Geopolitical tensions, weather upheavals, and supply and demand point to volatility throughout season

The 2024/2025 heating season started off with increased volatility in crude oil and refined products futures prices. The volatility is expected to persist, driven by supply chain disruptions and ongoing geopolitical tensions that could continue to impact global energy markets. Understanding the key factors impacting heating costs this season is crucial for anticipating potential price fluctuations and preparing for winter.

Geopolitical Events

The war in the Middle East, which began with the October 7, 2023, attack on Israel by the Palestinian militant group Hamas and Israel’s retaliation in the Gaza Strip, has expanded to include Hezbollah, a militia based in Lebanon and even Iran. Iran is a major supporter of both Hamas and Hezbollah, providing financial, logistical, and military support to these groups. Hamas and Hezbollah have both been identified as terrorist groups by the United States. Tensions between Israel and Iran have also intensified, with both countries engaging in retaliatory actions. As of late October, however, neither oil nor nuclear facilities in Iran had been impacted. As Iran accounts for about 24 percent of oil reserves in the Middle East and 12 percent globally, any attacks on its energy infrastructure could disrupt the global oil supply and potentially drive prices higher. Attempts at a ceasefire have been made with the help of the United States, but as of late October, all discussions had fallen through. Meanwhile, the Russia-Ukraine war is another conflict that continues to impact global oil markets, particularly the European one. Russia has redirected its crude oil exports to Asian markets, mainly China and India, while European countries have had to seek alternative sources, further contributing to price volatility.

Weather Outlook

Weather is another critical factor this season. According to the National Oceanic and Atmospheric Administration (NOAA), the emergence of a weak La Niña effect is expected to influence weather patterns across the U.S. this season. The East Coast is likely to see above-normal temperatures from December to February, while the Midwest has equal chances for warmer or cooler than normal temperatures. NOAA has also forecasted wetter-than-average conditions in the Great Lakes region, while near-normal precipitation levels are expected along the East Coast.

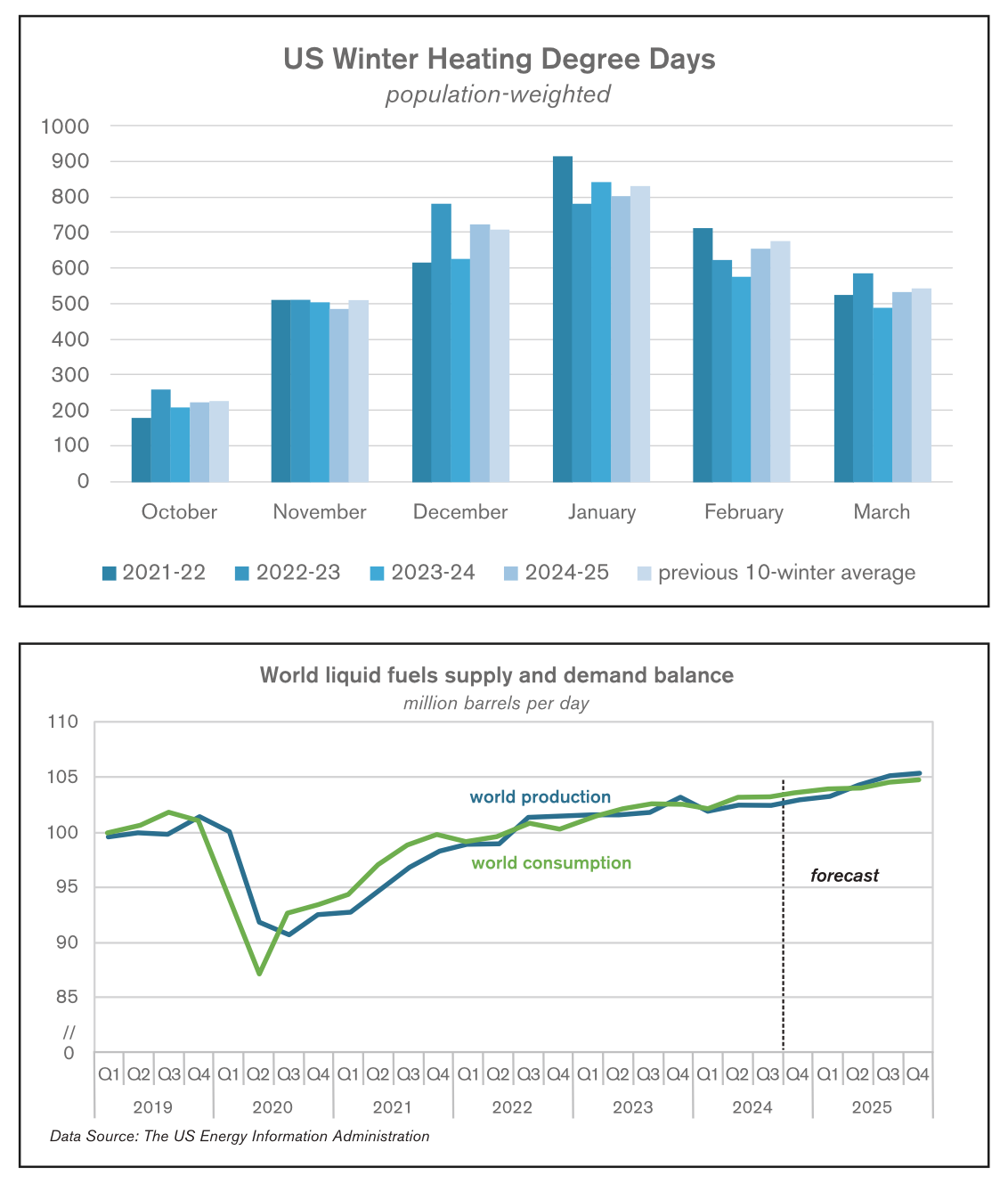

The US Energy Information Administration (EIA) expects this winter to be colder than the last for most of the country, especially in the Midwest, with temperatures near the 30-year average. In its Winter Fuels Outlook, the EIA forecasts 13 percent more heating degree days (HDDs) in the Midwest this winter and 5 percent more in the Northeast. Overall, heating degree days for the United States are expected to average around 3,200 HDDs - 5 percent higher than the previous season.

