Annual Energy Outlook projects a quiet revolution in the U.S. energy mix

The U.S. Energy Information Administration (EIA) has released its Annual Energy Outlook 2022 (AEO2022), with projections for the domestic energy market through 2050. As always, the report outlines multiple cases, each of which has different underlying assumptions. The central set of assumptions, or the “Reference case,” projects there will be improvement in known energy production, delivery and consumption technologies.

The complete AEO2022, available on the EIA website at eia.gov/outlooks/aeo, includes the following side cases: the High Oil Price and Low Oil Price cases, High Economic Growth and Low Economic Growth cases, and the High Renewables Cost and Low Renewables Cost cases. This article focuses primarily on the Reference case.

Notably, EIA reviewed the Bipartisan Infrastructure and Jobs Act for provisions that would influence energy consumption, production, or trade in the U.S. economy, and factored four such provisions into AEO2022 projections. However, three other provisions were not included as their future impacts are unclear.

Among those provisions not included was funding from 2022 through 2031 to assist states and local governments with adopting codes that meet or exceed the 2021 International Energy Conservation Code and the American Society of Heating, Refrigerating and Air-Conditioning Engineers, 90.1-2019.

Nonetheless, AEO2022 provides a window to the future based on modeled projections rather than speculative predictions. Reviewing these projections enables liquid heating fuel stakeholders to consider their individual business operations, as well their overall industry, within the larger context of the domestic energy market.

This year, Oil & Energy has again taken steps to curate EIA’s AEO2022 narrative for the liquid heating fuel industry. Though no texts or charts from the EIA document have been substantially altered, this top-line summary seeks to highlight information of most immediate relevance to Oil & Energy readers.

EIA’s Key Takeaways

Petroleum and natural gas remain the most-consumed sources of energy in the United States through 2050, but renewable energy is the fastest growing

- Motor gasoline remains the most prevalent transportation fuel despite electric vehicles gaining market share.

- Energy-related carbon dioxide (CO2) emissions dip through 2035 before climbing later in the projection years.

- Energy consumption increases through 2050 as population and economic growth outweighs efficiency gains. Electricity continues to be the fastest-growing energy source in buildings, with renewables and natural gas providing most of the incremental electricity supply.

U.S. crude oil production reaches record highs, while natural gas production is increasingly driven by natural gas exports

- U.S. production of natural gas and petroleum and other liquids rises amid growing demand for exports and industrial uses.

- Driven by rising prices, U.S. crude oil production returns to pre‐pandemic levels in 2023 and stabilizes over the long term.

- Refinery closures lower domestic crude oil distillation operating capacity, but refinery utilization rates remain flat over the long term.

- Consumption of renewable diesel increases as a share of the domestic fuel mix.

Wind and solar incentives, along with falling technology costs, support robust competition with natural gas for electricity generation, while the shares of coal and nuclear power decrease in the U.S. electricity mix

- Electricity demand grows slowly across the projection period, which increases competition among fuels.

- Renewable electricity generation increases more rapidly than overall electricity demand through 2050.

- Battery storage complements growth in renewables generation and reduces natural gas‐fired and oil‐fired generation during peak hours.

- As coal and nuclear generating capacity retire, new capacity additions come largely from wind and solar technologies.

Electric Vehicles Lag Behind

Motor gasoline remains the most prevalent transportation fuel despite electric vehicles gaining market share

