It’s that time of year again. Energy marketers are getting prepped to launch offers to their customers for their pricing programs in the 2024-2025 heating season. There are basically two models used in the industry for delivering the proposals to the consumer. One allows for the customer to jump online whenever they’re ready to order. This typically runs on a 24/7 clock all year round. A portal is provided for the customer to order. The other is determined by the marketer and is typically timed to coincide with when their budgets are set. This model can either require the customer to fill out a contract that commits them for the year, or they are auto enrolled and would need to notify the marketer if they do NOT wish to participate, or opt out. I’ve always preferred the opt-out method, though our client base seems to be split evenly between each of these methods. The opt-out not only gives the marketer much more control over the outcome or participation rate, but I’ve seen considerable evidence that the consumer prefers the marketer to make this decision for them.

Every marketer has their preference and likely has a better feel for what works best for their customer base. I wish to simply review best practices for getting the program hedged properly at launch; particularly for those that need to have the sales volumes hedged ahead of the offer. The best strategy for scaling in is heavily debated. Dan Lothrop, the head trader at Northland Energy Trading, Hedge Solutions’ sister company, recently wrote a great article in this magazine two issues back that focuses on this exact question. Dan was working on his PhD 10 years ago when we hired him. He’s a pretty good analyst by all measures, and he has back-tested pretty much every methodology for “scaling” in or cost averaging that one can think of. Ratable hedging, ramp up hedging, ramp down hedging, hedging at the launch. The result is that none of the methods stands out as the obvious best practice, if you will. The ramp up method has proven to stand the test of time when looking for a process that will result in a COGS that is competitive. For this reason, we have typically advised our clients to adopt a slow ramp up to the launch because it has held up the best against all the other processes.

Regardless of the methodology one chooses to adopt, it is important to map out the game plan in detail. This can be done on the back of a paper napkin, as I always say (not preferable), or in a spreadsheet. We use a program called Lodestar. Lodestar deploys the D.E.D. rule: Develop a plan-Execute the plan-stay Disciplined to the plan. It’s that simple. However, it does call for some detail. To create your game plan, you need to decide on the following details:

Time period for scaling in:

How many weeks before the offer launch will you start scaling in? And how many times per week will you scale in? This will determine your total “buys” or hedges. For example, if you are going to scale in 8 weeks ahead of time and plan on adding hedges twice per week, this will give you 16 buys to cost average.

Volume per period:

How much volume per hedge will you be covering? If you need to hedge 500,000 gallons total, you’ll want to decide how you will apply this volume over the 16 buys. As an example, if you are going with a ratable buy strategy, this would have you buying 31,250 gallons per hedging period. If ramping up, you would want to plan out just how that looks for each buy. We like to apply a percentage of volume as we ramp up.

Breakdown the hedging strategy:

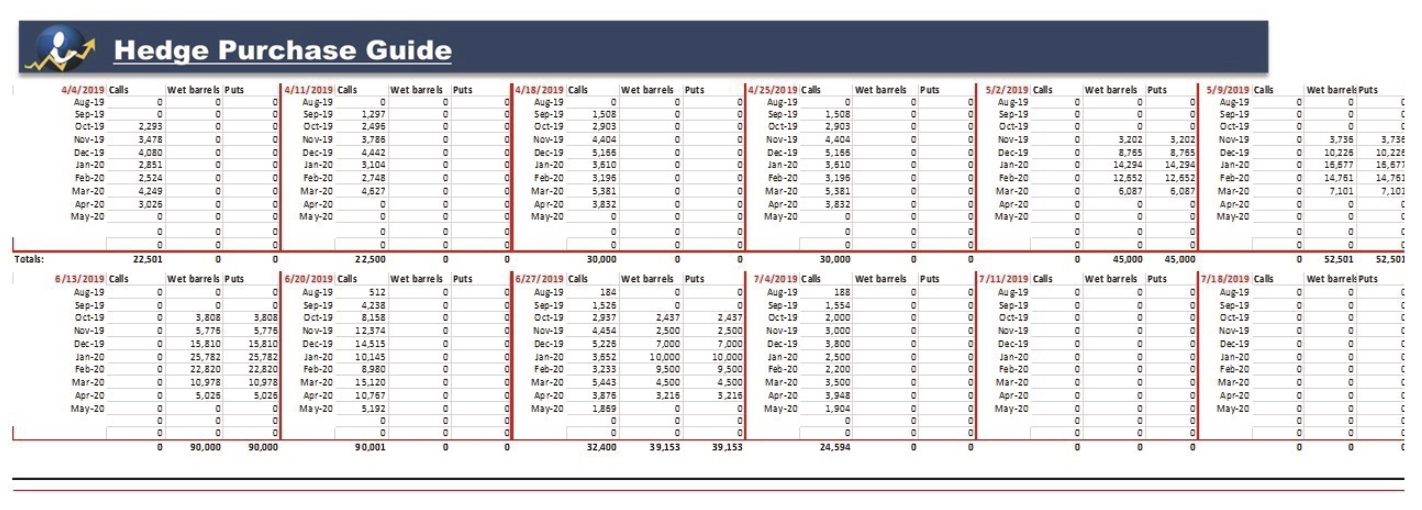

Exactly how are you going to hedge your program volume? Assuming it’s a cap, you’ll want to break down how much of the volumes will be hedged with calls versus wet barrels and put options. This should be broken down monthly. A study of your local rack basis will help you determine how much call volume and wet barrels with puts you want in each.

Included in this article is a view of Lodestar. Note in illustration #1 the breakdown for each month between call options, wet barrels, and put options. The accompanying charts show the breakdown in an easy visual while also mapping out the scale in strategy (upper left). In illustration #2 you can see how the weekly buy-in periods are broken down. Again, by having an actual “purchasing guide” with the strategy laid out it will engender that discipline you want. This will help you avoid trying to predict price direction. You can do something similar in a spreadsheet. The point is to organize your strategy ahead of time and stick with it.

Rich Larkin is President of risk management consultancy Hedge Solutions. He can be reached at rlarkin@hedgesolutions.com or 800-709-2949. www.hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.