The U.S. Energy Information Administration (EIA) released its Short-Term Energy Outlook in mid-March. The following was taken from that document.

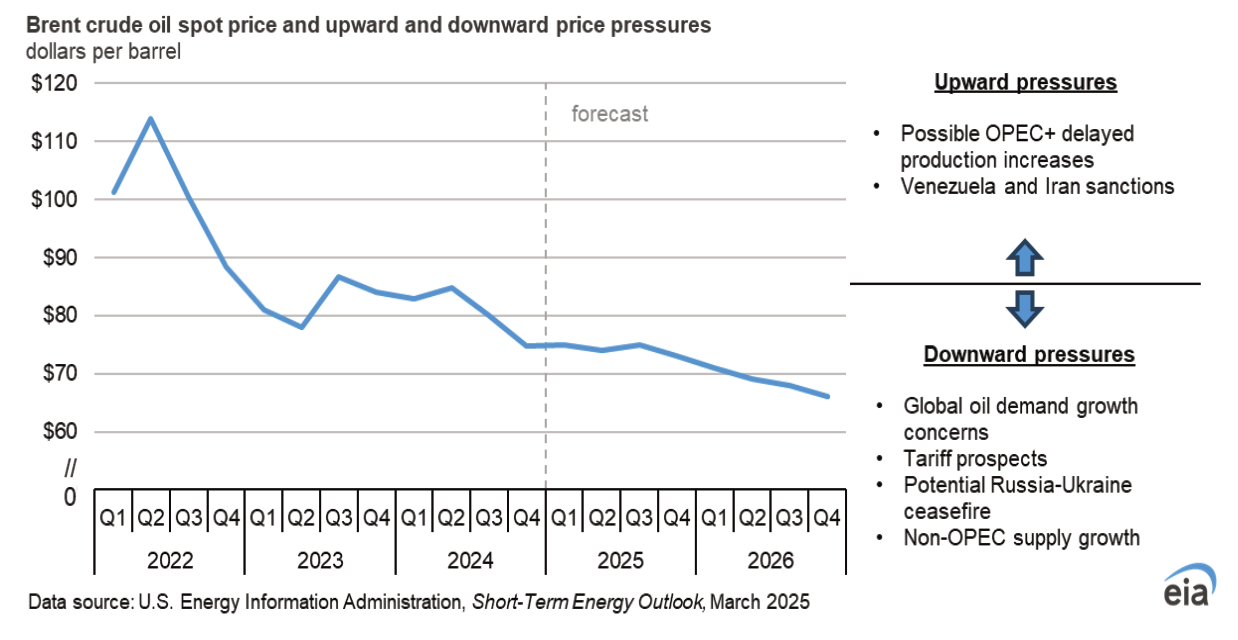

• Global oil markets. Global oil markets will remain relatively tight through the middle of 2025 before gradually shifting to oil inventory builds later this year. We expect global oil inventories will fall in the second quarter of 2025 (2Q25) in part due to decreasing crude oil production in Iran and Venezuela. As a result, the Brent crude oil spot price in our forecast rises from about $70 per barrel (b) to $75/b by 3Q25. However, we expect oil inventories will build and place downward pressure on crude oil prices in late-2025 and through 2026 when we expect OPEC+ unwinds production cuts and non-OPEC oil production grows. As a result, we forecast the Brent crude oil price will fall to an average of $68/b in 2026.

• Natural gas consumption and inventories. Cold weather during January and February led to more consumption of natural gas and large withdrawals of natural gas from inventories. We now expect natural gas inventories to fall below 1.7 trillion cubic feet at the end of March, which is 10% below the previous five-year average and 6% less natural gas in storage than we had expected last month. We also increased our forecast for overall electricity generation over the next two years. As a result, we now expect the electric power sector will use more than 36 billion cubic feet per day of natural gas on average in 2025 and 2026, 2% and 1% more, respectively, than last month. Overall, we expect natural gas in storage to be 4% lower in 2025 and 3% lower in 2026 compared with what we had forecast last month.

• Natural gas prices. Because we now expect more consumption of natural gas in 2025 and 2026 and less natural gas in storage, we have raised our forecast Henry Hub spot price. We expect the Henry Hub price will average around $4.20 per million British thermal units (MMBtu) in 2025, 11% more than last month’s forecast. We expect the annual average price in 2026 will be near $4.50/MMBtu, up 8% from last month.

