Oilheat dealers are working together to defend the industry against a new generation of competitive threats launched by state officials trying to expand the natural gas footprint in the Northeast.

Officials in Connecticut, Massachusetts and New York are pursuing natural gas expansion with proposals and/or projects aimed at making it easier and less expensive for utilities to expand their distribution networks. The plans take dead aim at the oil heat market, with visions of hundreds of thousands of current homes and business converting to natural gas heat.

The proposed expansion of natural gas in the Northeast is playing out on a state-by-state basis but is also part of a regional strategy. The governors of the six New England states have highlighted natural gas expansion as a shared priority and recently issued a joint statement confirming their commitment.

“As the region’s electric and natural gas systems have become increasingly interdependent, ensuring that we are efficiently using existing resources and securing additional clean energy supplies will be critical to New England’s economic future,” the governors wrote in a statement. “To ensure a

reliable, affordable and diverse energy system, we need investments in additional energy efficiency, renewable generation, natural gas pipelines and electric transmission.”

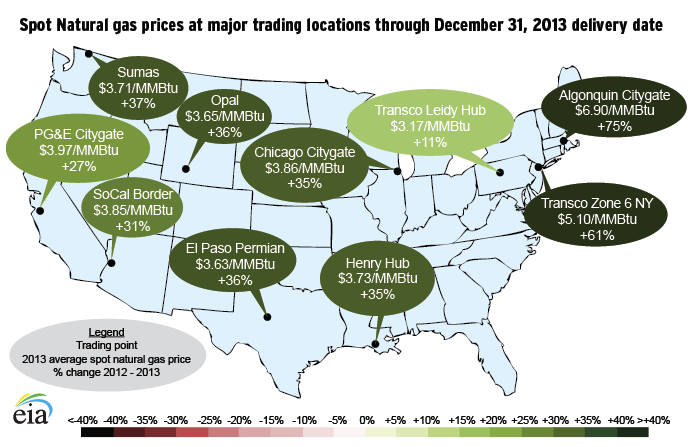

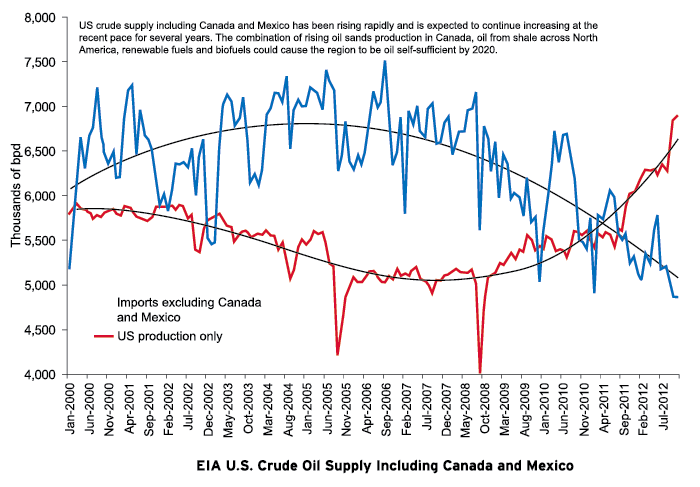

While the governors are beating the drum for expansion, the region’s utilities are grappling with serious supply issues that have caused natural gas spot prices to spike and interruptible gas customers to turn elsewhere for energy.

Battleground Connecticut

The state and regional trade associations that represent oil heat dealers are treating these incursions as existential threats and challenging the plans wherever possible.

The most public contest is in Connecticut, where the state officials are working to implement an aggressive state energy plan proposed by Gov. Dannel P. Malloy. The governor put natural gas front and center in October 2012 when he announced that he was looking to make the state more competitive by converting 300,000 homes to natural gas heat.

The Connecticut Energy Marketers Association (CEMA) has met Malloy head-on, challenging his plan at every turn and winning some important early victories. The state Legislature adopted the framework of his plan last year, and CEMA has moved to “street fight” mode to protect Oilheat dealers community by community.

