All

RINS, Explained

What they are and how they affect your profits

Members of the heating industry have been hearing about Renewable Identification Numbers (RINs) for years, and even more so in the last few months. Thrown about in the discussion are D and K codes, acronyms including RFS, RVOs, OPs and more. What does it all mean, and, more importantly, what does it mean to Oil & Energy readers?

In the simplest of terms, according to Sean Cota, President of the National Energy and Fuels Institute (NEFI), “RINS make us more environmentally friendly and make our fuel cheaper.”

“With the $1 per gallon Blenders Tax Credit and RIN values between $0.50 and $3.00 per gallon, these two elements reduce the carbon content of heating oil. As heating oil can blend higher amounts of biodiesel, it lowers the cost of the fuel compared to conventional diesel,” he explained further.

There is, of course, a lot going on behind the curtain: how RINs are created, who needs to buy them and who can sell them, and how many RINS can be sold per gallon of blended liquid renewable heating oil, or Bioheat® fuel. That last item is currently at issue due to the Environmental Protection Agency’s (EPA) latest proposed rule for biofuel volumes under the Renewable Fuel Standard, which is discussed at length in this issue’s Front Burner on page 3. RINS will also be a big topic at the HEAT Show in June. Oil & Energy has been given advance notice of a planned seminar on how the RIN system works, as well as a presentation by Chevron Renewable Group on RINs. We are sure these will be most informative and urge you to attend. Consider the following your “crib notes” to help you better understand what’s going on right now and give you a foundation for the June presentations.

