Supply and demand remain steady in the early days of Russian price caps

It has been a year since Russia invaded Ukraine and fighting continues. Following the invasion, both WTI and Brent crude oil prices hit highs not seen since the 2008 economic crisis, with WTI reaching $130.50 per barrel (bbl) and Brent crude hitting $139.13/bbl on March 7, 2022. Western nations soon began imposing sanctions on Russia that have mainly affected the energy market. The rationale was to curb Russian cash flow from oil and refined products exports, which account for about 40% of total export revenue, and which Russia greatly relies upon to fund the war. Possibly the most impactful sanctions include the European Union ban on the purchase, importation, and transfer of Russian seaborne crude oil and certain petroleum products; and a price cap on oil and refined products imposed by the Group of Seven (G7) nations, the European Union, and Australia. Let’s take a look at how these price caps work and their impact on global energy markets.

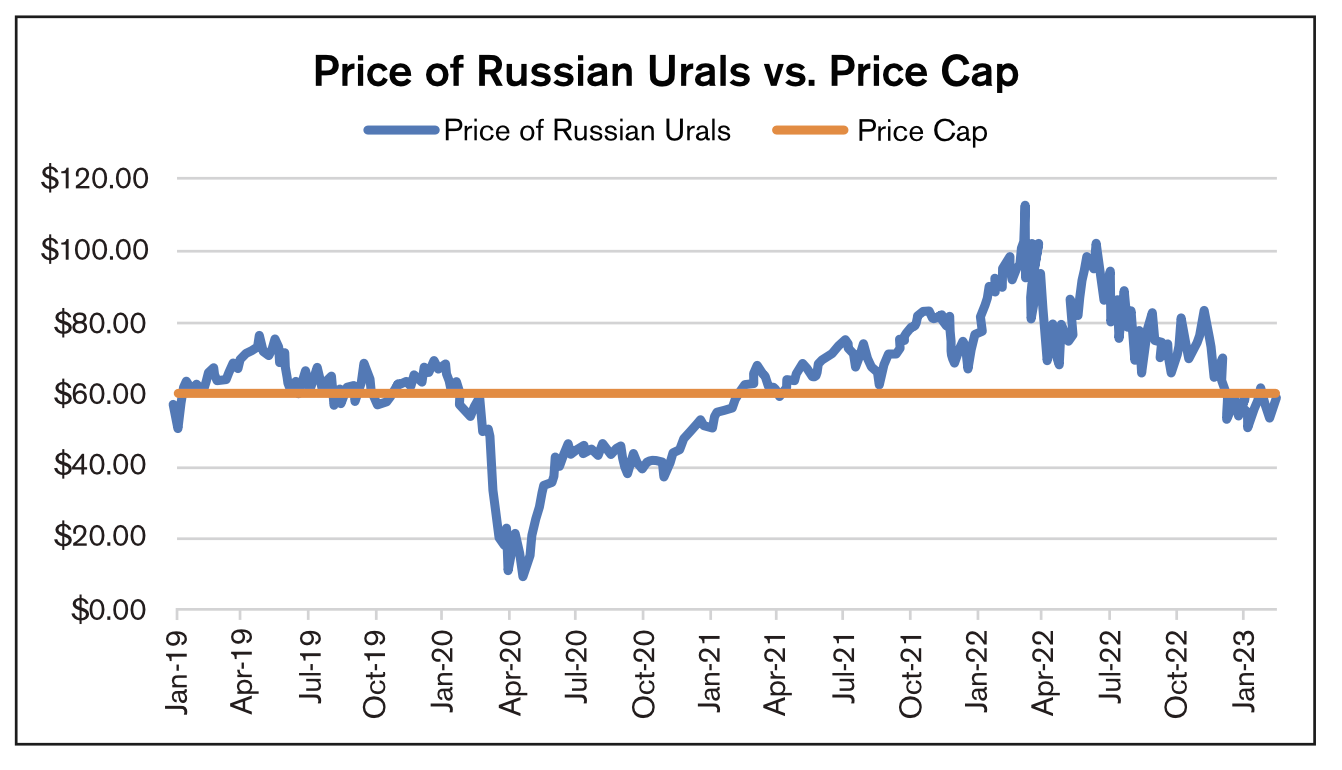

The Price Cap Coalition, consisting of the G7, the European Union, and Australia, agreed to set a price cap on Russian crude oil at $60.00/bbl, which took effect on December 5, 2022. This means that anyone who wants to engage in the trade of Russian oil through operators or insurers based in these countries cannot do so if the contracted price exceeds $60.00/bbl. Most of the major shipping companies and insurers are based in G7 countries. The price cap mechanism is to be reviewed every two months and can be adjusted based on the developments in the market. It is to be set at least 5% below the average market price for Russian oil, calculated on data provided by the International Energy Agency.

On February 5, 2023, price caps on certain Russian refined petroleum products came into effect in addition to the previously issued restrictions on Russian crude oil. The February price caps were set at $45/bbl for petroleum products trading at a discount to crude prices, such as fuel oil and naphtha; and at $100/bbl for products trading at a premium to crude, such as diesel, jet fuel, and kero-sene. These restrictions are meant to limit sudden spikes driven by extraordinary market conditions and significantly reduce Russian revenue collected from petroleum sales, as well as help stabilize global energy prices.

