Companies need to weigh risk, cost, and history before determining if weather derivatives are worth the investment

It is tough to picture the cold, wind-whipped snow coming this winter given the 90°F heat wave hitting us in mid-July. But in just five short months, we will be monitoring the latest weather forecast, hoping for an arctic blast. Unfortunately, not all winters have been like the recent 2024-2025 season, which had a nice stretch of below normal temperatures in January and February.

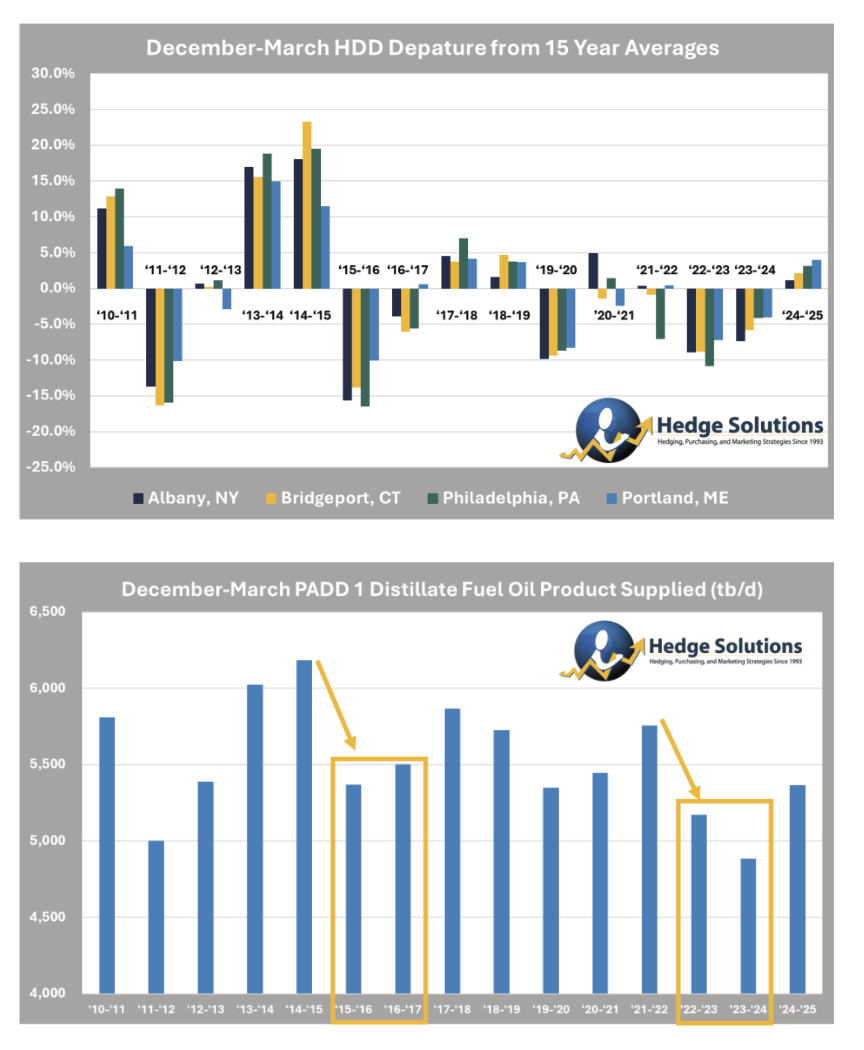

Weather derivatives are a way for fuel deliverers to compensate for lost profits during years of slower sales and are often priced using heating degree days (HDD). To better understand these contracts, it is helpful to review HDD variability and how it can drastically change expected gallon usage. The “December-March HDD Departure from 15 Year Averages” compares the HDD departures for four cities: Albany, NY; Bridgeport, CT; Philadelphia, PA; and Portland, ME. The calculations compare NOAA’s Climate Prediction Center total HDDs from December-March to their respective 15-year averages.

Clearly, we’ve leaned toward the warmer side and have not had many blockbuster winters as of late. In fact, the most recent season when HDDs were 10 percent above average was 2014-2015. Another interesting point that the data shows is the variability between cities. Although it may seem minimal in terms of classifying a good vs bad year, that variability could significantly impact the payouts of weather derivatives.

