In March 2022, as fuel prices spiked, the Biden Administration announced their decision to sell off 180 million barrels of crude oil from the Strategic Petroleum Reserves (SPR). Combined with other drawdowns and mandated sales, there have been approximately 300 million barrels removed from the SPR during President Biden’s first term, bringing it to its lowest levels since 1983.

Earlier this year, the Administration purchased approximately 6.3 million barrels as part of the plan to replenish the barrels sold in 2022. The fuel had been sold at approximately $95 per barrel and repurchased at $72.67. In July, a solicitation was released for the re-purchase of another 6 million barrels. (Ed. note: As this issue was going to press, the Administration withdrew the solicitation.)

Most mathematicians would see a drawdown of 180 million (or nearly 300 million) and a replenishment of 12 million as a shortfall of at least 168 million. But that math doesn’t work for politicians.

The Administration three-part replenishment strategy goes like this:

- Direct purchases with revenues from emergency sales;

- Exchange returns that include a premium to volume delivered; and

- Securing legislative solutions that avoid unnecessary sales unrelated to supply disruptions.

“Avoiding unnecessary sales” is where political calculations override traditional math - and common sense. There were congressionally mandated sales obligations of approximately 140 million barrels for Fiscal Years 2024 through 2027. The Administration has secured the cancellation of those sales and is counting the 140 million barrels … that are already in the SPR … as “significant progress toward replenishment.”

With approximately 346.8 million barrels, the SPR holds about half its authorized storage capacity of 714 million barrels. At present, the supply is equal to about 18 days’ worth of fuel requirements.

Energy Secretary Jennifer Granholm told CNN that the Administration plans to replenish the SPR, but added “the first term’s over in a year and a half. So, I’m not sure it’ll be fully replenished. But certainly, the plan is this term and the next term to be able to do that.”

This presumes a second term for President Biden and prices remaining within the $67-$72 per barrel range in which replenishment purchases must be made. Granholm’s optimistic view disregards the price risks from the war in Ukraine; production cuts from OPEC+, Saudi Arabia and Russia; as well as an uncertain presidential race still 18 months away. Furthermore, Energy Department spokespersons walked back Granholm’s comments to CNN, explaining that she did not mean the Administration would necessarily bring the SPR back to pre-Biden levels.

There are numerous other obstacles to refilling the SPR. Two storage sites are offline for maintenance, not surprisingly behind schedule and over budget. Congress has stripped a large portion of the Energy Department’s funds that were earmarked for oil purchases, and one does not need to be a political science expert to know that the McCarthy-era Republican House is unlikely to approve funds for any project requested by the Biden Administration - even one considered vital to public welfare.

When the SPR was created in the 1970s, the U.S. was a net-importer of crude and was reeling from OPEC oil embargoes. Domestic production is much stronger today. Some pundits have suggested that with domestic capacity at its current level, SPR levels are less critical than in the past. Of course, the $1.46 decline in prices at the pump last year after the release from the SPR might belie that premise.

Domestic production levels and low prices are far from guaranteed. Environmental policies are putting pressure on fuel prices, production costs and capabilities. Recent environmental, anti-liquid fuel/anti-drilling proposals would raise the royalties from oil companies from 12.5 percent to 16.67 percent for production on public lands.

