It is not too early to be making plans to hedge your programs for the 2025-2026 season

Following a blast of cold temperatures that brought welcome heating degree days, physical Ultra-low Sulfur Heating Oil (ULSHO) prices strengthened relative to NYMEX HO (ULSD) futures prices early this year. These cash market differentials rose above prior year levels in various markets, from the New York Harbor barge market to racks in Springfield, Harrisburg, Newington, and Portland. Those with fixed basis positions on their program gallon hedges were shielded from this rise, while others were not.

We can hedge our fixed price programs by buying futures or synthetic futures. We have offered the customer a fixed price, and these financial instruments will compensate us as the futures price increases. Should futures prices fall, we will lose on the financial contract, but our customers will continue to pay the fixed price. For capped price programs, we can hedge our exposure to futures price fluctuations using Call options. These pay out if futures prices rise above the strike price, compensating us for our increased costs so we can meet the commitment to the customer, but if prices fall, we simply do not exercise the option. If things were this simple, we could be perfectly hedged, but the reality is that the prices we pay at the rack do not move one-for-one with the futures prices on NYMEX. The spread between the cash price we pay and the futures price – basis – is a risk we have to consider.

In fact, by placing only a financial hedge on NYMEX, we took a position on basis – perhaps without even noticing it. By not fixing basis in our hedge, we benefit if cash differentials fall but are hurt if there is a basis blowout: we are short the differential. How could we take the opposite position and go long the differential? For our rack-to-retail gallons, we could enter into a fixed differential agreement with our supplier. For our fixed price programs, we could secure wet barrel contracts. How about capped price programs? Here, instead of Call options, we would use a combination wet barrels and Put options. This allows us to benefit from a drop in futures prices, but protects us against increases, similar to the Call option strategy, but with a fixed cash differential due to the physical (wet barrel) contract.

The next question is when to employ which strategy, and here history can be our guide. Without a crystal ball we cannot be certain when a basis blowout will or will not occur, but we can see if there are factors that make one more likely.

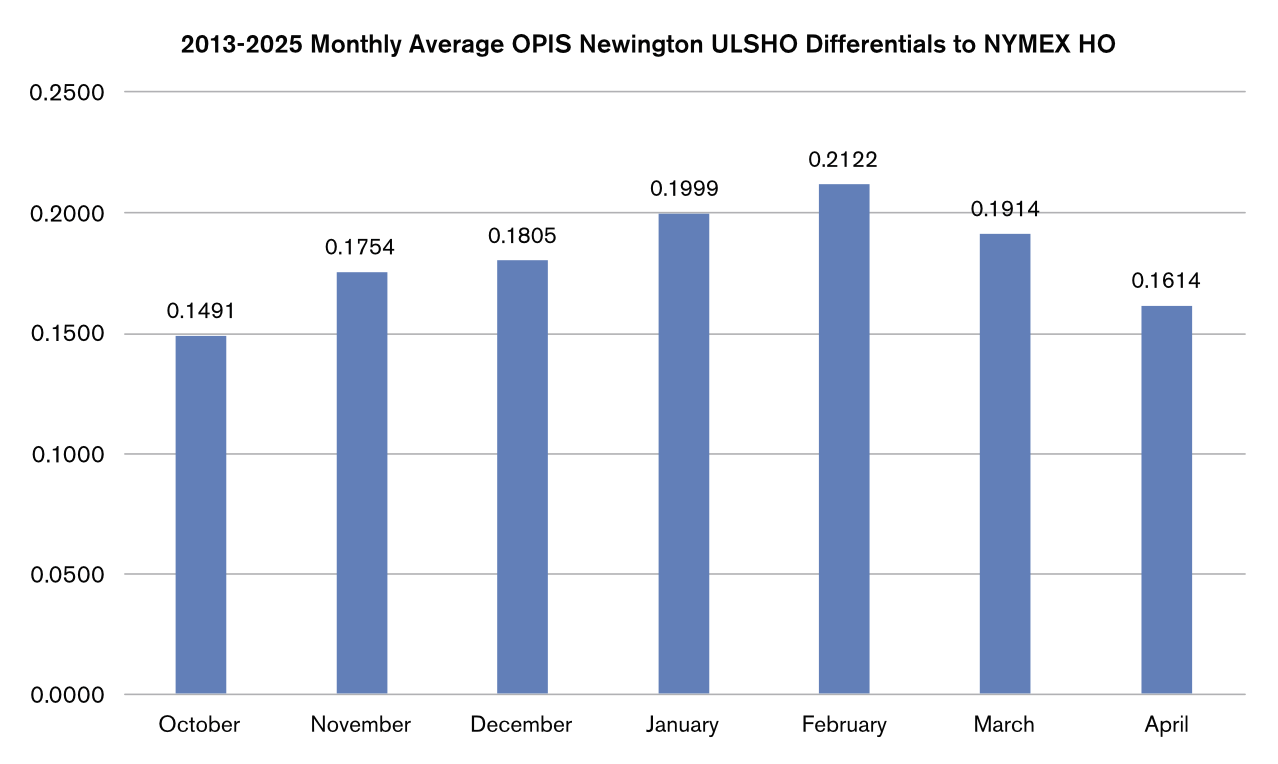

What could cause a basis blowout? A spike in demand is one possibility. Now, a five percent increase in demand in October is going to have much less of an impact than a five percent increase in demand in January. Accordingly, we might suspect that basis blowouts would be more likely in January and February, where the bulk of the winter’s heating degree days occur. On the other side of the supply-demand equation is production. U.S. refining activity tends to fall from the second half of December through late February, as refiners gear up to produce summer-grade gasoline and perform maintenance operations. This is another reason that basis spikes could be more likely early in the year. This reasoning is borne out in the data. Looking at Newington, New Hampshire, we see that the average monthly differentials during the October through April heating season, going back to January 2013, follow a nice curve that peaks in February.

