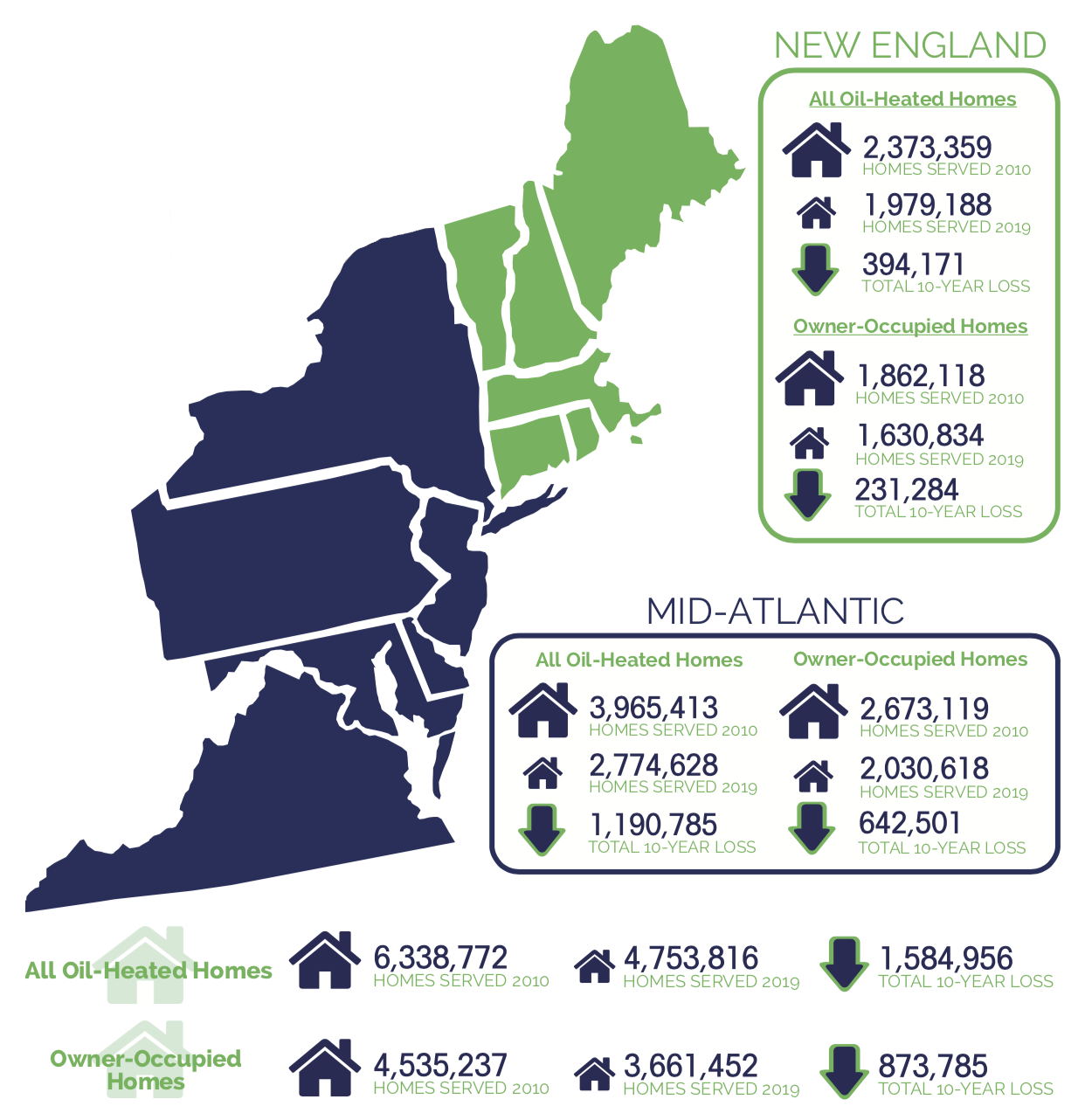

Fuel oil’s residential market share has steadily declined over the past several decades as homes across the U.S. Northeast and Mid-Atlantic regions have converted to other heating fuels, primarily natural gas. According to the U.S. Census Bureau’s 2019 American Community Survey, there are 4,753,816 oil-heated homes from Maine to Virginia. That is down 1,584,956 from 2010 when there were 6,338,772 oil-heated homes across the region – a decline of approximately 25%. In the starkest terms, this means that the residential heating oil industry lost one-quarter of its customer base over the prior decade.

With regional grid operator ISO New England forecasting a minimum of 1.1 million electric heat pump installations by 2030, many heating oil industry stakeholders fear that even more residential accounts could be lost to fuel conversions over the current decade (see “One Million Electric Heat Pumps” from June 2021 for more on this topic). These concerns certainly appear justified as state and local policymakers advocate for the wholesale electrification of all new residential buildings along with outright bans of heating oil infrastructure and combustion in these households.

All of that remains true. However, information has recently come to light revealing that heating oil’s losses in the residential market over the past decade aren’t quite as severe as was previously thought. In the January 27, 2022 edition of its CT Insider newsletter, the Connecticut Energy Marketers Association highlighted a data layer in the oft-cited American Community Survey that breaks down residential heating fuel use by owner-occupied or renter-occupied homes. Whereas previous reports combined owner- and renter-occupied homes into one group, differentiating these types of residences shows that heating oil’s market erosion is less severe among owner-occupied homes than total housing units.

Across New England, heating oil was used by 1,630,834 owner-occupied homes in 2019, down 231,284 from 2010 when it was used by 1,862,118 owner-occupied homes in the region. This is a decline of 12% — still a steep drop though considerably less than the 17% decline seen when accounting for all oil-heated homes in New England (both owner- and renter-occupied). Similarly, in 2019, heating oil was used by 2,030,618 owner-occupied homes in the Mid-Atlantic, down 642,501 from 2010 when it was used by 2,673,119 owner-occupied homes across the region. This is a decline of 24%, whereas the total number of oil-heated homes in the Mid-Atlantic fell by 30% over this period.

All told, in 2019, fuel oil heated 3,661,452 owner-occupied homes in the Northeast and Mid-Atlantic. This was down 873,785 or 19% from 2010 when fuel oil heated 4,535,237 owner-occupied homes in the region. For greater context and a better understanding of heating oil’s actual housing market share, it’s worth noting there were 17,201,546 owner-occupied homes in the Northeast and Mid-Atlantic in 2019 and 16,847,125 in 2010. Fuel oil heated 21% of these homes in 2019, down from 27% in 2010. By comparison, fuel oil heated 17% of all homes (owner- and renter-occupied) in the Northeast and Mid-Atlantic in 2019, down from 24% in 2010.

On one hand, the residential heating oil industry lost one-fourth of its customers over the past decade. On the other hand, it lost just under one-fifth of its share of the owner-occupied housing market. In other words, the situation is still extremely dire, but it’s at least slightly better than previously reported.