New policies aim to bring crude oil and refined products prices down by maximizing production

The Trump administration’s approach to energy policy has been controversial and bold, focusing on prioritizing domestic oil and gas production while working with other oil-producing countries to meet U.S. energy goals. The policies aim to bring crude oil and refined products prices down by maximizing production, not only in the U.S. but abroad as well. We are going to break down some of the key policies this new administration is working to implement and explore their possible implications.

“Drill, Baby, Drill” Policy

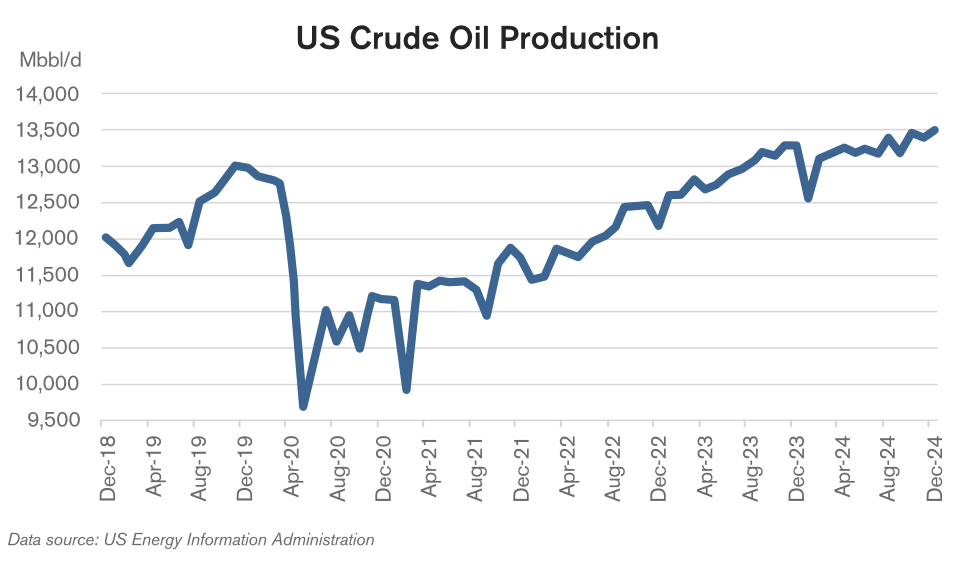

The Trump administration has been using the mantra “Drill, Baby, Drill” to emphasize its policy of maximizing domestic oil and natural gas production. On his first day in office, President Trump declared a national energy emergency and overturned automobile emission standards that had been in place since the 1970s energy crisis. Additionally, the Trump administration rolled back restrictions on oil and gas exploration in Alaska and lifted a pause on approvals for applications to liquefied natural gas (LNG) export facilities, which the Biden administration had set in January of last year. Moreover, an order to suspend new federal offshore wind leasing applications was announced in January, creating uncertainty for the renewable energy industry. Another move this administration made was accelerating the process of obtaining permits for energy projects and making it easier to acquire permits for drilling, pipelines, and refineries. The U.S. is already producing crude oil at record-high levels (13.51 million barrels per day as of February 28), and the EIA forecasted in its February Short-Term Energy Outlook that U.S. oil production will average 13.59mb/d this year and rise to 13.73mb/d in 2026.

