All

Loose Screw Economics

by Samuel Diamond

At the 2019 Heating & Energizing America Trade Show (HEAT Show) in Providence, Rhode Island, Northeast heating oil industry leaders laid out the case for renewable liquid heating fuels as the fastest, most economically viable pathway for the region to achieve net-zero greenhouse gas emissions by 2050. Crucial to making this case is explaining and demonstrating where the emissions reduction strategy currently favored by the utilities and many policymakers comes up short. That strategy calls for converting millions of homes across the region from oil and gas heating to electric heat pumps. This plan was unpacked, and its shortcomings exposed, at the HEAT Show during a presentation on the “Economics of Cold Weather Heat Pumps.” Presenters Richard Sweetser of the National Oilheat Research Alliance and Ray Albrecht, P.E. of the National Biodiesel Board addressed the standing-room-only crowd packed into Rhode Island Convention Center Ballroom C. This article summarizes key takeaways from the presentation, which is now available online at HEATShow.com.

A Dramatic Transfer of Wealth ... to the Rich!

Sweetser’s presentation began with a brief refresher on heat pump mechanics, efficiency and the key difference between whole-home ducted heat pumps and ductless heat pumps. While this might seem obvious to heating professionals who sell and service the devices, the same cannot necessarily be said for policymakers and consumers. Indeed, filling that gap in understanding is one thing liquid heating fuel proponents must do in order to make the case for their product (more on this to come).

Next, Sweetser pointed to a November 2017 field study from the Minnesota Department of Commerce Division of Energy Resources, which showed that electric heat pumps’ Coefficient of Performance (COP) averages 1.23 and frequently falls below 1 when outdoor temperatures dip below freezing. (For a more detailed discussion of heat pump COP as it relates to heating oil costs, see “A Follow-Up Examination” from our May 2019 issue.) Generally speaking, heat pumps’ performance and efficiency both languish under colder conditions.

However, electric heat pump technologies are improving, particularly on the compressor front. Today, Mitsubishi claims its H2i™ MXZ can operate in outdoor temperatures as low as -13 degrees Fahrenheit degrees albeit at 76% capacity — and that the device achieves 100% heating capacity at temperatures as low as 5 degrees Fahrenheit. This allows the company to market the product as a “year-round comfort” solution that works “in extreme climates without the need for energy-consuming indoor supplemental heating devices in many cases.” Such claims demand further investigation, if not from consumers than certainly from HVAC professionals.

Regardless of whether heat pumps actually perform as advertised, states and municipalities are moving forward with utility-backed efficiency programs that call for mass residential conversions. Sweetser pointed to the Draft New Jersey Energy Master Plan as “the most aggressive plan, even more aggressive than New England as far as conversions.”

Tellingly, this plan seems to miss the mark in terms of estimated heating system transition costs. For out-of-pocket expenses, it claims “the most significant expenditures will be the one-time capital cost of installing the electric heating system, which costs an average of $4,000-$7,000 for a typical residence.” This is likely to turn heads among full-service heating fuel providers who know from experience that number only begins to cover the cost of whole-home electric heating.

The basis for these cost estimates, Sweetser showed, is a study from the American Council for an Energy-Efficient Economy (ACEEE). The ACEEE study states: “These cost estimates assume that a house has adequate electric service to install a heat pump. For houses that have central air-conditioning, this will generally be the case. But for some older houses without central air-conditioning, upgrading the electric service will be needed.” Oh, you don’t say? “For cold-climate ducted heat pumps, we estimated installed costs at 30% more than a SEER 16 ducted heat pump, based on a suggestion from a major manufacturer... For ductless heat pumps, costs come from an ACEEE analysis of a Massachusetts database of installed costs for this equipment.” And here’s where it gets really interesting. “We looked at homes installing two or more multi-head heat pumps, finding an average cost of $7,065 per heat pump.” Per heat pump. “The sample size was 496 homes, nearly all of which purchased two multi-head heat pumps (just six homes installed three).” That’s two or three heat pumps at over $7,000 each, for a starting price of $14,000.

“Who can afford this ‘one-time capital cost?’” one might ask. And how did ACEEE even find the nearly 500 Massachusetts homes that had multiple heat pumps installed? Common sense might dictate that these numbers most likely represent wealthy homeowners adding a couple ductless heat pump/air-conditioning units for individual rooms of their large homes. Of course, the study doesn’t say, so again more investigation is required. If, however, this proves to be the case, and if New Jersey moves forward with a plan to incentivize such investments, then it could be argued that what the state is really doing is putting more wealth in the hands of the rich.

Indeed, many incentive programs may get their funding from utility ratepayers. That includes everyone who pays for electricity, whether they rent or own their homes. Therefore, such incentives could literally redistribute money from low-income ratepayers who are worried about keeping the lights on to wealthy homeowners who are thinking about having new heat pumps installed.

