All

Terminal Operations: Taking Stock for 2023

What’s in the pipeline for terminals and bulk plants?

The list of recent obstacles for fuel storage and supply facilities does not contain any surprises: low inventories, a backwardated market, supply chain challenges, tight markets and transportation and operational logistics headaches. These issues of the last few years were only exacerbated by Russia’s invasion of Ukraine and the ‘short war’ that has now lasted almost a year. The European Union sanctions on Russia, including the $60 per barrel price cap on crude petroleum and other oil exports that took effect in December 2022 and the ban on refined petroleum products as of February 2023, as well as any further expansion of the war, will continue to impact local fuel supply and prices.

Looking forward, terminal and bulk plant providers are doubling down on biofuels, customer service and supply management, infrastructure and acquisitions.

HBIIP Expansion Opens New Opportunities

There are many different opinions about the Inflation Reduction Act (IRA) of 2022, but it pumped an additional $500 million to the Higher Blends Infrastructure Incentive Program (HBIIP) and expanded the list of eligible facilities to include home heating oil distribution centers or equivalent entities.

“What’s groundbreaking with the expansion of HBIIP is that Washington is actively encouraging the growth of biofuel facilities by underwriting half or more of the costs to install tanks, pumps, dispensers and more, not just for the large terminals but also for liquid fuel oil distributors with bulk plants,” commented Sean Cota, President of the National Energy & Fuels Institute (NEFI). “This is a great opportunity for our members to expand their operations. Already, nine fuel suppliers in the Northeast have been granted more than $11 million in previous awards.”

The IRA grants are to be distributed over the next 10 years. Projects must request funds for the installation, retrofit or other upgrade to fuel dispensers, pumps and related equipment; storage tank system components; and other infrastructure related to dispensing biofuels containing at least 20% biodiesel. The IRA also included the option for the Department of Agriculture (USDA) to increase the scope of the grant to 75% of project costs from the previous 50%, but that determination is left up to the agency.

HBIIP was created in 2020 and the first grants awarded in 2021, with more than $11 million going to fuel suppliers in the Northeast. The next round of applications opened – and closed – last fall, but recipients have not yet been announced. There is no word, at present, of when the next Notice of Funding Opportunity will be published.

Following the announcement of the second Notice of Funding Opportunity, NEFI sponsored a “Higher Blends Infrastructure Incentive Program Overview and Enrollment Orientation” webinar in October 2022. During the presentation, representatives from the USDA explained the HBIIP application process and the multiple authentication requirements which must be completed before an individual can even enter the application portal. Any bulk plant or fuel terminal operation considering submitting for future grant awards should visit rd.usda.gov/hbiip for more information and begin authentication in advance of any notice.

Acquisition: A Growth Platform

Last year, many of the largest players in the liquid fuels market were either merged with or acquired by others. Two of the most notable were the acquisition of Renewable Energy Group by Chevron, creating the new entity Chevron Renewable Group; and the purchase and privatization of Sprague Resources by Hartree Partners. Both of the companies are poised for growth with these moves and spoke to Oil & Energy Magazine about the industry as well as their outlook for the future.

Chevron Renewable Energy Group

The acquisition of Renewable Energy Group was completed in June, and is seen as a “pivotal point in the advancement of liquid renewable fuels,” by Troy Schoen, Director of Sales for Chevron Renewable Group. As one company, they can “scale production and distribution of lower carbon intensity fuels more broadly than either could do individually.”

Furthermore, the expansion of the Geismar, Louisiana renewable diesel production facility will more than triple the facility’s production capabilities to 340 million gallons of renewable diesel per year by 2024 from the approximately 90 million gallons of renewable diesel it currently produces per year.

“Biodiesel and renewable diesel are some of the most efficient ways for the heating oil, on-road and off-road industries to achieve lower carbon targets. The tightness in the liquid fuels markets amplifies the need for more supply of these ‘homegrown contingencies’ which can offset supply shortages and price increases,” Schoen said. “We believe that in the years to come, we are going to continue to see increasing demand for lower carbon fuel options, and we have increased our biodiesel supply, terminal positions and partnerships to offer greater supply.” Chevron Renewable Energy Group has announced its goal to have the capacity to produce 100,000 barrels/day of renewable fuels by 2030.

Schoen acknowledged that Chevron Renewable Energy Group, like businesses and industries across the globe, faced unique supply chain challenges through the pandemic, some of which are still in play. The company, he claims, is working with terminal, distribution and retail partners to mitigate customer concerns in the short-term, and looking at ways to make the supply chain more reliable for the future.

Sprague Resources Goes Private

Sprague Resources closed on the NYSE for the last time on October 31, 2022. As of 12:01 a.m. November 1, the company was part of Hartree Partners, a private company operating in the financial and investment segment of the wholesale energy market.

According to Kristyn Schweitzer, Sprague’s Director of Wholesale North, the recent challenges in the marketplace are opportunities for growth. Amid the unforeseen market volatility and supply constraints with the War in Ukraine, the company was able to adapt to the market and meet their customers’ needs, she explained.

