What we know, and what we know we don’t know

2022 began, as many years do, with optimism. The Dow Jones Industrial average, often positively correlated with crude oil futures prices, closed 2021 at 36,338, not far from all-time highs. Forecasts called for continued increases in 2022. There were clouds on the horizon, however, as tensions between Russia and Ukraine had heightened. Looking at distillates specifically, US stock levels were 15.5% weaker than their historical average and Ultra-Low Sulfur Heating Oil (ULSHO) barge differentials at New York Harbor had started to creep up.

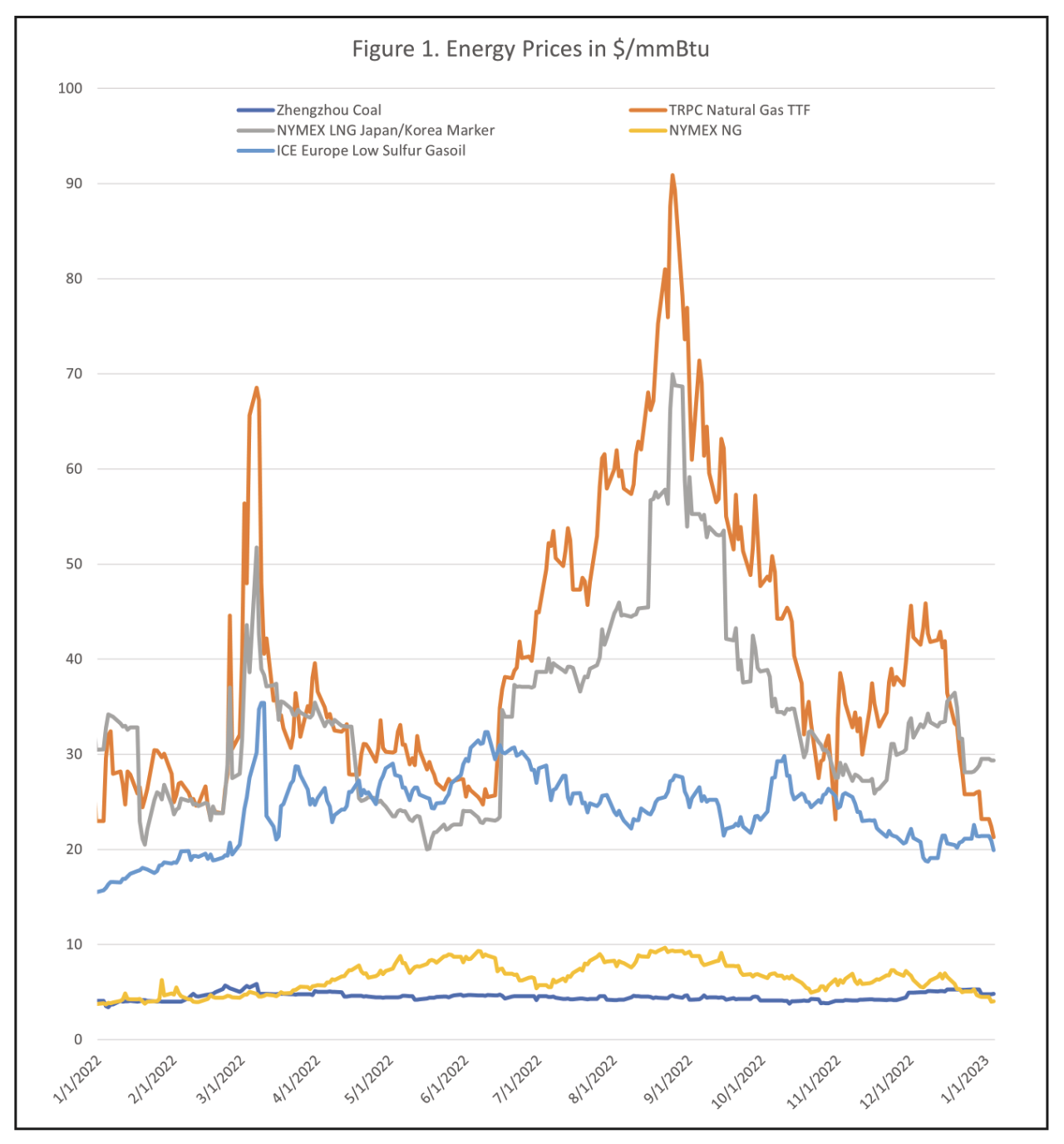

Then, on February 24, Russia invaded Ukraine. In response to the invasion, Western countries imposed numerous sanctions on Russia. The US was relatively well poised to cut off the importation of Russian crude oil and products, being much less reliant on them than their European allies. In fact, the displacement of Russian barrels was in many cases filled with US exports (sometimes indirectly, in this global market) especially when it comes to diesel and propane in western Europe. This was in large part incentivized by a huge natural gas price spike in Europe and Asia that made gas-to-oil switching for power generation economical. Charted in Figure 1, prices at the Dutch Title Transfer Facility (TTF), a major European benchmark, shot up from about $23/mmBtu ahead of the invasion to a high of over $68/mmBtu in early March, far outpacing a rise in Low Sulfur Gasoil prices. Prices for both calmed in the spring, but natural gas prices shot up in the summer with the sabotage of three of the four undersea gas pipelines from Russia to Europe (Nordstream 1 and 2), heightened geopolitical tensions, and the need to ramp up storage ahead of the winter. Dutch TTF prices skyrocketed to a high of over $90/mmBtu in late August, trading at a huge premium of over $60/mmBtu above Low Sulfur Gasoil and incentivizing gas-to-oil switching.