One of the professed goals of emissions reductions strategies is to achieve “climate justice” — i.e., giving back to the communities that have been disproportionately impacted by pollution — a noble cause, no doubt. However, paying rich people to put additional air conditioners into their mansions does not exactly fit the bill, to say the least.

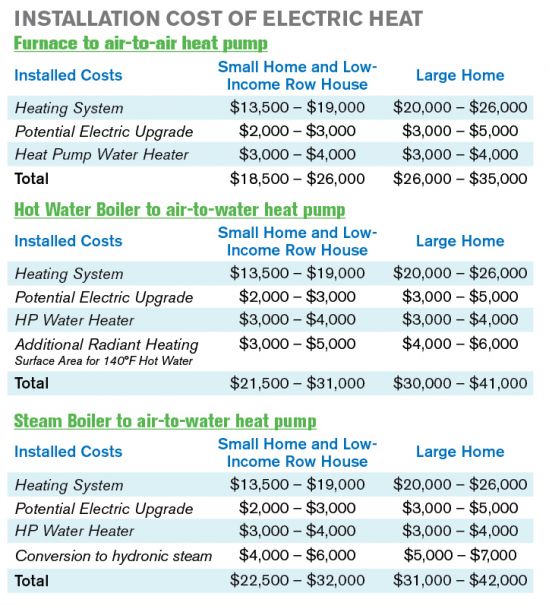

All that being said, this argument against heat pumps resonates with heating fuel professionals because they are more familiar with the transition costs than consumers are. As an unofficial basis of comparison, Sweetser pointed to several actual installation projects in which multi-split heat pumps were applied to small or large homes that previously used boilers or furnaces. The project costs are outlined in the tables on page 30.

As you can see, actual total costs have been as high as $32,000 for small homes and as high as $42,000 for large homes. In addition to the heat pump cost itself (up to $26,000 for a two-story home) and $5,000 for a potential electric upgrade, there are water-heating costs to consider. This could be as much as $4,000 for a heat pump water heater, up to $6,000 for the additional radiant heating surface (extended radiant of supplemental fan coils) needed to get 140 degrees Fahrenheit hot water at 47¼F ambient temperature, or another $7,000 for conversion to a hydronic boiler.

To make these numbers publicly defensible — to be able to counter figures such as those from the ACEEE’s Massachusetts study — heating fuel dealers need to mobilize. “Your actual case studies are critical to these efforts moving forward,” Sweetser said. He encouraged everyone present at the session to contact NORA President John Huber for case study requirements.

Closing out his argument against heat pump conversions, Sweetser ticked off several of the questions that need to be addressed when considering transitions to electric heating and related case studies. These include the following.

How much of the cost of electric conversion incentives will come from investor owned utility shareholders’ equity as opposed to investor owned utility ratepayers’ equity reflected in their monthly bills? With the increased winter demand on the system, what will the heating cost be per kilowatt hour (kWh)? What will the cost be for backup heat when it’s too cold for the heat pump to maintain the set temperature? And what will the cost be for time-of-day demand pricing? In other words, will it cost 60% more for every kWh used to heat the home, cook food, heat water, and dry clothes between 4:00-9:00 p.m., as is the case in California?

The latter question, especially, points to larger economic issues with power generation, a topic Ray Albrecht, P.E. took up during the second half of the presentation.

Power Plants & Electric Utilities Profit at the Expense of Everyone Else

Understanding power generation at the grid level, according to Albrecht, is critical to understanding how heat pumps work or don’t work from an economic and environmental perspective. As a member of the ISO New England (ISO-NE) Planning Advisory Committee, Albrecht offered insight into how the region’s electrical grid network actually operates on a daily and hourly basis as well as over the long term.

In fact, Albrecht explained, the average monthly bills and annual data that consumers and policymakers see when shown power generation costs typically mask the price spikes that accompany peak-load scenarios. Hence, hourly analysis is needed in order to see what’s really happening “behind the scenes.”

Most people already realize that grid loads increase significantly during cold winter weather. What they don’t necessarily know is that generation efficiency plummets when grid loads change rapidly (due to start-up fuel consumption), and that increases in grid load have a huge impact grid-wide on energy consumption and costs for power generation.

