate for the wet/put strategy, whereas the front portion of the season is generally a better candidate for the paper-only strategy.

Will there be a basis blowout this winter? No one can know for sure, but consistent application of sound hedging strategies provides insurance against these adverse events. And with weak stock levels, chances look stronger that this insurance could pay off this winter.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.