• Electricity consumption. We expect total U.S. electricity sales will increase by 3% in 2025, led by strong growth in the residential and commercial sectors. Residential sector growth is mostly related to cold weather during January and February that increased the use of electricity for space heating. Commercial sector growth is being driven by the expansion of data centers.

• Electricity generation. With more electricity consumption in our forecast this month, we expect the U.S. electric power sector will generate 3% more electricity this year than it did in 2024, compared with forecast growth of 2% last month. We expect electricity generation will grow by another 1% next year. We expect most of the additional generation compared with last month’s forecast will be supplied by natural gas.

• Trade policy assumptions. The current landscape for U.S. trade policy continues to rapidly evolve. On February 1, President Donald J. Trump signed an Executive Order announcing the imposition of tariffs on imports from Canada, Mexico, and China. Subsequently, the implementation of tariffs for most imports from Mexico and Canada has been delayed until early April, so the effects of those potential tariffs are not reflected in this outlook. Our outlook does include a tariff on U.S. imports from China and also includes an assumption about China’s imposition in February of tariffs on U.S. energy products. The U.S. macroeconomic outlook we use in the STEO is based on S&P Global’s macroeconomic model, which this month assumed an increasing universal tariff that will reach 10% by the end of 2025 and an effective tariff rate of approximately 20% on U.S. imports from China. That model was released in mid-February and does not reflect current policy. We will continue to monitor and will update our outlooks as policies change.

Global Oil Prices And Inventories

The Brent crude oil spot price averaged $75 per barrel (b) in February, $4/b lower than in January and $8/b lower than at the same time last year. Crude oil prices fell during February driven largely by economic growth concerns related to potential tariffs by both the United States and other trade partners. On February 1, President Donald J. Trump signed an Executive Order announcing the imposition of tariffs on imports from Canada, Mexico, and China. Subsequently, the implementation of tariffs for most imports from Mexico and Canada has been delayed until early April, so the effects of those potential tariffs are not reflected in this outlook.

The evolving tariff policy has added uncertainty around expectations for global oil demand growth, concerns about which had persistently weighed on oil prices over the last year. On the supply side, any potential ceasefire in the Russia-Ukraine conflict could add Russian oil volumes back into the market. Lastly, continued supply growth from producers outside of the OPEC+ agreement, primarily in North and South America, adds additional downward pressure to our price forecast in 2026.

Although crude oil prices fell in February and were near $70/b in the first week of March, we expect key upward price pressures will push the Brent price back into the mid-$70/b range in the coming months. This month’s outlook includes the introduction of new U.S. sanctions on Iranian crude oil issued on February 24, which have the potential to remove significant volumes of crude oil from the market. Similarly, we expect the recent announcement revoking licenses for Venezuelan oil production and exports to the United States will reduce Venezuela’s oil production beginning in March, tightening near term oil market balances significantly compared with our February STEO.

Despite less production from Iran and Venezuela in this month’s forecast, we still expect OPEC production will grow over the next two years. OPEC+ reaffirmed its commitment on March 3 to proceed with “a gradual and flexible return” of the 2.2 million barrels per day (b/d) voluntary adjustments starting on April 1, 2025. This announcement included the stipulation that the production increases could be paused or reversed subject to market conditions, which leaves some uncertainty about whether increases will materialize in line with the announcement.

We anticipate global oil inventories will begin to build in the third quarter of 2025 (3Q25). In our February forecast, we had expected inventories to begin increasing in 2Q25. Our expectation that inventory draws will continue through mid-2025 is in part due to the recent announcements concerning sanctions on Iran and the revoked license for Venezuela’s production and exports to the United States.

Although we expect oil market balances to be tighter this year than we expected in the February STEO, we maintain our forecast that Brent will average about $74/b this year. With tighter forecast balances, we now expect prices to average $75/b in 3Q25, or $1/b more than our forecast last month. Higher forecast summer prices are offset by lower prices during the first half of the year, owing to market concerns over potential macroeconomic weakness and OPEC+ supply additions.