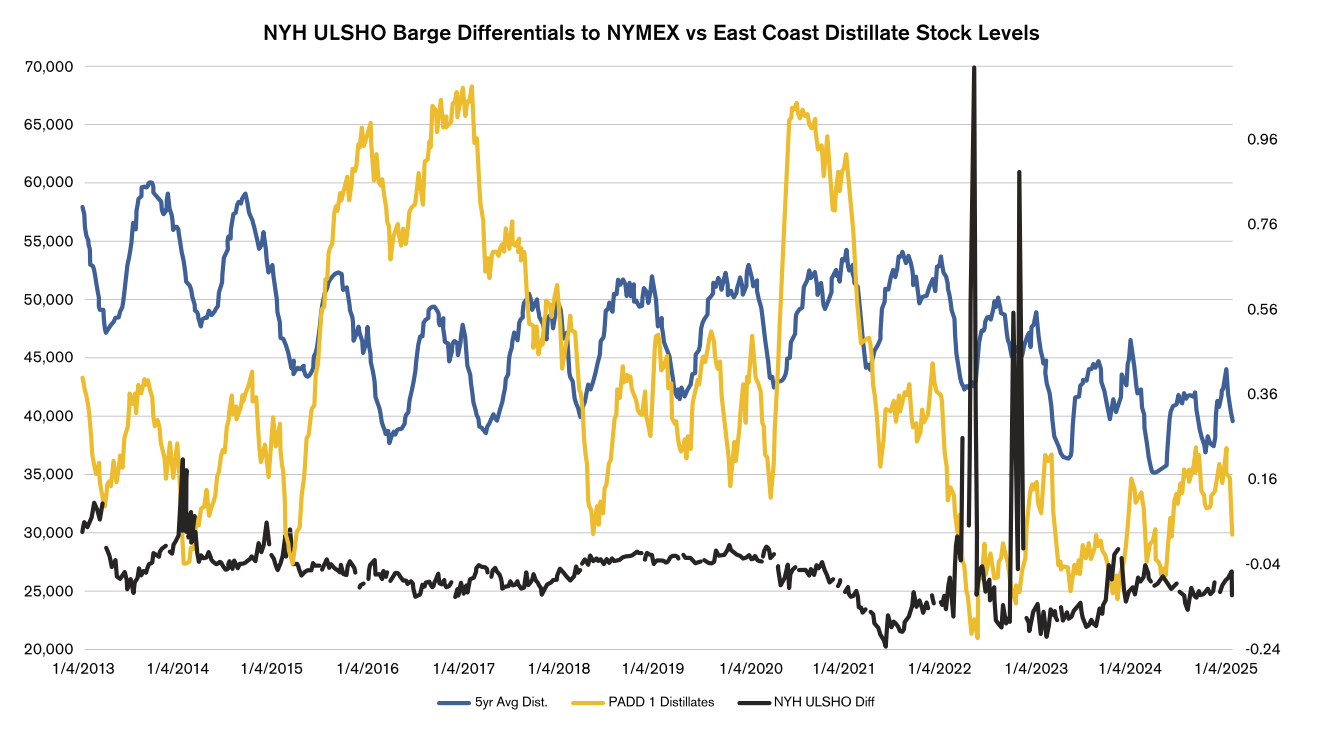

Looking at this local market highlights another important consideration: it takes time to move diesel produced by refineries up through the Colonial Pipeline and on from Linden, New Jersey, to local markets. Here is where inventories come to play a part, as they are the readily available supplies. Basis blowouts should then be more likely when inventories are relatively low, because we have a smaller cushion to absorb any demand spikes or supply snags. And we find that this is the case historically.

Charting New York Harbor ULSHO barge price differentials to spot NYMEX HO back to 2013 against the weekly East Coast distillate stock figures from the Energy Information Administration, we can see that differentials were relatively tame when inventories were strong compared to historical levels, from summer 2015 to the fall of 2017 and in the summer of 2020 through mid-February of 2021. Meanwhile, we saw jumps in basis in January of 2014, December of 2014, November of 2022, and November of 2023 – all during periods where inventories were at deficits against the five-year average. While it is only March, it is not too early to be making plans to hedge our programs for the 2025-2026 season. What the analysis we walked through today indicates is that, especially in times when East Coast distillate stock levels are looking weak, placing some protection against basis blowouts could be wise – especially for the months of January and February.

Dan Lothrop is Head Trader at over-the-counter derivatives company Northland Energy Trading LLC. He can be reached at 800-709-2949 or daniel@hedgesolutions.com.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.