Historic 12-week comparison answers the eternal questions, when and how to hedge

The 2021-2022 heating season is still ongoing, drawing to a close by next month in April, and yet it is already time to think about next season. Why? Because our capped and fixed price programs demand it. When should we launch our offers? How should we hedge our offer price with options and/or swaps as we approach our launch date?

Let’s say we plan to launch our program in June and are considering a hedging period from March through May to prepare. In an ideal world, with a crystal ball, we would hedge our offer at the lowest NYMEX HO (ULSD) futures prices from this period. As of this writing in late February, prices are near some of the strongest levels we have seen in years due to the Russia/Ukraine conflict, as well as chronic underproduction by OPEC+ relative to its agreed-upon output ceiling.

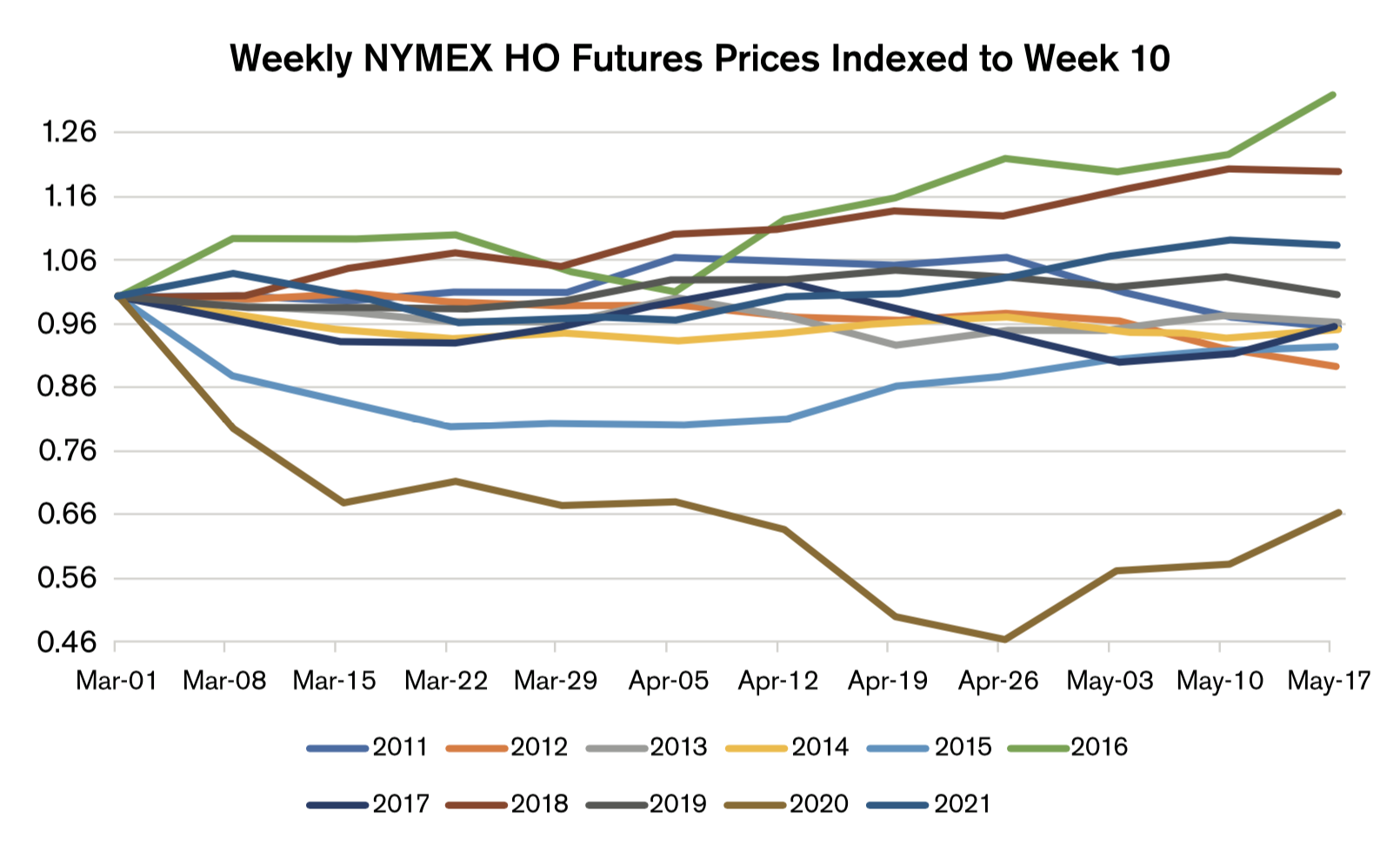

In 2020, prices fell sharply from early March through late April as the pandemic struck and lockdowns curbed economic activity. By contrast, prices generally trended higher from March through May in 2016. Not only could prices rise or fall during the scale-in period, but they could also stay fairly steady as they did in 2019.

