New England grid operator expects over 1.1 million installations by 2030

Can your business afford to lose more than half of its customers over the next nine years? Can any business?

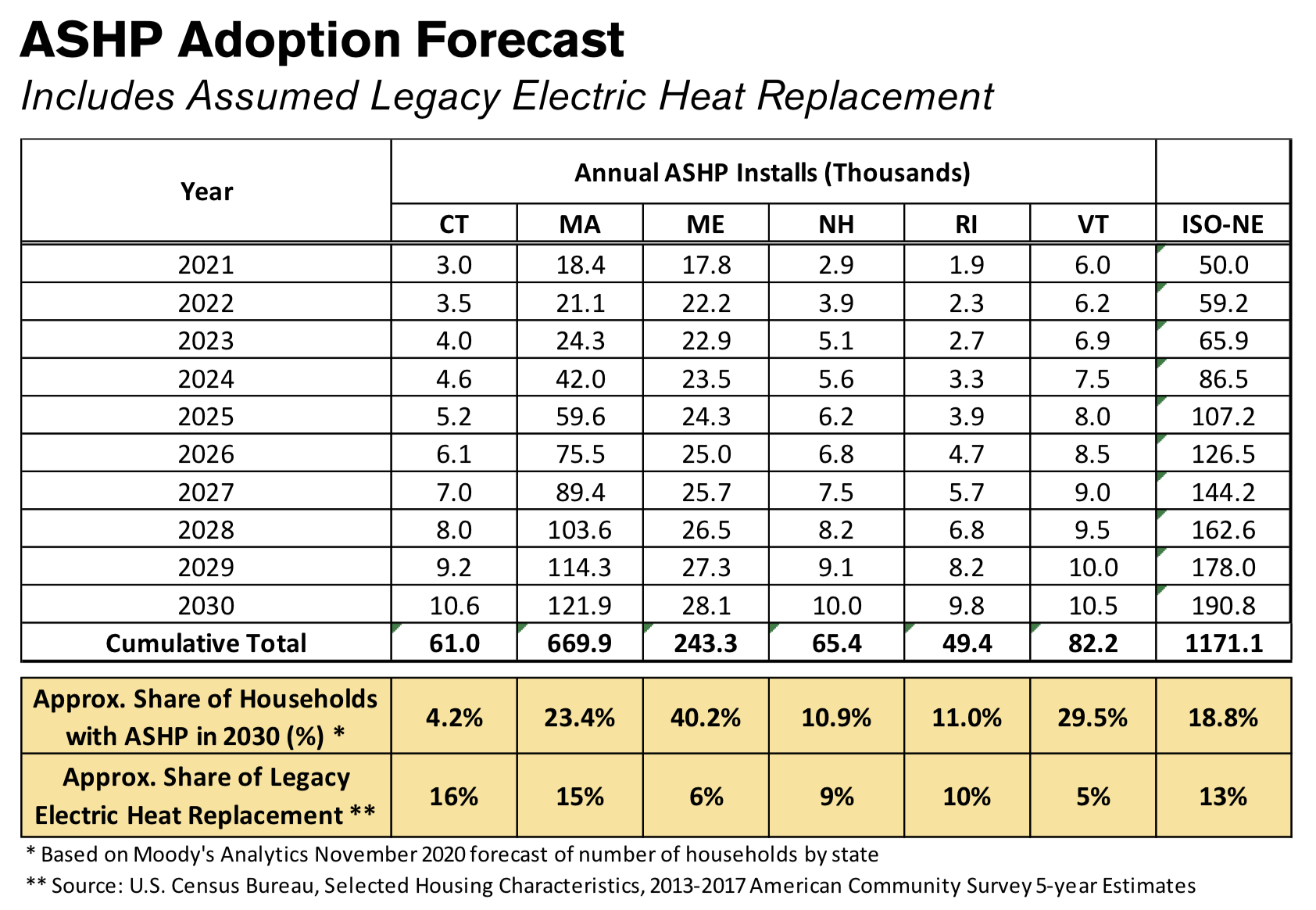

According to the 2021 Heating Electrification Forecast by electrical grid operator ISO New England, 1,171,100 new air source heat pumps will be installed in the region by 2030. This includes 61,000 in Connecticut, 669,900 in Massachusetts, 243,300 in Maine, 65,400 in New Hampshire, 49,400 in Rhode Island, and 82,200 in Vermont.