Supply and Demand

The Energy Information Administration, the International Energy Agency (IEA), and OPEC all continue to revise their global oil demand growth forecasts downward for both 2024 and 2025. In its October monthly report, OPEC estimated that global oil demand would increase by 1.93 million barrels per day (mb/d) in 2024 and by 1.64mb/d in 2025. The Paris-based IEA forecasts a more modest growth of 0.86mb/d for this year and 1.00mb/d for next year, noting in its October Oil Market Monthly Report the impact of slowing Chinese economic growth and a shift toward electric vehicles. Lastly, the EIA anticipates global oil demand growth of 0.92mb/d in 2024 and 1.29mb/d in 2025, placing its forecast between those of OPEC and the IEA. In the US oil market, demand for liquid fuels is expected to hold steady compared to 2023, at 20.28mb/d, while a growth of 0.21mb/d is forecasted for next year.

On the other end of the equation, the EIA estimates a 0.50mb/d increase in global production of crude oil and other liquid fuels this year, with production seen rising even further in 2025, by 2.04mb/d. This implies a market deficit of 0.56mb/d in 2024, which is expected to turn into a surplus of 0.14mb/d in 2025 as supply growth exceeds the demand growth. The IEA also forecasts a sizeable surplus in 2025, with global oil supply rising by 2.0mb/d to 105.0mb/d. Crude oil production in the US is expected to average 13.22mb/d in 2024 and reach a record high of 13.54mb/d next year.

Crude Oil Price Forecasts

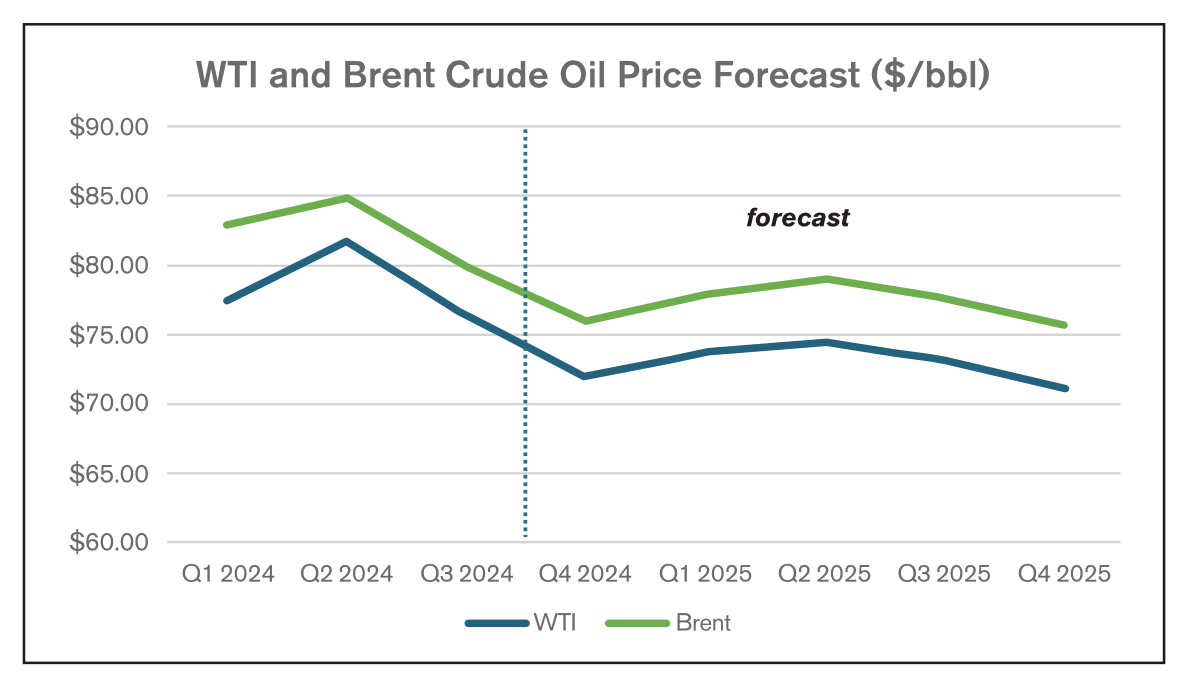

In the October issue of the Short-Term Energy Outlook (STEO), the EIA expects the West Texas Intermediate crude oil price (WTI) to average $76.91 per barrel (bbl) in 2024 and $73.13/bbl in 2025. Brent crude oil prices are expected to average $80.89/bbl in 2024 and $77.59/bbl next year. Both of these forecasts are lower than what the agency forecasted in its September STEO, largely due to a reduction in the global oil demand growth forecast for 2025.

As the 2024/2025 heating season unfolds and energy markets remain highly volatile - impacted by geopolitical events, supply-demand imbalances, and weather-related shifts in demand - it is important to stay informed about potential energy price fluctuations and global oil production changes. At Hedge Solutions, we offer consulting services designed to help clients navigate these market uncertainties, mitigate price movements risks effectively, and make more informed strategic decisions.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.