All

Is It Déjà Vu All Over Again?

by Richard M. Larkin, Hedge Solutions

Echoes of last year in backwardated markets and rising prices.

Though we are a year and a half removed from the oil price shock precipitated by the Russia invasion of Ukraine, the residual fallout is still working its way through the oil markets. Russia is still selling oil, albeit at discounts to the rest of the sellers and to different customers. Though we should be impressed at the speed at which the European markets have adapted to the sudden withdrawal from its addiction to Russian oil, the U.S. markets are still adjusting to the vacuum created.

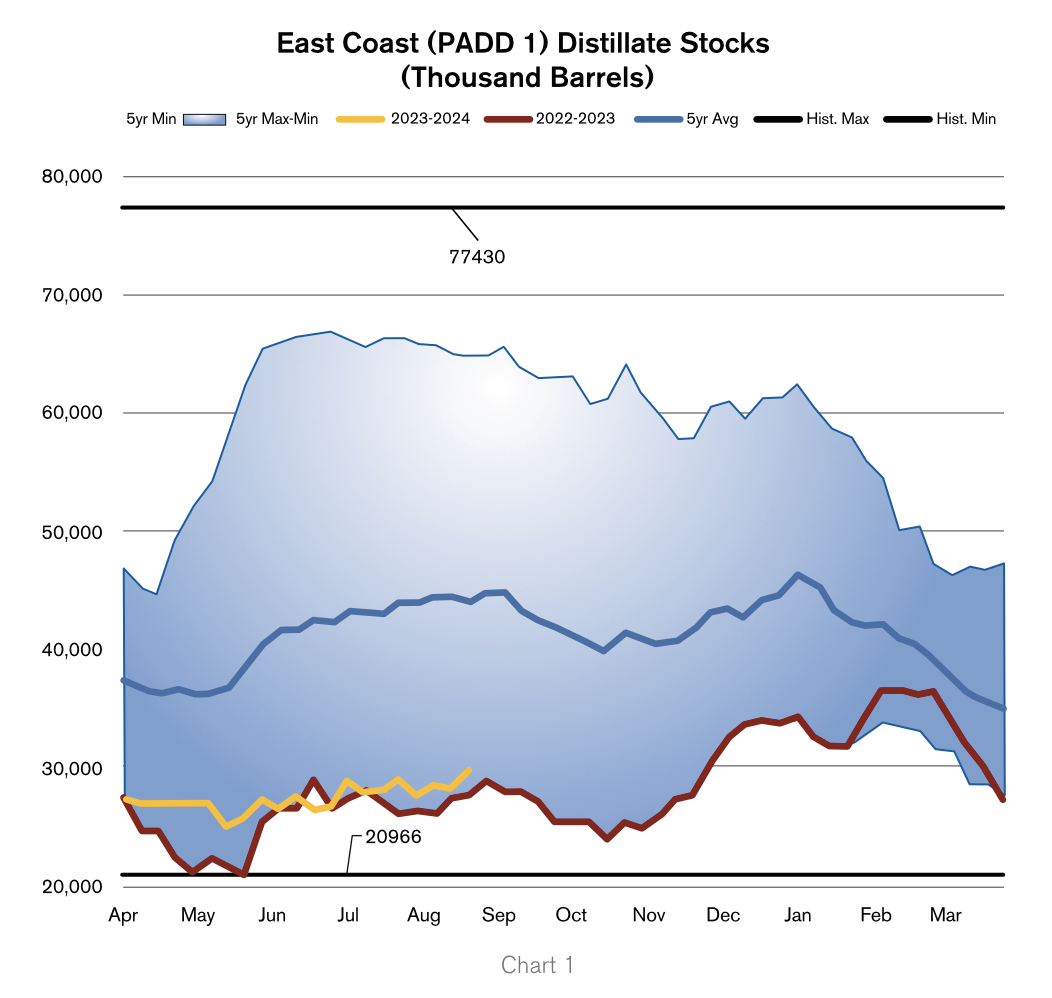

Interestingly, as we review where we are heading into the heating season, it feels a little bit like the infamous movie “Groundhog Day.” Unfortunately, a lot of the data as well as the potential issues in front of us are a mirror image of last year. Let’s start with the fundamentals. PADD 1 (East Coast) inventories are almost exactly where we were this time last year (chart 1). In spite of the backwardation briefly exiting the forward curve last spring, refiners and suppliers were still not able to raise stock levels ahead of the season. The cause of this is still being debated by analysts with different opinions, typical in the world of commodities. We know that the diesel in Europe was fetching a premium most of the summer, attracting Gulf Coast shipments to markets like Rotterdam. Jet fuel demand spiked mostly from international travel as pent-up demand from patrons resuscitated foreign travel.