We forecast that by the end of this year rising oil supply will mean more oil is being produced globally than is being consumed, leading to inventory accumulation and downward pressure on prices through the remainder of our forecast period. As a result, we forecast the Brent crude oil price will fall to $66/b in December 2026, averaging $68/b in 2026. Our 2026 Brent price forecast is $2/b higher than we forecast last month, mostly as a result of less crude oil production from OPEC next year than we previously expected, which largely reflects our expectation of less crude oil production from Iran and Venezuela.

Significant uncertainty remains in our price forecast. The impact of existing sanctions on Russia and recently announced sanctions on Iran, as well as the revocation of licenses for Venezuela oil exports, have increased oil price volatility in recent weeks while markets and trade patterns adjust. Additionally, the extent to which OPEC+ adheres to announced production increases will be a key factor for oil prices in the coming months.

U.S. Distillate Inventories And Net Trade

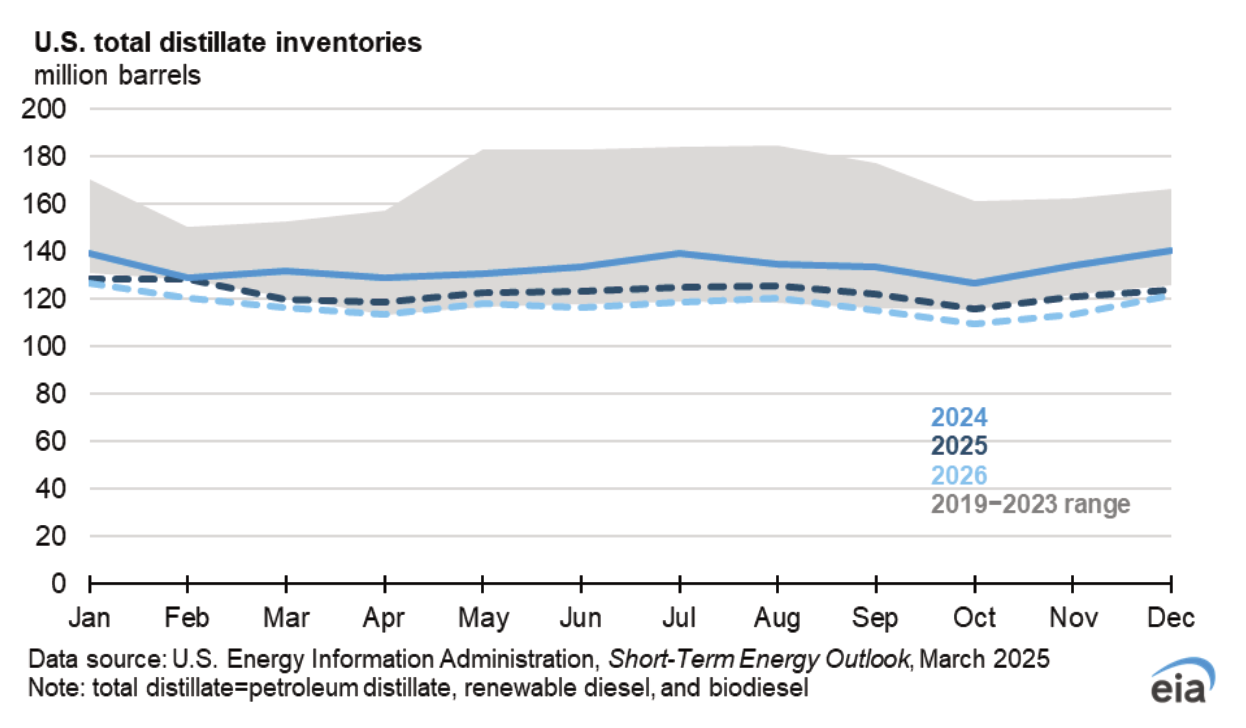

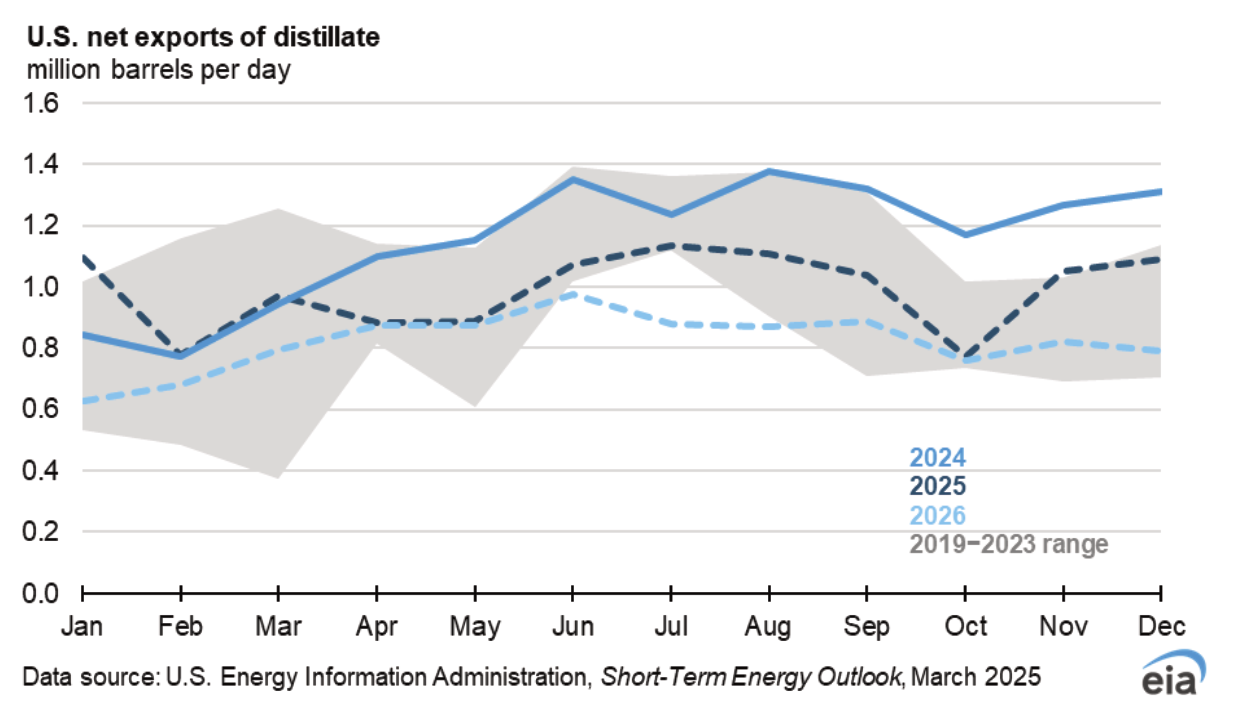

A decrease in U.S. refining capacity and an increase in U.S. distillate fuel consumption contribute to low distillate fuel inventories in our forecast. We forecast end-of-month total distillate stocks—which include petroleum-based distillate, renewable diesel, and biodiesel—will be 8% lower on average in 2025 compared with last year and will decline another 4% in 2026. Closures of two U.S. refineries in 2025 are likely to decrease the production of refined products over