All

Back to Basics with Hedging for Fuel Dealers

by Rachel Luc, Client Support, Hedge Solutions

Which heating oil program(s) are you offering your clients this winter? How well is your profit margin protected? Ever felt the need to revisit your hedging strategies?

The New York Mercantile Exchange (NYMEX) launched the first heating oil futures contract in 1978, which was also the world’s first energy futures contract. Later in 1987, options on the heating oil futures contract were introduced. Fuel dealers have been using these derivatives contracts as tools to offer their customers various price insurance plans for their fuel purchases. An effective hedging program will protect and guarantee a stable profit margin for fuel dealers, as it helps offset losses accrued in an adverse and volatile oil market. Although energy hedging is not a new concept, it is critical that fuel dealers fully understand the nature of hedging, to ensure an effective implementation of their hedging program.

Home Heating Oil Programs and Hedging Strategies

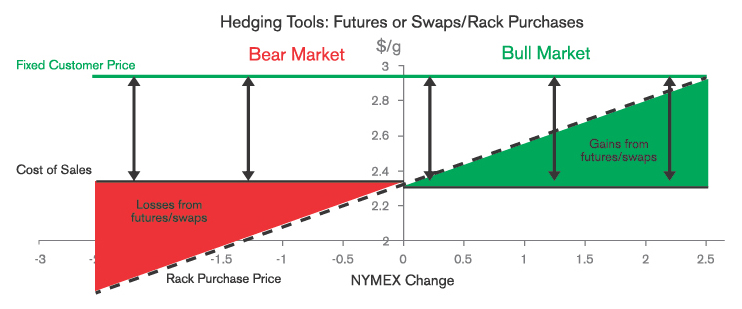

A Fixed Price Program allows fuel dealers to sell heating oil to their customers at fixed prices that were previously agreed between the two parties. Sellers are then obligated to deliver heating oil at promised prices to customers during the winter months. Sellers, thereby, have upside risks, as their cost of lifting heating oil from local racks would go up if oil prices increased in the winter. With fixed revenue and rising cost, dealers’ profit margin would be bound to narrow if prices were up. One way to eliminate the upside risk is for dealers to purchase futures contracts (on the exchanges) or swaps (in the OTC market), which help guarantee fixed costs for customers’ fixed sales.

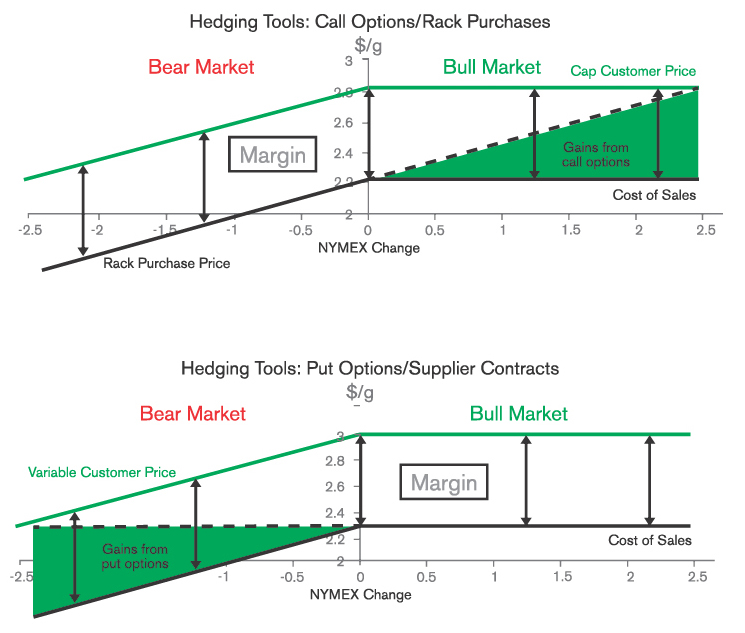

On the flip side, dealers are exposed to losses resulting from their long futures positions in a down market, offsetting any gains from lower supply costs, as they have locked in higher purchasing prices than market prices. Another downside of a fixed price program is that dealers might risk losing unsatisfied customers, as customers might not like the idea of having to pay higher-than-market prices (even though they previously agreed to fixed prices). In that regard, a Cap Price Program appears to be better for customer retention purposes. With a cap program, dealers can raise selling prices for customers up to a certain limit in an upside market, while reducing prices for customers in a down market. One possible way to protect dealers’ profit margin from upside risks is to purchase call options, which would generate payouts to offset any lost revenue (due to increased cost) if prices rose above a certain level (strike price) in an up market.

Another way is to enter into supplier contracts and purchase put options to protect the downside. Put options would generate payouts to offset any losses resulted from falling prices below a certain level (strike price), allowing dealers to keep their promise to reduce selling prices for customers in a down market, while being able to maintain a stable profit margin.

Note that options are used to reduce price risks, as they serve as price insurance plans for dealers’ profit margin. Premiums are unavoidable costs even if the oil market moves in dealers’ favor and no protection is needed. Basis risk, the risk of disproportionate movements between values of futures contracts and underlying assets, is also another major factor that needs to be considered when employing these hedging strategies.

Ready to Hedge This Winter?

A well-known, publicly traded retail oil company was on the verge of declaring bankruptcy when it failed to pass on high fuel costs to its customers in 2004. It was reported that one of the reasons leading to the company’s financial trouble was that price caps that the company offered its customers turned out to be well below its supply costs, which rose significantly in the 2004 winter. This could have been avoided with a well-planned hedging program, with a combination of call options and/or supplier contracts together with put options.

With 25 years of experience in the energy risk management industry, Hedge Solutions, Inc. works towards enhancing our customers’ knowledge of the petroleum market by providing market intelligence through our daily reports and protecting customer’s margins by offering leading hedging advisory and trading services in the OTC market. Contact us today for your market report trials!

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.