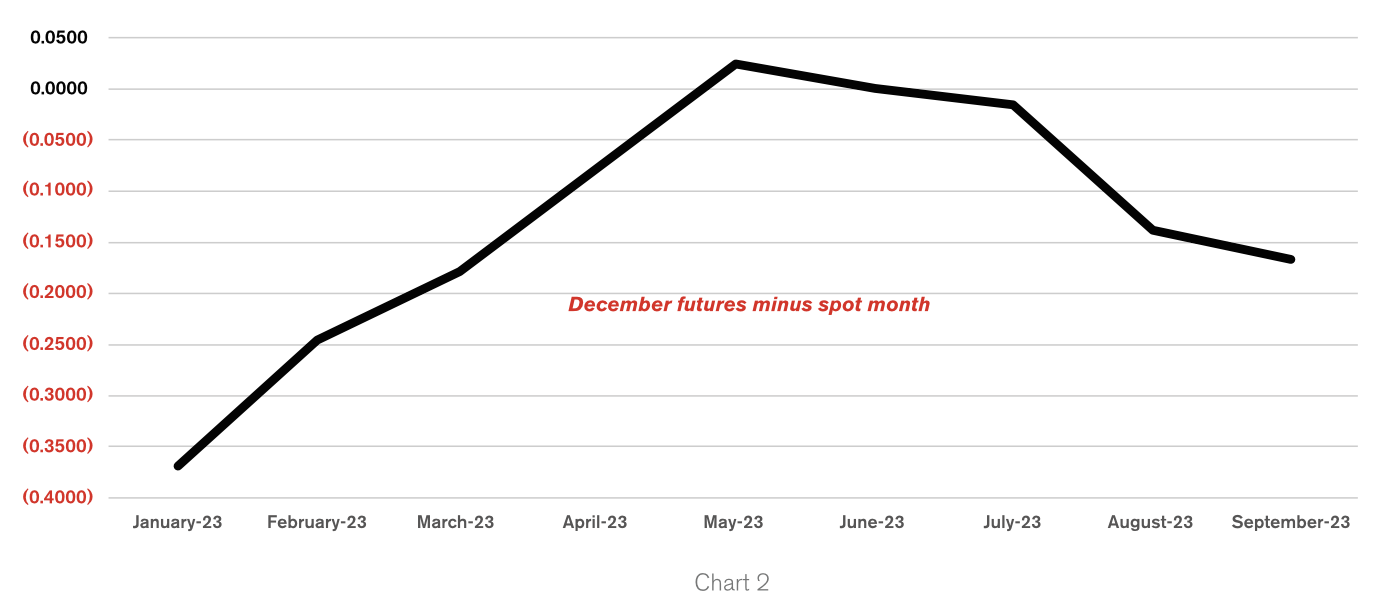

Meanwhile, the first half of the year saw hedge fund managers getting bearish on ULSD fundamentals. Economic models looked bleak as predictions for a recession in the U.S. and Europe grew louder. The considerable selling of ULSD futures emerged from a warmer than normal heating season, wiping out a year’s worth of backwardation in less than 3 months (chart 2). Additionally, for energy marketers anyway, the dip in the oil price and the significantly lower price down the forward curve contrasted with last year’s price spike this spring, helping sales of the 2023-2024 cap and prebuy programs. Unfortunately, the relief was short lived. Traders woke up at the end of June and discovered that distillate inventories both in the U.S. and globally were once again taking on an anemic posture. Oil prices rallied eighty cents per gallon over the next several weeks and the market returned to its backwardated structure as indicated in the chart.

Meanwhile, the first half of the year saw hedge fund managers getting bearish on ULSD fundamentals. Economic models looked bleak as predictions for a recession in the U.S. and Europe grew louder. The considerable selling of ULSD futures emerged from a warmer than normal heating season, wiping out a year’s worth of backwardation in less than 3 months (chart 2). Additionally, for energy marketers anyway, the dip in the oil price and the significantly lower price down the forward curve contrasted with last year’s price spike this spring, helping sales of the 2023-2024 cap and prebuy programs. Unfortunately, the relief was short lived. Traders woke up at the end of June and discovered that distillate inventories both in the U.S. and globally were once again taking on an anemic posture. Oil prices rallied eighty cents per gallon over the next several weeks and the market returned to its backwardated structure as indicated in the chart.

So where are we exactly as we head into the 2023-24 heating season? Hedge Solutions ran our models at the beginning of September to review the distillate supply status. As mentioned, the backwardation in the futures market makes it difficult to build inventories and that is currently evident in the statistics below. I have provided several charts to help visualize the East Coast state of inventories.

So where are we exactly as we head into the 2023-24 heating season? Hedge Solutions ran our models at the beginning of September to review the distillate supply status. As mentioned, the backwardation in the futures market makes it difficult to build inventories and that is currently evident in the statistics below. I have provided several charts to help visualize the East Coast state of inventories.