According to the U.S. Census Bureau, there were 2,022,663 oil-heated homes remaining in New England as of 2019: 535,420 in Connecticut, 344,425 in Maine, 678,224 in Massachusetts, 233,035 in New Hampshire, 122,583 in Rhode Island, and 108,976 in Vermont.

New England states and their utilities are subsidizing conversions from heating oil and other fossil fuels to electric heat pumps. Figures for the forecast’s yearly installation numbers were provided by state officials and existing energy efficiency programs – the same programs that are paying customers to switch from heating oil to electric heat pumps.

In other words, the plans are already in motion; from here on, it’s a numbers game. That doesn’t mean the outcome is pre-determined — but it means the threat to the heating oil industry’s customer base is both real and quantifiable. With that in mind, let’s take a closer look at ISO New England’s forecast numbers and some of their possible implications for the future of home heating.

State by State, Year by Year

As mentioned earlier, the forecast’s assumptions about heat pump adoption were by provided the states – either by state-sponsored energy efficiency programs or by state officials themselves.

In Connecticut, state officials predicted 3,000 heat pumps would be installed in 2021, 3,500 in 2022, 4,000 in 2023, 4,600 in 2024, 5,200 in 2025, 6,100 in 2026, 7,000 in 2027, 8,000 in 2028, 9,200 in 2029, and 10,600 in 2030, for a cumulative total of 61,000. That means about 4.2 percent of Connecticut homes will have an air source heat pump by 2030. If that doesn’t sound like a lot, consider that this state’s forecast only takes into account numbers provided by public officials. The report acknowledges that additional policy drivers and state initiatives are currently in development, which could raise the numbers higher in future forecasts. As you’ll see, each state efficiency program — except for that of Rhode Island, which, of course, has far fewer homes — is significantly more bullish on heat pump projections.

For Massachusetts, the 2021 figures were provided by administrators of the state’s Mass Save® energy efficiency program, with the growth figures thereafter provided by state officials. Massachusetts anticipates 18,400 heat pump installations in 2021, 21,100 in 2022, 24,300 in 2023, 42,000 in 2024, 59,600 in 2025, 75,500 in 2026, 89,400 in 2027, 103,600 in 2028, 114,300 in 2029, and 121,900 in 2030, for a cumulative total of 669,900, which represents a staggering 23.4 percent of all homes in the state. While 669,900 heat pump installations accounts for more than half of the 1.1 million forecast throughout the region, the 23.4 percent housing share is actually third highest among New England states.

Perhaps surprisingly, Maine — the coldest and northernmost state in the region — leads the pack in terms of how many homes by percentage will have an electric heat pump in 2030, with 40.2 percent projected. Figures for 2021 and 2022 were provided by the Efficiency Maine Trust, with a 3 percent annual growth assumed thereafter in alignment with the state’s Climate Action Plan. The numbers include 17,800 heat pumps installed in 2021, 22,200 in 2022, 22,900 in 2023, 23,500 in 2024, 24,300 in 2025, 25,000 in 2026, 25,700 in 2027, 26,500 in 2028, 27,300 in 2029, and 28,100 in 2030, for a cumulative total of 243,300.

In New Hampshire, state energy efficiency program administrators say 2,900 heat pumps installations are planned for 2021, with 20 percent annual growth planned through 2030. That amounts to 3,900 installations in 2022, 5,100 in 2023, 5,600 in 2024, 6,200 in 2025, 6,800 in 2026, 7,500 in 2027, 8,200 in 2028, 9,100 in 2029 and 10,000 in 2030, for a cumulative total of 65,400, or a 10.9 percent share of all homes in the state.

The 2021 numbers for Rhode Island were also provided by energy efficiency program administrators who again assumed 20 percent annual growth through 2030. There are 1,900 installations planned in 2021, 2,300 in 2022, 2,700 in 2023, 3,300 in 2024, 3,900 in 2025, 4,700 in 2026, 5,700 in 2027, 6,800 in 2028, 8,200 in 2029, and 9,800 in 2030, for a total of 49,400 new heat pumps, accounting for about 11 percent of Rhode Island homes.