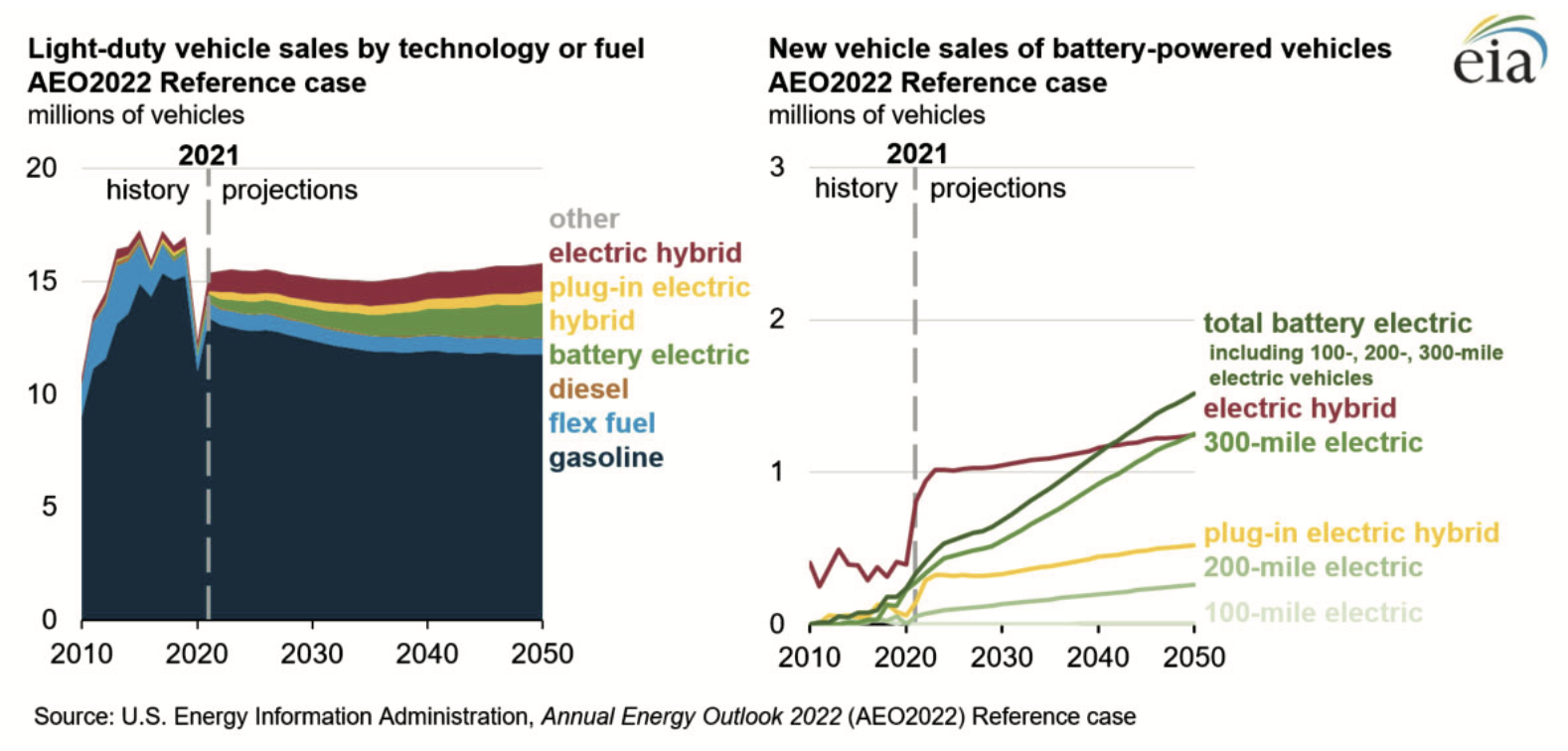

- Combined share of sales of internal combustion engine light-duty vehicles (LDVs) — including gasoline, diesel, flex-fuel, natural gas, and propane powertrains — will decrease from 92% in 2021 to 79% in 2050 because of growth in sales of battery-electric vehicles (BEVs), hybrid-electric vehicles (HEVs), and plug-in hybrid-electric vehicles (PHEVs).

- Total electric vehicle share — including BEVs and PHEVs — of on-road LDV stock grows from less than 3% in 2021 to 13% in 2050.