Are these controls affecting Russia as much as had been anticipated? Prior to policy deployment, the price of Russian Urals had already plummeted to around $60.00/bbl and has remained mostly below this mark since, meaning that the effect of price caps on Russian oil revenues might not be immediate. Some countries, like Poland and Ukraine, have pushed for a much lower pricing regime, but the US and some other countries were worried that if the ceiling was set too low, it would cause Russia to significantly cut its oil production and disrupt the supply/demand balance in the global energy market. As of this writing in February, the price cap on Russian crude oil remains at $60.00/bbl.

Additionally, after Western nations started imposing sanctions on Russian energy, Russia turned to markets in Asia, particularly in China and India, where the importation of Russian crude oil hit record highs late last year. Total Chinese imports from Russia more than doubled in 2022 compared to the year before, and Indian imports of Russian crude oil hit a record high in December, with India becoming the top buyer of Russian oil. However, China and India could use the level of price caps set by the West to negotiate a lower price of oil with Russia, and they also must follow them if they want to access European shipping and insurance services.

Russia has responded to these restrictions set by the EU and G7, promising to not sell oil to those who directly or indirectly adhere to the pricing policies. Days after the cap on refined products began, Russian Deputy Prime Minister Alexander Novak announced that the country will cut crude oil production by 500,000 barrels per day, or around 5%, in March, and that it plans to sell 80% of crude oil and 75% of its refined products to “friendly” countries. We could also see similar production cuts in refined products in the future.