Like Maine, Vermont is extremely bullish on heat pump installations, with 29.5 percent of all homes in the state expected to have a heat pump in 2030. However, the state is an outlier in the ISO New England report in that the installation numbers for each single year from 2021 to 2030 were provided by Efficiency Vermont, indicating the state has very specific and aggressive expectations for heat pump adoption over the decade. This includes 6,000 installations in 2021, 6,200 in 2022, 6,900 in 2023, 7,500 in 2024, 8,000 in 2025, 8,500 in 2026, 9,000 in 2027, 9,500 in 2028, 10,000 in 2029, and 10,500 in 2030, for a cumulative total of 82,200.

Altogether ISO New England forecasts the region will see 50,000 air source heat pump installations in 2021, 59,200 in 2022, 65,900 in 2023, 86,500 in 2024, 107,200 in 2025, 126,500 in 2026, 144,200 in 2027, 162,600 in 2028, 178,000 in 2029, and 190,800 in 2030, for a total of 1,171,100. The grid operator projects 18.8 percent of all New England homes will have an electric heat pump in 2030.

But how many of these new heat pumps will provide warmth all winter? The ISO New England forecast states that air source heat pump “technologies deployed in the coming years are expected to improve in terms of overall coefficient of performance,” but could these expectations be overstated? We’ll consider both questions in the next section.

