OPEC and Russia Announce Production Cuts

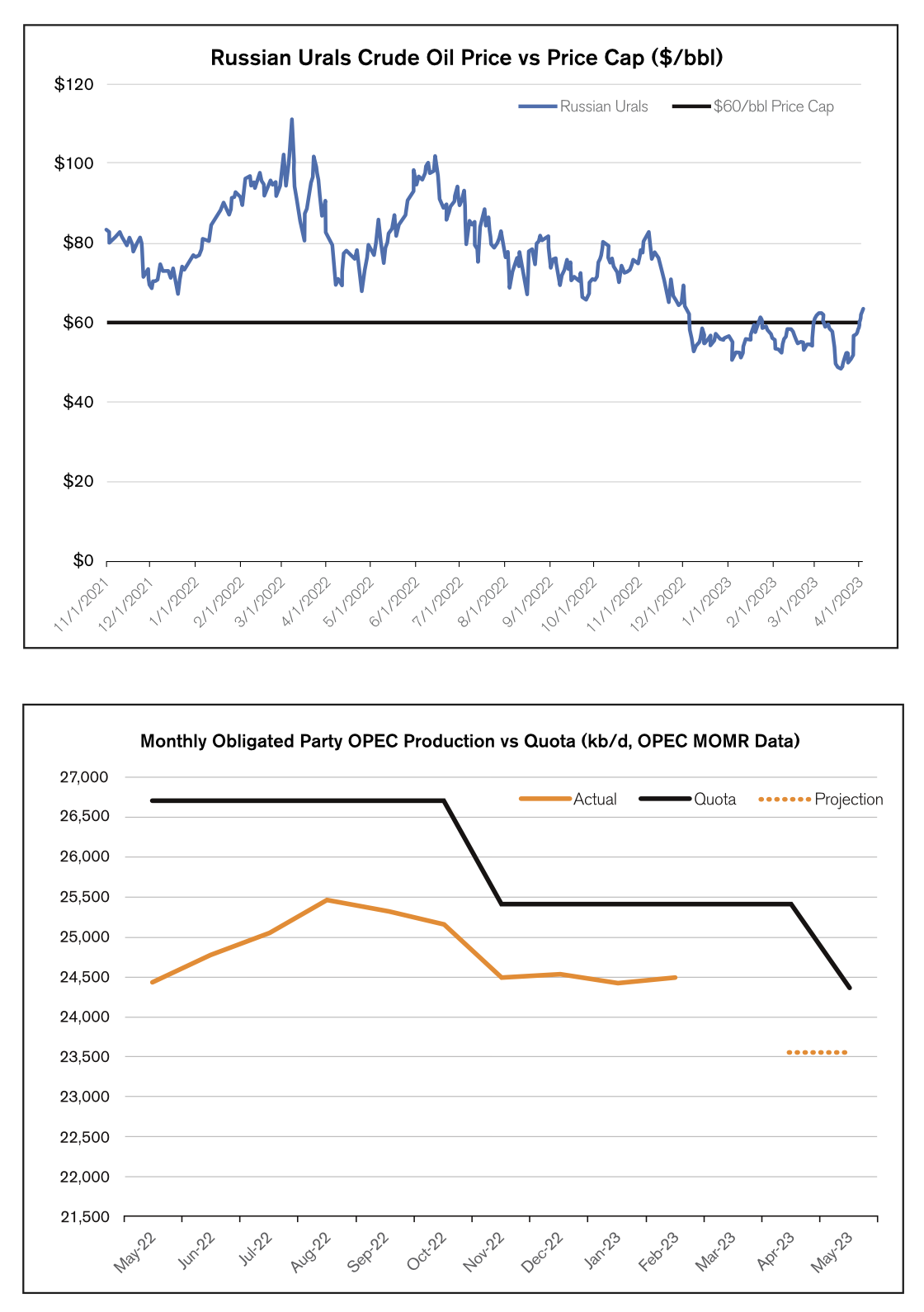

West Texas Intermediate (WTI) crude oil futures prices plummeted nearly 50 percent lower from a summer 2022 high of $123.68/bbl to a low of $64.12/bbl on March 20, 2023. Oil prices were elevated last summer following the Russian invasion of Ukraine and the imposition of Western sanctions, as well as seasonally strong refinery and power generation demand for crude oil. Although the European Union imposed a ban on the seaborne importation of Russian crude oil in December, shipments along the 1.3mb/d Druzhba pipeline were allowed to continue, and the Group of Seven (G7) and European Union countries exempted the shipping, brokering, and insuring of Russian cargos so long as they fell under a price cap, set at $60/bbl as of this writing.

The price cap was effective, as the Russian Urals price fell from over $80/bbl in early November to $62/bbl by December 5. Between December 6 and April 3, the price averaged $56/bbl. According to Reuters sources, there was little appetite among the G7 in the month of March for any reduction in the $60/bbl price cap, especially as the European Union had instituted a ban on the maritime importation of Russian oil products on February 5. While able to sell crude oil under the price cap, the EU seaborne import ban saw Russian crude oil shipments to Europe fall by 2.1mb/d year-on-year in February, pushing Russia to look for markets elsewhere. China and India filled much of the gap, with exports to India jumping 1.6mb/d higher and exports to China rising by 0.5mb/d year-on-year in February.

Russia has also been a large supplier of refined products to the European market, but the maritime importation of these was also banned by the EU on February 5 (with a similar exemption for the facilitation of shipments to other destinations under price caps, as we saw with crude). Exports to the EU plunged 0.55mb/d lower from January to February and were 1.7mb/d lower year-on-year in February. Accordingly, Russia sought out new markets for refined products, including Turkey and countries in Africa and the Middle East. Exports to these destinations rose by 0.24mb/d, 0.3mb/d, and 0.18mb/d in February compared to pre-war levels, respectively, and exports to Asia increased by about 0.3mb/d.

Despite these efforts to find new markets, Russia announced in February that it would be cutting oil production by 500kb/d in the month of March. Russia did cut production but estimates put the cut at closer to 300kb/d, at least for the first three weeks of the month. Nevertheless, oil prices initially fell in March amid fears over the banking sector after three U.S. banks (Silvergate, Signature, and Silicon Valley) failed, and as the embattled Credit Suisse was acquired by UBS. Prices recovered in the second half of the month amid optimism over Chinese demand growth this year. Then, in early April, OPEC+ dropped a bombshell: output cuts of over one million barrels per day, to take effect this month (May).

