As of this writing on October 1, we find ourselves on the cusp of another adventure into the unknown. Let’s look at what the heating season might bring us in context of the three elements that will impact us the most: weather, politics and price.

Weather

Per usual, early long-term weather forecasts are mixed. The Old Farmer’s Almanac is predicting a “milder than normal” winter this year in the Northeast region. The snowiest periods will be in November and December, while the coldest periods will be mid-January through late February. Other forecasters are mixed in their outlook; see this magazine’s “Winter Forecast” article for more details. Not to pick on the weather forecasters, but few if any have predicted the last two winters very well.

Geopolitics

There is plenty going on here. This time last year we had a mid-term election on the horizon, which ended up with a Democratic majority in the House. To add further volatility to the oil markets, we were dealing with the murder of dissident and journalist Jamal Khashoggi at the Saudi Arabia consulate in Istanbul, Turkey. Oil prices were in the midst of a sizeable rally at the time, up 35 cents/gallon since July 5. Prices were mainly hyping on the IMO 2020 concerns, a strong equities market, and positive vibes about a China deal. OPEC cuts were also contributing.

So, in the midst of all this bullish sentiment, what happened next? Prices tanked from a high of $2.45/gallon on the eve of the Khashoggi debacle, October 2, to a low of $1.62 just three months later on December 31. Go figure, prices cascade on a torrent of bullish headlines.

In contrast — or perhaps not — to last year, where are we now? President Trump faces potential impeachment. On September 14, it appeared that the Iranians had bombed the world’s largest oil refinery, located in Saudi Arabia (the Houthis actually claimed responsibility). Significant production is impacted. What do prices do? After a two-day spike (roughly 20 cents), the ULSD spot contract traded within a penny of where the price was pre-attack.

Meanwhile, IMO 2020 — the much-hyped regulation calling for the global shipping industry to cut distillate sulfur emissions by 86%, to 5,000ppm from 35,000ppm by January 1 — has been a major focal point, with questions surrounding the influence this will have on middle distillate prices. Analysts are somewhat unified on the impact to fundamentals. We need to produce roughly 2.2 million barrels/day of low sulfur distillates (somewhere between 15ppm and 5,000ppm) that we don’t have in the global capacity.

Yet, in spite of all this bullish news, prices are falling. Sound familiar?

ULSD Outlook

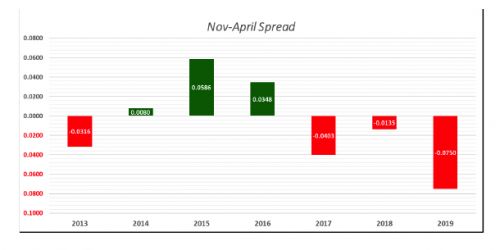

Let’s take a look at where distillate fundamentals are. One cause for concern is the position of the ULSD futures contracts. A look at the spread between the November through April futures contracts reveals a fair amount of backwardation. November is .0750 cents/gallon higher than April. When comparing this year to previous years, the backwardation is considerable — almost double the lowest of the previous years (2017). This inverted structure in the forward futures market is a disincentive to store oil, making it difficult to keep inventory in the terminals at critical moments during the heating season. Does it mean we will have shortages or basis spikes? Not every time.

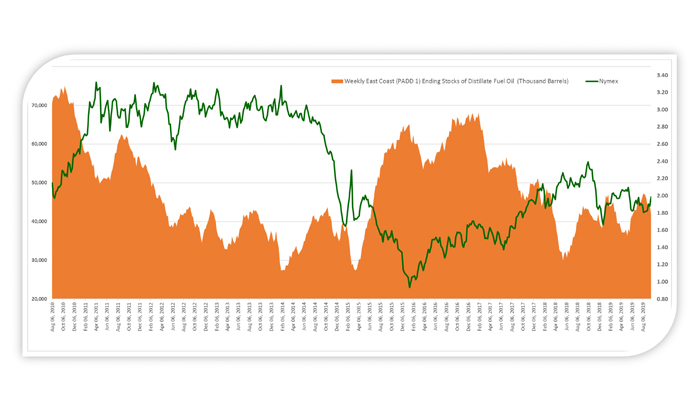

The graph showing PADD 1 (East Coast) inventories and Nymex price trends indicates subtle but not perfect correlation between inventory levels and price movement over the years. As of this writing, total U.S. distillate stocks are 1.8% below last year and about 3% below the five-year average. PADD 1 inventories are also about 1.8% below last year’s levels. I must say I am curious as to why the markets are comfortable with the current status going into the heating season, which current price movements are indicating. The East Coast is about to enter the winter minus one refinery (PES) that was producing roughly 135,000 bbls/day of low sulfur distillates. Perhaps the recent development allowing product flows on the Laurel Pipeline to move west to east, giving central Pennsylvania greater access to Midwest refining capacity, has dampened concerns in the Mid-Atlantic region?

I would advise caution when looking at the supply picture going into the winter. When considering the red flags out there — an inverted futures market, a strong cash market for this time of year, IMO 2020 unknowns, and a missing refinery — any heavily concentrated and severe cold spells could spell trouble with both basis and price action. A more granular view of the winter supply outlook will be out in the November/December issue.

In the meantime, please feel free to email or call me with comments or questions: rlarkin@hedgesolutions.com or 603-644-3343.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.