All

It’s Hedging Season

by Anja Ristanovic, Hedge Solutions, Inc.

Setting your company up for price certainty in a volatile market

Hedging is a risk management strategy used by players in financial markets to protect themselves against adverse movements in prices. It includes taking positions in futures contracts, options, swaps, and other financial instruments to offset the risk of price volatility. Heating oil companies can use call options or a put option plus a wet barrel strategy to hedge their cap programs, while swaps or synthetic futures (buying a call option while simultaneously selling a put option) are used to lock in prices for a fixed program. Let’s look at a few benefits of hedging and key factors to look for this hedging season that could impact price movements in the oil market.

One of the key benefits of hedging is that it can provide price certainty. By taking a position in the futures or options market, we can lock in a price for a product at a future date. By hedging, companies protect themselves against price volatility in the energy markets, reducing the risk of sudden increases in prices.

Additionally, by locking in a price in advance, companies can manage their risk exposure in case of supply disruptions, geopolitical events, or changes in demand, and ensure that they have a steady supply of fuel to meet their customers’ needs. For example, purchasing a wet barrel at a locked price in advance would put you ahead of rack customers “in line” at the terminal, should there be supply shortages.

Furthermore, by hedging their position, companies can plan their budgets more effectively. By knowing their fuel cost in advance, heating oil business owners or managers can allocate resources more efficiently and make better-informed business decisions. Now let’s break down some key factors that could impact oil prices this hedging season.