It is obvious that warmer winters lower fuel use by residential and commercial customers. This can be seen in the PADD 1 implied consumption of distillate fuel oil as reported in “December-March PADD 1 Distillate Fuel Oil Product Supplied tb/d)” chart. During warmer winters, there was a clear drop in product supplied. The boxes show years when the implied consumption dropped 10 percent from the season or two prior. These decreases can cause major headaches for fuel deliverers who invest in their businesses to be ready for cold winters. So, how can weather derivatives attempt to protect profits across all weather outcomes?

These financial instruments are usually tied to HDDs at a particular location and within a certain number of months. They should line up with the marketer’s delivery area and necessary coverage period. An upfront premium is paid by the buyer and an HDD strike level is set. The buyer receives a payout for each HDD below the strike that does not occur. This means that the warmer the winter, the greater the payout. The payout can replace some of the profits lost as gallons go undelivered. The flip side to this is that during normal and cold years, profit margins will be limited because the buyer will forfeit the premium and may not receive any payment.

As a professional in the oil industry and a meteorologist, I know that forecasting oil prices or the weather several months out is a fool’s errand. Banking on a cold winter nor loading up on weather derivatives betting on a warm one is not prudent. So, when does it make sense to hedge against the weather? There are several factors to consider. It is important to have an advisor who can review the structure and pricing of the derivative. They can provide answers to several key questions: How many times in previous years would the contract have expired worthless? How warm does it have to be for the company to see measurable benefits? Which weather station and contract period best matches the book of business? Their analysis will better inform the go/no go decision.

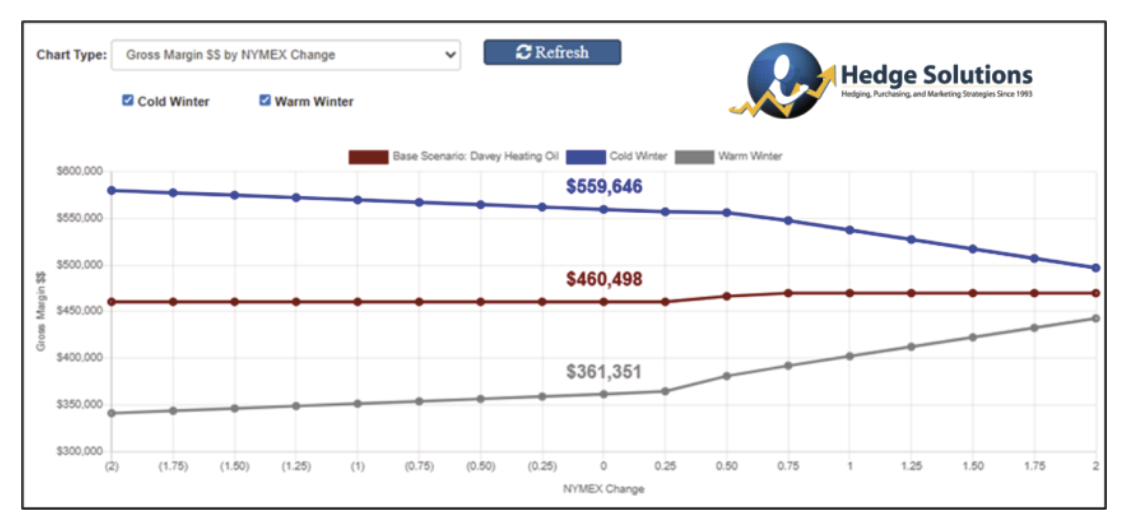

Another aspect to review is to identify the level of gross margin that is unacceptable given fixed business expenses. Scenario planning is an excellent tool to better understand the risk/reward of all options. Marketers can leverage industry tools like Hedge Insite to see the full picture. The chart below for the fake company “Davey Heating Oil” shows several winter outcomes. Hedge Insite allowed us to add our expected variable, fixed and capped sales. We then overlay any current hedges and estimate our rack costs. Finally, we add our preferred margin to those costs to determine our retail price. We can take this base scenario and alter our expected gallons by +/- 20 percent. The resulting gross margin of base, warm and cold winter scenarios can be analyzed across NYMEX price changes. From these numbers, we can quickly understand the benefits and costs of the weather derivatives in context of the specific financials of the company.

We’ve found that often, the upfront cost burden and the likelihood of payout of weather derivatives may not justify their use. Additionally, it is difficult to insert the cost of these derivatives into program fees or price margins. But in the end, the decision of whether or not to leverage weather derivatives needs to be evaluated on a case-by-case basis.

Matt Davey is an Account Executive for Hedge Solutions working with consulting clients on hedging forward sales programs and purchasing oil and propane. He can be reached at: mdavey@hedgesolutions.com.