Who will win and who will lose as West Coast LCFS, East Coast Biofuel Mandates and Federal SAF Incentives pull renewable feedstocks in all directions?

There was a time, not too long ago, when used cooking grease and animal tallow were sold for a few cents per pound for use in soaps, detergents, cosmetics and animal feed. These were waste products, not business-generating income streams.

Times have changed. Used cooking oils (UCO), tallow, and vegetable oils are bought and sold and traded and fought over like any other premium commodity.

The reason: renewable liquid fuels. Biodiesel. Renewable Diesel (RD). Sustainable Aviation Fuels (SAF). These low or lower-carbon fuels are produced from the same pool of renewable feedstocks: UCO, tallow, yellow grease, and plant-based oils.

All these fuels are necessary for any plan to reduce greenhouse gas emissions. Were there a nationwide program with market-based incentives to lower GHGs, supply and demand would, ideally, balance. There would be enough for all. Instead, we have inconsistent policies creating a three-way (at least) tug-of-war for renewable feedstocks.

Where does that leave the liquid fuel distributor?

Left, Right And in The Air

As with most environmental policies, California has led the way, with its Low Carbon Fuel Standard (LCFS). Washington and Oregon have implemented similar standards, and New Mexico’s Clean Fuel Standard was signed into law in March 2024. On the East Coast, New York, Connecticut, and Rhode Island have biofuel mandates in place and other regions are enacting or considering clean heat standards. Various federal policies, including the Inflation Reduction Act, are adding weight behind sustainable aviation fuels.

“The LCFS policies in California and surrounding states have set aggressive targets for reducing carbon intensity, driving strong demand for low-carbon fuels. This has resulted in increased investment in renewable fuel production facilities on the West Coast, as well as higher prices for feedstocks due to the intense competition. The East Coast is seeing a different dynamic with biofuel mandates and Clean Heat Standards. These policies are aimed at reducing greenhouse gas emissions from heating oil, which has led to an increased blending of biodiesel with traditional heating oil. This regional demand adds pressure to the supply chain, especially during the winter months when heating demand peaks,” Paul Nazzaro, President of Advanced Fuel Solutions explains.

“The IRA has prioritized SAF, providing substantial incentives for its production. This focus is diverting feedstocks that would otherwise be used for biodiesel and renewable diesel, further tightening the supply of these fuels. As a result, producers are faced with decisions on whether to allocate resources to SAF or other renewable fuels, impacting overall market availability,” he continued.

There is often confusion over the Renewable Fuel Standard (RFS) and Low Carbon Fuel Standards. The RFS requires transportation fuel sold in the U.S. to include a minimum volume of renewable fuel. It sets the “renewable volume obligations” (RVOs) of biofuel required, and these are tracked by Renewable Identification Numbers (RINs) attached to each gallon of biofuel. The RINs can be bought by fossil fuel producers from biofuel producers to help meet their obligations.

State LCFS regulations require a specific reduction in transportation carbon intensity. Providers can meet targets by selling more low-carbon fuels, reducing the carbon intensity of fossil fuels, or purchasing credits from producers of low carbon fuels.

Whereas the goal of the RFS is to increase the use of biomass-based fuel, the goal of the LCFS is to reduce emissions.

