All

Market Forecast: What to Watch

by Anja Ristanovic, Hedge Solutions

Reviewing the market forces that will affect fuel prices in 2024

The year 2023 was a rollercoaster for the crude oil market, which experienced high price volatility due to geopolitical tensions, economic uncertainties, and OPEC+ interventions. The year began with bearish sentiment and sharp decline in Brent and WTI crude oil prices but ended with cautious optimism and a more stable market.

The first week of 2023 ended with a sharp drop of 8% in both Brent and WTI crude oil futures prices, the biggest first-week drop since 2016. Rising U.S. interest rates and fear of an economic slowdown weighed on prices, but these soon recovered with an easing of COVID-19 restrictions in China and the expectation of smaller than previously expected U.S. rate hikes by the Federal Reserve. Crude oil prices remained fairly stable until the beginning of March, when we saw a sharp drop in prices following news of the failure of three U.S. banks – Silicon Valley Bank, Silvergate Bank, and Signature Bank. Price volatility in the second quarter was impacted by OPEC+ production cuts (price supportive); rising U.S. interest rates; increased exports of Russian oil to Asian countries, particularly to China and India and which ultimately offset sanctions imposed on Russia in 2022; and concerns over the U.S. debt ceiling (unsupportive for prices).

The second half of 2023 started off with an announcement of a surprise voluntary oil production cut of one million barrels per day (mb/d) by Saudi Arabia and a 0.3mb/d export cut by Russia. Crude oil prices continued to rise after the International Energy Agency reported that the global oil demand hit a record high in June, with Brent and WTI crude oil futures closing at their highest point in the year on September 8. Brent settled at $90.65/bbl and WTI closed at $87.51/bbl. The Israel-Hamas war broke out on October 7, causing high volatility in oil prices as market participants considered a potential expansion of the conflict to other Middle Eastern countries. Weighing on the price action was the news that the Energy Information Administration reported a record-high in weekly U.S. crude oil production, which reached 13.20mb/d in early October and remained at this level for the next eight weeks. The last month of the year continued to bring interesting developments in the market, with attacks by Yemen’s Houthi movement on ships traveling through the Red Sea, causing global shipping companies to reroute their vessels, leading to delays in shipments.

With another exciting year behind us as we step into 2024, a lot of the previously mentioned factors will continue to have a significant impact on the market. One thing that is certain is that the oil market landscape remains dynamic and unpredictable, demanding its participants pay close attention to key elements. We will now take a look at a few factors to keep an eye on over the next year.

Geopolitical Tensions

Ongoing conflicts in the Middle East and in oil-producing countries will continue to pose a threat to global oil supply chains. The Russia-Ukraine war is still in effect and could continue to develop, recent attacks on cargo vessels in the Red Sea continue to cause delays in shipments, the Israel-Hamas conflict does not show signs of stopping any time soon, and instability in countries such as Venezuela and Iran could further contribute to global oil supply concerns.

OPEC+

Angola recently decided to exit OPEC, which could influence OPEC’s future strategies and decisions, and require a reassessment of how the group operates. OPEC+ announced additional voluntary production cuts of 2.2mb/d on November 30th, in addition to existing production targets and voluntary cuts which were set in June 2023. These cuts are set to remain in place until March 2024 and the group is projected to produce less than its currently-stated targets in 2024.