Alphabet Soup

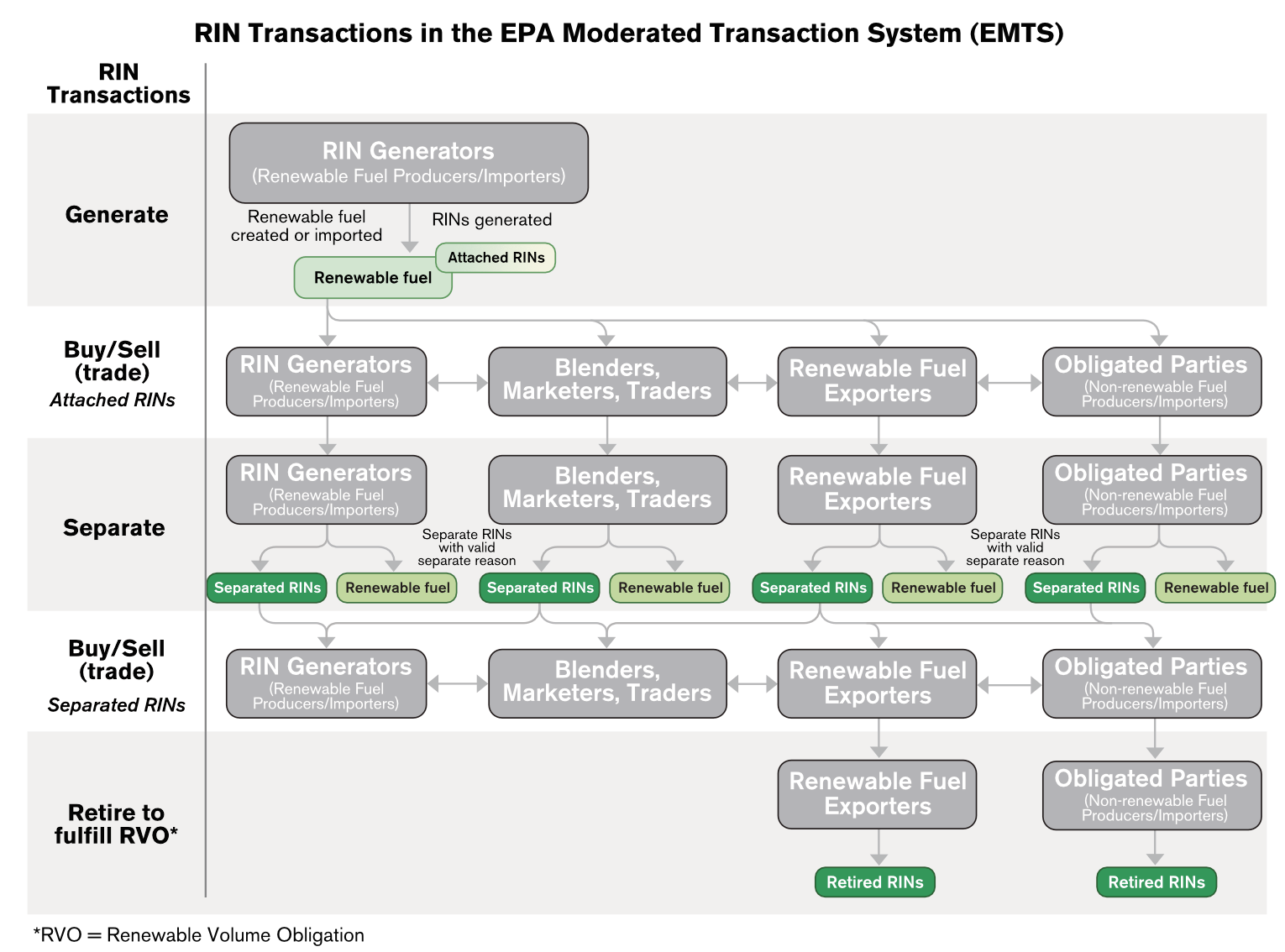

Any discussion of RINs will include a lot of acronyms. That makes talking and writing about the programs easier, but often more confusing. Here’s your breakdown: The U.S. Environmental Protection Agency (EPA) administers the Renewable Fuel Standard (RFS) program. The RFS requires renewable fuels to be blended into transportation fuels each year, and tracks compliance through Renewable Identification Numbers (RINs).

The RFS program assigns obligated parties (OP) a renewable volume obligation (RVO). OPs include transportation oil producers and refiners and gasoline and diesel importers. The RFS program was developed specifically to increase the use of renewables in transportation fuels, and so heating fuel producers, wholesalers or retailers are not obligated parties.