Chris Herb, President of CEMA, said the state Public Utilities Regulatory Authority (PURA) has approved a docket that allows for 900 miles of new gas pipeline with a modified goal of converting 280,000 homes to gas heat. The plan is tremendous threat in a state with 600 oil dealers serving a combined 680,000 homes.

Town-by-Town Fight

While the overall expansion plan has the blessing of the state Legislature, Connecticut’s gas utilities must propose each expansion project to PURA separately. This affords CEMA the opportunity to marshal its forces and mount a local campaign in opposition.

Gas line expansion is an expensive proposition, and Herb says the utilities have demonstrated an aversion to risking their own money on system expansions. Their preference is to shift project costs either to ratepayers or to the state, so that company shareholders are not exposed to the risk of building pipelines on speculation.

Spotting a local threat will require vigilance on the part of Connecticut oil dealers, because the utilities are not required to make an announcement when they solicit customers for an expansion project. Instead, CEMA expects them to reach out quietly to customers and try to meet their threshold requirements, as set by state regulators.

PURA allows the Connecticut utilities to pass the costs of expanding gas service into a neighborhood only when the utility pre-enrolls 60 percent of the potential customers on the line in service agreements. If fewer than 60 percent of the potential customers sign on, PURA will not let the utility charge the costs to its ratepayer base. Instead, the utility must underwrite the project on shareholders’ backs or abandon it. “They do not want to expend any of their own money,” Herb said of the utility shareholders.

“Originally, the utilities wanted to be able to lay the pipeline and have the customers come to it, and they would simply raise rates on current customers and impose premiums on new customers,” Herb said. “We said that was unfair.”

Herb said that CEMA’s members are very engaged and active in the process, and they are keeping their ears close to the ground, listening for any talk of utilities soliciting customers on their turf. CEMA has equipped its website homepage (www.ctema.com) with a “Report Natural Gas Activity” button, so members can notify the association as soon as they learn of a potential expansion project.

Early Intervention

By spotting expansion projects in the early stages, CEMA can enter the fray and conduct a public relations blitz. Herb said there are plenty of helpful messages to share with customers considering conversion. They can make a great positive case for heating oil, focused on the attentive, personal service that oil heat dealers provide; the importance of maintaining choice and diversity in the marketplace; and the excellence of the liquid fuels that blend ultra-low sulfur heating oil with renewable biodiesel.

They can also make a strong negative case against natural gas. The utilities’ fuel damages the environment and aggravates climate change, and customers must trade in their reliable oil heat service to do business with a utility. On the utilities’ favorite issue, today’s relatively low natural gas prices, CEMA and its members and allies can make an excellent case that the prices of natural gas and heating oil will soon converge again.

Herb said the utilities historically have had an uphill battle signing up enough customers to make expansion projects worthwhile. “They have never been able to achieve the conversion estimates they have made in the past,” he said. “Granted the economics have changed in the utilities’ favor with the low gas prices, but we are happy that the conversion rate the regulators picked is much higher than what the historical rates of conversion have been. We believe this will limit the expansion plan.”

Signing up customers on the basis of low price will be a challenge too, because new gas customers have to pay a 30 percent surcharge on their gas for 10 years to help cover the costs the utility has paid to serve them.

If CEMA and its member companies can dissuade customers in a proposed expansion area from signing on for gas service, “we’ll put a real kink in the utilities’ plans,” Herb said. “We need the commodity costs to sort themselves out, and we’ll be buying some time by meeting these plans with resistance.”

The association will prepare a number of communications pieces that members can pass on to consumers who might be considering fuel conversion. There will be a lot of different options for the dealers,” he added. “They will have to make a risk assessment and ask themselves how valuable it is to fend off a threat in a particular neighborhood.” CEMA will also continue to reach out to government officials and the media and to call out any false information that is presented to state residents.

