All

Pricing Outlook for the 2020-2021 Heating Season

by Anja Ristanovic, Hedge Solutions

What we’re seeing right now and what it could mean moving forward

With the start of the new heating season, I thought that we should take a look at current events and other factors that could possibly impact ULSD prices, namely the weather, geopolitical considerations, and — of course — the coronavirus pandemic.

Weather

According to the Farmers’ Almanac Extended Forecast, this upcoming winter is expected to be very different from last year’s, where we saw mild and almost snow-free weather conditions in the Northeast. According to the age-old journal, we could see a blizzard hitting the Mid-Atlantic and Northeast states during the second week of February. Colder weather and snow normally cause reduced travel, cutting gasoline demand, but they do increase home heating demand since people are staying home. As a result of the pandemic, travel is already reduced and people are staying home more, so these weather conditions are likely to have much more muted impacts than normal. That said, one has to consider the COVID-19 “work from home” effect on heating demand.

On the other hand, the National Oceanic and Atmospheric Administration’s early long-term winter forecast projects above-average temperatures for most of the U.S. this winter.

Meanwhile, this Atlantic hurricane season has been very active. Forecasts called for 18 named storms over the entire season, yet there had already been 17 as of September 10. To date, Hurricane Laura and Tropical Storm Marco hit the Gulf of Mexico the hardest, causing U.S. energy companies to shut 84 percent (1.56 mb/d) of offshore crude oil production. Additionally, about 12 percent (2.33mb/d) of U.S. refining capacity was shut due to these storms.

Geopolitics

Perhaps one of the biggest events to look for this year is the U.S. presidential election, which is likely to have a significant impact on the global economy and business environment. Additionally, tensions between the U.S. and China continue to escalate and there were no real indications of a resolution to the latest issues as of this writing. However, in late August, U.S. and Chinese trade negotiators discussed the implementation of phase one of the trade agreement and the two sides agreed to create conditions to continue pushing forward the implementation of the trade deal. It is becoming increasingly unlikely that China will be able to fulfill its promise to buy an additional $200 billion in goods and services from the U.S. by 2021. If the trade deal falls through, this would have a negative impact on the market, whereas any progress in U.S.-China relations would be supportive for oil prices.

Coronavirus Pandemic

Another thing that we have to keep an eye on is the coronavirus pandemic, which has already seen resurgences of new cases in many countries across the world. The pandemic continues to have an impact on global demand and even though there has been progress toward the development of a vaccine, it is unlikely that one will be ready by the end of the year. Even if one were ready, it would take time to produce the large quantities needed to satisfy current demand. The global economic recovery continues to stall due to the pandemic, which could lead to a fresh build-up of global crude oil inventories. This could possibly cause both onshore and offshore storage capacities to approach their maximum again, as they did in April.

Outlook

This year’s East Coast distillate stock building season has been going well so far. As of September 10, regional inventories were 46.7 percent stronger than last year and 23.6 percent above the five-year average, which represents a strong cushion against the possibility of a basis blowout (sharp increase in cash market prices against spot futures prices) this coming winter.

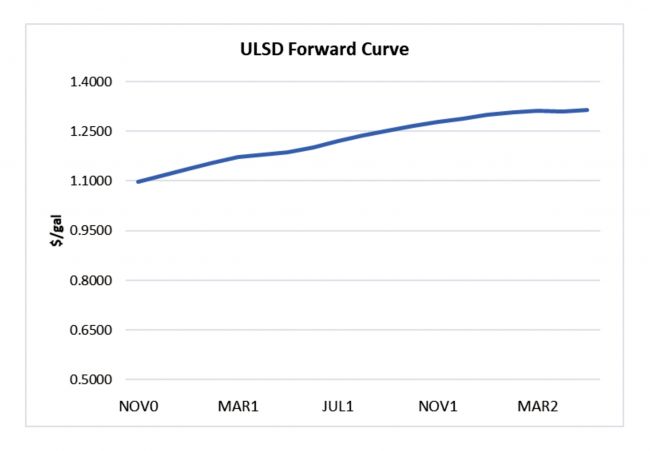

At the moment, the ULSD futures forward curve shows a contango, which means that the spot price is lower than prices for delivery in future months. The current spread between the November 2020 and April 2021 futures contracts is -$0.0841 cents/gallon (c/g), meaning that the April 2021 futures contract is currently trading at a $0.0841 c/g premium over the November 2020 contract. The inventory surplus that we have been seeing is consistent with a contango.

As previously mentioned, basis blowouts risk seems low right now, but political uncertainties and continued concerns over the COVID-19 pandemic could be reflected in the price action.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.