Oil & Energy looks at a perfect storm of fuel supply challenges

“It’s going to be a challenging heating season.”

That is the opinion of Michael Devine, president of the National Oilheat Research Alliance (NORA), and it is echoed by just about anyone you talk to, including industry leaders, market analysts and financial reporters. It is probably repeated, in one form or another, in your own offices.

How challenging it turns out to be may become a make-or-break situation for many independent retailers who could face supply shortages, trickles of cash flow and historic rack prices as they try to meet high demand driven by extended cold periods. All this is in the seasonal forecast, even before considering increased demand from China’s easing of some zero-COVID restrictions.

How did we get here? And where do we go from here?

A Perfect Storm

As one challenge builds upon another, they not only magnify but also become enmeshed to create the perfect storm bearing down on the liquid fuels industry.

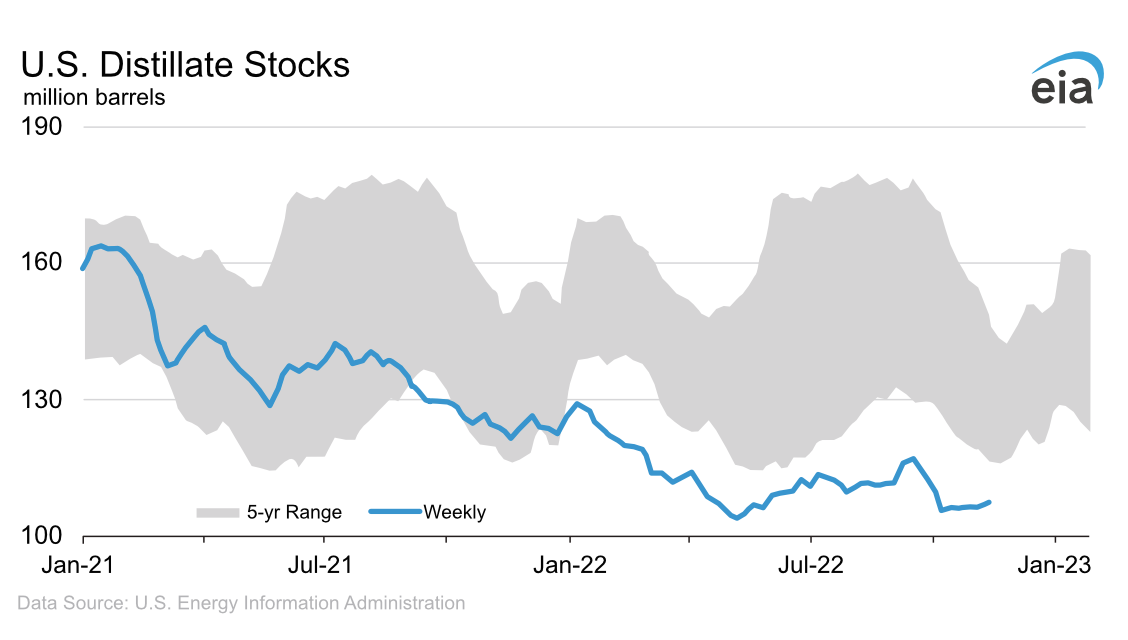

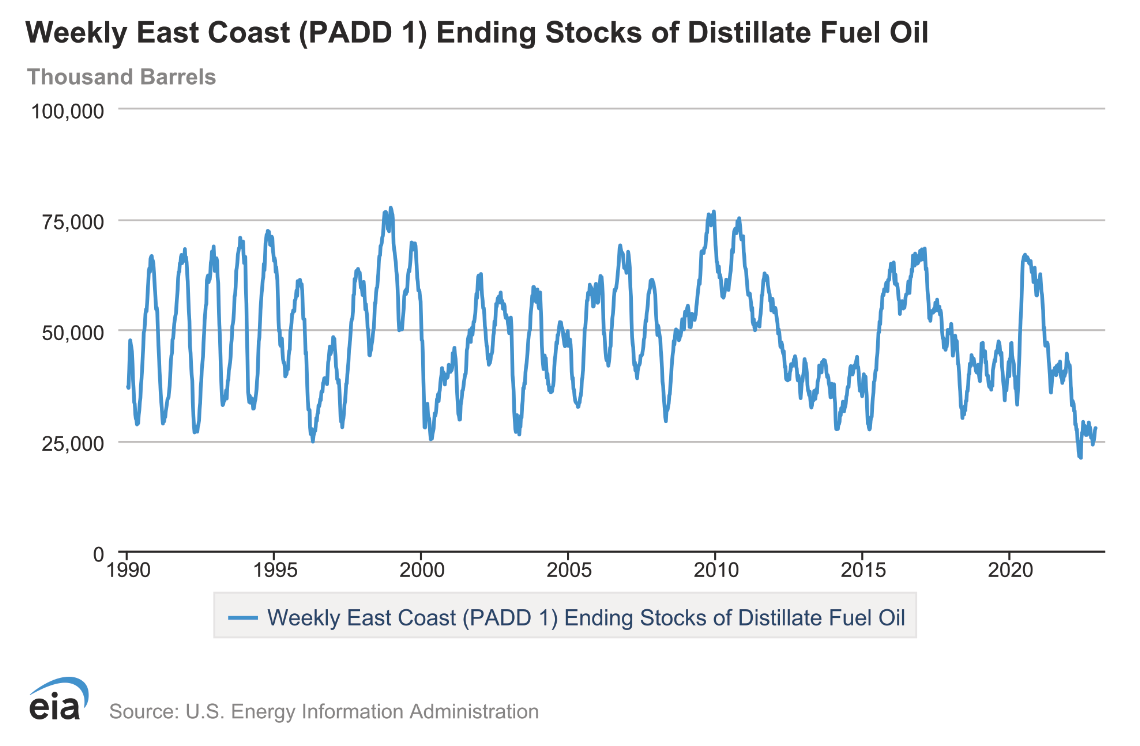

Nationally, current fuel supplies are lower than ever before (per EIA reporting through 1982) going into the heating season, and a fraction of the historic 5-year range. For the Northeast (PADD 1), inventories are 44% lower than last year.