Pressure on OPEC+ to Increase Production

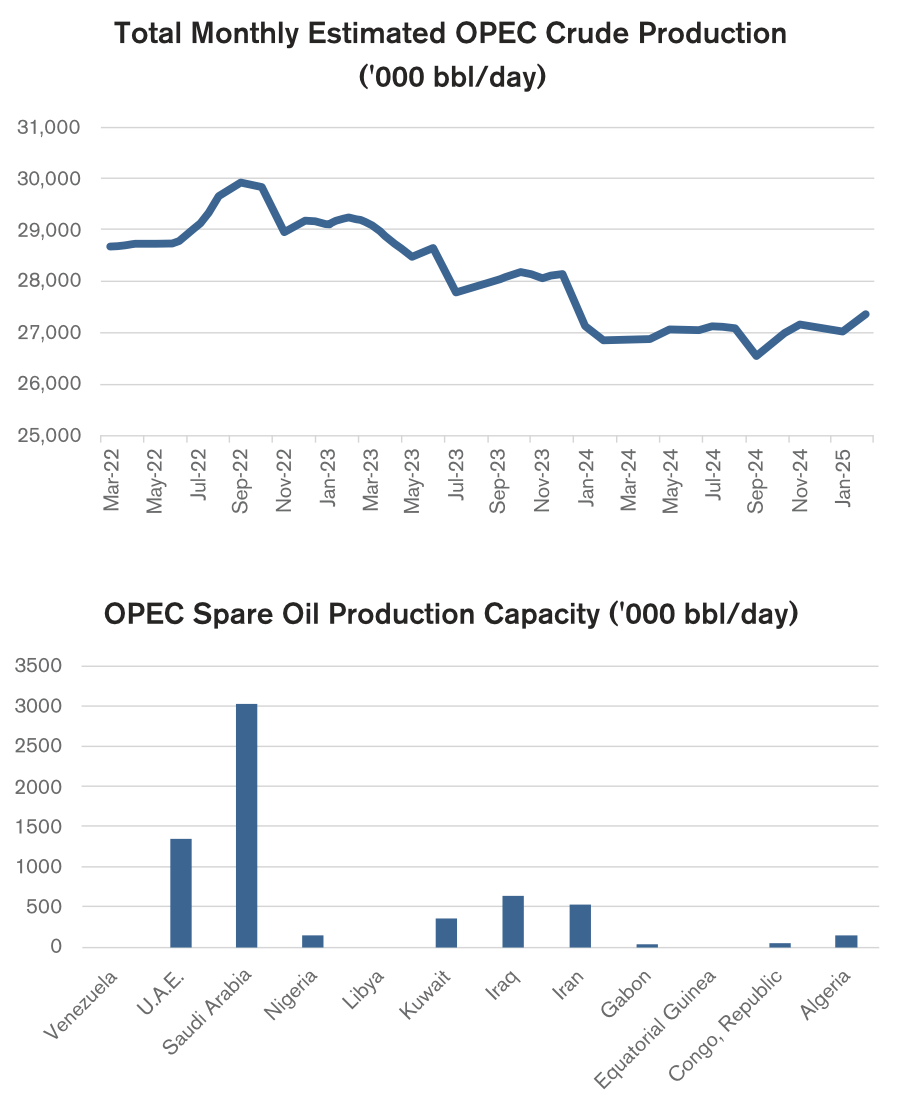

Another policy that President Trump took charge of within days of being sworn in was putting pressure on the Organization of Petroleum Exporting Countries (OPEC) and its allies to increase oil production and lower crude oil prices. The cartel responded with discussions of yet another delay in the oil output hikes that had previously been planned to begin in April. This would have been the third time since 2022 that OPEC+ delayed planned production increases. However, in early March, the group, led by Saudi Arabia and Russia, announced that it would go ahead with the plan to increase production by 138,000 barrels a day starting this month. This would be the first in a series of monthly increases to revive production, which will gradually rise by a total of 2.2mb/d by 2026, assuming there are no pauses. The group also noted that these output hikes could be paused or reversed depending on market conditions. Putting pressure on OPEC+ has mixed effects. Although the global economy and the U.S., in particular, could benefit from lower oil prices, it also highlights that despite increased domestic production, the U.S. still relies on foreign oil. Additionally, tensions between the U.S. and OPEC+ could have wider consequences for global oil markets and lead to an oil price war similar to the one we saw in 2020.