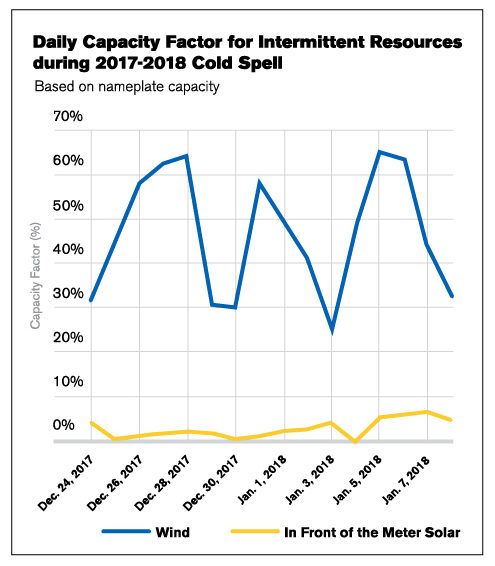

Natural gas is the dominant energy source for power generation in New England, with over 16,000 megawatts (MW) capacity as of winter 2018. This represents about 49.5% of the region’s power generation capacity. Oil-fired generation has substantial capacity as well, but is only used during severe grid peaks. Among renewable energy sources used for power generation, solar and wind are growing steadily but continue to be available only with intermittent output. There is significant variability in wind power output because it drops significantly under reduced wind speed, and wind power systems also shut down during high wind conditions. Likewise, solar output is lost whenever the sun is blocked by clouds or snow.

As fuel marketers are well aware, natural gas availability in the Northeast during cold weather is limited due to pipeline constraints. Power plants are required to purchase natural gas from spot markets so as to avoid direct competition with residential and commercial buyers. These spot market prices start to climb — often drastically so — once the outdoor temperature falls to 30 degrees Fahrenheit. Not surprisingly, there is great correlation between fuel costs and wholesale power costs. As fuel costs represent about 80% of power generation costs, the price of electricity jumps whenever natural gas prices spike or supply shortages occur.

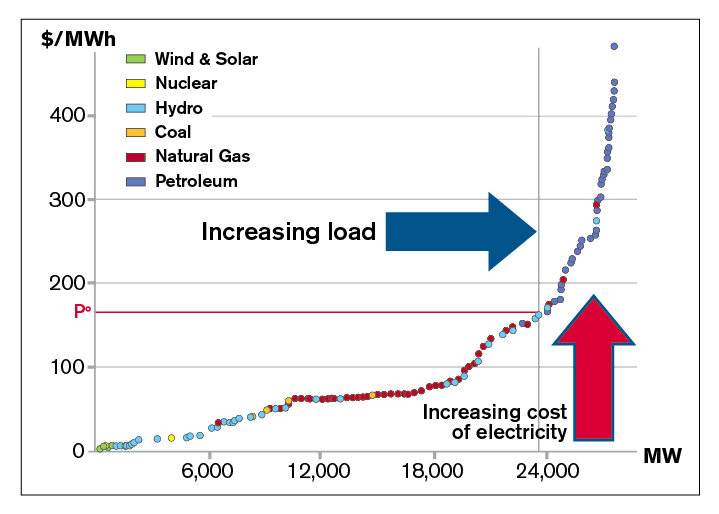

At a more macro level, ISO-NE and other independent system operators hold auctions at hourly and five-minute intervals to determine power generation costs. In effect, whoever is the highest bidder sets the price for everyone else. So, when heat pump loads push up grid loads and costs, power plants win big while all ratepayers end up paying more, which is reflected in the “energy supply” component of a consumer’s electricity bill.

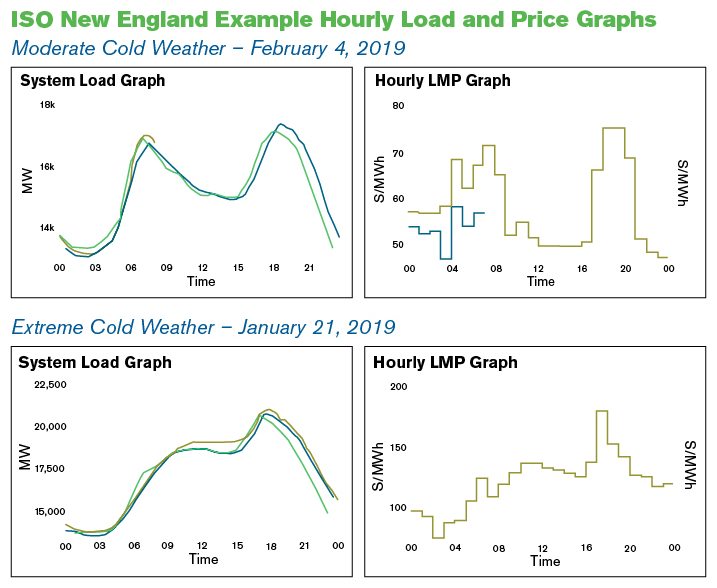

During moderate cold weather conditions, such as on February 4, 2019, the grid peaked at just under 18,000 MW, at which point peak prices jumped up to just under $80 per megawatt hour (MWh). These existing peak loads are already the result of electric heating and can range from 15,000-20,000 MW during the winter, Albrecht explained. “Adding more heat pumps will just make things worse.” This is even clearer during extreme winter conditions.