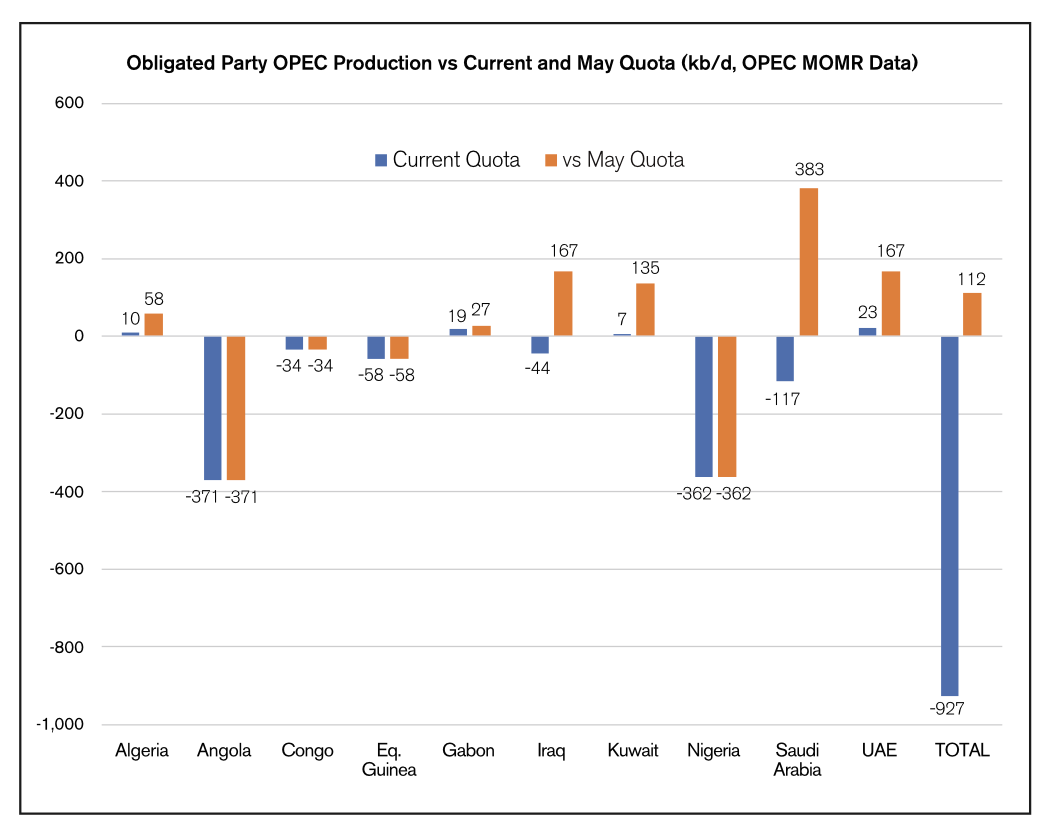

The group announced output cuts totaling approximately 1.16mb/d, with Saudi Arabia and its allies contributing the bulk of the cuts. Non-OPEC countries Oman and Kazakhstan were to contribute cuts of 40kb/d and 78kb/d, respectively. The remaining 1.04mb/d of cuts were to come from OPEC. Obligated parties to the OPEC+ agreement have been significantly under-producing for a long time. Output among the obligated OPEC parties saw a recent peak of 25.45mb/d last August, which was still 1.24mb/d below target. OPEC+ announced cuts effective in November of 2022, and this cut the OPEC output target by 1.27mb/d, but OPEC output continued to fall – resulting in smaller but still significant underproduction of an average of 0.94mb/d through February. The new 1.04mb/d drop in the May quota would theoretically eliminate this gap, but a gap is likely to persist. The reason for this is evident when we look at for whom the quotas are binding.

Most of the OPEC underproduction is due to Angola (371kb/d under target) and Nigeria (362kb/d under target), even after a cut to both of their output targets in November. Unless these countries, along with the Congo (34kb/d) and Equatorial Guinea (58kb/d), increase output, a wide production gap against the OPEC target will persist. Saudi Arabia and Iraq underproduced by 117kb/d and 44kb/d in February (the latest month for which data was available at the time of this writing), respectively, meaning their actual cuts from those production levels will need to be 383kb/d and 167kb/d. The UAE will need to contribute a 167kb/d cut, and Kuwait a 135kb/d cut. Assuming all parties with voluntary output cuts fully comply and other parties hold production steady, output would fall by 0.94mb/d to 23.55mb/d, which would be 0.83mb/d below target. Accordingly, the announcement was impactful on market prices, with spot futures prices for both Brent and WTI rocketing 6.3% higher on April 3 following the news.

In its monthly oil market report released in March, the International Energy Agency (IEA) saw oil supply meeting demand in the first half of the year, but falling into a deficit in the second half with rising Chinese demand and seasonal trends. The IEA commented on the OPEC+ output cut announcement by stating that, with global oil markets “already set to tighten in the second half of 2023,” there is now “the potential for a substantial supply deficit to emerge.”. The output cuts would deepen this deficit, all else equal. This could be abated somewhat, however, should both higher prices and increased demand for US oil abroad spur US production gains. Other non-OPEC countries could also see production rise for similar reasons. While US production has risen significantly year-on-year, it remained well below the 13.10mb/d pre-pandemic high as of this writing.

Dan Lothrop is Head Trader at over-the-counter derivatives company Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.