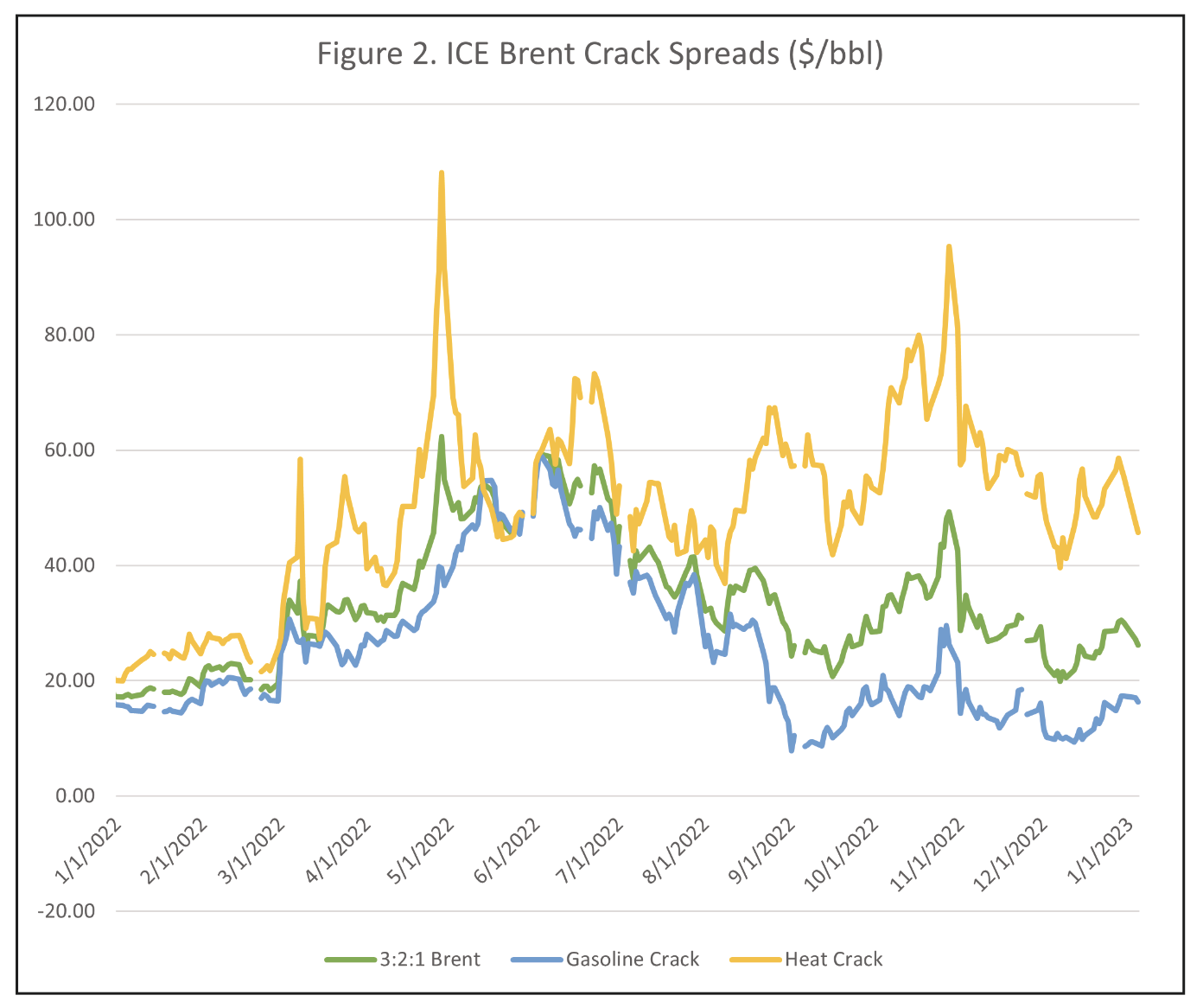

Increased appetite for distillates for power generation purposes, plus summer diesel driving demand in Europe and uncertainty and some likely self-sanctioning of Russian barrels led to strong distillate prices last year. The ICE Brent-NYMEX ULSD (HO) spread shot up from $20/bbl in early 2022 to as high as $108.10/bbl in late April. The spread remained strong throughout the year, with further increases in late August and in late October, when it hit $95/bbl. As of this writing, the spread remained wide at $47/bbl. This crack spread serves as a proxy for refinery economics, meaning distillate production has been quite economical. The US took advantage of this, being a major net exporter of distillates. Refineries tweaked yields to produce a larger share of distillates compared to gasoline than normal, and exports surged.