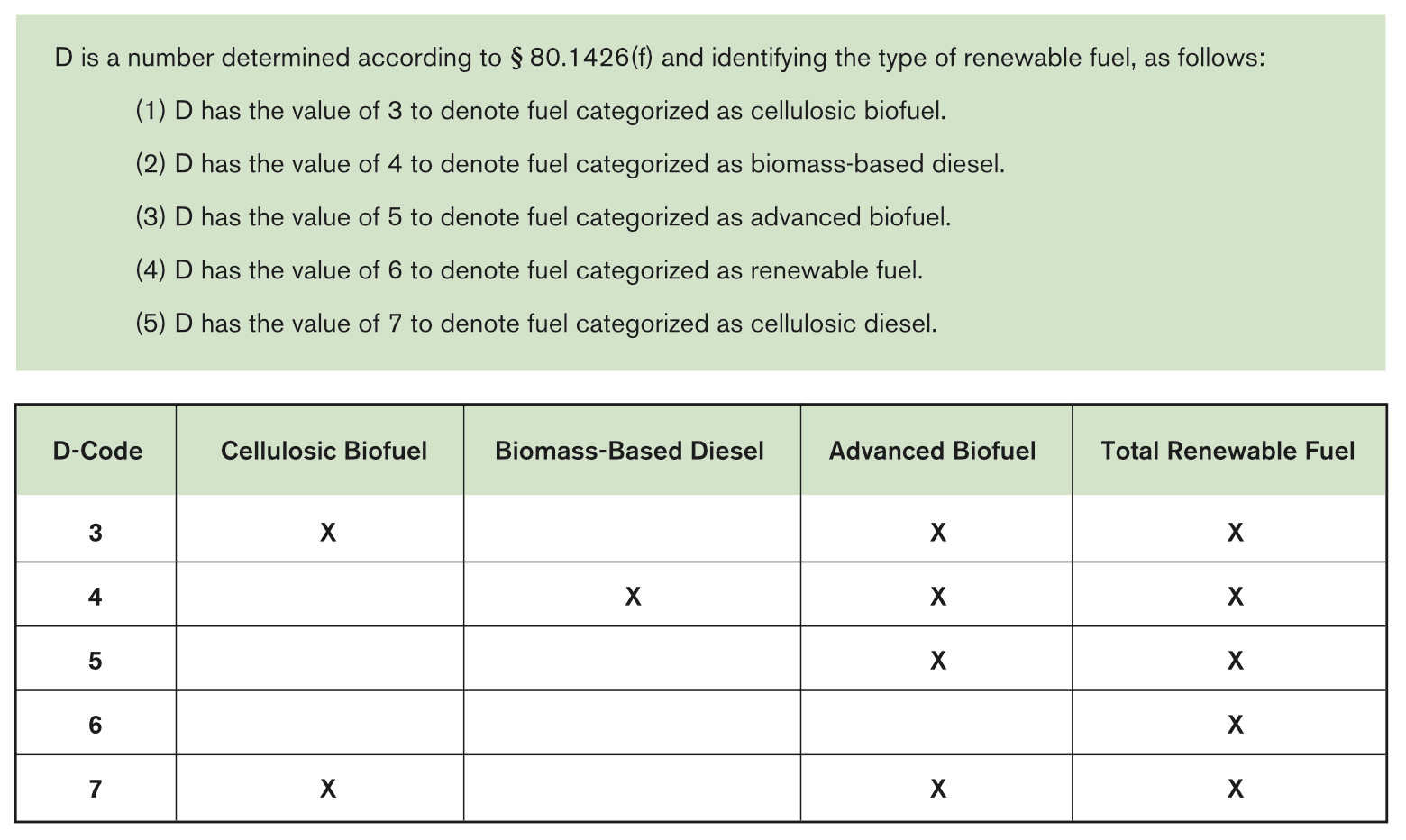

A unique RIN is attached to each gallon of renewable fuel such as biodiesel. The K code identifies the RIN as assigned to a gallon of biodiesel (K1) or separated and eligible for sale (K2). Renewable fuel type is identified in the RIN by a D code. Biofuels are sold as D4, and are worth 1.5 RINs per gallon when sold.

What it Means

The RVO is the volume of renewable fuels an obligated party is required to sell, based on a percentage of the company’s total fuel sales. Once the fuel is blended, the RINs are separated from the blended gallons and used as proof that the company has sold its obligated volumes. K1 RINS are attached to unsold/unblended gallons and cannot be sold. Once the renewable fuel is blended, the RIN is separated from the biodiesel and coded as K2. The EPA does not consider biodiesel a “transportation fuel” until it has been blended at or below 80% (B80 or lower). On the other hand, the IRS allows biodiesel to be considered “blended” and eligible for the $1 per gallon Blended Tax Credit at B99, which explains why most biodiesel in the pipeline has at least one percent diesel.

Obligated parties that produce or own RINs must register with EPA and comply with RIN recording and reporting guidelines on a quarterly basis. With every regulation there’s a work-around, and with the RFS, that’s the ability for RINs to be bought by OPs that have not met their annual RFS requirement. This enables obligated parties which have surpassed their volume or non-obligated parties such as renewable heating fuel producers to sell the K2 RINS, lowering the cost of Bioheat® fuel and other renewable liquid heating fuels. This is also where the proposed change in the RFS causes an issue for the industry.

It is important to remember that when purchasing blended Bioheat® fuel, the RINs have already been processed, so most renewable liquid home heating retailers do not need to manage or sell RINs. At the same time, changes to that process will directly affect the cost and blend levels of Bioheat® fuel available.

We project that the supply of BBD to the U.S. will increase through 2025. We project that the largest increases will come from domestic renewable diesel as new production facilities come online and ramp up to full production. We project slight decreases in the volume of biodiesel used in the U.S. as new renewable diesel producers are able to out-compete some existing biodiesel producers for limited feedstocks. One significant factor that is likely to negatively impact biodiesel production is that opportunities for biodiesel expansion in California, where producers can benefit from LCFS credits in addition to RFS incentives, are very limited while there is significant opportunity for the expansion of renewable diesel consumption in California. The availability of LCFS credits will likely be a significant factor in the competition between biodiesel producers and renewable producers for access to new feedstocks, particularly feedstocks with low carbon intensity (CI) scores in California’s LCFS program. While we project most of the biodiesel and renewable supplied to the U.S. will be produced domestically, we project that imports of both biodiesel and renewable diesel will continue to contribute to the supply of these fuels through 2025.

