Sulfur content regulations have impacted, and continue to impact, the distillate product landscape on the East Coast. The distillate fuel sulfur content history in Petroleum Administration for Defense District 1 (PADD 1, the East Coast) can be summed up as a shift from a bimodal (two-tier) distribution, to increasing heterogeneity (disparity among the states and cities), and now to increasing homogeneity (convergence to the ultra-low standard). In addition to impacting costs from the refinery level down to the consumer, this has also affected paper hedging, as physical product specifications and the NYMEX HO futures contract specifications changed.

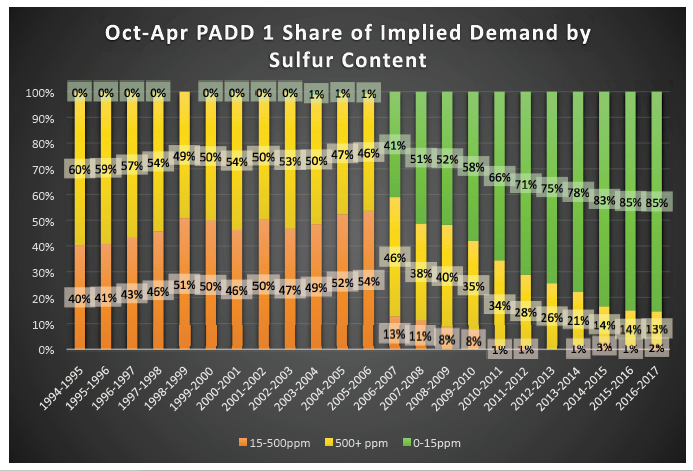

The Environmental Production Agency (EPA) began regulating sulfur levels in diesel fuel in 1993, before which EPA says diesel fuel contained as much as 5,000 sulfur parts per million (ppm), or 0.5%. The Energy Information Administration (EIA) has monthly implied demand data (as measured by product supplied) for the East Coast dating back to 1994, and the data — depicted in the accompanying chart — show that the region’s demand was bimodal, with roughly half for 15-500ppm fuel and the other half for greater than 500ppm fuel. Let’s call these low sulfur and high sulfur, respectively, with 0-15ppm being ultra-low sulfur. The landscape changed dramatically in 2006, when EPA began phasing in the ultra-low standard for on-road diesel (ULSD), through 2010. During the 2006-2007 heating season (October to April), this category materialized from nowhere to account for 41% of regional demand. This also marked peak heterogeneity for product demand on the East Coast, with 41% of demand for ULSD, 13% of demand for low sulfur, and 46% of demand for high sulfur fuel. Heterogeneity then decreased as ULSD market share increased, with the next major change — the one that hit closer to home for heating oil marketers — being the shift to ultra-low sulfur heating oil by New York State in the summer of 2012.

The ultra-low sulfur share of East Coast demand increased by 4 percentage points year-on-year to 75% for the 2012-2013 heating season, an 11% increase in volume to 198.89 million barrels (mb). This change, along with plans by other Northeastern states to follow suit, also impacted hedging, as the New York Mercantile Exchange (NYMEX) changed the specification for its heating oil futures contract (which specifies delivery at New York Harbor) to match the ultra-low sulfur diesel specification, beginning with the May 2013 futures contract. Thus, New York marketers found themselves with a clean hedge in the 2013-2014 heating season, but marketers in other states did not. The boutique-ing, or increasing heterogeneity, in the market increased in 2014, when New Jersey, Massachusetts, Rhode Island, Vermont, and Connecticut reduced the sulfur limit to 500ppm, a step on the path toward ULSD. Implied demand for this category shot up by 200% to 8.245mb in the 2014-2015 heating season. This was the recent high point for heterogeneity with regard to sulfur specifications (we will leave aside biofuel blending requirements), as demand for this category was weaker in the next two heating seasons despite tighter regulations in Maryland and Pennsylvania. As we move toward a region-wide ultra-low sulfur specification, homogeneity is returning.

In the 2016-2017 heating season, ultra-low product accounted for 85% of product supplied. With Massachusetts, Rhode Island, Vermont, Connecticut, Maine, and New Hampshire all moving to this standard next year (according to the New England Fuel Institute, see the July issue of Oil & Energy), this share is set to increase substantially. Only Pennsylvania and Maryland will be working with the low sulfur (15-500ppm) specification next year, as things stand at the time of this writing. All other states in the region will have returned to having a cleaner hedge with the NYMEX HO futures contract, as they had early in the decade. That being said, the NYMEX contract has been very tightly correlated with Platts New York Harbor barge prices among the different categories. For June 2014 through July 26, 2017, the correlation between high sulfur heating oil barge prices and the front-month futures contract is 99.54%, tightening to 99.61% for ultra-low sulfur heating oil, and to 99.66% for ULSD. Low sulfur is also tightly correlated, and less so than ULSD; from October 2016 to July 26, 2017, the LSHO correlation to NYMEX HO was 92.39%, below the 94.75% ULSD correlation and the 92.55% ULSHO correlation.

As the off-road distillate market on the East Coast converges to the same ultra-low sulfur standard that exists for on-road diesel, and to the contract specification for NYMEX HO futures, paper hedges are set to become tighter for a number of states, and the uniformity should ease logistical burdens and improve product availability, all else equal, as the need to store and transport multiple grades is removed and the same product is used in more markets.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.