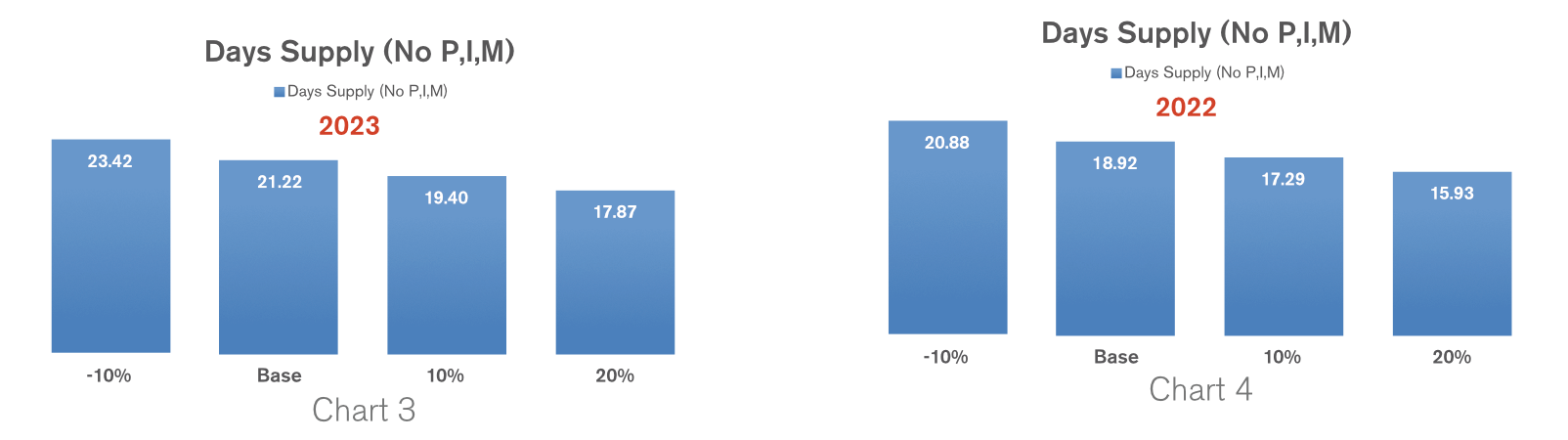

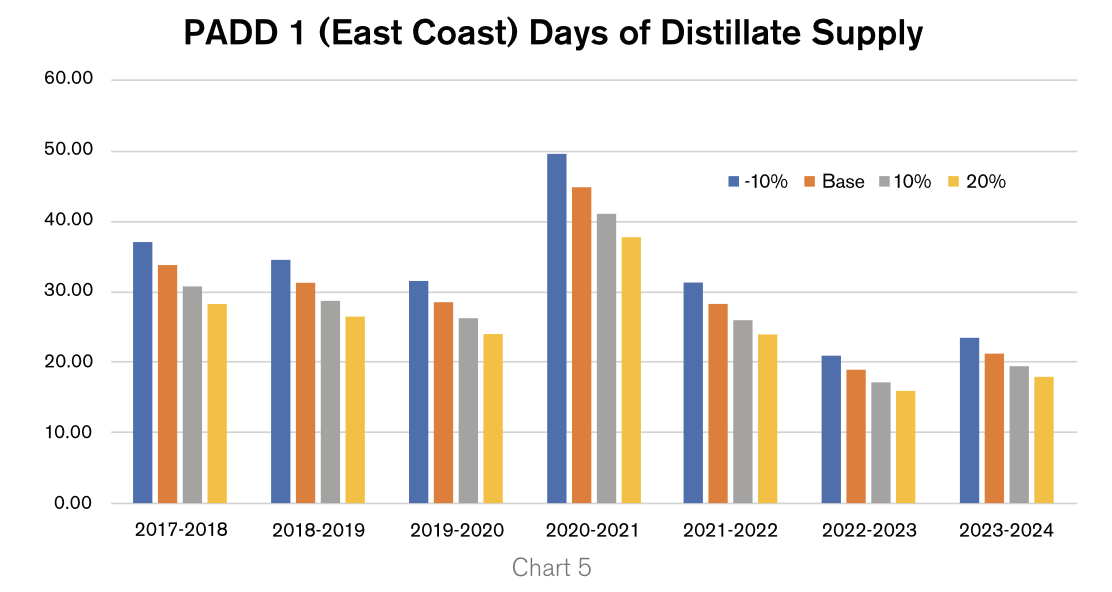

Charts 3 and 4 display the number of days’ supply we had on hand at the beginning of the 2023 and 2022 prospective seasons. As you can see, there is a slight improvement this time around. The base scenario in this year’s model shows approximately a 21-day supply on hand vs last year’s model at approximately 19 days’ supply. The models also stress a 10 percent warmer than normal, 10 percent colder than normal and a 20 percent colder than normal winter. Finally, chart 5 gives a view of the past 7 years’ models.

Rich Larkin is President of risk management consultancy Hedge Solutions. He can be reached at rlarkin@hedgesolutions.com or 800-709-2949. www.hedgesolutions.com

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

Related Posts

2025 Hedging Survey

2025 Hedging Survey

Posted on April 29, 2025

Trump Policies and Energy Markets

Trump Policies and Energy Markets

Posted on April 28, 2025

Hedging Strategies for Next Winter

Hedging Strategies for Next Winter

Posted on March 10, 2025

A Volatile Start to the 2024-2025 Heating Season

A Volatile Start to the 2024-2025 Heating Season

Posted on December 9, 2024

Enter your email to receive important news and article updates.