‘Heating Oil Fighters’

Even with PURA setting such demanding thresholds on pre-enrollment, the gas expansion plan remains “a very serious threat,” according to the CEMA President. “Approximately 40 percent of our market is at stake. The consequences are potentially dire for this industry. That’s why we don’t have any choice but to succeed.

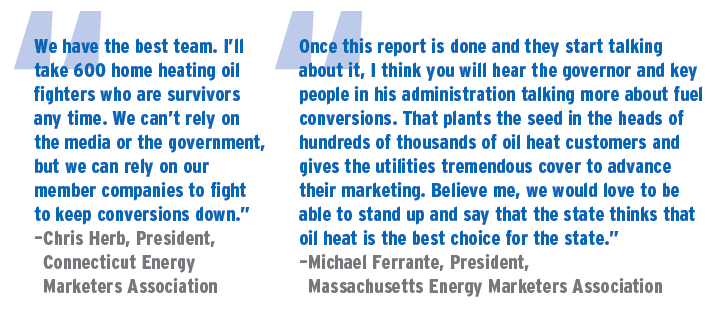

“We have the best team. I’ll take 600 home heating oil fighters who are survivors any time. We can’t rely on the media or the government, but we can rely on our member companies to fight to keep conversions down.”

CEMA also plans to take the battle to the streets, literally, by making it more costly for utilities to install gas mains and service lines. The Association is asking members to introduce a proposed paving ordinance in every Connecticut city and town. The proposal would require any company that digs through the pavement to resurface the street from curb to curb.

“Our goal in 2014 is to get all 169 municipalities in Connecticut to introduce a paving ordinance. Many times what you see after a gas main project is a 36-inch wide strip that is five miles long,” Herb explained. “They patch it and go away, and it gets all chewed up. That is unacceptable. The ordinance would drive up the price, and that’s another reason for them not to do the project.

“Mayors, first selectmen and finance committees will love this, because instead of them having to spend more of their municipal budget on pavement, the utilities will have to pay for it. It will save communities money, and everyone will benefit from it.”

Important Victories

Connecticut oil dealers had already demonstrated their mettle before the state Legislature approved Malloy’s energy plan. When the state held five public hearings to gather input, more than 200 dealers attended, and many of them testified.

Dealers also worked closely with the association to defeat a proposed $.035 per gallon tax on heating oil that would have provided subsidies to convert heating oil customers to natural gas. “That one never even got out of committee,” Herb noted.

The dealers also helped defeat a proposal to authorize state borrowing via bond sales to help pay for natural gas expansion.

“The state has tremendous ability to borrow. If there was financing through bonding, that could have made conversions virtually free,” he added. “As disappointed as we are with the overall policy, our approach has been to dry up the financing sources. If they can’t get the money they are limited in what they can do.”

Herb said PURA might have done the oil heat companies a favor by building in the premium or surcharge on new customers.

“If we’re right and the commodities prices sort themselves out, you could see tremendous price pressures on natural gas customers in the future. He said the 30 percent surcharge rate is not locked in, and the utilities might come back and look for an even higher rate. Southern Connecticut

Gas has indicated that they would like to see the rate at 60 percent, according to Herb.

“If they drive up the price of their product, that’s not the worst thing that could happen,” he added. “All that this expansion plan has done in Connecticut is drive up the price of natural gas. Consumers will see higher natural gas prices because of government intervention.”

CEMA is also considering legal action against the State regarding the approval process for the natural gas expansion. “We believe the state cut a corner on the general Environmental Protection Act, which states that for any policies that impact protected wetlands, you need to do an environmental impact study, and no one did that,” Herb said.

Threat Emerges in Massachusetts

Unlike the much-publicized struggle in Connecticut, the battle over state-assisted fuel conversion in Massachusetts is happening away from the public eye. Gov. Deval Patrick has not announced any natural gas expansion policy, but the matter is under study at the state Department of Energy Resources (DOER).

