All

A New Revenue Stream for Home Heating Providers

Policymakers in Vermont look to establish the nation’s first Clean Heat Standard

“…You can look at California and see that’s where we’re all going to be in the Northeast in 10 or five years.” That was National Oilheat Research Alliance President John Huber speaking at the third annual liquid heating fuel Industry Summit during the 2021 HEAT Show in Ledyard, Connecticut (see “Answers to America’s Clean-Energy Challenge” from last issue). Huber wasn’t predicting a great migration of heating fuel dealers to the West Coast; rather, he was speaking about the eventual creation of a clean fuels program similar to California’s popular Low-Carbon Fuel Standard, but perhaps for heating instead of transportation.

Exactly when, where and how might such a program take effect in the Northeast? It’s far too early to tell. But the Clean Heat Standard recently recommended under the state of Vermont’s Climate Action Plan could provide a window into what a government-regulated incentives program might someday look like for the liquid heating fuels industry. With this in mind, Oil & Energy spoke with Vermont Fuel Dealers Association Executive Director Matt Cota about the Clean Heat Standard and its possible implications for the future of home heating.

As a broad introduction, Cota recalled that 10 years ago then-Governor Peter Shumlin signed a plan meant to eliminate the consumption of all petroleum in Vermont. This put the state government on a path “to rapidly decrease the amount of heating oil, diesel, gasoline and propane sold in Vermont,” Cota said. “Vermont was probably on the leading edge of this electrify-everything movement that’s now part of every energy plan in the Northeast,” he reflected. “The policies put in place to eliminate liquid heating fuels in Vermont have not been successful. Only 1% of Vermont homeowners made the switch to electric heat over the past decade, according to U.S. Census data.”

This led to the passage of the Global Warming Solutions Act of 2020, which called for the state to develop and release a Climate Action Plan by December 1, 2021. As this issue went to press in late November, the plan was being rolled out, but Cota had confirmed that it would recommend the creation of a Clean Heat Standard (CHS) along with various other initiatives. Although the CHS had not yet been fully developed, a consulting firm called Energy Action Network had drafted for the government a white paper outlining in broad terms how a CHS might work in Vermont.