Transportation Energy Consumption Rebounds

Despite steep declines during the pandemic, consumption of energy for transportation returns to pre-pandemic levels

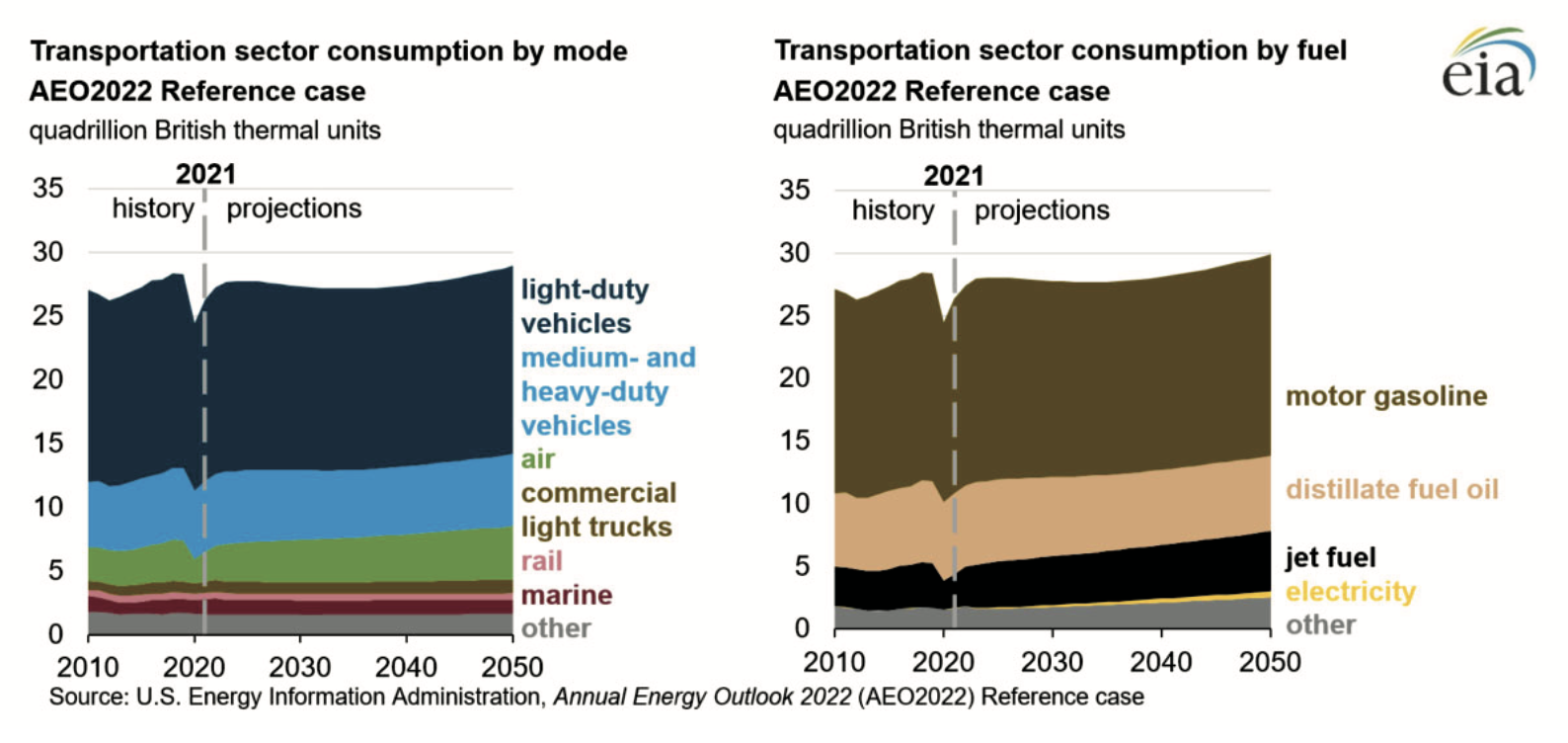

- Energy consumption in the transportation sector nearly returns to the 2019 pre-pandemic level of 28.4 quadrillion British thermal units (quads) in 2025 before declining slowly through 2035. Energy consumption in the sector then rises through the remainder of the projection period to 29.9 quads. Motor gasoline, distillate fuel oil, and jet fuel account for more than 90% of the transportation sector’s energy consumption throughout the projection period.

