All

Really Bad Timing for a Major Hurricane

by Rich Larkin, Hedge Solutions

As winter approaches, energy marketers are hoping to avoid the perfect storm!

By the time this edition of Oil & Energy hits the proverbial newsstands, it will be August and we will be fastapproaching peak hurricane season and hoping to avoid an apocalyptic scenario – a major hurricane hitting the U.S. refining hub in the Gulf Coast.

I don’t wish to quibble over what the exact period is for “peak” season as I’m not a weather historian, meteorologist, or atmospheric scientist (whatever that is). But I do know how to count and read simple charts, so I went back into the National Hurricane Center (NHC) archives and did some research on when hurricanes tend to meander into the Gulf Coast region as well as the size and scope they have attained. We are not talking about a lot of data here, particularly since I was only interested in the bigger ones – the storms that really matter, the bruisers that wreak havoc on the U.S. refineries.

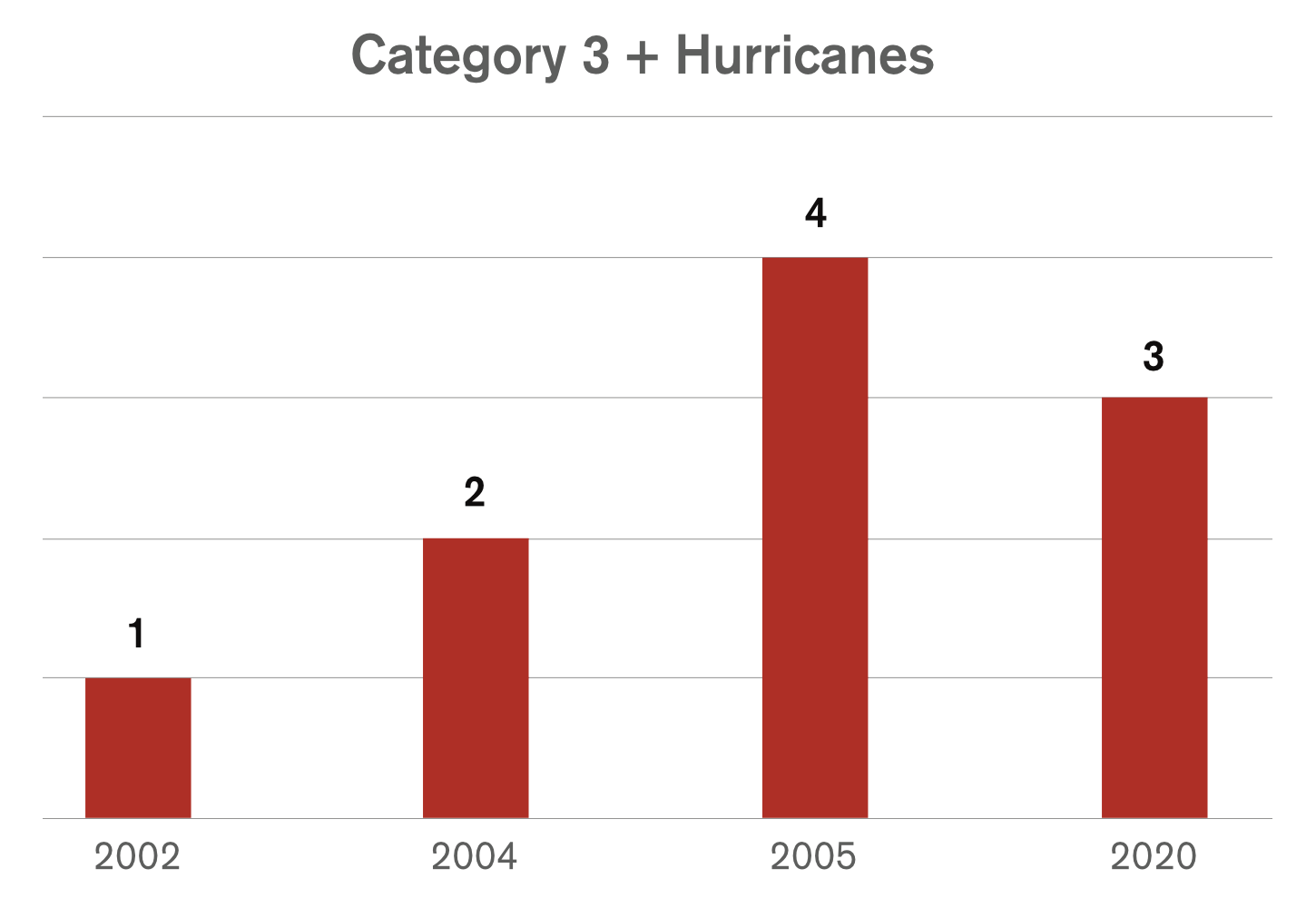

A quick look back over the past 22 years does not elicit much anxiety at first glance (see Hurricane chart). I pulled data on just the major storms and only those that threatened the Gulf Coast refineries. The NHC defines a major storm as a Category 3 rating or higher. We have had 10 such storms threaten or pass over Gulf Coast refineries since 2000. Everyone, of course, recalls the epic Katrina, which