Tariffs and Trade Wars

One of the most controversial policies of the Trump administration was imposing tariffs on imports of goods, including energy products, from China, Canada, and Mexico. These trade policies could have a significant impact on global energy markets and also affect domestic energy industries. On February 1, the U.S. imposed a 10 percent tariff on Chinese goods and China retaliated with a 15 percent tariff on U.S. LNG and coal, as well as a 10 percent levy on U.S. crude oil and farm equipment. On March 4, the Trump administration announced that tariffs imposed on China would double to 20 percent, and China did not back down. Instead, it added a 15 percent duty on U.S. agricultural goods and restricted exports to 15 U.S. companies. On the same day these additional tariffs on China were announced, the U.S. decided to go ahead with tariffs on Mexico and Canada, which had been previously postponed. These included a 25 percent tariff on most goods imported from the neighboring countries and a 10 percent tariff on Canadian energy products. However, two days later, President Trump issued exemptions for about 50 percent of Mexican goods and 38 percent of goods coming from Canada, which fall under the U.S.-Mexico-Canada Agreement (USMCA). As of this writing in early March, these exemptions were granted until April 2. The tariff strategy could incentivize domestic production on the one hand but could also lead to price volatility and disruptions in global markets as trade tensions escalate on the other.

Calmer Middle East and a Possible End to the Russia-Ukraine War

The war in the Gaza Strip between Israel and the Hamas-led Palestinian militant group has been ongoing since October 7, 2023. During the conflict, important shipping routes have been impacted due to attacks and blockades, particularly in the Red Sea and the Strait of Hormuz in the Persian Gulf, causing disruptions in transportation and increased shipment costs. A temporary ceasefire between Israel and Hamas was reached on January 17, which included the release of hostages from both sides of the conflict and a return of “sustainable calm.” The U.S. took an active role in trying to broker peace, but the overall approach often favored Israel. The ceasefire deal was divided into three phases and Hamas stated that it had fulfilled the first-phase obligations under the U.S.-brokered agreement, suggesting that Israel was evading entry into the second phase. The U.S., which traditionally does not negotiate with terrorist groups, has been in direct talks with Hamas to end the conflict. In early March, President Trump issued a “last warning” to Hamas to release all of the hostages in Gaza immediately, or the U.S. government will help Israel “finish the job”. The ceasefire agreement continued to hold as of March 7. Houthi attacks on ships in the Red Sea had been reduced, but ships had continued to avoid this region until it was clearly safe to travel through.

Another conflict that the Trump administration is working to resolve is the Russia-Ukraine war, which marked its three-year anniversary in February. President Trump has put significant pressure on both Ukraine and Russia to end the war, threatening Russia with high tariffs and further sanctions, pausing all financial and military support to Ukraine, and even considering the revocation of the temporary legal status of about 240,000 Ukrainians who fled to the U.S. Talks over a ceasefire began in late February, with the U.S. acting as the main mediator. As part of the negotiations, President Trump suggested that Ukraine grant 50 percent ownership of the country’s rare earth minerals to the U.S. as reimbursement for the billions of dollars in weapons and support the U.S. has provided. As of this writing, talks between the two countries continue, but no ceasefire has been reached. An ending to both of these conflicts would allow access to energy resources, as both regions are significant oil producers. Stabilizing the Middle East would also ensure relatively secure oil transport and prevent major disruptions to global supply chains.

The energy policies of the Trump administration play a significant role in both domestic and global energy markets. By promoting maximum domestic energy production, pressuring OPEC+ to increase their output, and leveraging strategic diplomacy, the U.S. is solidifying its position as a dominant energy player. While these efforts help boost energy production, they also introduce new challenges, such as trade tensions, geopolitical instability, and environmental concerns. As the world continues to shift towards cleaner energy alternatives, the long-term effects of these policies will likely continue to shape both the U.S. and global energy markets. The outcomes of ongoing diplomatic efforts in the Middle East and Ukraine could also bring market stability and energy security.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.