Partial vs. Full Heating

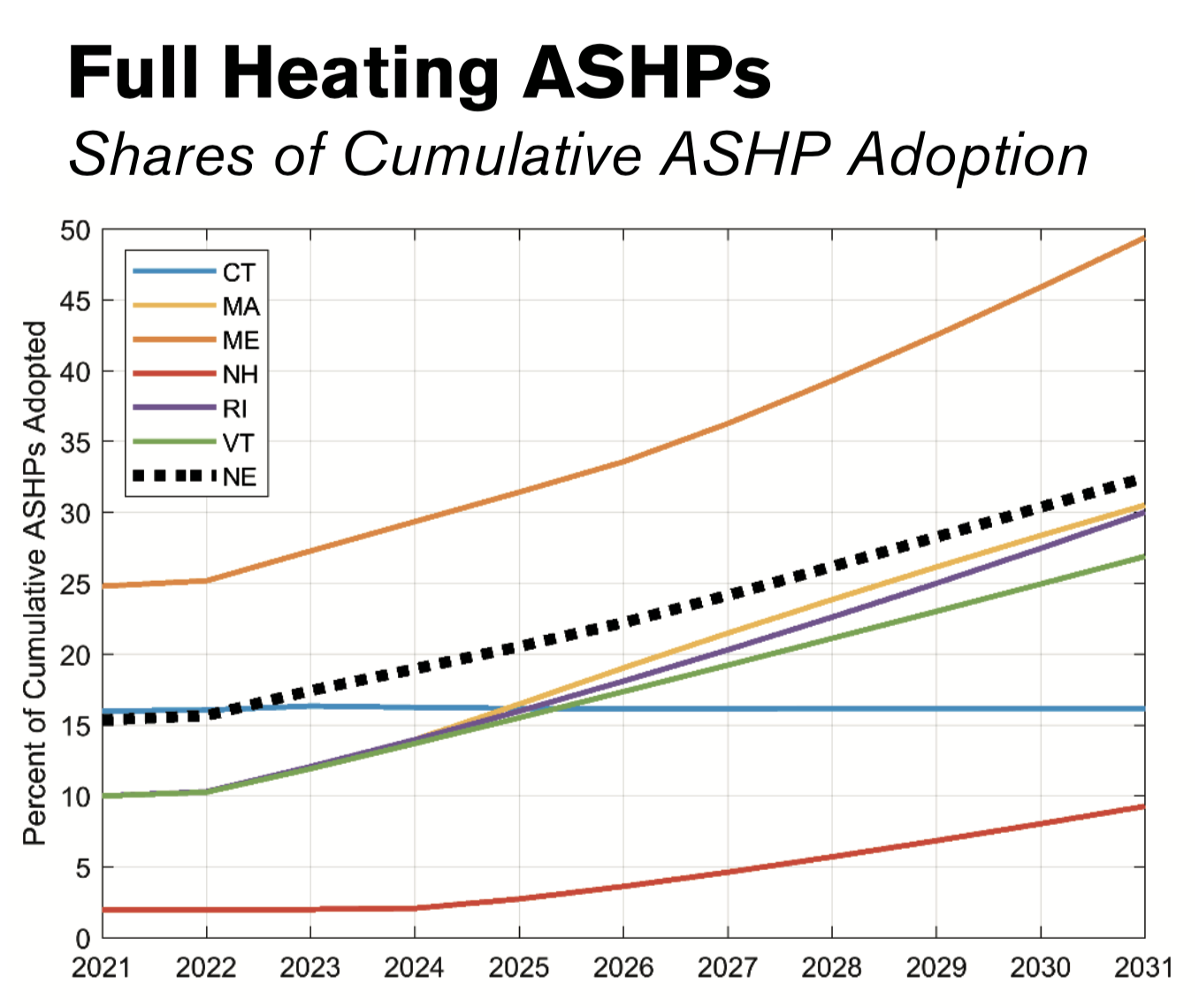

In addition to projecting how many heat pumps will be installed each year, ISO New England’s 2021 Heating Electrification Forecast estimates how many of these new systems will provide either full or partial heating. “Full heating” means heating the home from October through April without a secondary heat source. “Partial heating” means that a secondary or backup heat source, such as an oil-fired boiler or furnace, will still be required during the coldest conditions.

According to the forecast, approximately 15 percent of heat pump installations across New England in 2021 will be for full heating applications. This share will grow over time, reaching 20 percent around 2025 and 30 percent in 2030. The forecast also provides projections for each of the six New England states.

In Connecticut, 16 percent of new heat pumps provide full heating each year from 2021 to 2030. Notably, the rate remains consistent here because Connecticut public officials are only citing “legacy electric heat replacement” installations as full heating applications. In other words, only in cases where the home already uses electric heating year-round — such as homes with an electric baseboard heater and no other heating system — does the state foresee customers being able to depend on their new heat pump for the entire heating season.

A starkly different scenario is projected in Massachusetts, Rhode Island and Vermont. Here, the states’ respective efficiency programs see 10 percent of heat pumps installed in 2021 providing full heating, with that percentage increasing every year until 2030, at which point it reaches 40 percent. It’s worth pointing out, however, that the cumulative share of heat pumps providing full heating in these states from 2021 to 2030 is significantly lower – between 25 and 30 percent.

Again, Maine leads the pack, with the state’s Climate Action Plan calling for 35,000 heat pumps providing full heating by 2025 and nearly 116,000 doing so by 2030. Exactly how public officials see this playing out — in a state that has on average far more degree days than its neighbors to the south — remains unclear. At the opposite end of the spectrum, New Hampshire projects that only a modest 2 percent of heat pumps installed in 2021 will provide full heating, with that percentage increasing by another 2 percent each year thereafter.

To put this all in context, recent studies in Massachusetts and New York show that very few heat pumps installed in these states provide warmth all heating season. Most homes end up keeping a fuel-fired heating system as their primary heat source and use the heat pump as a secondary source that doubles as an air conditioner in the summer.

Nevertheless, the effect on fuel dealers remains similar, if less extreme; by providing heat during even part of the winter, electric heat pumps reduce homes’ fuel consumption, thereby reducing dealers’ gallons sold. So, let’s say only 20 percent of customers who add a heat pump stop using heating oil altogether. States are still planning to install heat pumps in as many as 50 percent of all oil-heated homes.

For most companies, even 20 percent of 50 percent is a significant loss.

On the other hand, renewable liquid heating fuel — with its higher energy storage capacity and quicker path to net-zero emissions — offers companies the opportunity to prevent customer losses and actually gain market share for the first time in generations. Of course, it’s up to the industry’s advocates to make this case to consumers as well as the public officials who oversee state energy policies. As NEFI President Sean Cota stated in this issue’s Front Burner (page 2 of the print edition), “Failure is not an option.”