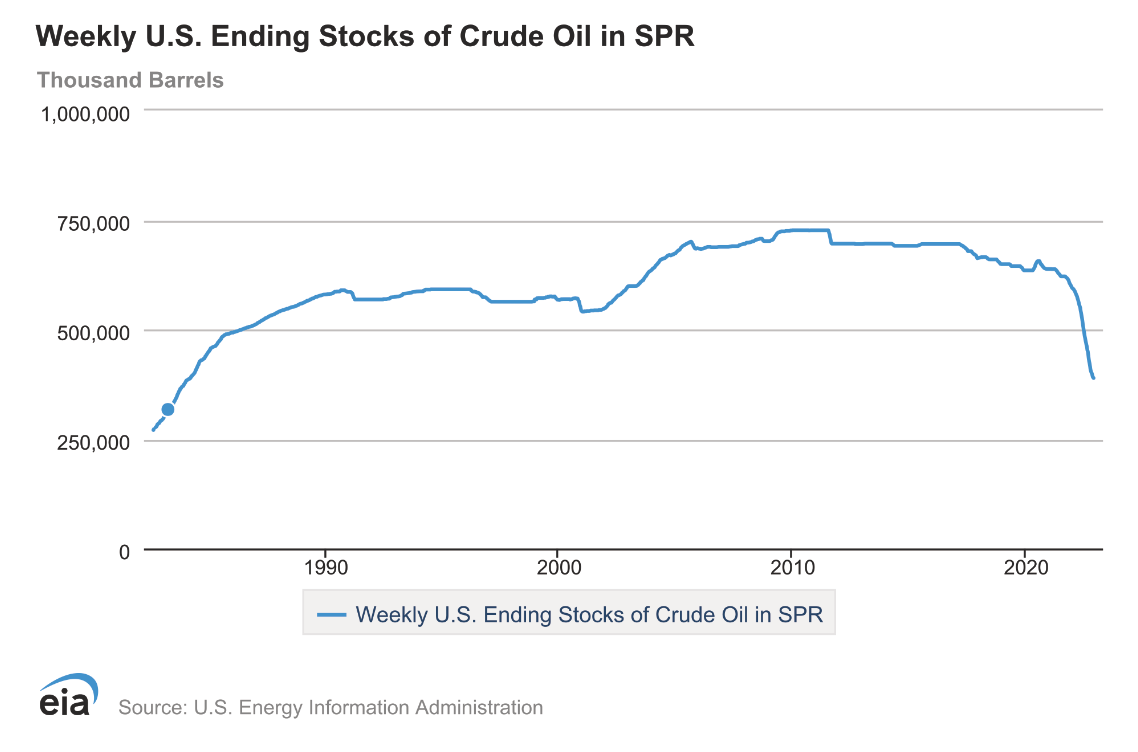

The Strategic Petroleum Reserve is down to 390.5 million barrels, a far cry from the 604.5 million it held this time last year and well below the current authorized storage of 714 million barrels. In March of this year President Biden announced the sale of up to 180 million barrels, with the last 15 million to be released during December 2022.

On top of the short on-hand supply are production and distribution challenges. Domestic refining capacity is about half of what it was a decade ago; international shipping is taking twice as long as it did pre-pandemic; and OPEC+ has cut production approximately 1 million barrels per day. At the time of this writing, the December 5 European Union and Great Britain outright ban on Russian oil or compromise price cap and any subsequent in-kind retaliation from Putin had yet to take effect. Any restriction on Russian oil, about 10% of international supply, will increase the demand for domestically produced fuels which might otherwise be distributed in the States.

Going Backward?

The market responded to the current situation with extreme backwardation, where daily rack prices were higher than the futures. In a November email update, NEFI connected the dots between the trillions of dollars in margin call bailouts in Europe and the backwardation of the futures markets. Backwardation leads to “just in time” supply situations for wholesalers and retailers: buy what is needed right now, because you could pay less tomorrow and no one wants to be holding overpriced fuel.

In late November, NEFI President Sean Cota warned of issues with contract ratability, explaining that in contango markets, when the futures price is higher than the current price, fuel dealers can pull their contracted gallons on the first of the month. In tight markets, those futures contract volumes might be held until the tenth of the month, when the contract comes due, and wholesalers may further limit supply to one quarter of the contract per week, or only allow half a tanker per day.

“If you thought product was going to be available, it might not be, even with contracts,” Cota explained, adding, “If you can’t get your fuel until the 10th, you might not get the last of the contract until the beginning of the next month. Although it is routine for other liquid fuels, like propane, it will be another challenge for heating oil retailers.”

Retailers will have to look beyond long-standing relationships with wholesalers and diversify their supply options by setting up additional lines of credit and securing contracts with other providers.

Electric Generation Could Cause More Supply Issues

If basis blowouts, a dearth of wholesale forwards and fixed differentials, and historically low stocks weren’t enough to cause concern, there is also a threat from electric power generation.