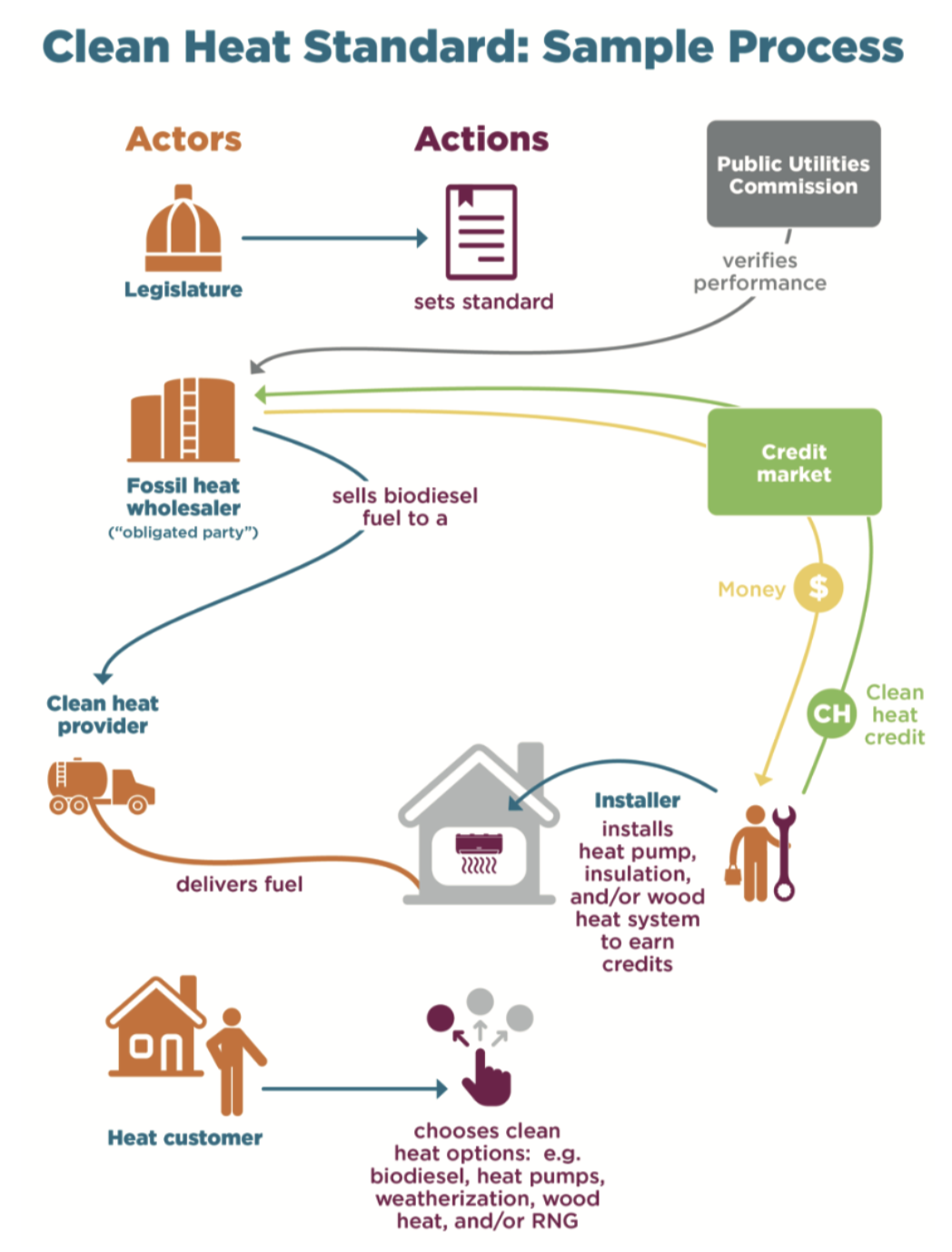

According to Cota, the CHS “would incentivize heating oil retailers to conduct measures among their customers that show a reduction of carbon emissions.” These “measures” would include selling wood pellets, installing electric heat pumps, and delivering renewable liquid heating fuel (RLHF) blends containing biodiesel, renewable diesel, and/or other low-carbon fuels. “If you’re a retailer or service provider and do a variety of different things that can help reduce carbon emissions, including selling RLHF, weatherization, heat pumps, etc., then here’s a revenue stream which heretofore didn’t exist,” Cota said. Likewise, for companies that do not currently provide these products and services, “there’s an opportunity to carve out another revenue stream.”

Perhaps one of the greatest strengths of the CHS, from a business-to-customer perspective, is that it does not limit consumer choice. The customer chooses from a range of different clean heat options, the business providing that option receives a financial incentive in the form of a “clean heat credit,” and the regulated marketplace allows for continued competition – may the best clean heat source win.

How much would the program’s financial incentive amount to, and where would the money for it come from? The first question would need to be answered when the CHS is actually designed and developed. However, the second already has an answer. “The money would come from natural gas, propane and oil wholesalers,” Cota said. “Under the CHS, wholesalers would essentially pay an amount into the program for permission to sell their products based on those products’ carbon score.” That score, which would dictate retailer incentives as well as wholesaler fees — and will therefore be the subject of intense debate in the weeks and months ahead — is still to be determined. However, Cota noted, “If you’re a heating oil wholesaler who sells blends of renewable diesel, biodiesel or ethyl levulinate (EL), and you can show that, then you would not pay the full load — you’d pay a discount.”

As for dealer and wholesaler reactions to the CHS recommendation, VFDA “member perceptions are all over the map,” Cota conceded. “We have heating oil marketers that see an opportunity in selling RLHF and diversifying, and wholesalers that see how the regulations would work and the opportunities therein. As for propane wholesalers, they’d have to sell renewable propane, which would be a challenge. For companies that aren’t interested in diversifying their offering, the CHS may not be of value to them.” Beyond questions about fuel supplies and carbon scoring, some companies’ reservations reflected long-standing concerns about government overreach.

Cota acknowledged that independent, family-owned businesses have not typically been eager to monetize government policy mechanisms. “Regulation historically has not been here for our benefit, so there’s a healthy skepticism that government is here to help,” he said. “That being said, for the first time, regulators and policymakers are talking about the necessity of the heating fuel service industry to ensure that the energy transition happens in an orderly way and that the same people who install home heating systems keep their jobs.”

At the end of the day, that simple acknowledgement may turn out to be one of the most important and promising aspects of the CHS. “It took a while but people are finally recognizing that Vermont’s heating oil retailers don’t own a well in Texas,” Cota said. “They don’t have a pipeline — they have a customer list and are dedicated to making sure those customers are safe, and they’re not likely to give up that mission and that business model no matter what a Climate Council decides to do.”

Related Posts

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

From Retailer to Representative: Chris Keyser’s Road to the Vermont State House

Posted on June 16, 2025

Northeast Working Group for Industry Principles Gets to Work

Northeast Working Group for Industry Principles Gets to Work

Posted on May 8, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

NEFI Introduces the National Home Comfort PAC

NEFI Introduces the National Home Comfort PAC

Posted on April 28, 2025

Enter your email to receive important news and article updates.