There are myriad factors which can impact futures prices and their volatility (indeed, financial advisors should be well versed in these and provide an array of market intelligence products to help inform their clients). However, fuel sellers simply can’t know for sure what will happen any given hedging season. The good news is that your competitors are in the same boat. We just need a strategy that will be competitive against them.

Would it have been best to hedge everything right before launch? To start early and buy evenly every week? Let’s ask the historical data and see what it has to say.

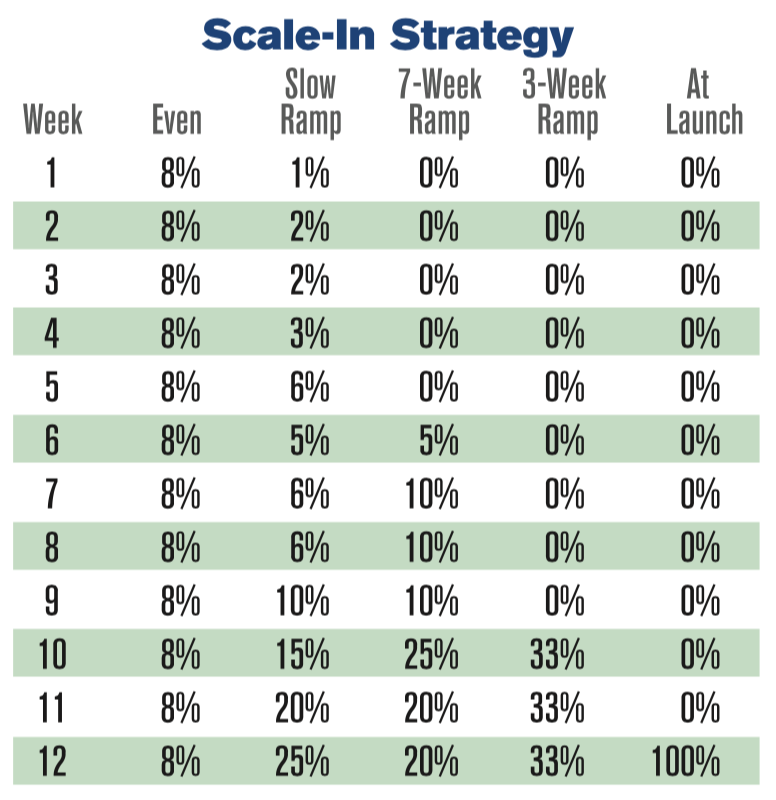

This table shows five different scaling-in strategies for 12 weeks leading up to program launch. For each, I’ve outlined the percentage of volume we would hedge each week.

The first is “Even,” where we would hedge the same number of gallons systematically each week and then calculate our offer price based on the average hedged price. We could also do a slow ramp from March through late May, or shorter ramps of seven weeks or three weeks. Finally, we could just hedge everything right before sending out our offer letters (“At Launch”).

