All

RINs and Repeat

Volatility in the RINs market directly affects liquid heating fuel companies

A little less than a year ago, the energy industry was anxiously awaiting the U.S. Environmental Protection Agency’s final determination of the Renewable Fuel Standard (RFS) for 2023 through 2025.

The RFS came through in June, with mixed results. The advanced biofuels obligations came in lower than the original proposal, which was already lower than those that industry leaders had recommended. However, thanks in part to the letter writing and advocacy efforts led by the National Energy & Fuels Institute (NEFI), the proposed disastrous 20 percent separation limit was not included in the final rule.

The final rule dropped, and most liquid renewable heating fuel retailers stopped thinking about the RFS and the renewable identification numbers (RINs) that prove volumetric obligations were met by fuel producers. There were other threats to their livelihoods: cities and states trying to enact bans on fossil fuels in new construction; the EPA floating proposals to remove oil- and gas-fueled boilers, furnaces and water heaters from ENERGY STAR®; governors across the country uniting in their efforts to convert hundreds of thousands of homes to electric heat; and a winter that was 5 percent warmer than last year and 12 percent warmer than the norm. In other words, home heating retailers – and wholesalers and even equipment manufacturers – were focused on a lot of things, but the RFS was not the highest item on their lists.

At first glance, one might think the RFS has little to do with the day-to-day of home heating. After all, the standard was developed to increase renewable fuel use for transportation. But the RINs – credits that are created with the production of biofuels and sold to obligated parties – can significantly affect the price for renewable liquid heating fuels.

Breaking it Down

The Renewable Fuel Standard (RFS) is administered by the EPA. The EPA assigns the renewable volume obligation (RVO) that transportation fuel producers and refiners, as well as gasoline or diesel importers, must meet. You may remember the fuss about the Small Refiner Exemptions (SRE) that were applied for and approved for divisions of giant oil companies. Most of those were rescinded a few years ago. The SRE was developed to help small refiners, for whom meeting the obligation would be a hardship, not multinational conglomerates.

Compliance with RVOs is tracked through RINs. A RIN is attached to each gallon of renewable fuel. The type of fuel is identified by a “D” code. Biofuels are D4, and have a value of 1.5 RINs per gallon. When a RIN is first created and attached to the fuel, it is given a K1 code. If that biofuel is being sold to a non-obligated party, such as a heating oil wholesaler or retailer, the RIN can be “separated” from the fuel, and the “RINless” fuel is sold to the dealer at a reduced rate. Most heating oil companies purchase RINless fuels, and do not have to register with the EPA or record their transactions. Once separated, the RIN can be sold to obligated parties who have not met their RVO requirements.

