The country’s oil output has risen every month since November 2020

The glut in oil stockpiles, which developed as the coronavirus pandemic struck last year, has largely been alleviated. Commercial crude oil inventories among the OECD countries fell below their five-year average in March of this year and were both below said average and about flat to 2019 levels as of June 2021. The group of OPEC and its Russian-led allies, known as OPEC+, cut output in order to eliminate this stock overhang (and therefore support prices, although they have been careful lately not to state this as a goal). As demand recovers, the group is further easing cuts.

The OPEC+ production ceiling is set to increase by 0.4 million barrels per day (mb/d) each month through December, with increases having begun in August. Additionally, baseline production levels are being raised by 1.63mb/d beginning in May of next year, as part of a compromise with the United Arab Emirates after talks broke down in July. There are three sources of uncertainty that OPEC+ will have to keep an eye on: U.S. shale production, the spread of the Delta variant of the coronavirus and its threat to oil demand, and the Iran nuclear agreement.

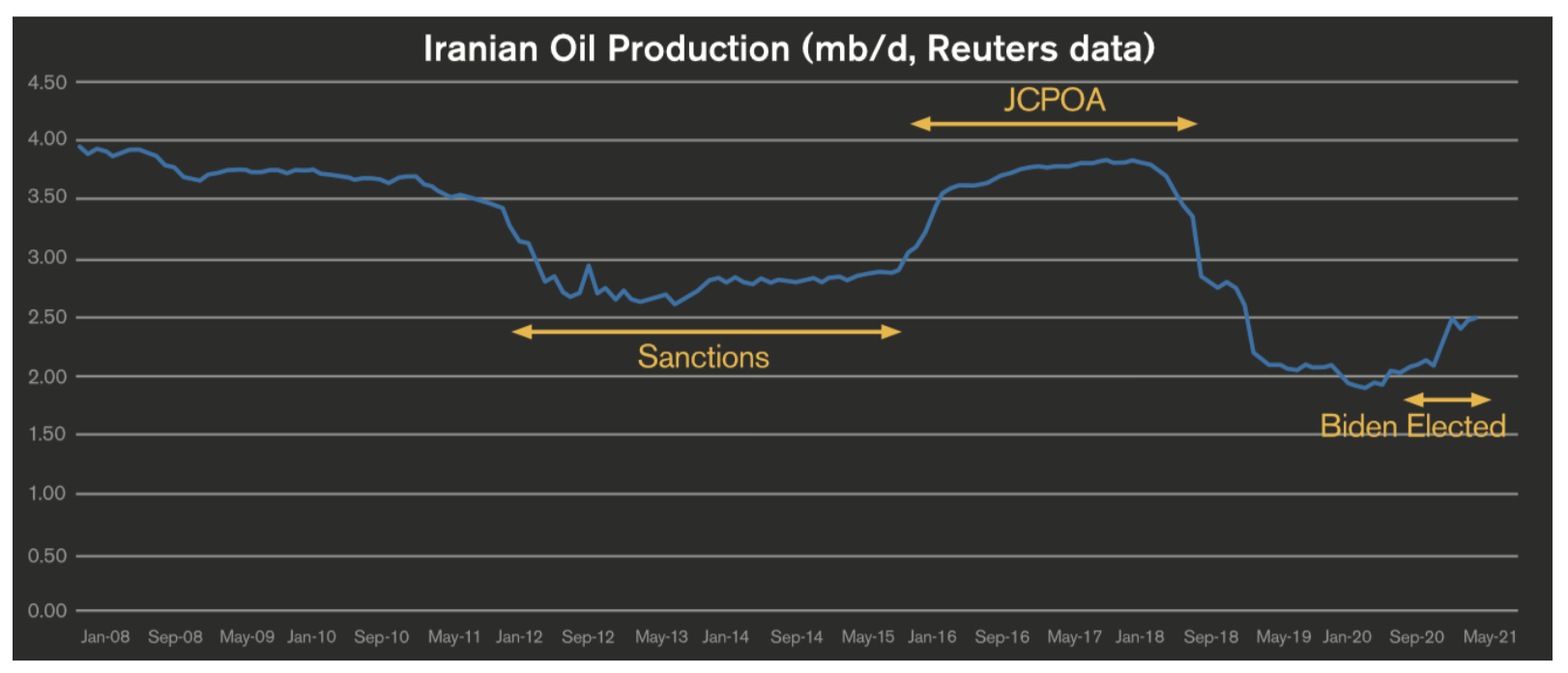

Iran, the five permanent members of the UN Security Council (China, France, Russia, the U.K., and the U.S.), and Germany signed the Joint Comprehensive Plan of Action (JCPOA) back in 2015. In exchange for International Atomic Energy Agency (IAEA) monitoring of Iran’s nuclear program and restrictions on its nuclear activities — including sharp reductions in uranium stockpiles, the number of active centrifuges, and enrichment levels — Iran received relief from U.S., EU, and UN Security Council sanctions related to its nuclear activities.

Iranian crude oil production jumped from lows of about 2.63mb/d in the summer of 2013 to nearly 3.8mb/d in the first months of 2017. Production hovered around these levels until the summer of 2018, as then-President Trump announced the U.S. withdrawal from the JCPOA on May 8. Amid tough sanctions, Iranian oil production fell well below levels from the previous round of sanctions (2012-2016). Output stabilized at about 2.1mb/d by the fall of 2019 and in early 2020 before taking yet another hit as the COVID-19 pandemic struck, sending production down to a low of just 1.93mb/d by July.

Iranian oil sector prospects appeared to improve with the inauguration of President Biden, with many expecting that parties would return to the negotiation table. In fact, Iranian oil production began creeping higher as early as November of 2020 – up by 42,000 barrels per day (kb/d) that month according to secondary sources as reported in the Monthly Oil Market Report from OPEC. Output has risen every consecutive month to date as of this writing in early September, by an average of 60kb/d from November 2020 through July 2021. July output was 2.49mb/d, a 0.56mb/d or 29% increase from the July 2020 low.

How much higher could Iranian production rise? The previous peak was 3.8mb/d in March of 2018 – meaning Iran could still add another 1.3mb/d on the global market. To put this in perspective, that is near levels produced by OPEC member countries Libya and Nigeria. It would take time for this production to return, however, as Iran would first need to clear out floating and onshore storage – as it did when the JCPOA was first signed.

Recent events have clouded the outlook for a nuclear agreement with Iran. Six rounds of indirect talks were held this year in Vienna, and it appeared that some progress was being made. However, the IAEA monitoring agreement with Iran expired at the end of June, and talks were stalled surrounding the Iranian presidential elections. Conservative cleric Ebrahim Raisi was elected and took his oath on August 5. On the one hand, he has vowed to bring an end to “tyrannical” U.S. sanctions against Iran, but on the other, tensions flared this summer with attacks on ships (the Mercer Street and the Asphalt Princess in August) and a proxy battle with Iran-backed Hezbollah forces in Lebanon trading strikes with Israel. Meanwhile, Iran has continued to breach limits on its nuclear program set under the JCPOA.

An eventual agreement is likely at least partially priced into oil futures prices, so a definitive end to discussions would be a bullish surprise. If an agreement is reached, on the other hand, the bearish impact will likely depend upon the degree to which it has been priced in, and also on the reaction from OPEC+ as they will have to contend with rising Iranian oil production while they attempt to continue influencing the global oil market.

Dan Lothrop is Head Trader at over-the-counter derivatives company Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.