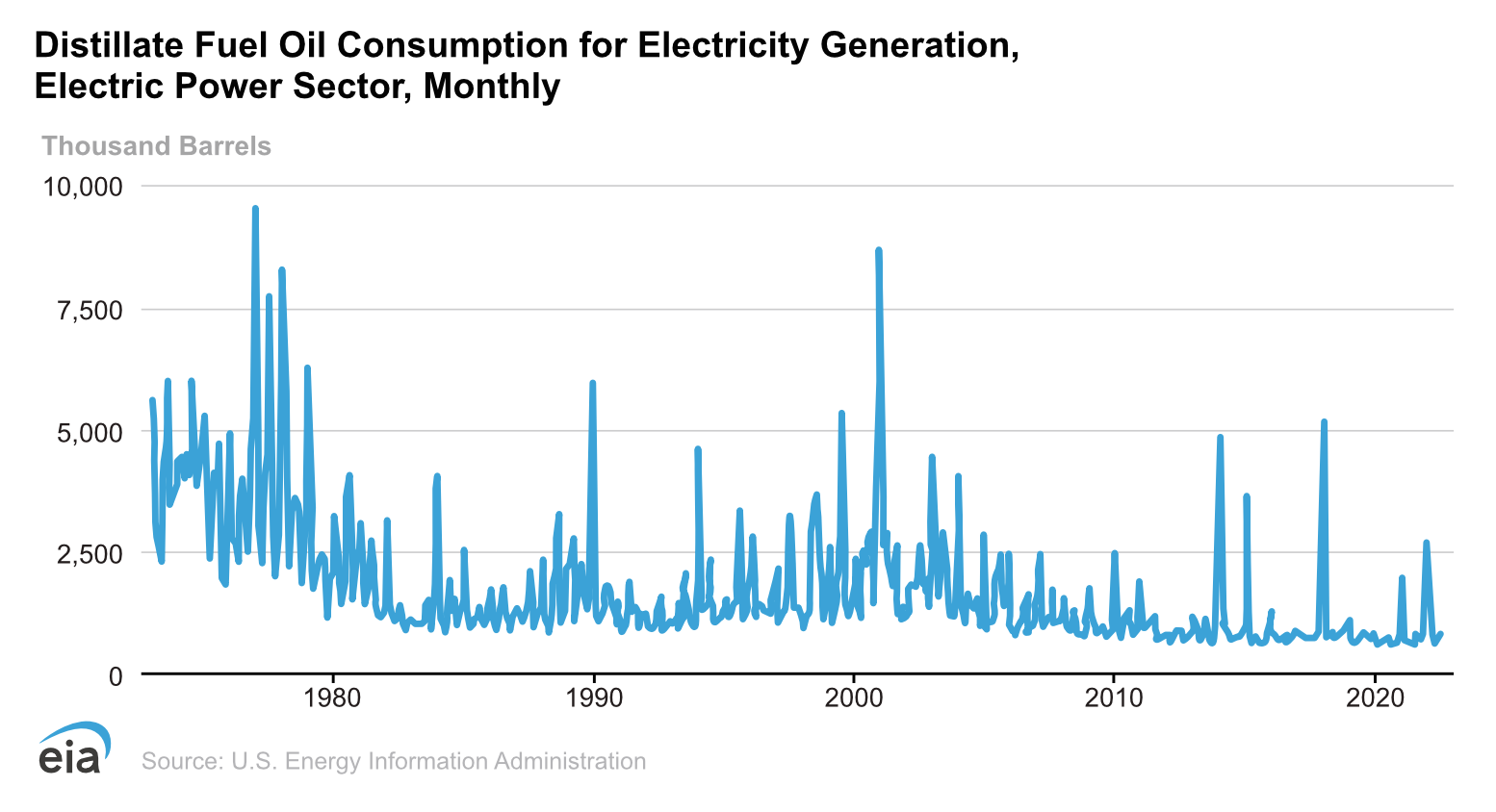

In January 2022, 11% of the electricity produced in New England came from diesel fuel. In 2018, ISO-New England reported that 84 million gallons were used for electric generation in less than two weeks.

Gas inventories for New York and New England power generation are barely sufficient for winter demand. The utilities are anticipating higher demand than in the past, and an extended cold snap will overwhelm their available supply and distribution infrastructure.

How bad could it get?

Groton Electric Light in Connecticut has warned customers of rolling blackouts and recommended that they fill 5-gallon fuel containers with backup heating oil or propane for generators and stock at least a one-week supply of pellets for wood burning or pellet stoves.

Joseph Nolan, Jr., president of Eversource, wrote directly to President Biden, warning, “the New England region remains dependent on natural gas to meet our power needs this winter and for the foreseeable future as we work expeditiously to bring additional renewables online. As both an energy company CEO and a lifelong New Englander, I am deeply concerned about the potentially severe impact a winter energy shortfall would have on the people and businesses of this region.”

The letter continued with, “ISO-New England, the region’s electricity grid operator, and the Federal Energy Regulatory Commission have acknowledged for many months that New England will not have sufficient natural gas to meet power supply needs for the region in the event of a severe cold spell this winter. This represents a serious public health and safety threat.”

More Concerns: Pricing and Weather

In early November the average national wholesale price for heating oil was recorded at $5.22 per gallon with residential pricing of $5.84. The November Winter Fuels Outlook issued by the EIA reported $6.13 in Delaware. Prices began to drop after those peaks, but, as Cota observed, “the market has, for now, returned to normal activity, but that is only going to last a few days, and I expect it to get crazy again in December.”