reached Category 5 status in August 2005. Seven of the 10 major storms took place between 2002 and 2005. And four of the 10 practically ran through the alphabet between July and September of 2005. Their names read like a who’s who in hurricane lore; Dennis, Emily, Katrina, and Rita all made their mark on the Gulf Coast over a period of 12 weeks. We then enjoyed a quiet period of 15 years with no major hurricanes hitting the refinery sector in the Gulf. Even when we did get three major storms in 2020, the damage was limited compared to 15 years ago, in part thanks to refinery improvements engineered to mitigate wind and rain damage.

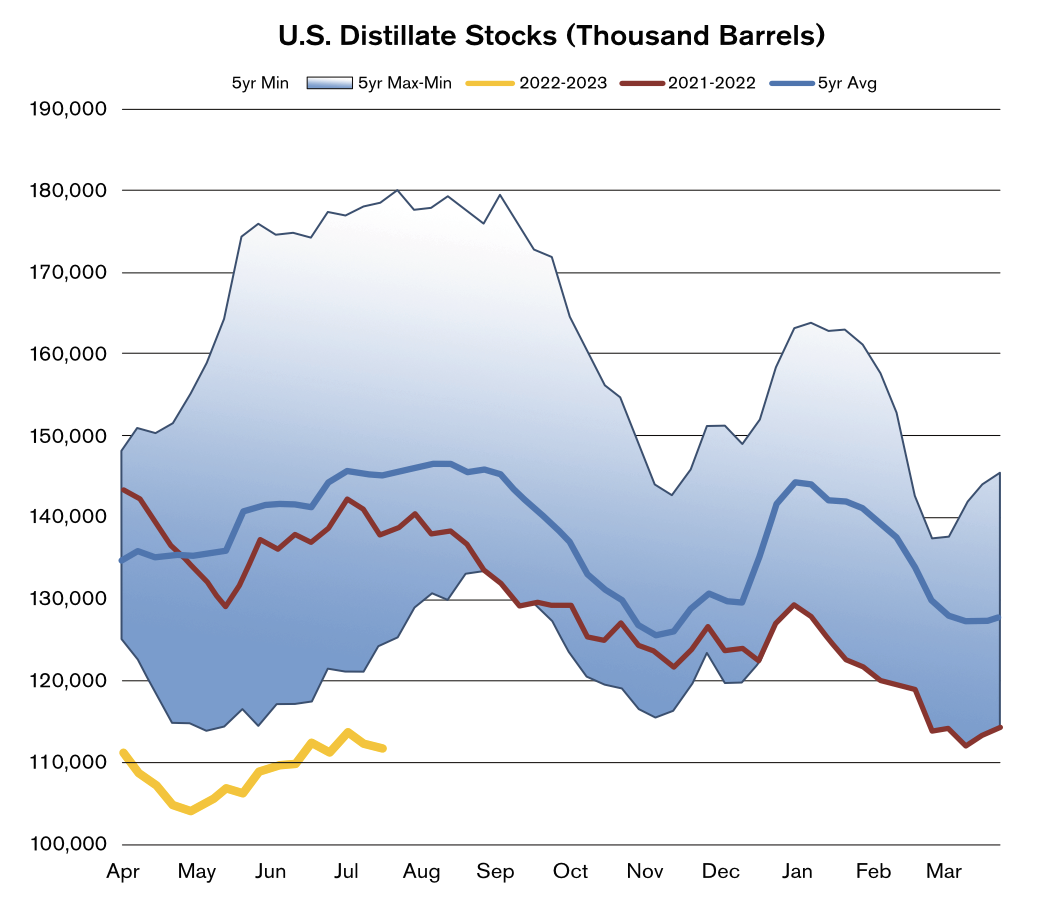

Still, a Category 4 or 5 hurricane with winds that can exceed 160 mph would likely cause a significant interruption of production capacity. Additionally, it would impact natural gas output and shut-in crude production for days. After Katrina, Nymex spot distillate prices jumped 45 cents in a week, which comes across as paltry compared to today’s price moves. Gasoline prices did double in a week, from $1.66 to a whopping $3.66 per gallon. However, those were different times with vastly different circumstances. For one, price movements and hence, volatility, were much lower. We also had not moved to low sulfur heating oil yet. Total U.S. Inventories were twice the level we are at now. Refinery production in PADD 1 alone had twice the output that we have on the East Coast today.