What’s a RIN Worth

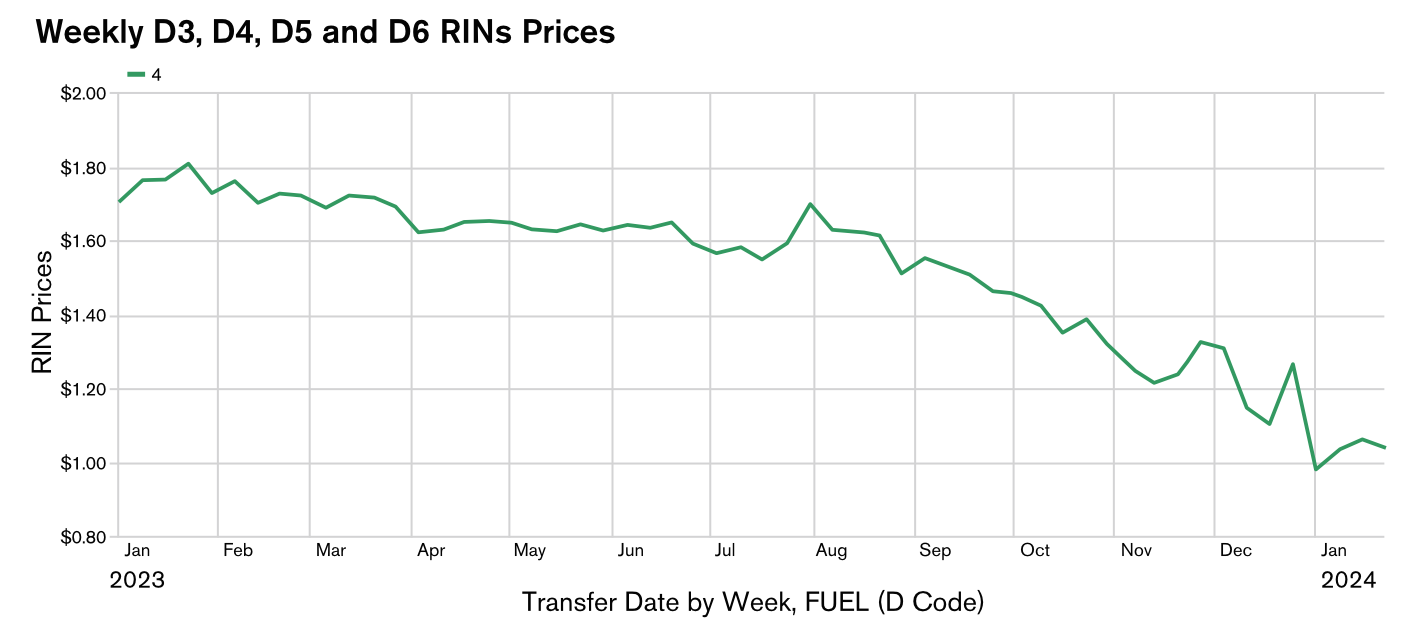

According to S&P Global, D4 RINs dropped to 51.50 cents/RIN in late January 2024, the lowest level since May 6, 2020. They predict pricing will drop even further, reaching the breakeven point for biodiesel production.