During extreme cold weather, such as on January 21, 2019, peak evening loads climbed to over 20,000 MW, causing prices to jump to almost $200/MWh. Again, homes, businesses and industry all shoulder the cost even though peak power prices remain somewhat hidden from customers. A cumulative sum of wholesale prices determines the average supply charges that appear on customers’ electricity bills.

Likewise, when calculating heat pump operating costs, most utilities and state agencies use average annual prices for electricity, thereby concealing winter price spikes. Nevertheless, winter prices for wholesale power will continue to rise with added thermal loads from additional heat pumps — prices that will be paid by everyone.

For an estimate of just how much prices could increase, consider that a single 48,000 Btu/hour cold-climate heat pump adds about 6 kW to the peak grid load. One million of these heat pumps would add 6,000 MW to grid load, increasing winter peak loads from 21,000 MW to 27,000 MW.

The Northeast Energy Efficiency Partnership (NEEP) and some partner states such as Connecticut have promoted the goal of using heat pumps to replace 89% of oil-fired heating systems and 63% of natural gas-fired systems. This would result in about 25,000 MW of grid load growth, many times greater than even the most optimistic growth forecasts for solar PV and wind power, and would push the New England grid into completely uncharted territory.

As a result, wholesale power supply costs could double from $100/MWh to $200/MWh. The resulting retail electricity cost, including delivery charge, could climb above $.30/kWh for all residential, commercial and industrial ratepayers. Any supposed cost savings resulting from heat pumps would disappear completely, and the devices might very well end up costing more to run than conventional fuel-fired heating systems, as again, the increased cost of electricity would impact all customers. Also worth reiterating: the added costs paid for wholesale power would end up going to the power plants as a windfall.

The Environmental Perspective

If all the above sounds like a lot to digest, well, it is. And we haven’t even begun to discuss emissions related to heat pumps, renewable liquid heating fuels, and the various different sources of power generation.

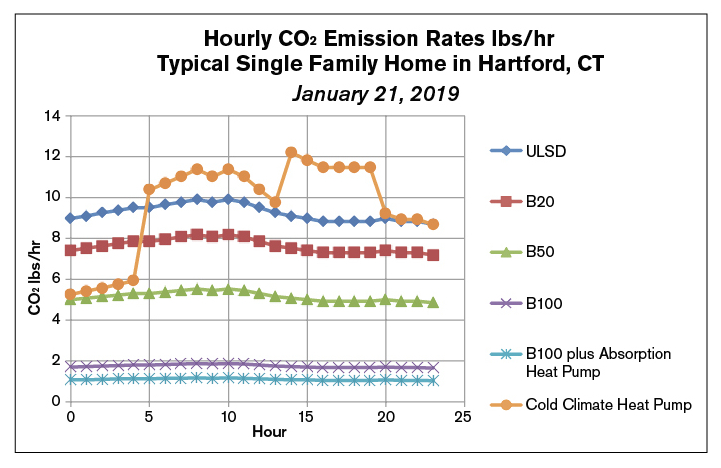

There are huge quantities of data available on average emission rates, but very little data when it comes to the hourly marginal emission rate (MER). However, it’s this data that's most illuminating, Albrecht argued, as the often-unseen hourly MER accounts for those extreme winter conditions when power generation energy sources and costs shift dramatically. Whereas the average marginal CO2 emissions per MWh for the year hides emissions spikes, a look at hourly marginal CO2 emissions per MWh reveals “trouble spots” during cold weather as well as morning and evening peak conditions.

According to an evaluation of representative single-family homes in downstate New York, on a moderate winter day heat pumps have approximately the same carbon intensity as B50 heating oil blends and higher carbon intensity than B100. However, on a cold winter day, heat pumps have higher carbon intensity than B100 and B50 during off-peak periods, and higher even than that of unblended ULSD during peak periods. Move to a colder city like Hartford, CT, and heat pumps' carbon intensity looks even worse. There, on a cold winter day, heat pumps have a higher carbon intensity than ULSD for virtually all of the 24-hour period except during overnight hours.

Again, it’s a lot to process. But behind these figures is the fact that renewable liquid heating fuels provide the most cost-effective path to significant emissions reductions. Making all of this clearer to policymakers and consumers alike will be key to capturing new market opportunities in the years to come.

Related Posts

From Blue Flame to Biofuels

From Blue Flame to Biofuels

Posted on June 25, 2025

HEAT Show Announces Fenway Park Backyard BBQ

HEAT Show Announces Fenway Park Backyard BBQ

Posted on May 15, 2025

Delivering New York City’s Clean Energy Solutions

Delivering New York City’s Clean Energy Solutions

Posted on May 14, 2025

Are You a Leader or a Boss? The Choice is Yours

Are You a Leader or a Boss? The Choice is Yours

Posted on May 14, 2025

Enter your email to receive important news and article updates.