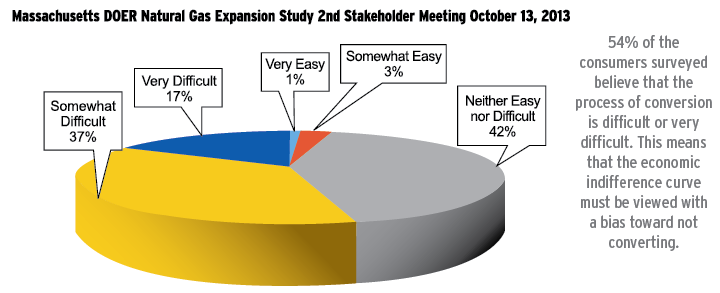

Michael Ferrante, President of the Massachusetts Energy Marketers Association (MEMA), said DOER is looking at options for accelerating the expansion of natural gas to help the state’s obligations under the Massachusetts Global Warming Solutions Act of 2008.

The state agency has hired consultants to perform a natural gas expansion study and prepare policy recommendations, and Ferrante sees an imminent threat to oil heat dealers. “They’re calling it a study, but to use their phrase they are studying policy options along with strategies and rate models that would advance the use of natural gas.”

Indeed a preliminary report on the study by consultant Sussex Economic Advisors is focused largely on potential rates of conversion to gas heat in different policy scenarios. “These are clear efforts to further erode oil,” Ferrante observed.

MEMA pushed back against the study from the outset and made it clear to the DOER that heating oil dealers were very concerned about the state’s approach, he said. “The governor has not stood up and said he wants to convert X number of homes, but our state clearly has a greenhouse gas emissions law and goals set by the Legislature that they have targeted,” Ferrante said. “This is proof of that.”

Setting the Stage

“What scares me is that they have the underpinnings to move forward on this. It could be done in the name of the Global Warming Solutions Act. We have established state laws that call for emissions reductions, and this could be one of the roadmaps. The governor could use the Sussex report, if it is favorable in terms of encouraging conversions, and say we are following this report and we see this as a good policy.

“Once this report is done and they start talking about it, I think you will hear the governor and key people in his administration talking more about fuel conversions. That plants the seed in the heads of hundreds of thousands of oil heat customers and gives the utilities tremendous cover to advance their marketing. Believe me, we would love to be able to stand up and say that the state thinks that oil heat is the best choice for the state.”

MEMA has participated in the study as a stakeholder, filing a report that makes a case for heating oil as environmentally sound fuel and refuting the notion that today’s low natural gas prices will continue. “Our task was to refute the claims about natural gas being a better fuel and show that there should not be an aggressive plan for moving people to natural gas,” he said.

“Our board views this as a very serious threat, an attempt to erode their businesses once and for all,” the MEMA chief added. “There is an off-oil policy that exists here. [State officials] see us as part of the energy mix, but they would not be unhappy if our role was diminished.

“The fact that they are using taxpayer dollars to fund this is uncomfortable for us. Government funds are being used almost to eviscerate this industry. We don’t see taxpayer dollars being spent on looking to expand the use of Bioheat® heating oil.”

MEMA has also raised to DOER the question of whether the gas utilities are prepared to support hundreds of thousands of new customers, given the identified problems with natural gas shortages and leaking natural gas pipelines in Massachusetts.

“We are encouraging them to look at the problems with the natural gas industry before looking at expansion,” Ferrante said. “If you’re going to add hundreds of thousands of customers to lines that are already strained due to supply and demand, that is a question that has to be explored.”

Wait and See in New York

In New York, the largest-volume oil heat state, there is also a government-initiated natural gas expansion plan. The New York Public Service Commission (PSC) floated the plan in late 2012 to expand the natural gas footprint, and the oil heat associations in the state participated as stakeholders. They filed four reports covering potential environmental and economic impact as well as current assumptions about oil and gas prices, according to Kevin Rooney, CEO of the Oil Heat Institute of Long Island (OHILI).