New Challenges

Currently, RINS on heating fuels can be sold up to the full B80 level as identified by the EPA as eligible for separation. At higher blending levels, enabling more sales of RINs, wholesale prices are reduced further and the carbon content of the fuels drop as well. This has been one of the strongest drivers of the growth of the renewable home heating liquid fuels market. The new proposed RFS rule would change the 80% blending limit for separation of RINS to a maximum of 20% (B20). This limit would not affect ethanol, renewable diesel or other fuels.

Calling it a “free gift to the ‘electrify everything’ movement and gas and electric utilities,” Cota sees this change as politically motivated. “Heating oil is targeted, as the provision only refers to blending in transportation fuel and heating oil and the definition of ‘diesel’ fuel is broad enough to cover Bioheat® fuel,” Cota explained. “Even if the limit were restricted to on-road diesel blends, heating oil would be directly affected because this could affect supply into the home heating market.”

As NEFI stated in the action alert it released on this issue, “this would severely disincentivize blending biodiesel into heating oil,” making our industry less competitive in a market and culture demanding low-carbon home energy solutions. It creates even greater risk in states such as New York, Connecticut and Rhode Island where blends of up to 50% (B50) will be required by law by 2030.

The proposed RFS also removes the ability to sell “RINless” biodiesel. These fuels are offered at a discounted rate to non-obligated heating dealers and wholesalers unable or unwilling to invest the cost and paperwork involved in RIN registration and aggregating the RINs per gallon purchased.

As explained in an article for the National Association of Truck Stop Operators (NATSO), “RIN and RIN-less biodiesel options allow for expanded flexibility in the marketplace and provide customers at each level of distribution the choice of purchasing biodiesel that can be quickly blended, or comes with RIN paperwork that ensures EPA compliance and will allow the company to achieve a desired level of carbon credits.”

