Oil, natural gas and coal prices have risen dramatically across the globe

A global energy crunch caused by weather and rising global demand was getting worse. Energy prices, especially coal and natural gas, had skyrocketed to fresh multi-year highs as of this writing in late October. With the winter approaching, when more energy is needed to light and heat homes, the recent spikes in prices had put added pressure on businesses and consumers already dealing with higher expenses from supply chain and labor constraints.

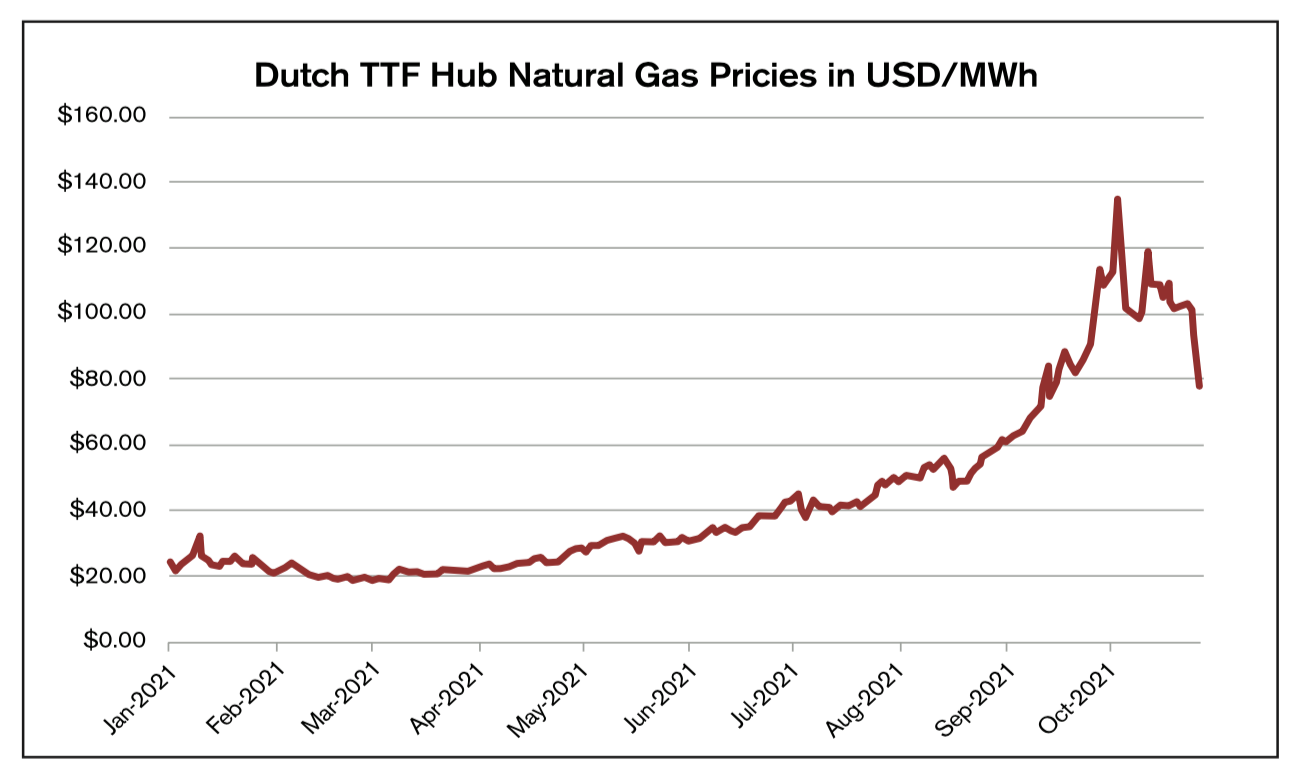

Natural gas prices in Europe were hit particularly hard, rising almost 500% between the start of the year and October 5. The November gas price at the Dutch TTF hub, a European benchmark, hit an all-time high of 116.02 euros (USD134.54) per megawatt hour (MWh) on October 5. The contract had traded at 19.84 euros/MWh at the beginning of the year ($24.30). With inventory levels depleted, Europe imports about 90% of its natural gas supply, mostly from Russia, which has limited exports this year in a move some have called politically motivated. In early October, Russian President Vladimir Putin offered to increase the country’s gas supplies to Europe, causing prices to come down slightly. Russia has been waiting on Germany to authorize the $11 billion Nord Stream 2 gas pipeline for use, which would take Russian supplies to Germany via the Baltic Sea. It is suspected that Russia’s offer to increase supplies to Europe was likely intended to pressure Germany to authorize use of the pipeline.