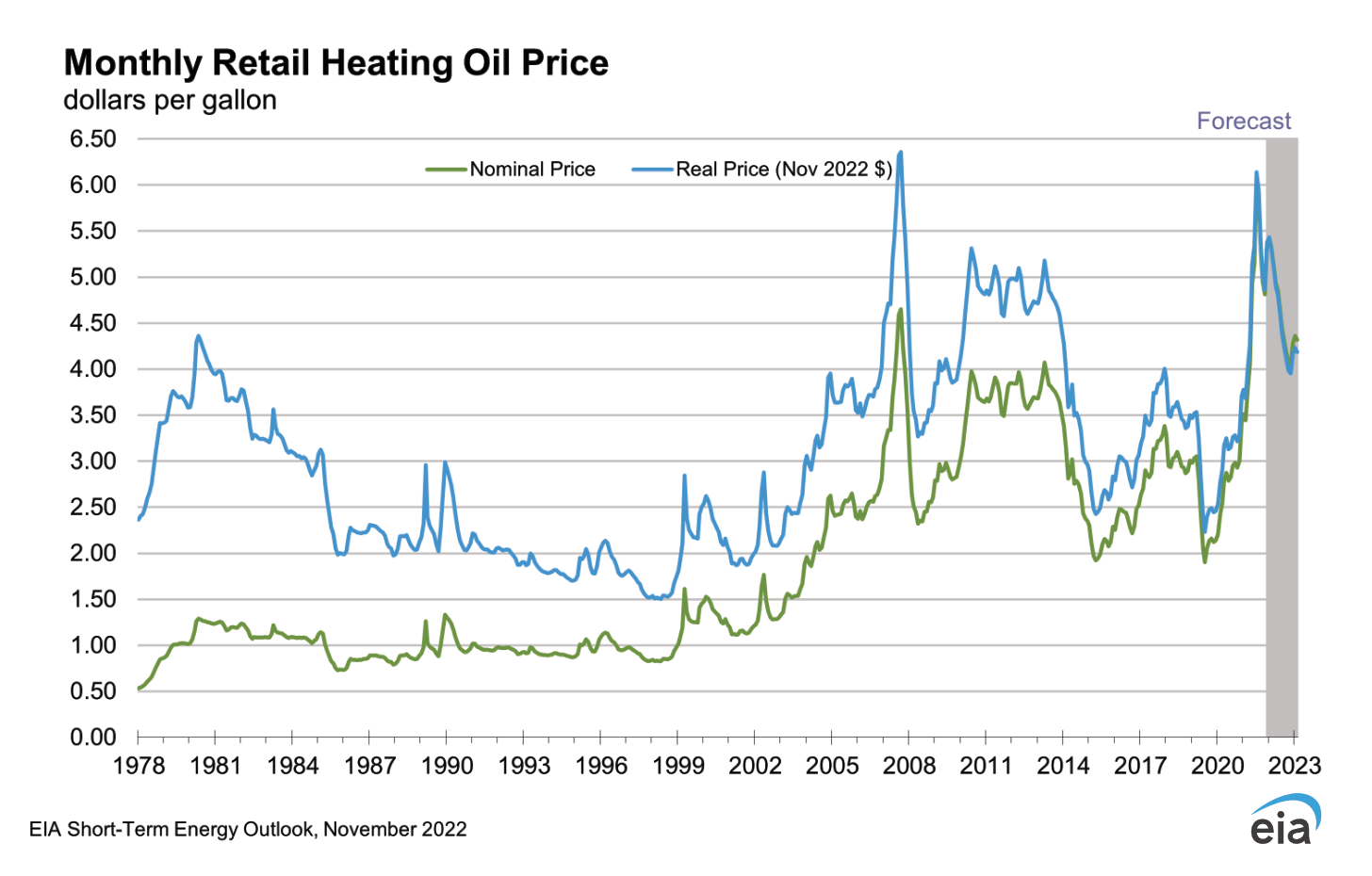

Weather forecasts are for a cold December with additional cold spells in January. While the winter season is anticipated to be slightly warmer than average due to a warmer February, no one cares about seasonal averages when temperatures have been near or below zero for several days. Nor will customers be soothed by the fact that when adjusted for inflation, prices were higher in 2007. Fifteen years is a long time, and anyone who remembers will only focus on the nominal price of $4.60, not the adjusted price of $6.25.

