Proactive measures are essential

In the midst of another hurricane season, the Gulf Coast braces itself for potential disruptions that could impact vital energy infrastructure, thereby triggering significant fluctuations in energy prices. The region is pivotal for crude oil production and refining, accounting for approximately 15 percent of total U.S. crude oil production and more than 47 percent refining capacity. Additionally, the Gulf Coast is home to 51 percent of total U.S. natural gas processing plant capacity. Hurricanes, especially those classified as Category 3 or higher, pose significant risks of causing substantial disturbances in operations.

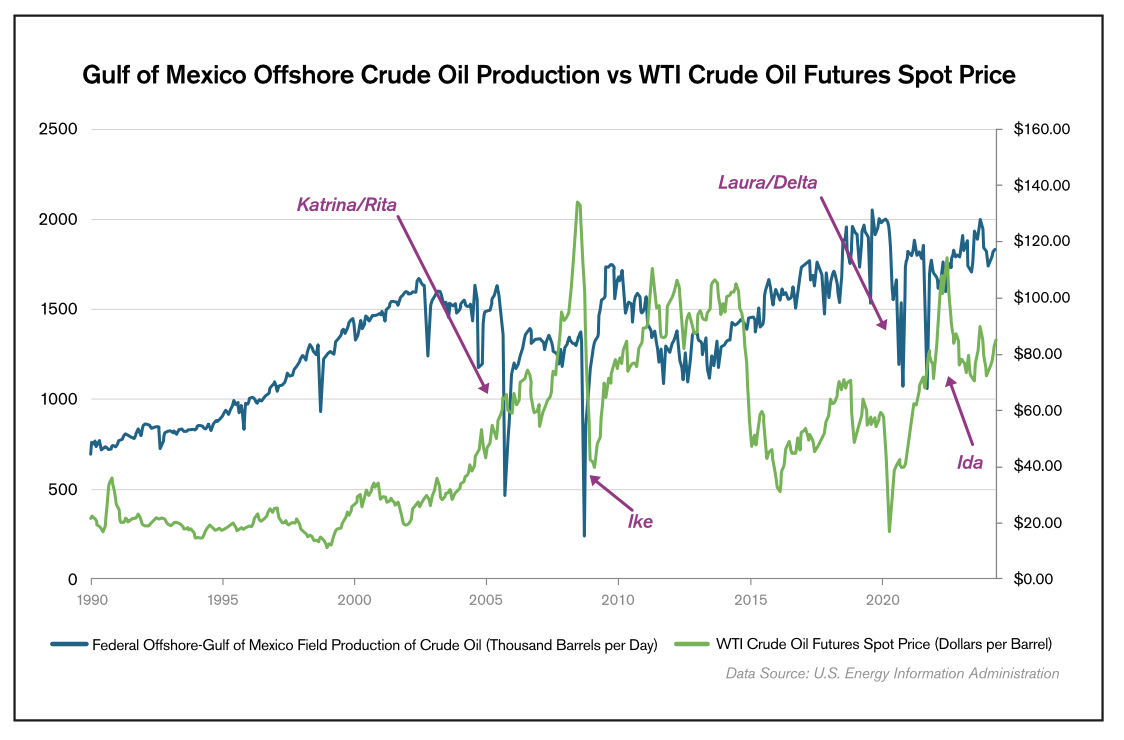

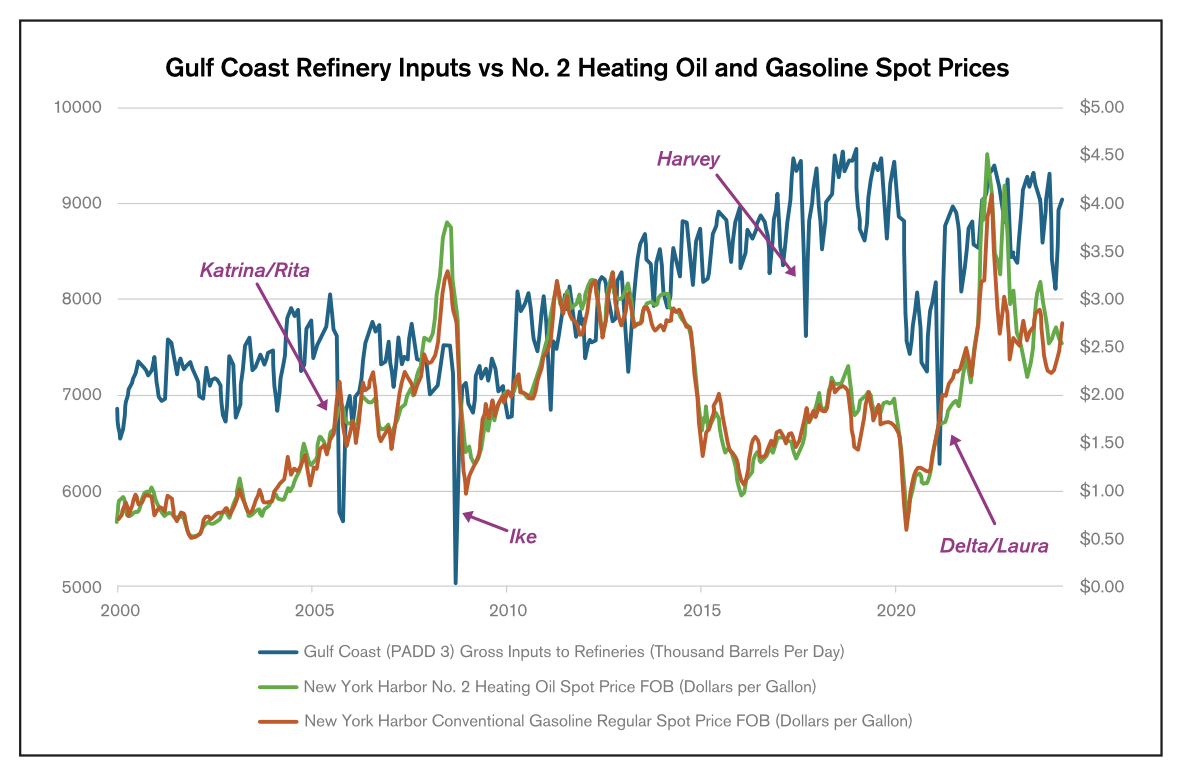

Past events, such as Hurricanes Katrina and Harvey, have vividly demonstrated the potential for these natural disasters to halt production and temporarily shut down refineries, as well as disrupt distribution networks. Historically, these storms have caused immediate effects on energy markets, influencing both prices and supply dynamics. The 2024 hurricane season started off with Tropical Storm Alberto in mid-June and Hurricane Beryl in early July, which reached Category 5 strength on the Saffir-Simpson wind scale. Both storms made an impact on the Gulf of Mexico, and Beryl made landfall in Texas, leading to some production shutdowns in the region.

Following the busy start to this year’s Atlantic hurricane season, Colorado State University (CSU) updated its outlook and increased the number of named storms it expects. In the outlook released on July 9, 2024, CSU forecasted 25 named storms this season, with 12 expected to become hurricanes and 6 reaching Category 3 status or higher. The National Oceanic and Atmospheric Administration (NOAA) predicts 17-to-25 named storms this season. Of those, 8-to-13 are expected to become hurricanes, which include 4-to-7 that are forecasted to become major hurricanes. Both forecasts indicate above-normal activity in the Atlantic compared to the 30-year average (1991-2020) of 14 named storms, 7 hurricanes, and 3 major hurricanes.

In recent years, there has been a noticeable change in how the industry prepares for and responds to hurricanes. Refineries and offshore platforms have invested heavily in infrastructure, constructing stronger facilities, implementing better evacuation strategies, and improving communication and coordination with government entities. The economic cost of extended shutdowns due to hurricanes far outweighed the initial investment in precautionary measures, leading to increased investment in infrastructure and therefore reducing the risk of drastic damage and impacts on energy markets.