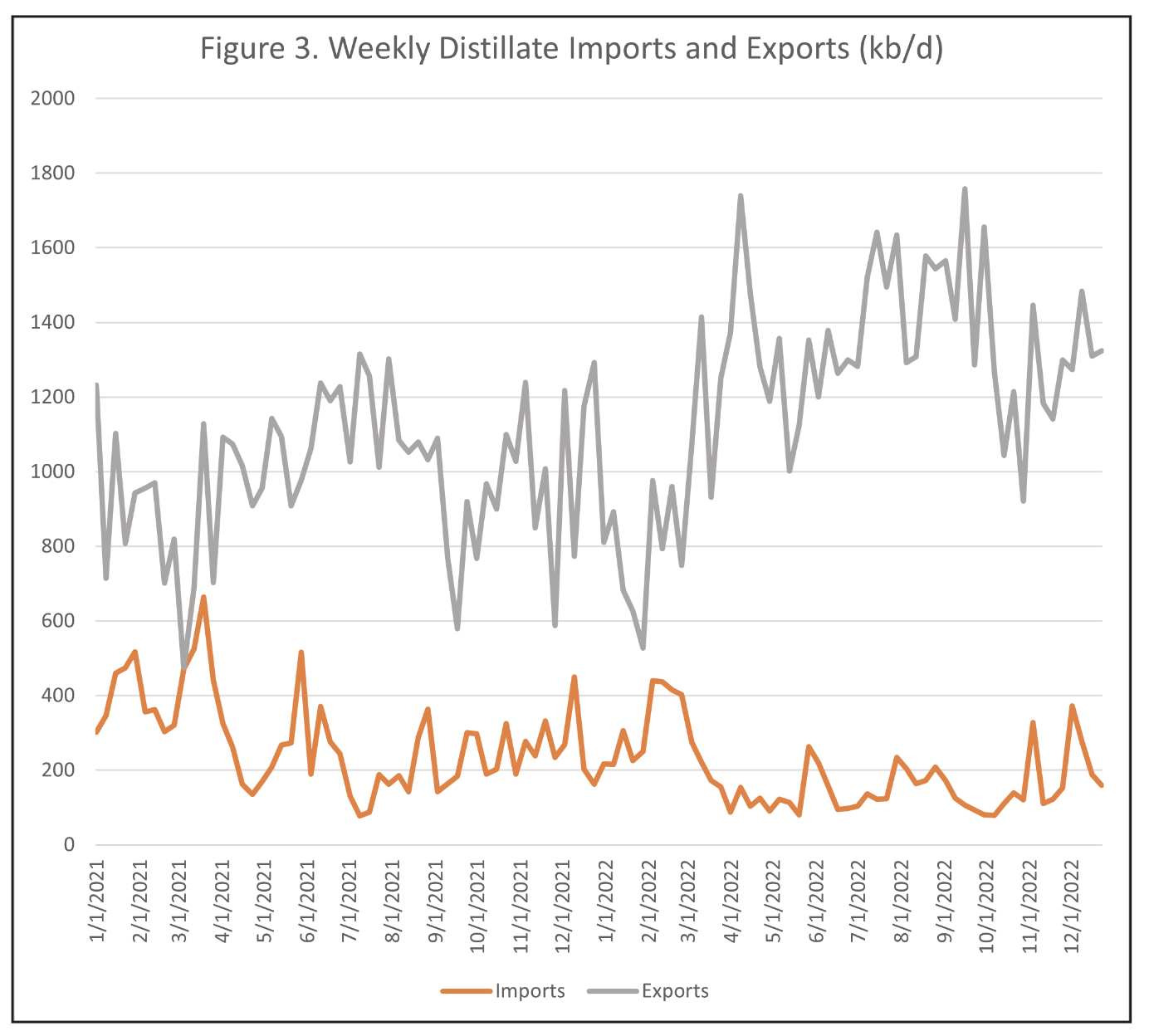

According to weekly EIA data, charted in Figure 2, US distillate exports averaged 0.86mb/d in February of 2021, rising to an average of 1.18mb/d in July. In 2022, US exports averaged a similar 0.87mb/d in February – but surged to a 1.51mb/d average in July. Meanwhile, imports slowed from 0.42mb/d in February to 0.14mb/d in July. While this is a seasonal pattern, it was likely exacerbated by the shifting economics in the market, and Figure 2 clearly shows the year-on-year increase in net export activity.

An interesting, export-related aside is that the surge in European gas prices also meant that European propane was being re-injected into the natural gas stream, opening up petrochemical appetite for US propane exports out of the Gulf Coast as feedstock. According to OPIS, this led to Mt. Belvieu becoming an important price benchmark for European LPG, which makes sense when we note that US LPG exports to the region shot up 54% year-on-year, with especially high import activity into the ports of Karlshamm, Szczecin, Gdansk, and Gdynia.

Shifting our focus back to distillates we saw that, despite crack spreads incentivizing increased distillate yields, the loss of about 1mb/d of US refining capacity following the pandemic, plus increased net exports, compounded by the backwardated market structure that Rich Larkin wrote about in the Nov/Dec issue of this magazine, led to weak US distillate stock levels and spikes in cash market differentials.

New York Harbor ULSD and ULSHO barge price differentials, shown in Figure 3, began rising in February following the invasion, but really spiked in the first half of May, reaching $1.1950/g and $1.1250/g respectively. Differentials calmed down by late that month and remained relatively subdued until a spike in mid-October and an even larger jump in mid-November. Differentials ended the year 2022 quietly.