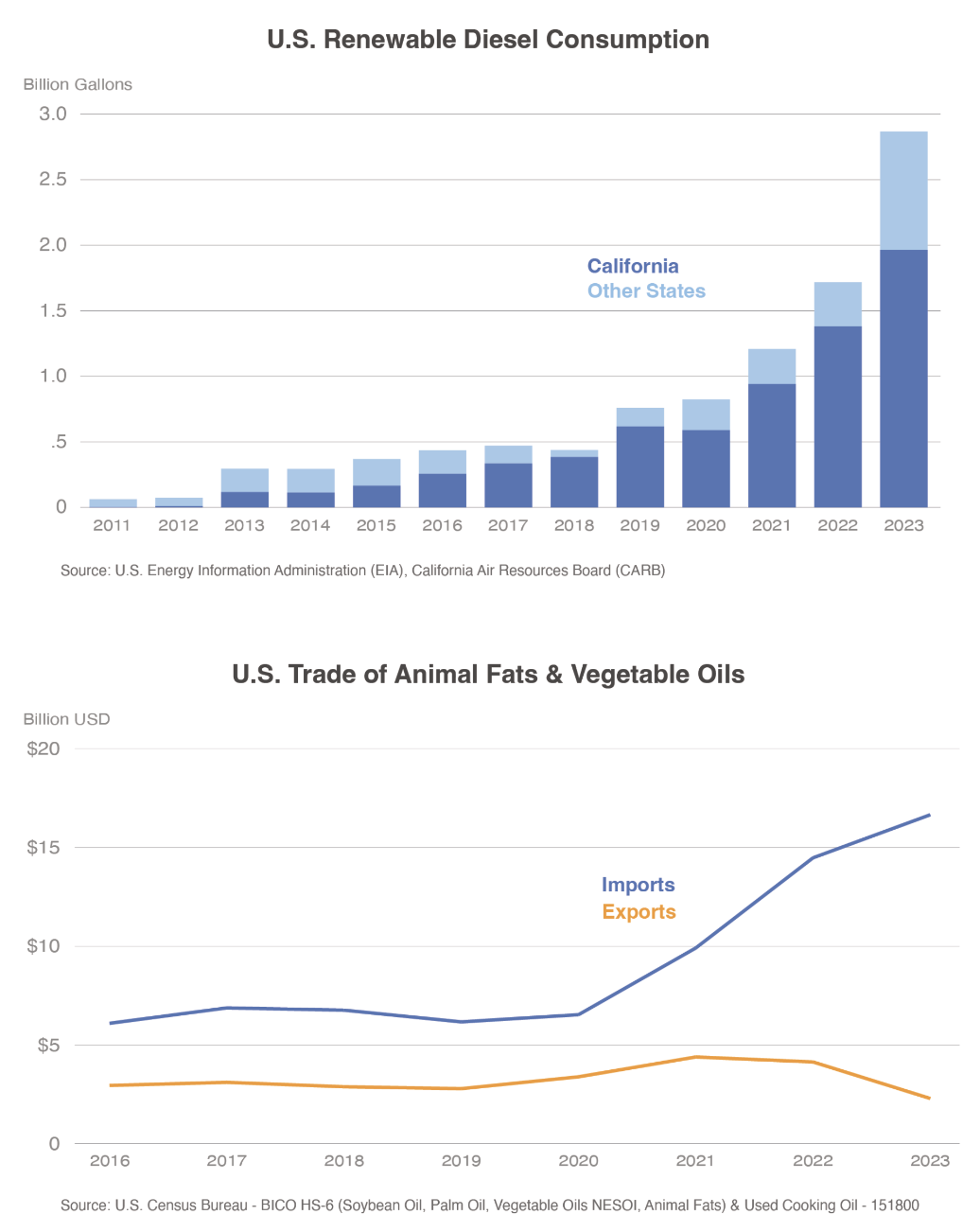

In June, 2024, the USDA released “U.S. Renewable Diesel Production Growth Drastically Impacts Global Feedstock Trade,” which delves further into the effect of the policies.

“During the past few years, the landscape for U.S. renewable diesel production has drastically changed, akin to the growth of ethanol and biodiesel during the past two decades. Driven by federal and state policies aimed at reducing emissions, this dramatic U.S. renewable diesel production and capacity growth is causing significant, market-altering shifts both domestically and to foreign feedstock trade. Renewable diesel, like biodiesel, is produced from the same renewable feedstocks such as vegetable oils, animal fats, or used cooking oil (UCO). The difference is that renewable diesel is produced using a hydrogen treatment which makes it chemically equivalent to petroleum diesel and can therefore be blended at higher levels and transported using existing pipelines.

“As a result, the United States is rapidly expanding imports of animal fats and vegetable oils to both use as feedstocks for renewable diesel production and to backfill other feedstocks, like soybean oil, that have been diverted to renewable diesel production,” the report stated.

“The real driver for renewable diesel expansion has been the California Low-Carbon Fuel Standard (LCFS). Like the blender’s credit, this policy offsets higher biomass-based diesel production costs through a carbon credit for meeting emission targets and has driven renewable diesel consumption in California. Since California had already reached blending maximums for both ethanol (10 percent of gasoline pool) and biodiesel (5 percent of diesel pool), blenders needed to utilize other carbon-emission-reducing alternatives such as blending more renewable diesel, using more SAF, or lowering the carbon emissions of producing and blending existing biofuel consumption. As a result, renewable diesel expanded as it doesn’t have a blending ceiling like biodiesel and ethanol, and because of an influx of private investment to increase production capacities spurred by the long-term demand stability for biofuels created by the LCFS,” it continued (emphasis added).