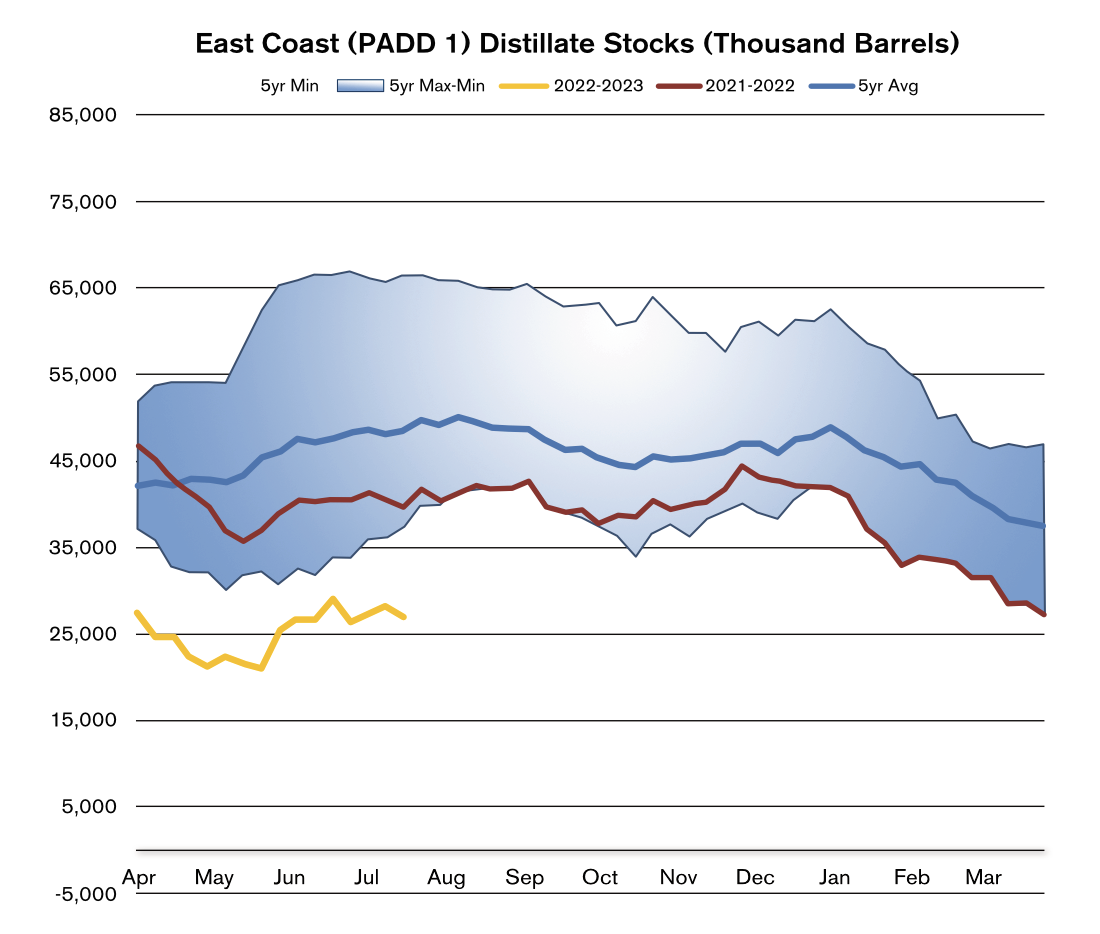

To be sure, there is a gauntlet of issues that could negatively impact either production or supply between now and the upcoming heating season. Total U.S. distillate inventories are at their lowest levels since 2005 and East Coast distillate inventories are at an all-time low, according to U.S. Energy Information Administration data.

Meanwhile, we have that other 800-pound gorilla in the room, or across the pond, as they say. The Russian invasion of Ukraine, which has resulted in a host of sanctions intended to cut off Russia’s energy revenues, also has consequences for Europe and the rest of the world. It is a global energy marketplace, which means the highest price point attracts the supplies. The U.S. has seen net imports of all products (more going out than coming in) sink to record lows this year. Will Europe demand more distillates to supplement the likely deficit in natural gas supplies caused by Russian sanctions? Will Putin further weaponize the energy card just in time for winter?

Making matters worse for poor distillate fundamentals, the market is still backwardated, making it unattractive to build inventories, particularly here on the East Coast where suppliers like to fill storage as a buffer to winter demand.

So, right now would be really bad timing for a major hurricane. Over 47% of total U.S. refining capacity is located along the Gulf Coast, as well as 51% of total U.S. natural gas processing capacity.

One thing is certain. Refiners, crude producers, suppliers, and energy marketers have a lot to be concerned about these days. You can bet that between now and the end of October, they will have one eye on the weather and hurricane alley, hoping to avoid the perfect storm.

Rich Larkin is President of risk management consultancy Hedge Solutions. He can be reached at rlarkin@hedgesolutions.com or 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.