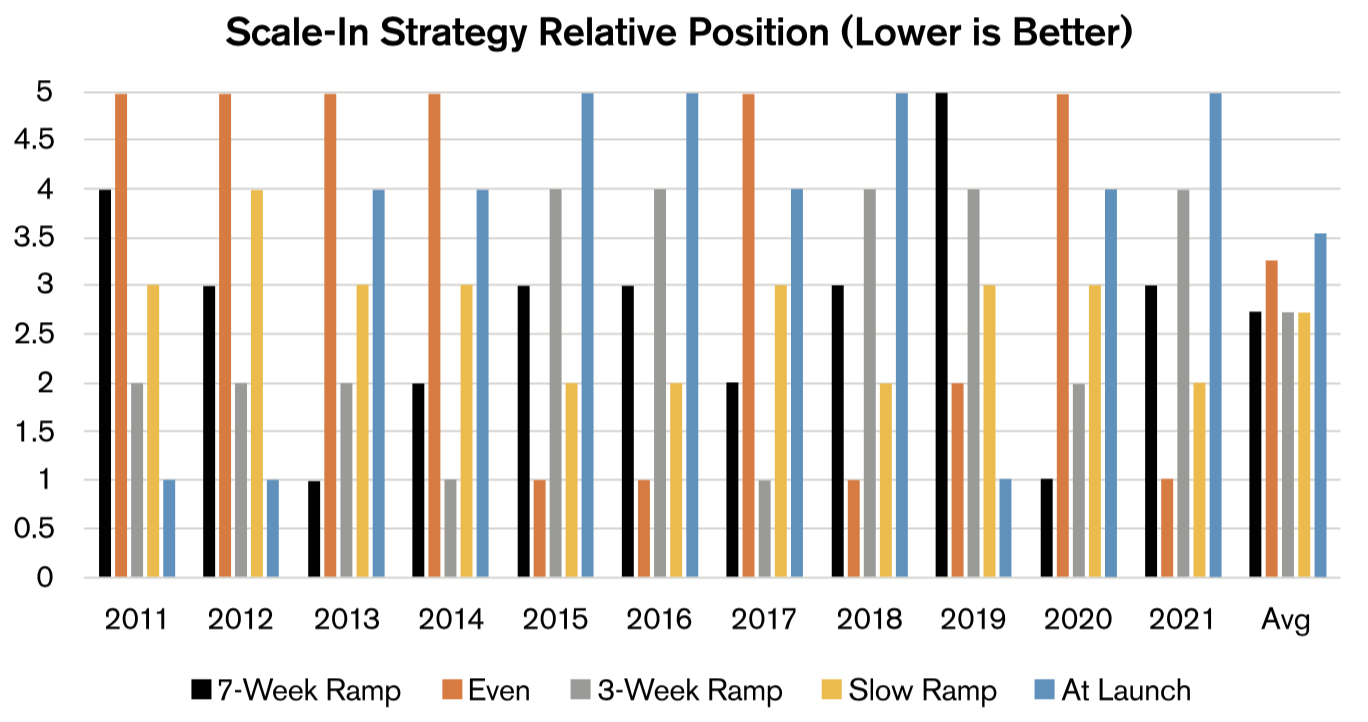

Testing these strategies for the last 11 years (2011-2021) demonstrates that the “best” (lowest-price) strategy varies depending on the path NYMEX futures prices took during a given year. For the first four years, where prices trended slightly lower over the scaling-in period, Even turned out to be the worst (highest-price) strategy. Because of the late dip in prices, At Launch was the best strategy the first two years – but then the second-worst in the next two years as there was a late uptick in futures prices. Overall, both of these extremes — At Launch and Even — ended up with the worst average positions, scoring 3.55 and 3.27 out of 5, with 1 being the best.

The ramp-up strategies, conducted over 12 weeks, seven weeks, and three weeks, all had a similar average performance over this 11-year period. We have looked at the data for a larger set of periods and have found that the seven-week ramp seems to be a good place to settle on, as it puts us in the running most of

the time.

We’ve discussed the hedged futures price, but what about option premiums? Well, to a large degree we are in the same boat here as we are with the futures prices. Without a crystal ball, we can’t know whether option implied volatilities will rise or fall during the hedging period, what will happen to interest rates, nor the underlying futures price as we have discussed. The only known, predictable variable is time value, which tells us that (all else equal) option premiums should fall throughout the scale-in period. But with a period of just 12 weeks for options that specify delivery many, many months ahead, this factor is fairly negligible. In other words, the ramp-up strategy continues to make sense when we factor option premiums.

Dan Lothrop is Head Trader at over-the-counter derivatives company Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com. The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.