Furthermore, the USDA forecasts increases in imports of animal fats and vegetable oils as biomass-based diesel production grows, and that feedstock imports will be boosted in 2025 when the Blender’s Tax Credit is replaced by a Producer’s Credit. Once the tax break applies only to biomass-based diesel produced in the United States, demand for biofuel imports will drop as feedstock requirements grow.

Follow the Money

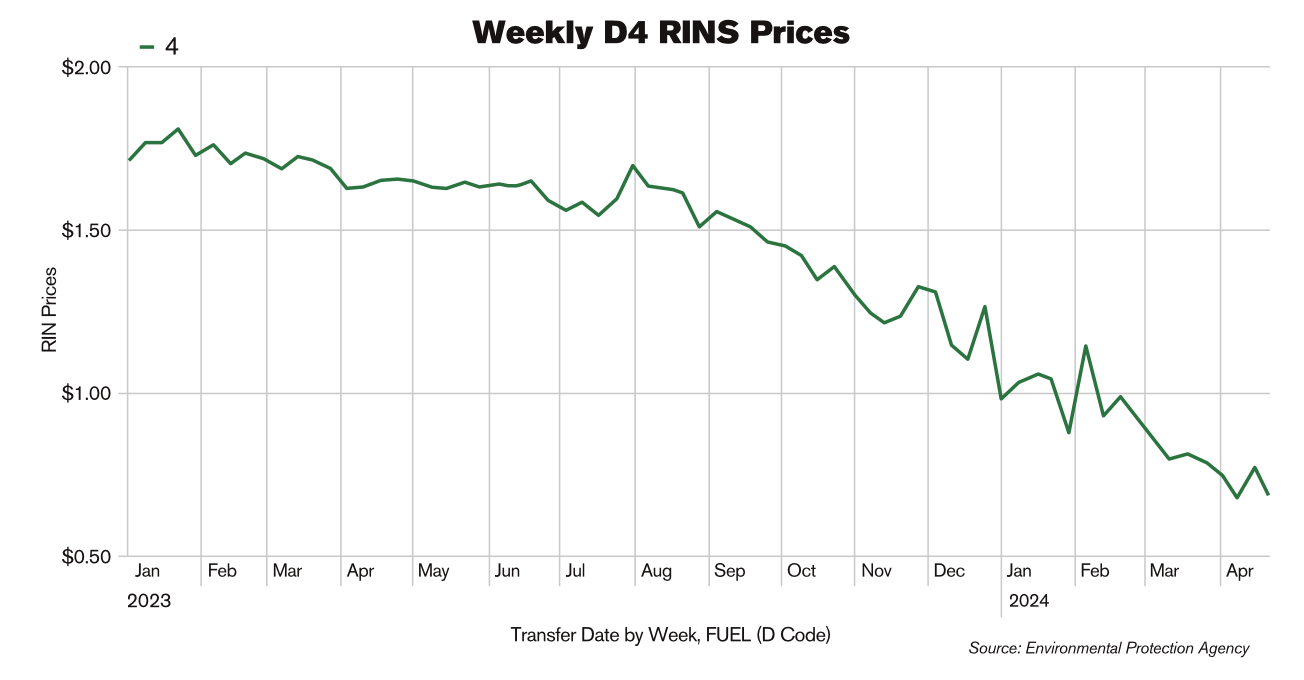

“In February 2023, Chevron and many other biofuel producers and trade associations urged the EPA to increase the Renewable Volume Obligations (RVO) in the 2023 SET Rule to keep pace with the increased biomass-based diesel production capacity and feedstock growth. The industry was very disappointed with the final rule. The biomass-based diesel RVO’s were much lower than warranted, and the RIN price has since lost significant value. This has created a very challenging margin environment for biofuels producers,” Neville Fernandes, Vice President, Corporate Affairs & Development for Chevron Renewable Energy Group, said.

“We are urging policymakers to implement supportive biofuels policy to enable growth, investments, and jobs. We support the appeal from Representative Feenstra (R-IA), Senator Ernst (R-IA) and Senator Chuck Grassley (R-IA) urging the Administration to ‘immediately reconsider your past decision and raise the 2024 and 2025 RVO levels for biomass-based diesel, advanced biofuels and overall renewable fuels.’ We are also supportive of the bipartisan group of Senators who urged the Administration to increase the RVOs to support the renewable fuels industry. We are very hopeful that the EPA and the Biden Administration will heed calls from the industry and policymakers to immediately increase the RVOs in the RFS,” Fernandes continued.