- Rising diesel consumption is largely a result of projected medium‐ and heavy‐duty freight truck travel, which accounts for around 77% of consumption of diesel in the transportation sector throughout the projection period. After fuel economy returns to pre‐pandemic levels, EIA projects that fuel economy increases for trucks, which generally reduces consumption through 2041. Slowing gains in fuel economy and rising freight truck travel demand gradually cause consumption to rise through 2050.

Homes Use More Electricity But Also Less Natural Gas

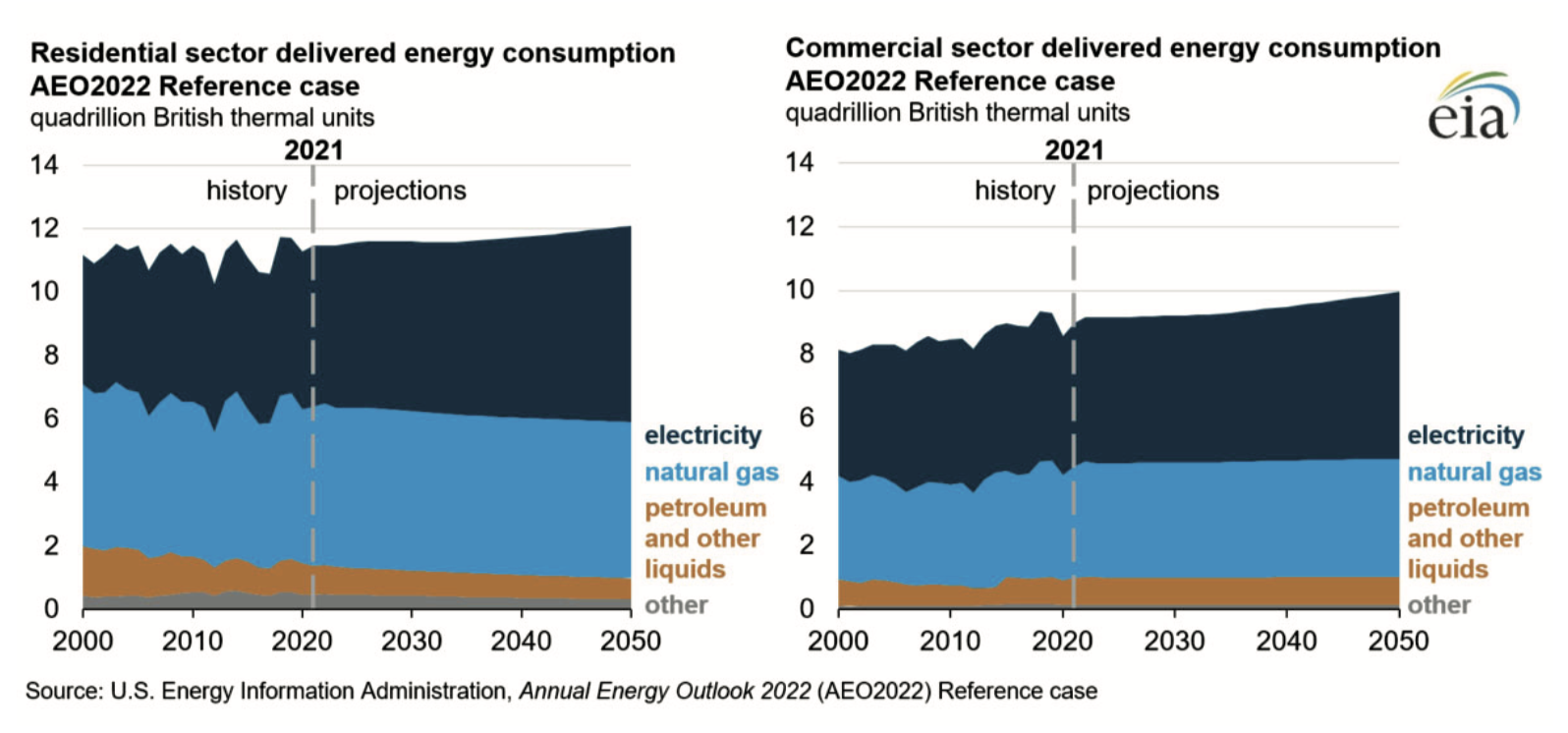

Growth in residential housing stock contributes to increasing energy consumption across the buildings sector

- Between 2021 and 2050, U.S. housing stocks, led by growth in single‐family homes, increase by 23%.