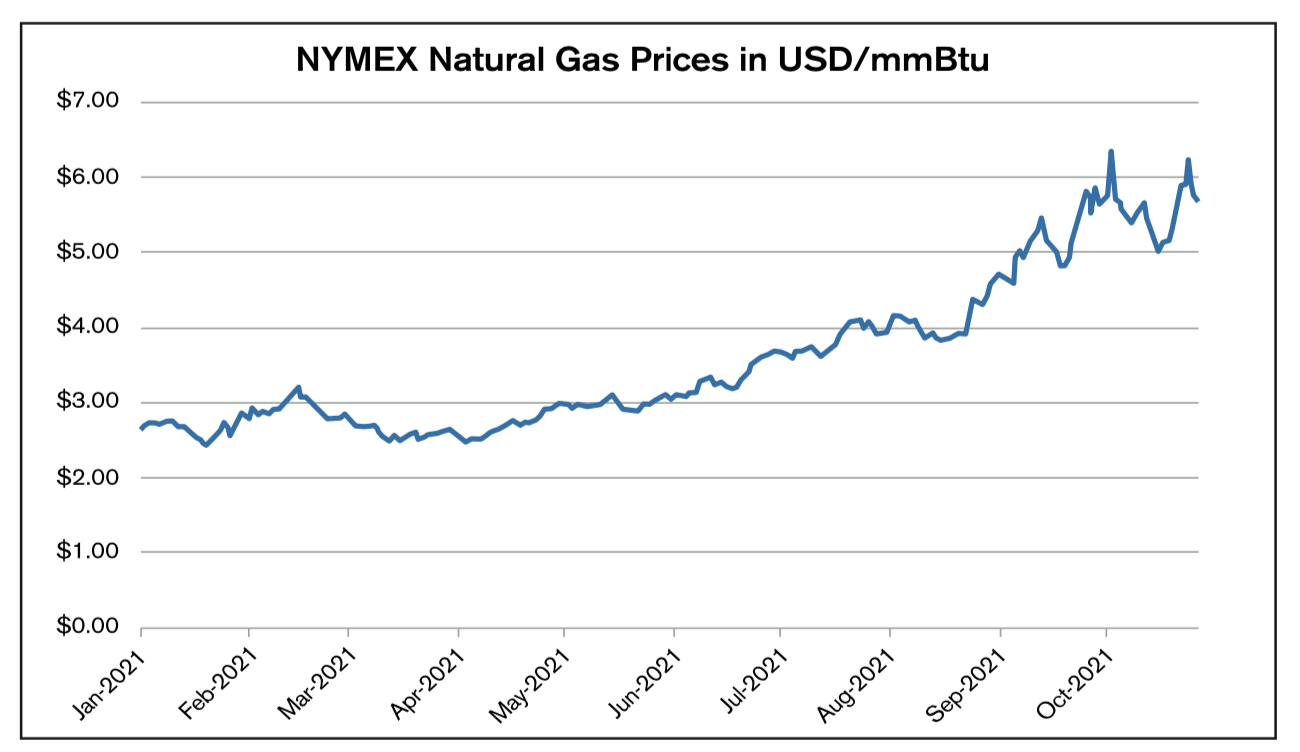

U.S. natural gas prices have been following the trend as well, but the spikes have been significantly less intense than those abroad. The NYMEX natural gas contract reached $6.466 per million British thermal units (mmBtu) on October 6, more than doubling prices from the beginning of the year ($2.580/mmBtu). In Europe, the natural gas price spike was so severe it was as if oil were trading around $200 per barrel.