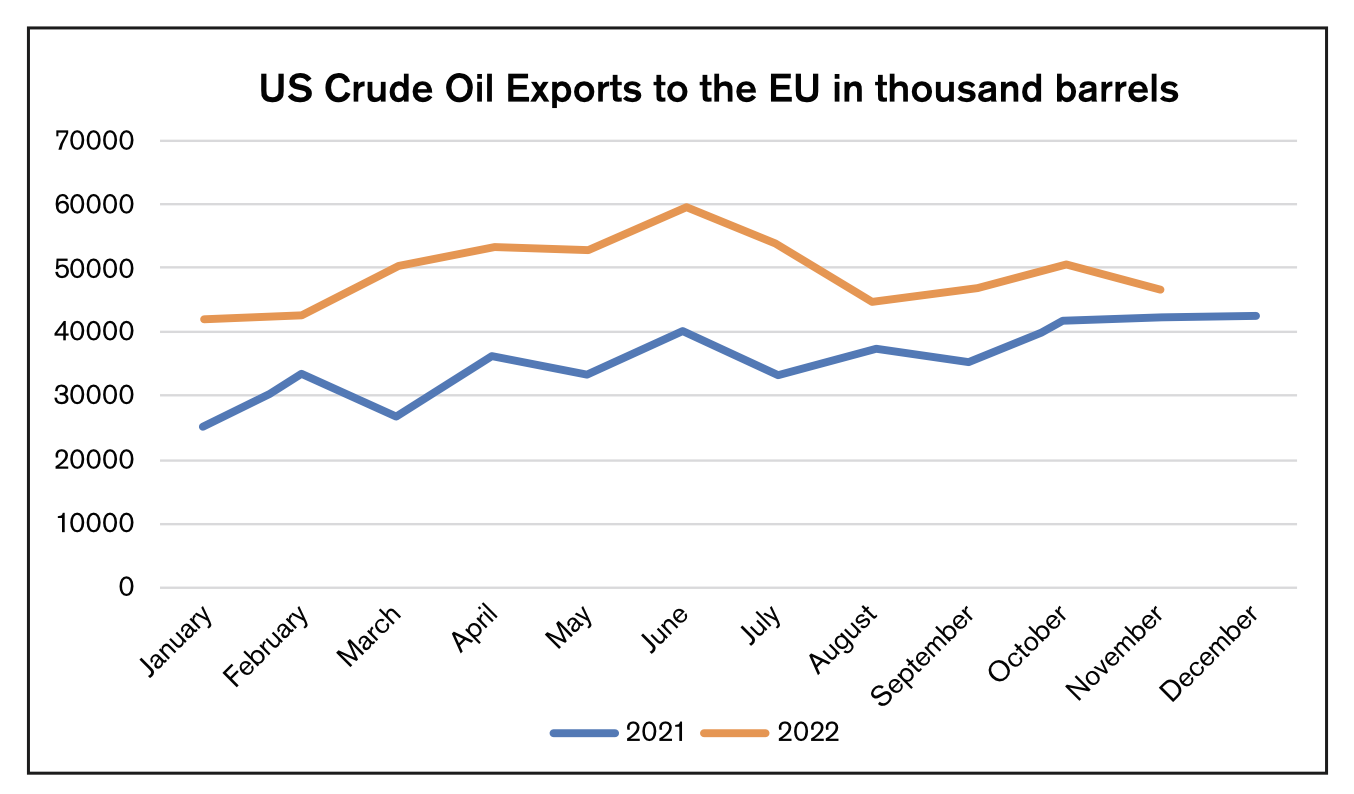

How are these restrictions affecting the US? The government banned the importation of crude oil, petroleum fuels, and liquefied natural gas from Russia in March of 2022. Imports from Russia made up only 8% of total US petroleum imports in 2021, which does not represent a great loss in petroleum supplies. Additionally, US crude oil exports to the European Union increased by about 41% in the period January-November 2022, compared to the same period the year prior, per Energy Information Administration data. On the supply side, the US has lifted some sanctions on Venezuelan oil, allowing Chevron to resume oil production in the country, with a goal to put more Venezuelan oil on the global market to compensate for the loss of Russian production.