- Electricity consumption in U.S. residences will grow 22% between 2021 and 2050.

- Natural gas consumption for space heating, which is the largest contributor to both U.S. commercial and residential delivered energy consumption throughout the projection period, declines through 2050.

Crude Oil Peaks

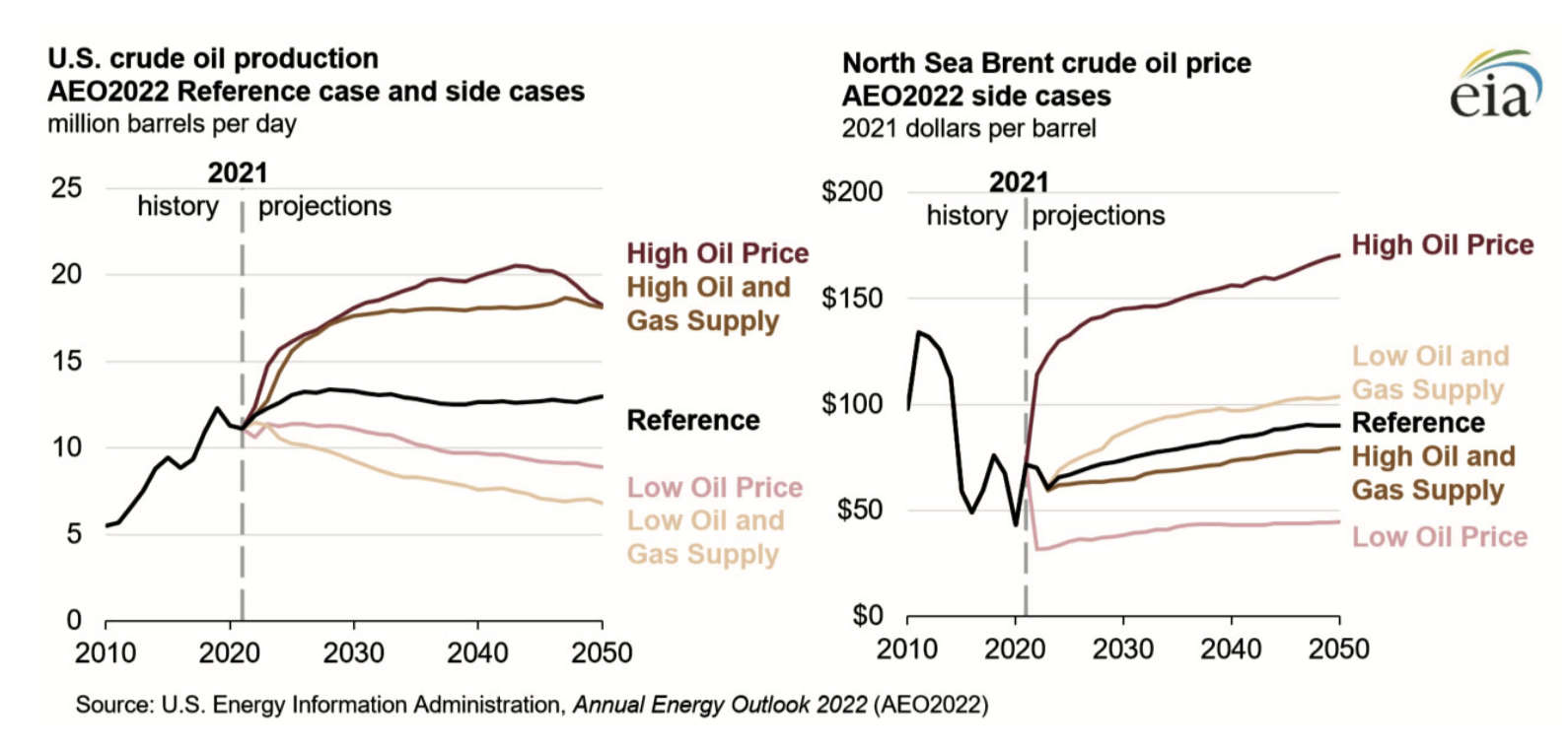

Projected U.S. crude oil production peaks in the late 2020s and remains near that peak through 2050

- During 2021, crude oil production did not grow, even as benchmark prices increased substantially. However, as the global economy returns to pre‐pandemic levels, EIA projects that both demand and prices will remain elevated, resulting in crude oil production reaching pre‐pandemic levels in the medium term.