Supply-Demand Balance

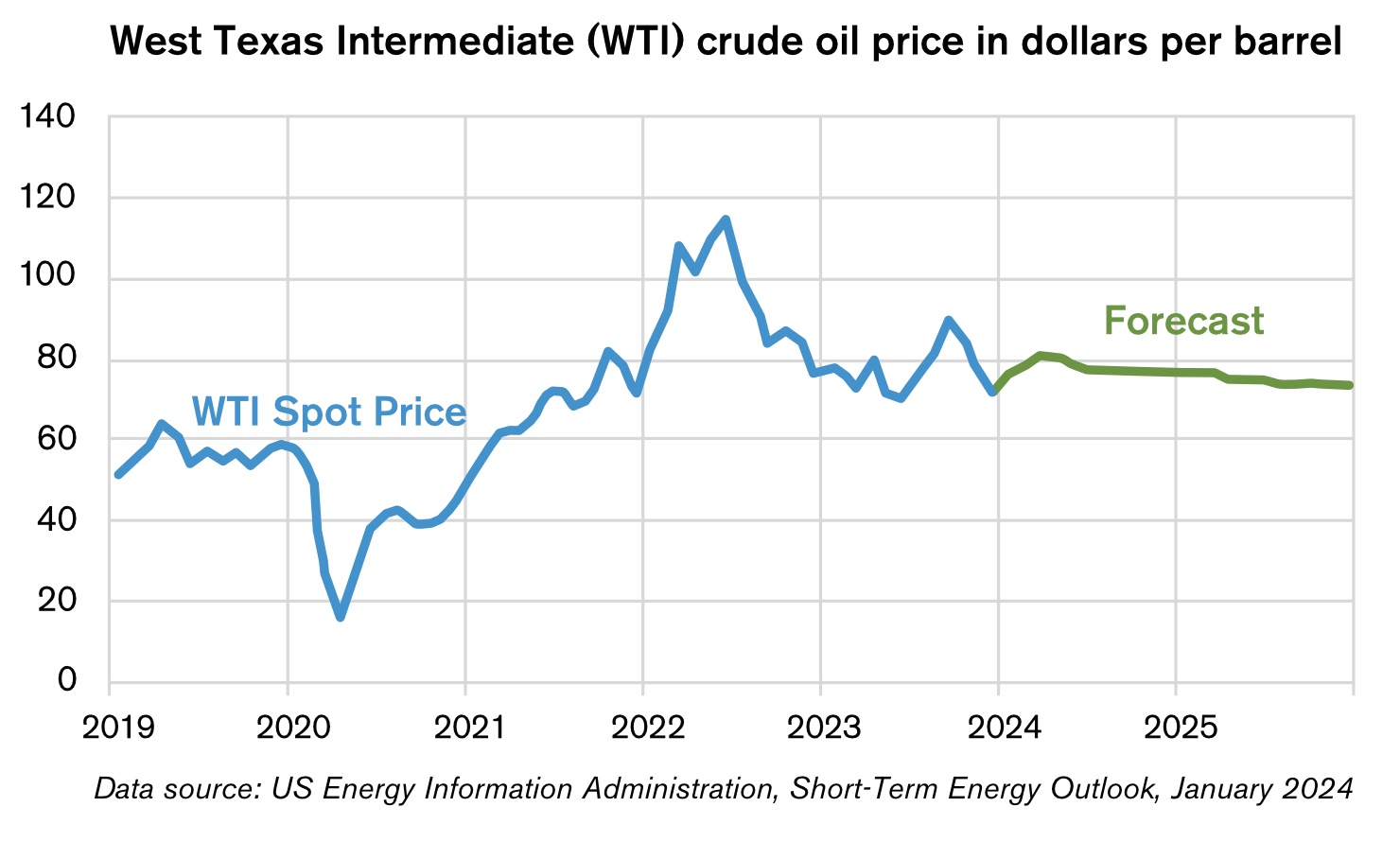

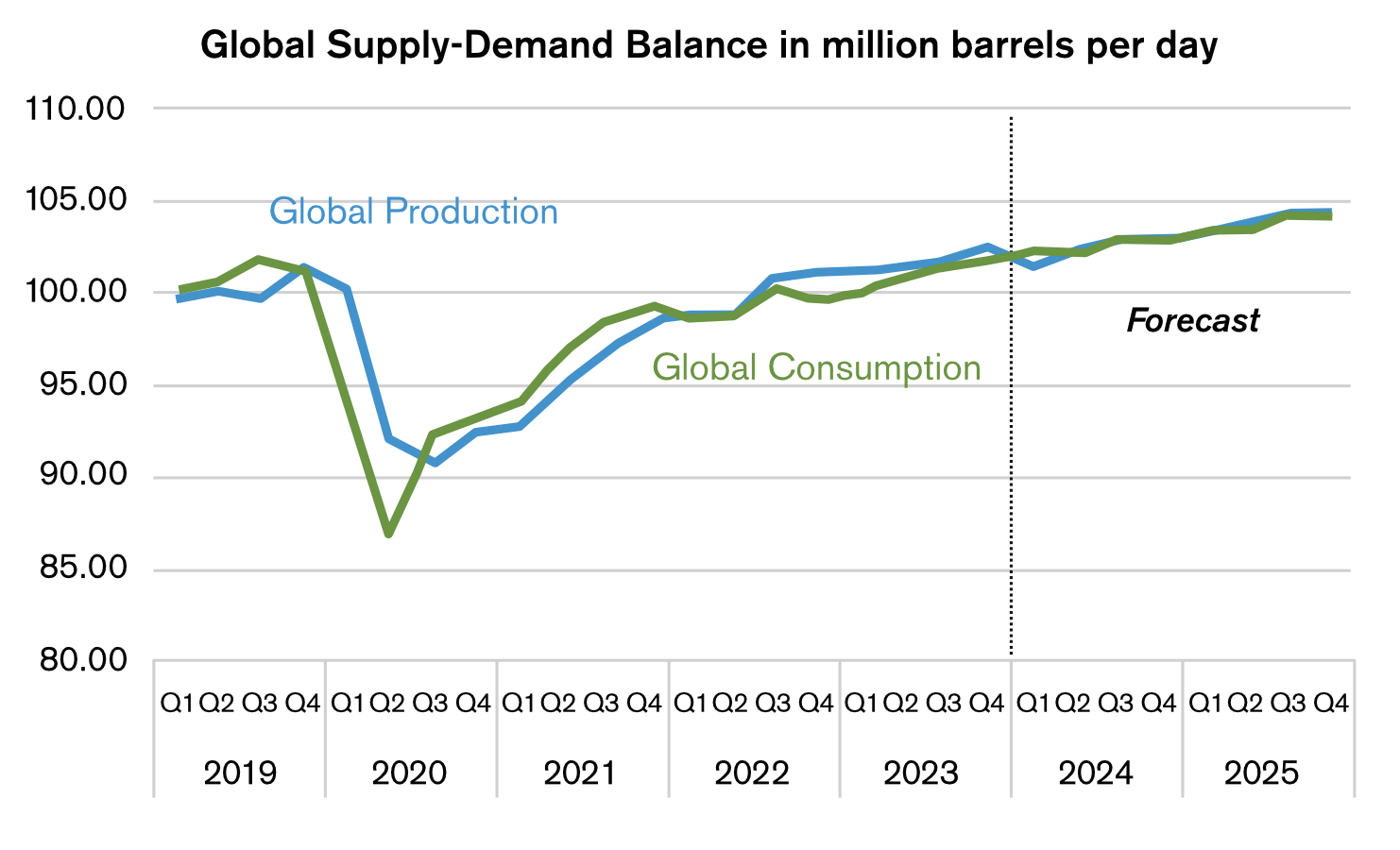

The equilibrium between oil supply and demand is susceptible to disruptions in oil-producing countries and shifts in global consumption patterns. According to the Energy Information Agency’s January Short-Term Energy Outlook, global liquid fuels consumption growth is expected to slow down in 2024, compared to 2023 and the 10-year average. Global oil demand is expected to grow by 1.4mb/d in 2024, down from 1.9mb/d last year and below the 1.5mb/d 10-year pre-pandemic average (2010-2019). On the other side of the equation, global liquid fuels production is expected to increase by 0.6mb/d this year, down from a 1.7mb/d increase in 2023. OPEC+ crude oil production is forecasted to decline by 0.6mb/d, which is offset by 1.2mb/d in production growth outside of the group. In the U.S., crude oil production is expected to hit a new record in 2024, averaging 13.2mb/d.

Economic Uncertainty

Uncertainty over the global economy remains one of the biggest questions in 2024. Opinions are still divided, with some economists seeing the global economy as rocky and forecasting that we could see it weaken further this year, while a smaller group sees the economy steadying or even improving, according to the World Economic Forum. Inflation across the world has slowed down and is expected to moderate further, from an estimated 5.6% in 2023 to 4.7% in 2024, according to S&P Global. S&P Global also forecasts that global annual real GDP will grow at a slower pace of 2.3% in 2024, compared to 2.7% last year.

In 2024, the global oil market continues to face many challenges and uncertainties, with market participants keeping an eye out on developments in the Middle East as well as geopolitical events in the rest of the oil-producing countries as well as global economic activity and a potential economic recovery. According to the EIA, Brent crude oil prices will average $82/bbl in 2024, similar to 2023, and WTI is expected to follow the same path, averaging $78/bbl, just slightly above $77.64/bbl in 2023. The oil market remains complex and volatile, impacted by a range of factors, and requires close attention from industry participants in the year ahead.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.