All

Shallow Stock Levels Continue, Despite Early Cushion

by Anja Ristanovic, Hedge Solutions

Continued production cuts lead to pricing concerns for winter

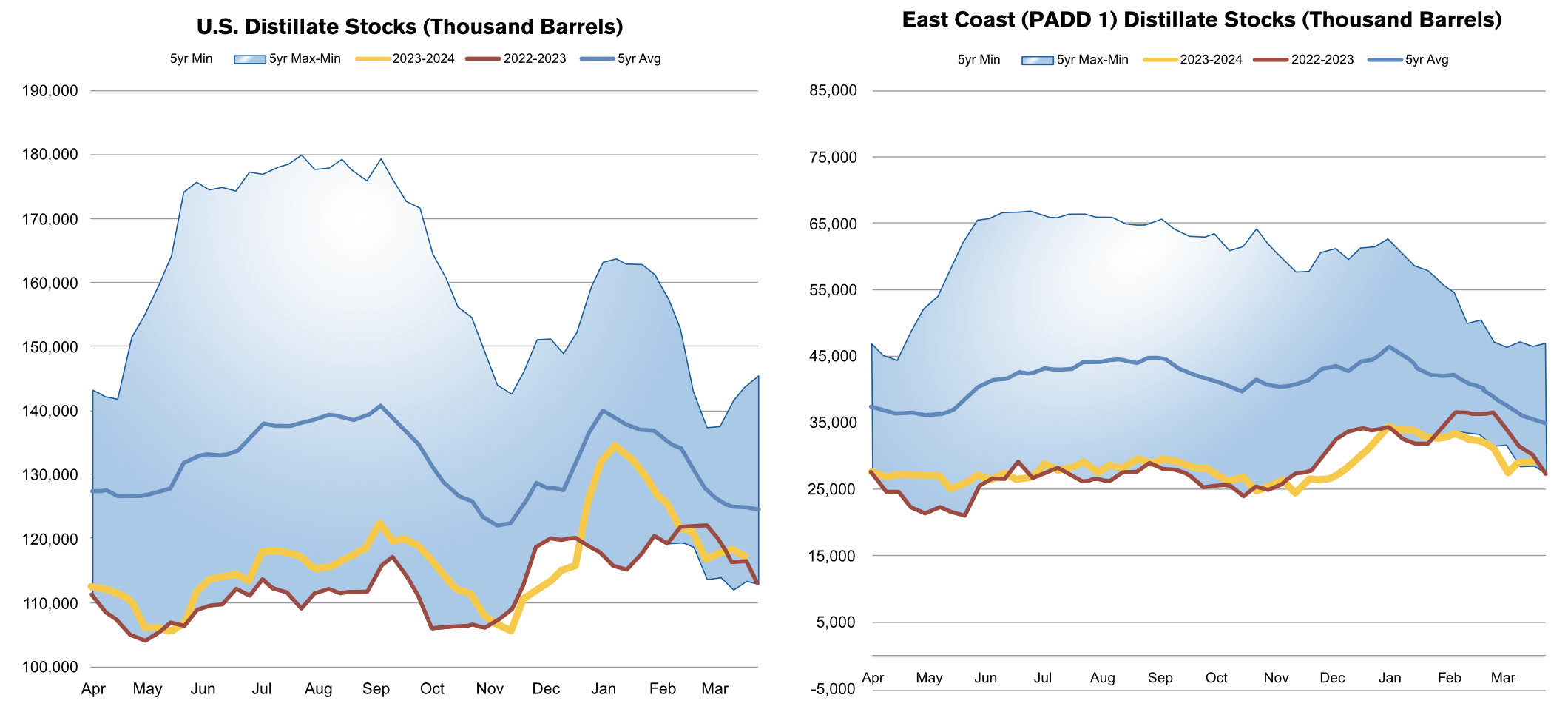

Distillate inventories, which include heating oil and diesel fuel, remained near historic lows at the end of the 2023-2024 heating season. This raises concerns about potential price spikes as the next winter season approaches. US distillate stocks had a healthy cushion at the beginning of 2024 but have been on the decline since late January. According to the latest data from the Energy Information Administration (EIA), as of March 22, 2024, total US distillate inventories sat at 117.34 million barrels (mb), which was just 0.6 percent higher than last year’s levels but 6.1 percent below the five-year average.

Though total US distillate inventories are low, the situation across the East Coast region or PADD 1 continue to run at anemic levels. As of the March 22 report, PADD 1 distillate inventories fell to 29.17mb, which is 3.0 percent lower year-on-year and represents a sharp 18.0 percent deficit compared to the five-year average.

So, what is causing the persistent shallow stock levels? Global geopolitical tensions, which include the Russian-Ukrainian war, the Gaza strip conflict, and attacks on vessels in the Red Sea, have disrupted global energy markets. Additionally, US refinery utilization decreased by about 11 percent in the second week of February, compared to the start of the year. They have since rebounded and were 4 percent lower as of March 22. Planned refinery maintenance on the Gulf Coast and a major unplanned outage at BP’s refinery in Whiting, Indiana (the largest refinery in the Midwest) contributed to the overall drop in US refinery runs. Moreover, cold weather in January brought additional pressure on inventory levels due to the resulting increase in demand. That said, overall heating degree days from November 2023 to March 2024 are expected to be 130 lower compared to last season and 260 HDDs below the 10-year winter average, according to the March 2024 Short-Term Energy Outlook by the EIA.

Low distillate fuel stock levels across the US and especially on the East Coast are causing some concerns as we look ahead to next winter. Even though winters are expected to remain relatively mild compared to the norm, the EIA forecasts about a 4 percent increase in heating degree days in the 2024-2025 winter season, compared to the previous season. Geopolitical tensions and OPEC+ production supply cuts could have a significant impact on global oil prices, which could consequently make distillate production more expensive and lead to tighter supplies. Moreover, the NYMEX ULSD futures forward curve has been experiencing some backwardation, a situation where futures prices are below the spot prices, which provides economic disincentives for storage operations.

The EIA reduced its US crude oil refining capacity forecast by 120,000 b/d beginning in March this year after Phillips 66 reported that it will permanently stop processing crude oil at its Rodeo facility near San Francisco, California. They plan to convert the facility to renewable fuels production. The refinery produced about 60,000 b/d of distillate fuel and around 65,000 b/d of motor gasoline. After the conversion is completed, which is expected to be done by the end of the year, the refinery will produce around 50,000 b/d of renewable diesel, almost replacing the entire lost petroleum diesel previously produced. Refinery utilization is expected to average 89 percent this year, one percentage point lower than last year and the average refinery operable distillation capacity is expected to fall from 18.25 mb/d in 2023 to 18.22 mb/d in 2024. Distillate fuel refiner and blender net production is forecasted to decrease from a 4.91 mb/d average in 2023 to 4.84 mb/d in 2024.

In its March 2024 STEO report, the EIA estimated that US distillate inventories will stay near five-year lows over the next year. Backwardation, supply disruptions, and lower refining output are some of the factors that could keep distillate inventories near the bottom of the five-year range. Low inventory levels represent a thin cushion against adverse market developments that could send cash prices higher this upcoming winter.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.