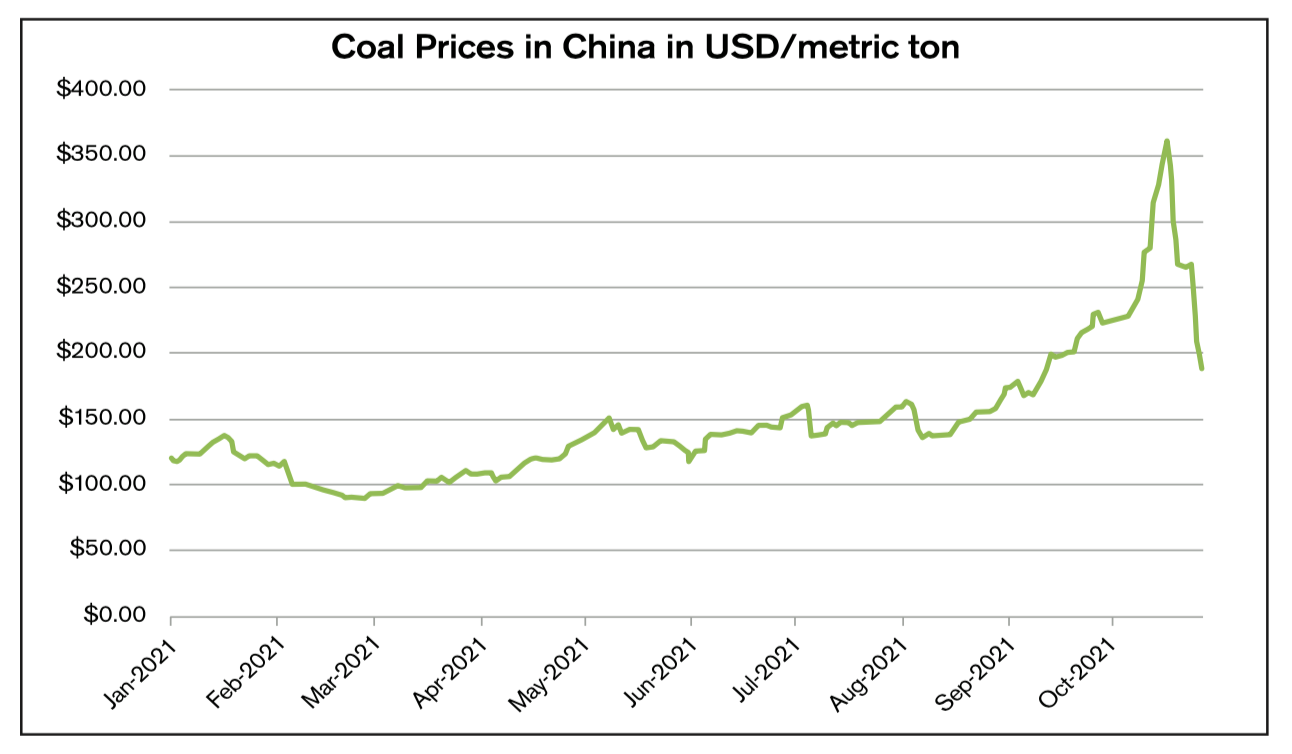

Asian demand for natural gas also jumped as countries, including China, looked to to switch from coal usage. This is because coal prices were on the rise as well, especially in China, due to heavy rains forcing 60 coal mines to shut down in Shanxi province (the country’s largest coal mining hub) amid a post-pandemic surge in demand. The most-traded thermal coal contract on the Zhengzhou Commodity Exchange rose to an all-time high of 2,301.6 yuan per ton on October 19 (USD360.6/ton), almost doubling from the beginning of the year when the contract was trading at 781.4 yuan per ton ($121.0/ton). Prices have come down since then by almost 50% to 1,197.0 yuan ($187.3) on October 29, after China’s National Development & Reform Commission (NDRC) set an immediate price target at 1,200 yuan ($187.56) per ton, according to Reuters sources. This would be the first target that the NDRC is trying to reach before pushing prices down another 300 or 400 yuan.