However, despite all these preparations, the potential for a major hurricane remains a significant concern every season. A Category 3 or higher hurricane could still force the shutdown of oil production and/or refineries on the Gulf Coast, which could lead to supply disruptions. Even a temporary halt in production can cause immediate price increases of crude oil and/or refined products. Crude oil production impacts would tend to increase the price of crude oil and potentially cause crack spreads to narrow (price difference between crude oil and products), whereas refining shutdowns typically result in wider crack spreads. In 2005, Hurricanes Katrina and Rita caused 5.6 million barrels per day (mb/d) of U.S. refining capacity to shut down, with some outages lasting for more than a year due to damage requiring extensive repairs. The peak outage rate was 33 percent of total U.S. capacity, and retail gasoline prices jumped about 17 percent higher during this period. Similarly, Hurricane Harvey caused a temporary refinery production shutdown of 4.4mb/d or about 24 percent of national capacity in 2017. Compared to disruptions to crude oil production, there can often be a greater impact on refinery operations as facilities can take longer to restart following a shutdown.

As another hurricane season unfolds and predictions call for above-average activity in the Atlantic, all eyes are on the Gulf Coast and energy markets. Proactive measures will continue to be essential in navigating the uncertainties posed by hurricanes. Hurricane Beryl caused the shutdown of the ports of Houston, Galveston, and Texas City, and some refineries in the area were forced to stop production and evacuate. However, all of these refineries, offshore production sites, and ports experienced minimum damage and quickly resumed normal operations. The Port of Freeport, the second-largest U.S. liquefied natural gas terminal, sustained prolonged power outages and took longer to reopen. We are only at the early stages of this year’s hurricane season, and with two major storms already impacting the U.S. shore in its first month, it is important to be prepared for any supply shortages or price jumps that could occur as we head into the most active part of the season, typically occurring between mid-August and mid-October.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.