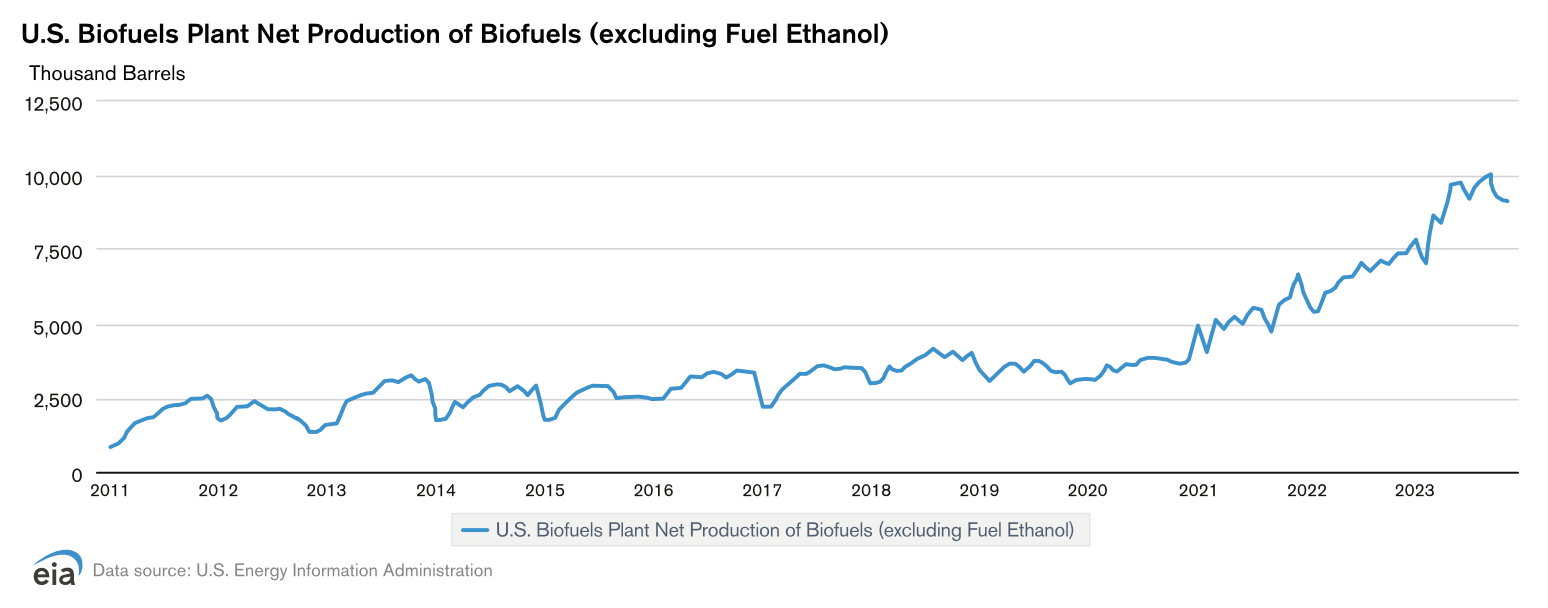

In 2023, 7.96 billion D4 RINs were generated from approximately 4.02 billion gallons, to meet an RVO mandate of only 2.82 billion gallons. RINs can be held and used in future years, but a glut of this magnitude upends classic supply-demand price structures and is one of the major downward pressures on RIN pricing. NEFI, Clean Fuels Alliance America and other industry leaders, well aware of the strong production of biomass-based fuels, warned of this eventuality when the EPA was setting the RFS last year. By the time the 2023 standards were released in June 2023, production had already reached nearly 2 billion gallons.

Blame it on the BOHO. BOHO is the pricing variance between (soy)Bean Oil and Heating Oil. Aegis reported that the BOHO was down to $0.92/gallon in late December, and S&P had that down to about $0.52/gallon a month later. Add in rising ULSD prices and dropping soybean prices, and the market is ripe for increasing production of biodiesel. Higher stock levels, and rising demand for biodiesel in all sectors, will continue to put downward pressure on RINS, which would, in turn, reduce any price benefits liquid heating fuel retailers and wholesalers see in purchasing RINless gallons.

RINs and Clean Heating Standards

While both RINS and the multiple clean heating standards and credits were (purportedly) developed to promote the use of lower or no-carbon energy – and create new marketplaces and revenue streams – they are not the same.

RINS are specific to increase production and use of renewables in the fuel supply, specifically transportation fuels. Clean heating credits are attached to space heating, in one way or another. Both can be sold by those who have earned the credit (the renewable fuel producer for RINS, the end user for clean heating credits) to those who need to meet obligations (upstream oil companies for RINS, retail liquid heating oil companies for clean heat credits). The requirements for clean heating credits will vary by state or region, and have not been finalized for Vermont or Massachusetts.

Obligated parties under the RFS (producers, refiners and importers) need to register with the EPA, comply with recording and reporting guidelines, and produce enough biofuels or purchase RINS to meet their obligations if they do not produce enough. Obligated parties under clean heat standards will need to register with their state or local oversight agency, comply with recording and reporting guidelines, and reduce their customers’ emissions or purchase clean heating credits to meet those targets.

The legislators may publicly describe clean heat programs as “incentives” to reduce emissions, but they have just as publicly announced that their end goal is to make traditional liquid fuels too expensive to use.

RINs have opened the way for fuel retailers to incorporate biofuel blends into their sales, and higher value RINs have led to widespread acceptance of even higher blends, which lower carbon emissions – and could offset the risks to companies facing the specter of clean heat credits.

Related Posts

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

Posted on June 16, 2025

Northeast Working Group for Industry Principles Gets to Work

Northeast Working Group for Industry Principles Gets to Work

Posted on May 8, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

NEFI Introduces the National Home Comfort PAC

NEFI Introduces the National Home Comfort PAC

Posted on April 28, 2025

Enter your email to receive important news and article updates.