- Crude oil production returns to pre‐pandemic levels in 2023 and peaks in the late 2020s. Production then remains relatively flat through 2050. Prices are high enough to maintain investment at steady crude oil production levels but not high enough to elicit increasing volumes from those levels of investment.

- Projected crude oil imports rise to pre‐pandemic levels by 2023 and then remain relatively flat through 2050. The U.S. will remain a net exporter of petroleum products through 2050 as net petroleum product exports remain mostly flat through the projection period.

Refineries Stabilize

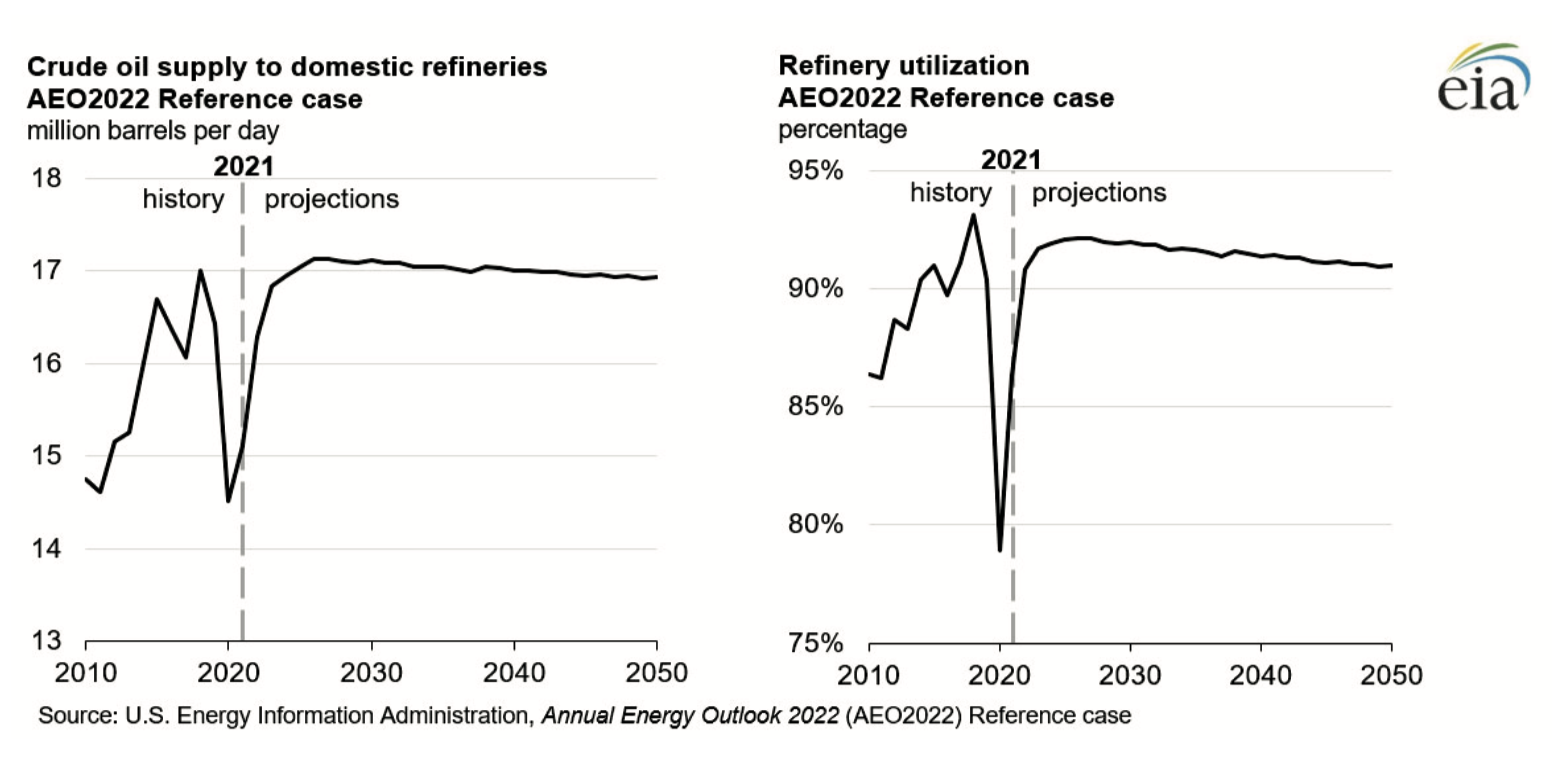

A number of U.S. refineries have closed over the last two years as a result of pandemic-related demand decreases or conversion to renewable diesel production

- Between 2020 and 2021, six U.S. refineries closed, totaling 750,000 barrels per day (b/d) of total capacity: the Western Refining refinery in Gallup, New Mexico; Tesoro (Marathon) refinery in Martinez, California; Dakota Prairie refinery in Dickinson, North Dakota; HollyFrontier refinery in Cheyenne, Wyoming; Shell refinery in Convent, Louisiana; and Philadelphia Energy Solutions in Philadelphia, Pennsylvania.

- Some of these closures are related to decreased demand caused by responses to the global pandemic. However, other refineries, such as HollyFrontier in Cheyenne, Wyoming, and the Dakota Prairie refinery in Dickinson, North Dakota, are converting to produce renewable diesel.

- Cumulatively, these closures have reduced national crude oil distillation operating capacity by approximately 3.5%.

Refinery utilization rates remain stable over the long run in response to diminished demand

- Despite the recent reduction in refinery capacity, refinery utilization and throughput (the amount of crude oil processed at refineries) will remain relatively flat over the projection period.

- Utilization rates will return to near historical averages in 2022, but it will not be cost‐effective for refineries to make up for lost capacity by increasing utilization beyond this point.

- As a result of lower capacity and stable utilization, EIA expects total production of refined products to remain below peak levels over the long run.