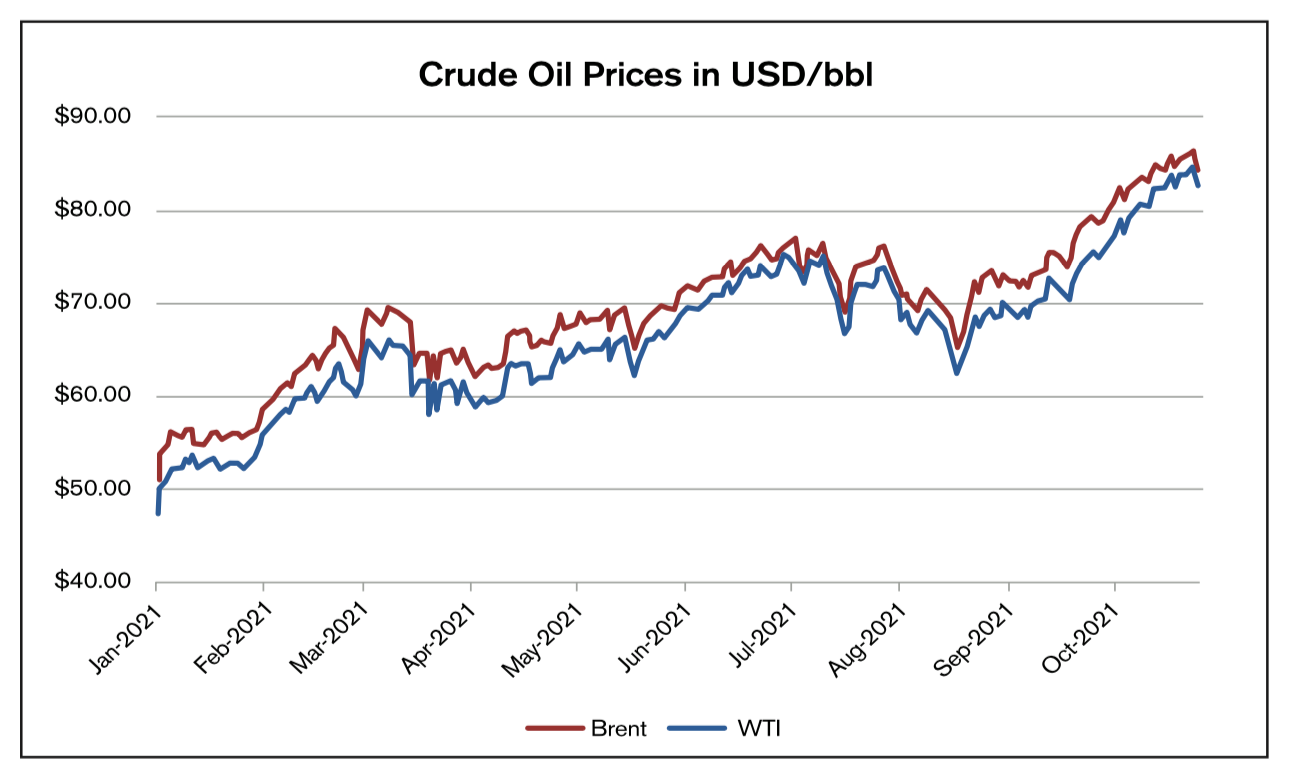

Spikes in natural gas and coal prices have prompted the power sector and energy-intensive industries to turn to oil products, namely diesel or gasoil. The Paris-based International Energy Agency (IEA) said that a global energy crunch was expected to boost oil demand by 0.5 mb/d and as a result, global oil demand was projected to recover to pre-pandemic levels in 2022. The agency revised up its global oil demand growth forecasts by 170kb/d to 5.5mb/d in 2021 and by 210kb/d to 3.3mb/d in 2022.

Brent crude oil futures prices reached $86.70/bbl on October 25, a fresh multi-year high not seen since October 2018. On the same day, West Texas Intermediate crude futures (WTI) prices hit a new seven-year high of $85.41/bbl. Goldman Sachs forecast that Brent crude prices could reach $90/bbl in December. The bank also stated that the gas-to-oil switch could raise oil demand by at least 1mb/d.

If the global energy crunch resumes this winter, we could possibly see crude oil prices reach the $100/bbl mark. Severe weather conditions and colder-than-average temperatures could potentially add more pressure on prices, particularly in countries that rely heavily on natural gas for energy production. According to National Oceanic and Atmospheric Administration Climate Prediction Center, the U.S. is expected to see a warmer-than-average winter, especially in the South and across the eastern states. Heading into the winter months, the U.S. is better positioned than other countries as it is the world’s largest natural gas producer and its current inventory levels are in a better shape compared to the rest of the world.

However, rising energy prices and the emergence of new COVID-19 variants could also put the global economic recovery at risk.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.