Supply and Demand

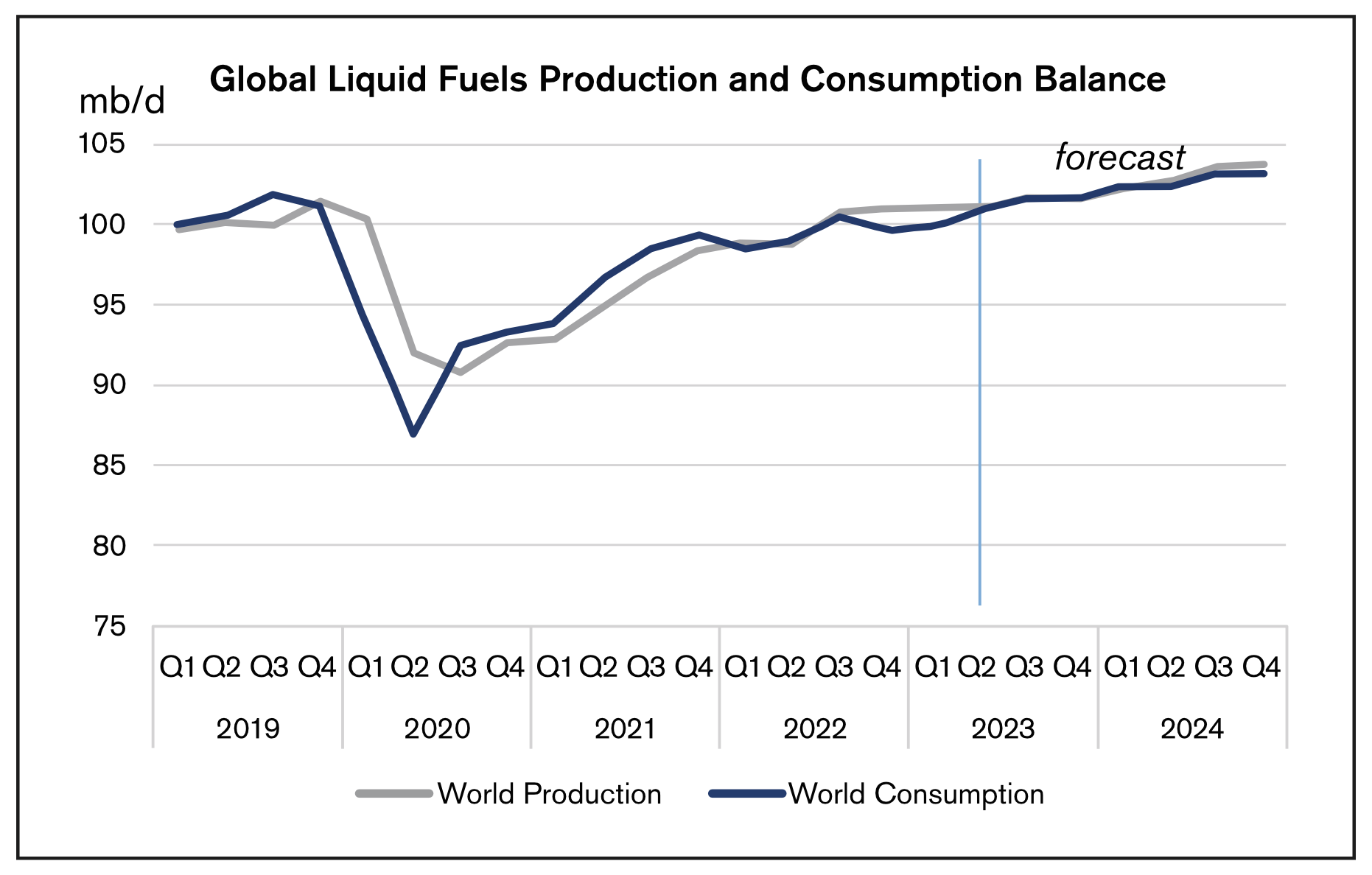

Changes in supply and demand could lead to significant price fluctuations. For example, if there is a sudden increase in supply, prices would fall, while an increase in demand would cause prices to go up. In the May edition of its Short-Term Energy Outlook, the Energy Information Administration (EIA) said it sees global liquid fuels production rising by 1.5 million barrels per day (mb/d) to average 101.34 mb/d in 2023 compared with last year, due mainly to growth in production in non-OPEC countries. OPEC crude oil output is expected to fall by 0.3 mb/d in 2023 due to a surprise OPEC+ announcement to cut production which took effect in May. Additionally, Russian production of crude oil and other liquid fuels is expected to decline by 0.3 mb/d as well, as the result of announced production cuts of 0.5 mb/d through the end of the year and maintenance at refineries in Russia through June. On the other end of the equation, global oil demand is expected to increase by 1.6 mb/d to 100.99 mb/d in 2023 compared to last year, according to the EIA. Consumption is seen rising by another 1.7 mb/d in 2024, which is expected to bring the global oil market back into balance near the end of the 2023 and beginning of 2024, which could cause crude oil prices to rise.

Geopolitical Events

Geopolitical events can have a significant impact on oil prices. Conflicts, sanctions, or political instability can disrupt supply chains and lead to price volatility. Last year’s serious disruptions of Russian supply, following its invasion of Ukraine and sanctions in response, caused spikes in crude oil and petroleum product prices. The ongoing war could continue to impact global oil markets. Additionally, COVID-19 lockdowns in China led to a drop in demand for petroleum products, and the recent reopening of the Chinese economy is expected to reverse that loss. Moreover, a global economic slowdown is expected to impact economies around the world, although there are still mixed views on whether global economies will experience a full recession.

Weather Patterns

Extreme weather events such as hurricanes, floods, and snowstorms can disrupt supply chains and cause price volatility. As of this writing in early May, the National Oceanic Atmospheric Association (NOAA) has yet to release its prediction for the 2023 hurricane season, but the Weather Company forecasts 15 named storms, out of which seven will become hurricanes and three of which will reach Category 3 status. This matches the 30-year average for hurricanes and is just above the average of 14 total named storms per year.

Weather during the heating season can impact the demand for heating fuels (heating oil and propane) and therefore cause changes in prices. Heating degree days (HDDs), based on outside air temperatures, are a useful indicator of energy demand requirements to heat a building. The 2022-2023 winter was relatively warm with New England seeing 325 fewer HDDs than last year and 887 less than normal as of May 6. The Mid-Atlantic saw 197 fewer HDDs year-over-year and 817 below normal. During the October 2022 through March 2023 period, New England saw a total of 4696 HDDs and the Mid-Atlantic saw 4420 HDDs. The 2023-2024 winter is expected to be slightly colder, as the EIA forecast calls for an increase to 5,043 HDDs in New England for the 2023-2024 winter and 4,643 HDDs in Mid-Atlantic.

Hedging can provide significant benefits including price stability, risk management, budget planning, and increased profitability. By carefully selecting hedging strategies, heating oil companies can effectively manage their risk exposure and operate more efficiently in the energy market.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.