Retailers will be caught between high demand, high prices, and customers delaying payments because of financial hardship. This is not unexpected. The August 2022 Oil & Energy Magazine offered “Six Things Heating Fuel Dealers Can do Now to Prepare for the Most Significant Winter in Our Industry’s History.”

Devine recommends that heating oil companies calculate their average cash flow needs for the winter and communicate with their lending companies and supply partners as quickly as possible. “It’s important to be candid about what’s happening in the markets. The lending institution isn’t going to be surprised. They live in the same world we do,” he explained. “There is going to be a cash flow problem all around. Retailers need to know what their credit terms are with their supply partners and stay on top of collections with customers.”

Value Proposition

Are Bioheat® fuel and energy efficiency the answer? They are at least a rallying cry for an industry facing a multitude of challenges.

The savings that come with higher efficiency systems is one value proposition for the fuel provider. The Inflation Reduction Act includes a $600 tax credit for the installation of heating equipment rated for B20 Bioheat® fuel and meeting Energy Star® 2021 requirements. Additional money for homeowners is available through association-sponsored, NORA-funded rebate programs, in some cases as much as $800.

The liquid fuels industry is one of the few where its retailers promote ways for consumers to purchase less, but the efficiency message is just that. On average, homeowners who replace a boiler or furnace see an 18%-to-20% increase in efficiency. At the current retail prices that is equivalent to a $1 per gallon discount.

“At a time where supply and storage are a concern, being able to improve the supply 20% with B20 will make a big difference,” Devine said. “Biodiesel isn’t facing the same geopolitical pressures as we’re seeing with oil, most biodiesel is domestically produced, and is not subject to the same backwardation that we’re seeing in the diesel, gasoline and heating oil markets. Also, biodiesel is not as volatile on some of the basis issues, pricing issues we’re seeing. It’s a phenomenal hedge from a supply standpoint.”

Clean Fuels Alliance of America (CFAA) Supply Chain Liaison Paul Nazzaro agrees, telling Oil & Energy, “My perspective on challenged distillate supply has been, consider higher blends of biodiesel in home heating oil up to 20% to start. The current demand of biodiesel entering New England and Mid-Atlantic markets have yet to be challenged. Supplying PADD I remains a fluid process. The industry has yet to make that 100% commitment to the evolution of Oilheat, but when they do, the biodiesel industry will meet the demand.”

Bioheat® fuel, of course, offers value beyond supply. No one would suggest that an environmental message of reduced greenhouse gas emissions is going to make consumers forget about prices nearing six dollars a gallon. On the other hand, transitioning a home to air source heat pumps will cost homeowners somewhere between $18,000 and $45,000, which makes Bioheat® fuel the “logical product,” as Nazzaro described it, for environmentally conscious consumers.

“We are facing threats on all sides. Not only from weather, pricing and supply shortages, but also from the electrify everything activists and legislators,” Cota explained. “As an industry, we’ve been leading the movement to a net-zero carbon future, starting with the Providence Resolution in 2019. Businesses and consumers are going to be looking for ways to save money. Drop-in renewable liquid heating fuels are a more immediate and more economical solution to reduce greenhouse gases at any price-per-gallon.”

Devine offered a similar outlook, saying, “The other opportunity that one would want to take advantage of with Bioheat® fuel, based upon the price per gallon of liquid fuel that our retailers are delivering, is the opportunity to provide a message of environment benefits with GHG mitigation, carbon mitigation, that they deliver to the consumer, to their neighborhood, benchmarked against what natural gas and propane can deliver.”

How much is enough? That question remains unanswered, subject to weather, inflation, international demand, and other pressures beyond our control. As Cota has said numerous times, “if it is a warm winter the industry will be fine, but if it is very cold it will be the most challenging we’ve seen.”

It will fall on the fuel retailers, wholesalers and producers to work through credit and supply issues together, and to rebut negative news reports about high prices with positive messaging on the financial and environmental value that Bioheat® fuel and equipment upgrades deliver.