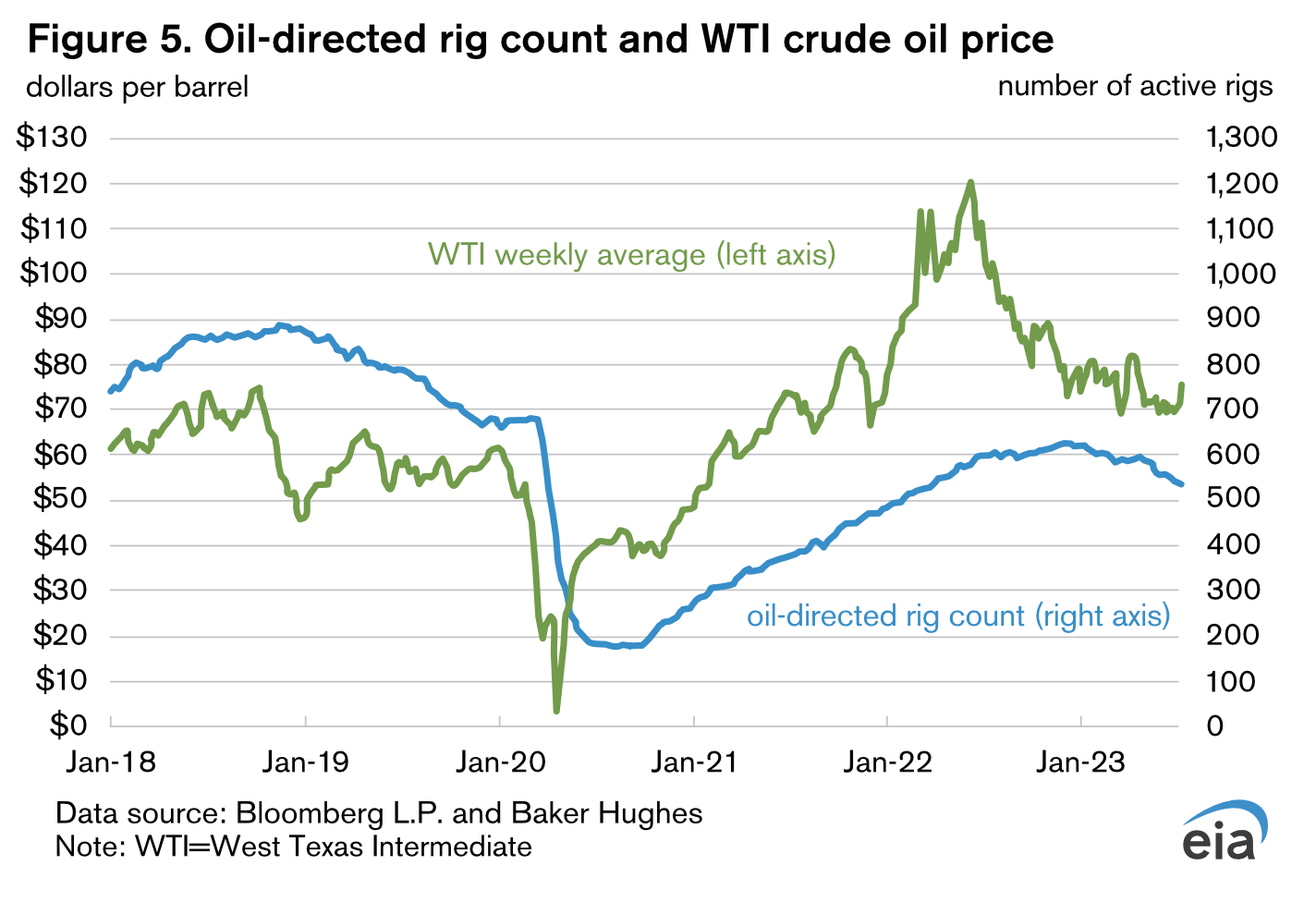

The Energy Information Administration (EIA) reports that capital expenditures from publicly traded exploration and production companies in the first quarter of 2023 were within 10% of the 2019 average, spurred by increasing crude oil prices in the first half of 2022. That would be good news, but, the EIA continues, declining rig counts since the start of 2023 suggest development activity could decline over the next two quarters.

Furthermore, according to the EIA, crude oil prices and production have a positive relationship: increases in prices stimulate production and decreases in prices reduce production within a four to six month period. Since the beginning of the pandemic, the number of oil-directed drilling rigs in operation increased as crude oil prices increased. The oil-directed rig count peaked at 627 rigs at the beginning of December 2022 and has since declined by 15% (97 rigs) and total U.S. crude oil production declined 0.5% (61,000 b/d) quarter-over-quarter in 2Q23 and is forecast to decline another 0.6% (72,000 b/d) in 3Q23. Declining rig counts and production are a recipe for increased prices. Increased prices put the replenishment of the SPR further at risk.