In sharp contrast to 2022, we opened 2023 with heavy losses in equities as a backdrop – and with further losses in the first trading session of the year – amid concerns over a possible recession. Inflation was showing some nascent signs of slowing but remained high and the Fed was set to continue raising rates at one or two more FOMC meetings. East Coast distillate stockpiles remained weak and cash market differentials were starting to rise as of this writing in early January. Relatively strong builds from early November through late December helped lift regional inventories by 98.9 to 33.8mb, but this was still 19.6% lower than last year, 29.2% below the five-year average for the reporting week, and well below the weekly five-year range. In other words, we were not out of the woods yet, especially considering that the months of January and February see a large share of the heating season’s degree days. To make matters worse, the European Union was set to impose a ban on the seaborne importation of Russian oil products, including diesel, beginning on February 5. European imports from Russia picked up in the months and weeks leading up to the ban, which is set to be more complete than the EU ban on crude oil imports as the crude ban exempts about 500kb/d of supply to Central and Eastern European countries. No such exception had been set for Russian oil products as of this writing.

In order to circumvent the ban, Russian cargos are likely to be exported to countries outside the EU, often to be then transferred and re-exported. This will come at a cost, however, implying lower supply on the market, all else equal. On the other side of the equation, depressed economic activity could translate into weaker distillate demand as diesel demand tends to be pro-cyclical. Additionally, relatively strong crack spreads would support stronger than otherwise distillate output from refineries.

However things might shake out – with the economy, the Russia-Ukraine conflict and Western sanctions, US and European monetary policy, and OPEC+ supply quotas – uncertainty remains high. This can be seen in the implied volatilities behind crude oil and diesel option premiums, which were running in the mid to high forties percent, compared to around 38% in early 2022 and 30% in early 2021. Volatility tends to be cyclical, and we enjoyed a period of low volatility from 2017-2019. How much longer the current period of higher volatility will last is anyone’s guess.

Dan Lothrop is Head Trader at Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.