Renewable Fuels Remain in the Mix

Consumption of renewable diesel increases as a share of the domestic fuel mix

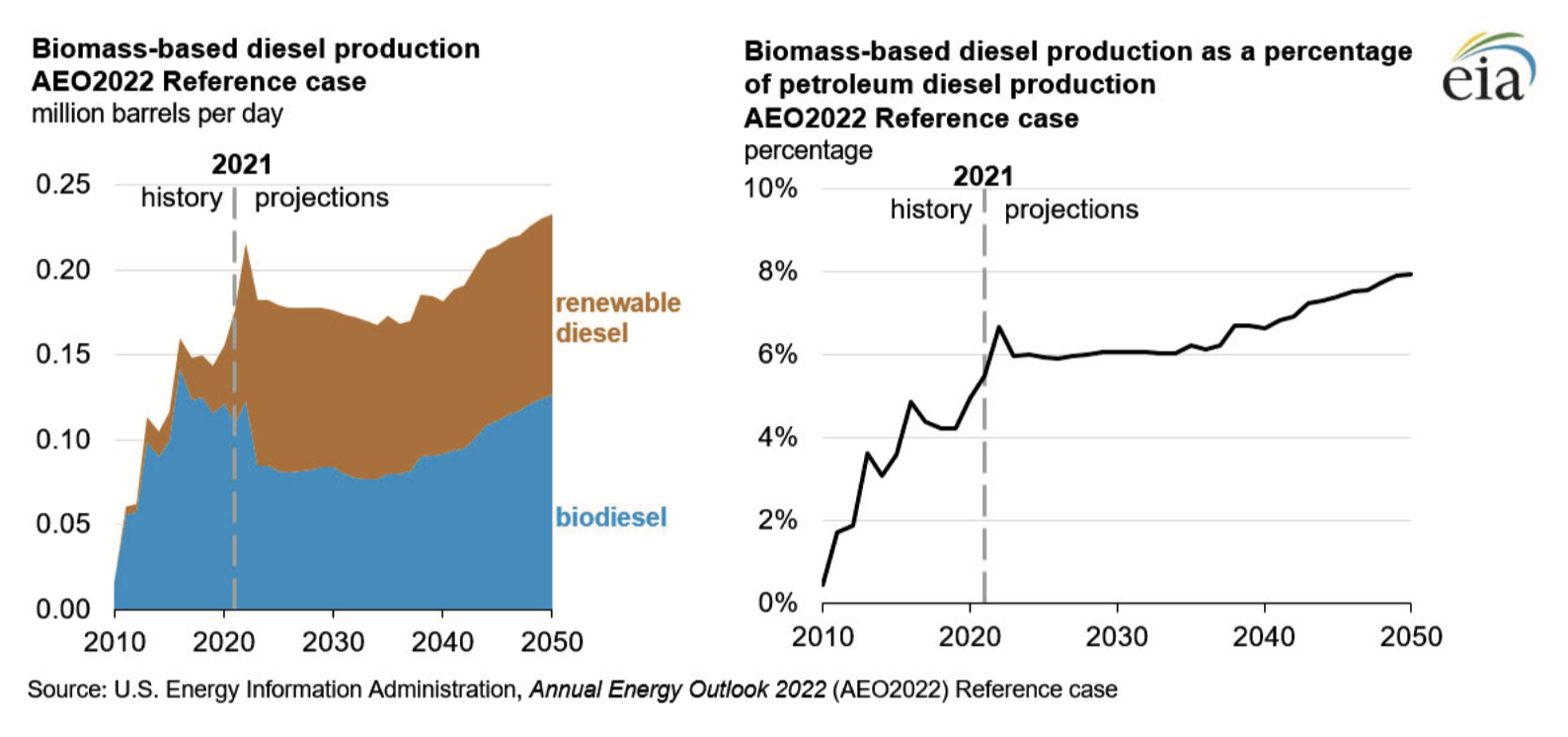

- Although biodiesel has historically been the predominant biomass‐based diesel fuel produced in the U.S., EIA projects a shift toward renewable diesel capacity in the medium to long term.

- Renewable diesel is chemically indistinguishable from petroleum diesel, meaning it meets specifications for use in existing infrastructure and diesel engines. Renewable diesel is not subject to any blending limitations.

- Renewable diesel’s growth is a result of its fungibility, along with higher state and federal targets for renewable fuel production, favorable tax credits, and the conversion of existing petroleum refineries into renewable diesel refineries. In response to the improved economics of renewable diesel, capacity has increased in the form of new stand‐alone facilities and converted petroleum refineries.

- The current market for biomass‐based diesel fuels is constrained by a combination of capacity, feedstock availability, and economics. Because the market penetration for biomass‐based diesel fuels is limited by market demand, and renewable diesel and biodiesel compete for the same feedstocks, growth in renewable diesel comes partially at the expense of new biodiesel capacity. The renewable diesel supply is supported by imported renewable diesel and remains higher than biodiesel supply through 2050.

Biomass-based fuels remain a small but important part of the total fuel mix

- Biomass‐based diesel fuels remain a relatively small part of the total diesel market, contributing less than 8% of the total supply in 2050. By comparison, current ethanol consumption as energy in the U.S. approaches almost 1 million b/d in 2050, almost five times the quantity of biomass‐based diesel. So, much more ethanol is consumed as energy than biomass‐based diesel fuels because almost all finished motor gasoline sold in the U.S. is blended with 10% ethanol (E10).

- However, despite higher blend ratios, future growth of U.S. ethanol consumption as energy is constrained near current levels through 2050 by declining motor gasoline consumption. Renewable diesel, however, does not need to be blended, and biomass‐based fuels continue to attract interest and investment because they represent a potential pathway for reducing carbon emissions in the transportation sector and provide an alternative fuel source to petroleum‐based diesel fuel.