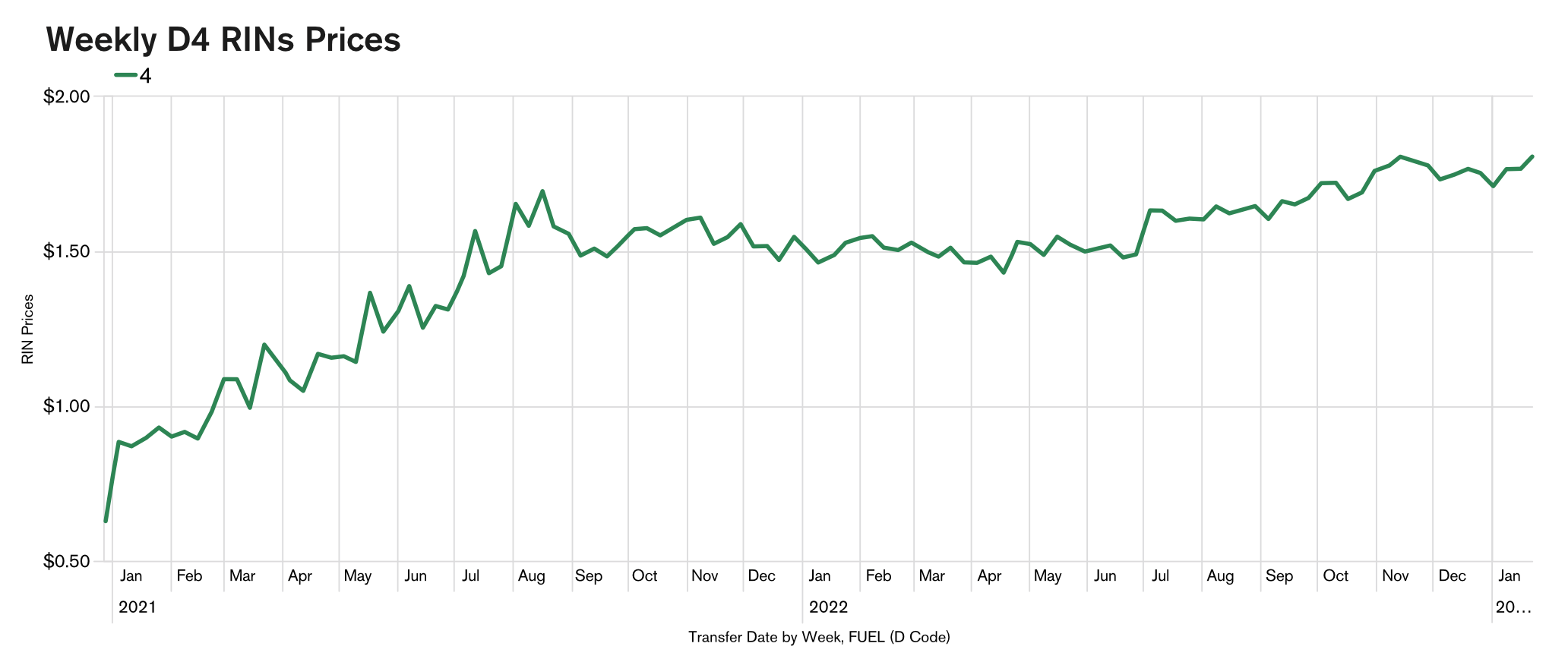

The lower cost RINless fuels allow smaller marketers to offer the higher blends of Bioheat® fuel that help advance the industry’s lower carbon goals and meet consumer and legislative demands for more environmentally friendly energy. Producers can offer the discounted RINless bio-diesel, because they retain the K2 separated RINs and then allow major RVO obligated petroleum customers to purchase an additional RIN per gallon. This increases the 1.5 RINs sold with each gallon of biodiesel to 2.5 RINs per gallon, helping the OP to meet their required volume. Current rates for D4 RINs were at $1.81 per gallon, as of January 23, 2023. The profit from the sale of additional RINs more than offsets the discount offered to the buyer of the RINless fuel. The proposed RFS change will remove this option – and the available discounts for smaller blenders, wholesalers and marketers – by limiting RINs per gallon to the standard 1.5.

As NEFI and its partners explained in their letter to the EPA objecting to the new rules, “The ability to sell ‘RINless’ biodiesel is particularly important for the heating oil industry that involves numerous small businesses. Reducing the RIN separation limit on biodiesel to 1.5 K1 RIN per gallon, or the equivalence value of biodiesel, could impose significant RFS compliance costs on heating oil suppliers in order to supply the market. While EPA may claim that it is allowing such entities to ‘opt-out’ of the RFS program through other proposed changes to 40 C.F.R. § 80.1426, we believe this misunderstands how supply in the fuels market works for diesel fuel, biodiesel, and heating oil. This option has also been an important way to ensure biodiesel can be marketed for heating oil, and its removal would have implications for the ability of the heating oil industry to participate in the RFS program. This would seem to be unexplored by EPA, rendering its proposal arbitrary.”

“Ensuring access to advanced biofuels is vital to the heating oil’s efforts toward decarbonization,” the response letter stated. “The RFS program largely establishes the market for advanced biofuels, particularly the biomass-based diesel fuels upon which heating oil suppliers and distributors currently rely for those efforts. Since the heating oil industry largely uses the same fuels that are used in the transportation fuel market (e.g., biodiesel) and the RINs generated are important economics for these biofuel producers, the operation of the RFS program and the growth of the volume requirements have significant implications for the availability of supply for heating oil.

Related Posts

Why Quality Matters in Your Biofuel Blends

Why Quality Matters in Your Biofuel Blends

Posted on June 25, 2025

Incorporating Higher Blends of Biofuels

Incorporating Higher Blends of Biofuels

Posted on May 14, 2025

NORA Programs at Eastern Energy Expo

NORA Programs at Eastern Energy Expo

Posted on May 13, 2025

March Short-Term Energy Outlook

March Short-Term Energy Outlook

Posted on April 28, 2025

Enter your email to receive important news and article updates.