In a preliminary study, the PSC identified more than 1.1 million homes that could be targets for oil-to-gas conversions, based on their proximity to a gas main. To date there has been no report issued, and it is unclear whether the Commission is continuing to pursue the plan, according to Rooney.

He said the utilities in New York State welcome the opportunity to convert hundreds of thousands of customers to natural gas heat but are reluctant to invest in new infrastructure without a favorable rate structure that shifts the cost away from shareholders.

Rooney said it’s hard to see how natural gas expansion would benefit the state. “Is the goal to improve the environment? We’re the only state that uses ultra-low sulfur heating oil with a bioblend. Where is the advantage? It all comes down to price, price, price, but you don’t make long-term investments based on short-term price disparities. That’s just plain dumb.”

Even with current favorable price conditions, natural gas is not something every New Yorker wants, Rooney noted. “People don’t necessarily buy only on price. They also buy based on intangibles, including reliability, service and the personal nature of the people you’re dealing with. When you need something, do you go to the local Ace hardware store, or do you go to Home Depot and wander the aisles for an hour and a half trying to find someone to help you? If you want the cheapest price, that’s the experience you get. That’s the best thing the heating oil industry has going for it: the highly personalized purchasing experience.”

Vermont Pipeline Gets Green Light

In Vermont, the natural gas infrastructure is expanding with recent approval by the state Public Service Board of Vermont Gas’s proposed pipeline from Burlington to Middlebury. Matt Cota, Executive Director of the Vermont Fuel Dealers Association (VFDA), said Vermont Gas could pick up as many as 3,000 fuel conversions along the new route.

“What swayed the Public Service Board was an economic argument based on assumptions about the disparity of fuel prices. As we all know, predictions about commodity prices haven’t been borne out, but [natural gas advocates] were making a claim that couldn’t be disproved or proved, and based on the political climate that was enough to get the pipeline passed.”

With the first extension approved, Vermont Gas is now pursuing a second pipeline extension that would traverse Addison County from Middlebury to serve the International Paper Co. plant in Ticonderoga, N.Y. The extension would include a pipeline built under Lake Champlain, which straddles the Vermont-New York border.

The utility is also expected to seek approval for further southward expansion to the city of Rutland. “The big prize for them is Rutland, where they think they can access another 13,000 accounts,” Cota said.

Unlike the utilities in Connecticut and New York, Vermont Gas succeeded in having its expansion costs paid by ratepayers by means of a rate surcharge. “The price of the pipeline at $2 million per mile is being borne by existing ratepayers,” Cota explained.

VFDA has seen very little appreciation of the heating oil industry from state officials. “We have not seen any effort to recognize that [natural gas expansion] will have negative economic consequences on the heating oil infrastructure,” Cota said. “When [tropical storm] Irene hit, it was the fuel dealers who provided the oil and propane that kept the hospitals and generators and backhoes going so that Vermont could recover. This infrastructure is not a problem that needs to go away; it’s a vital part of Vermont’s sustainability. It should not be sent packing because of a blip in commodity pricing.”

Open Invitation in Maine

In Maine, the state government is strongly encouraging natural gas expansion but has not rolled out any state-supported expansion plan. Instead, the state Legislature has authorized the state Public Utilities Commission to pursue collaborative arrangements with other jurisdictions that would bring more natural gas to Maine, according to Jamie Py, President of the Maine Energy Marketers Association. The Legislature has also authorized bonding to help pay for natural gas expansion, but no bonds have been issued.

“We opposed this completely with the argument that the state is stepping in where private enterprise should be left alone,” Py said. Maine needs its deliverable fuel infrastructure, because fuel dealers are vital providers who step up when the utilities can’t meet demand. In recent weeks, several Maine mills that fuel their operations with natural gas had to discontinue operations and furlough workers because natural gas price spikes made their operations uneconomical.