Cape Cod Biofuels prides itself on using locally-sourced UCO to produce biodiesel and then deliver it to the community for use in home heating and commercial fuels. “We are both a biodiesel producer and retailer. We sell a blend of B40 heating oil and own a local heating oil distributor, so we see the issue from a lot of angles. All our biodiesel is from used cooking oil (UCO). We buy some from other collectors, but pretty much we collect it all ourselves and sell cooking oil to our restaurants – we sell it and pick it up – a true circular marketplace,” owner Andrew Davison explains.

“At the current price of RINS, dealers are losing money – and they can’t make it up. Market forces are what they are for petroleum: what we have in the market – what you get for your margin. If your margin for heating oil is 65 cents per gallon as a benchmark, you can’t go up to a $1.15. If you can’t be competitive, you won’t sell anything,” Davison continued.

According to Paul Nazzaro, RINs prices are “highly sensitive,” and as policies drive up the demand for renewable fuels, the RINs follow suit in a classic supply-demand scenario. The scarcity of fuel to meet mandated volumes inflates the price. Furthermore, competition for feedstocks between biodiesel, RD and SAF creates additional volatility. As the feedstock prices rise, the cost of producing the renewable fuels rises, and RINs values increase to maintain economic viability. “At the moment, RINS appear to be moving up in value, albeit it’s anyone’s bet if that trajectory continues or abates. Let’s face it, it’s a commodity and energy supply chain players have resourceful ways to offset the risk using intelligent risk management tools to protect their companies and clients,” Nazzaro concluded.

Feedstocks, Production and Distribution

The large producers and refiners reached for this article insist that Northeast fuel retailers should not be concerned about the availability of feedstock or biofuels.

“While the policy debate is causing some uncertainty, production and use of renewable diesel (RD) and other low-carbon fuels are still expected to grow. Different states have varying methods for measuring and valuing carbon emissions, so it’s important to stay informed about legislative and regulatory changes to make the best decisions. Additionally, voluntary sustainability initiatives and new reporting requirements add to the complexity,” J.W. Hackett, Senior Director, Environmental Products for Global Partners said.

“In response to this uncertainty, we are making low carbon products available and working with our customers through our GlobalGLO initiative to customize solutions to their needs. Global has invested to make renewable diesel available at its terminals in Albany and Newburgh, New York; Providence, Rhode Island; and in Chelsea, Massachusetts – and can meet demand for biodiesel from our East Coast locations. We are also set up to provide carbon offset fuel,” he continued.

“Chevron Renewable Energy Group does not speculate about the market. We recommend that wholesalers and retailers find a partner with a good reputation who they can trust to get them the supply of biofuels they need. In addition, we recommend starting conversations early to discuss supply options and opportunities for next season,” said Fernandes of Chevron Renewable Energy Group.

Davison sees things a little differently, noting that RINs and tax credits aren’t covering the costs of “clean” UCO. He is also facing competition from grease collectors working for multinational operations out of Asia. “They’re buying UCO at higher rates and then selling biodiesel and renewable diesel on the West Coast. Renewable diesel is much more expensive than biodiesel. Biodiesel is the lowest cost, lowest carbon footprint fuel available, and it is being cannibalized by SAF and RD. This industry we built, our government is saying ‘forget the transportation sector, the sky is where we want to focus.’ It takes 25 percent more feedstock to make SAF, and RD and SAF are more carbon intensive than biodiesel. Why are we cannibalizing this market that we worked to make profitable; cannibalizing it to these other fuels? SAF is produced by big petroleum as a way to kill the Renewable Fuel Standard market for biodiesel,” Davison says.

“Next winter is going to be interesting. The supply of biodiesel isn’t what it should be, with plants closing or being idled. Plants that have to sell wholesale, have to make biodiesel, they are going to be struggling. And, in Massachusetts, the alternative fuel credit doesn’t even recognize ‘crop-based fuels’ such as soy biodiesel. Biodiesel is a renewable resource whatever they say. Getting bio-diesel into New England, you have to bring it in by railcar. You can’t ship it, but they can bring a tanker of renewable diesel to Boston from Singapore. Distributors would rather have tankers in deepwater than rail cars, and where are they going to send the biodiesel? You’ll go where you get the most money – and that’s California, Oregon, New Mexico.” It’s frustrating, beyond anything else,” Davison concluded.