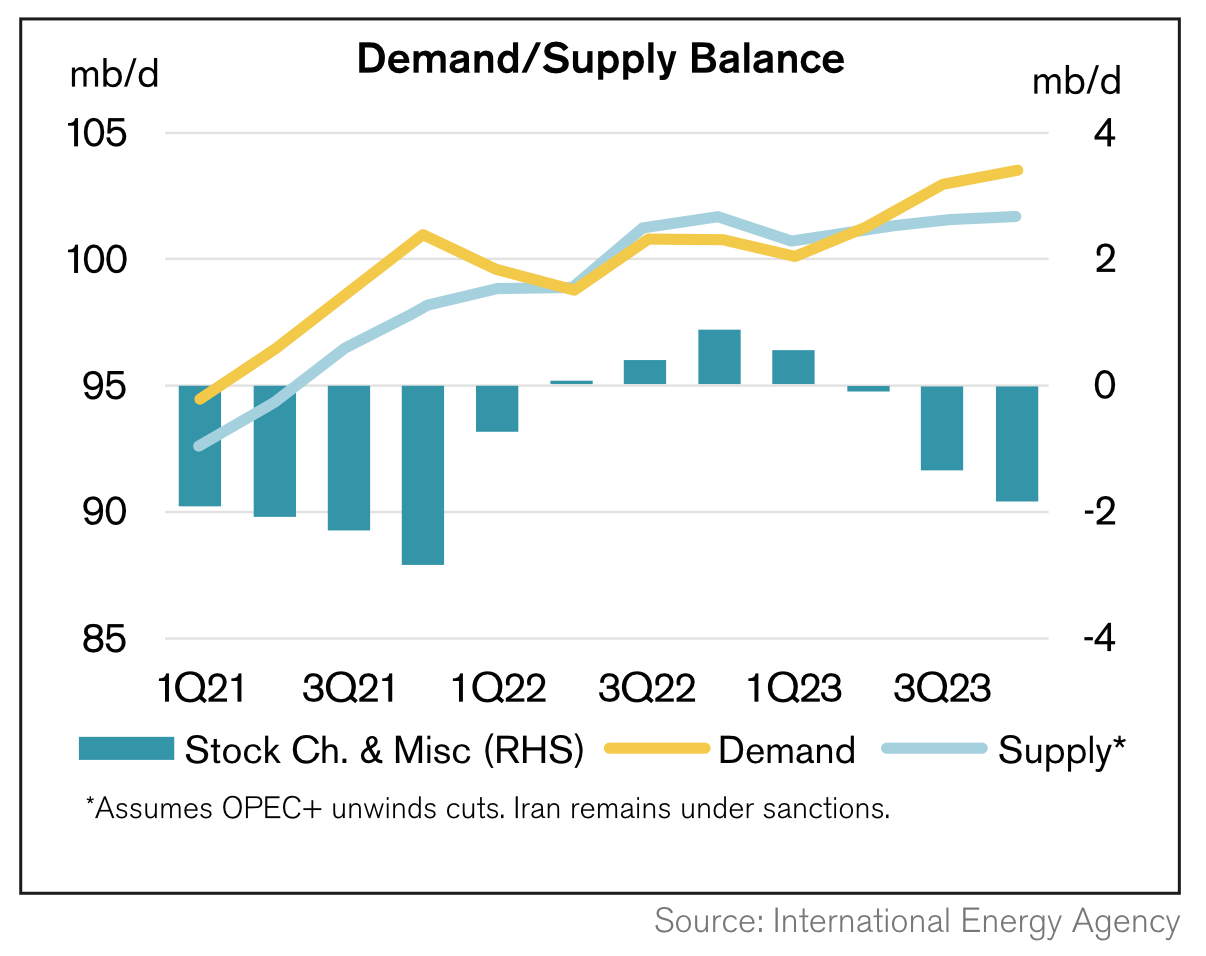

How is Russia faring under the Western sanctions? Oil production and exports have held up relatively well. As discussed above, the country has managed to reroute shipments of crude oil to Asia. In January 2023, Russian crude oil output was down by only 160,000 b/d compared to pre-war levels, but Russia’s plan to cut oil production in March could be a sign that Moscow is struggling, or it could be an attempt to raise oil prices. According to the International Energy Agency’s forecasts, global oil supply is expected to exceed demand through the first half of 2023, but we could see a deficit in the second half of the year as global oil demand rebounds with the reopening of China and with Russia expected to curb its production. Overall, global oil demand is expected to average 101.9mb/d in 2023, exceeding the global oil supply forecast at 101.2mb/d, according to the IEA February Oil Market report.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.