the next two years. At the same time, we expect U.S. distillate consumption will increase because of increasing industrial activity and growing imports of goods into the United States related to a strengthening U.S. dollar, which support demand for diesel fuel for on-highway trucking.

Declining distillate production and rising consumption make it likely suppliers will draw on distillate stocks and reduce U.S. distillate exports to balance the domestic market. If our forecast is realized, average end-of-month total distillate stocks in 2026 would be at their lowest since 2000. Lower stocks would contribute to tighter market conditions, especially during higher demand periods such as the fall harvest season and winter heating season, which could lead to higher prices for distillate. We expect refining margins for distillate fuel to rise from 52 cents per gallon (gal) last year to almost 60 cents/gal this year and nearly 80 cents/gal in 2026. However, declining crude oil prices could mitigate the effect of higher margins on retail prices. We expect retail diesel prices to average about $3.60/gal in 2025 and slightly more than $3.70/gal next year, both of which are down from 2024.

We forecast U.S. distillate net exports (exports minus imports) to decline in 2025 and 2026, mostly due to lower U.S. distillate exports. In 2024, the United States exported the most distillate fuel since 2019 because of relatively low distillate consumption in the United States and relatively strong demand overseas. We expect this trend to reverse in 2025 as increasing domestic distillate consumption and declining production pull product away from exports.