Nazzaro recommends that fuel dealers prepare by structuring supply agreements now, that “make sense, are ratable, competitive, and pathways to supply surety. Thinking that biodiesel or renewable diesel are just going to be where dealers want them when they wish to sell is wishful thinking, this business is no longer a ‘just in time’ playbook. Demand for these fuels is pulling it where players are acting early and intelligently. If you play the game thinking you can get what you want, where you want it, when you want it, someone will be disappointed. Get to the table, share your goals and objectives, and allow the seller of these terrific products to structure a deal for your consideration. Have a back-up plan as well. Bottom line, start the conversation. If you’re not talking, you’re likely going to miss the mark.”

At the same time, however, he asserts that the industry is strongly placed for the future. “While RD continues to move into systems nationwide, domestic biodiesel plants some 60 strong and capable of delivering 2.0BGY of high-quality biodiesel to the markets stand ready to nurture the growing demand for blending into home heating oil pools in any one of the twenty-two NORA states. Biodiesel remains the lowest cost decarbonizing tool and it is important that our industry support the biodiesel industry as displacing 2.0BGY of existing plant capacity would provide imbalance and volatility to the supply chain at large,” he said.

The Elephant in the Room

It would be impossible to talk about liquid renewable heating fuels in the Northeast without including the imminent implementation of Clean Heat Standards in Vermont and Massachusetts, and consideration of similar policies throughout the region. These programs will likely require fuel dealers to track their sales of fuel and ensure annual reductions in carbon emissions from their products. While initial reductions will be reachable by transitioning to biofuels and increasing the blend levels; the end goal of these policies is to convert all properties to electric heat by making liquid fuels so expensive as to render them unsaleable.

Fernandes sees the potential for growth under the Clean Heat Standards, as the policies should, ideally, offer customers additional supplies of lower carbon fuels. However, he continues, “These programs should expand on the types of lower carbon fuel solutions, recognizing that there are more lower carbon fuel types available in the marketplace. For example, the proposed program in Massachusetts only allows biodiesel and excludes renewable diesel, renewable natural gas, and renewable propane. The proposed program also requires the phase out of lower carbon fuels in favor of only electric heat pumps. These limitations and restrictions of the proposed program are unnecessary and should be modified so that customers may have choice and access to a large pool of lower carbon solutions and not just one technology.”

“Massachusetts is promoting heat pumps. They want everything to be electrified, but won’t score the grid. They just want to get rid of liquid fuels. They want everyone to drive electric cars, use electric heat pumps. It’s just not possible,” said Davison. “We know the grid in Massachusetts is 70 percent natural gas; and they’re going after natural gas, too. You can’t have new construction with gas appliances anymore. It’s craziness!”

Closing Thoughts

In general, these industry experts saw challenges but also opportunities for next winter and the longer-term position of liquid renewable fuels.

“Despite the challenges we are facing right now with the policy environment, we are optimistic for the future of the biofuels industry. However, we believe it’s going to take all parties working together – the producers, the wholesalers, the consumers, the policymakers, and more – to progress toward a lower carbon future in a way that is supportive across the value chain. We encourage regional suppliers to engage with policymakers to underscore the need to expand the supply of biofuels by supporting growth in the RVO,” said Fernandes.

Global Partners’ Hackett had a similar outlook, saying, “We are constantly looking at emerging fuels and environmental products to meet the physical energy and sustainability needs of today and tomorrow. Adaptability is key for dealing with the challenges and capturing opportunities caused by varying regulations and standards.”

“We only make about a million gallons a year, and we have a ‘captive audience.’ We’ll be OK and our customers will too. But people need to think about the amount of taxpayer support that was invested to bring biodiesel out as an industry – enormous spend of private and public money. They’ve forgotten about that and are now onto electric heating and the SAF, and cannibalizing the market for this new shiny object,” Davison of Cape Cod Biofuels, said.

Nazzaro looked at the future through a multi-focused lens. He sees technological advancements and innovations in feedstock processing and fuel production as alleviating supply constraints; asserts that greater alignment between state and federal policies could enhance the market; and reminds “past, present, and future handlers and distributors of low carbon liquid fuels that there are four essential pillars of a successful and seamless transition away from carbon-based energy sources. These pillars are technology, infrastructure, operational integration, and economic analysis, all vital for addressing the pressing questions our supply chain is seeking answers to. While the current policy environment presents challenges, it also offers significant opportunities for growth and innovation in the renewable fuels sector.”