Furthermore, Schweitzer continued, the supply team “managed our assets in a way that we were the last one maintaining inventory for our customers. Our internal and external communications helped our customers understand and manage their supply despite the market volatility.”

Looking forward, Schweitzer sees inventories remaining tight with a backwardated market and increasing U.S. liquid fuels exports to Europe in response to the sanctions. They recommend retailers should strengthen their supply partnerships and be aware of any available purchasing options.

Sprague is also anticipating a long future with renewables, and proudly claims the company’s designation as the first BQ9000 approved wholesaler “many years ago” as proof of their commitment to cleaner burning fuels.

Where We Are Right Now

The market volatility of the past few years is not likely to abate in the near future.

The full brunt of the European sanctions has yet to be felt, and the war continues to rage across Ukraine.

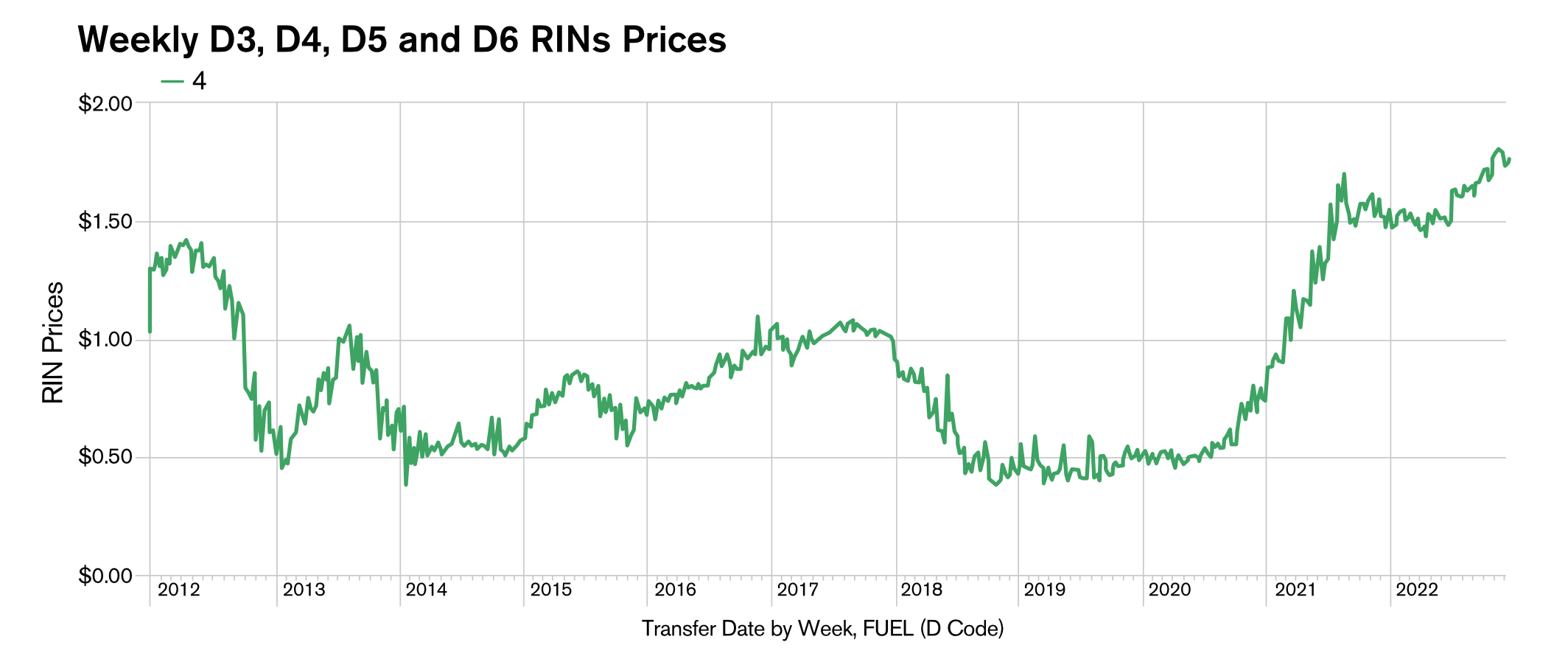

D4 RINS are at their highest point in more than a decade.

Distillate stocks have seen some increases from the extreme lows of a few months ago, helped along by the warmer than normal winter, but are still well below the 5-year average. Experts have noted the country is “one cold snap away” from a crisis, and almost hit that point in December when utilities in the Northeast switched over to oil for power generation.

RFS waivers are still being litigated, as so-called “small refiners” attempt to avoid their obligations to the rest of the world.

Representatives from both terminals reiterated the importance for customers and partners to plan in advance to ensure supply for the next year. It’s advice that should be heeded.

Related Posts

Why Quality Matters in Your Biofuel Blends

Why Quality Matters in Your Biofuel Blends

Posted on June 25, 2025

Incorporating Higher Blends of Biofuels

Incorporating Higher Blends of Biofuels

Posted on May 14, 2025

NORA Programs at Eastern Energy Expo

NORA Programs at Eastern Energy Expo

Posted on May 13, 2025

March Short-Term Energy Outlook

March Short-Term Energy Outlook

Posted on April 28, 2025

Enter your email to receive important news and article updates.