Reward your customers and add hundreds of thousands of dollars to your bottom line

As a thought leader in electronic payment processing for fuel dealers, I have spent the greater part of the last 20 years directly communicating with credit card brands on behalf of the heating fuels industry. And to be honest with you, I am not happy with the recent and unfortunate Visa Credit rate increases that just went into effect. These increases are detrimental to the industry as they eat into the well-deserved profits that you earn each and every day by providing your customers important essential services, comfort and peace of mind. How many other businesses are literally trusted with the keys to access their customers’ homes and businesses?

For even greater perspective, just think about the vast differences between the multigenerational heating fuels industry compared to the conglomerate utility companies that trade on the New York Stock Exchange. Your industry is different — it is an industry that focuses on individual customers and it cares about their immediate needs.

This is where “big business” drops the ball; their priorities are the investors and shareholders of the company, which, in turn, forces the majority of publicly traded companies to look at daily operations and overall priorities differently.

There was a time when good service and pride led the charge as it was sewn into the fabric of many companies, large and small. However, the landscape has drastically changed, compounded by advancements in technology, access to data, and greater transparency. It is intimidating enough to compete in today’s world, but throw all these additional obstacles into the mix and it is daunting.

From a competitive vantage point, there is no question that big business can utilize their resources to help tip the scales in its favor and win market share in the process.

The heating fuels industry is unique as it is made up of thousands of family-run businesses that now more than ever need to think creatively (out of the box) to complete in an environment where the odds are inherently stacked against them. It is this characteristic that attracts me to this industry. I grew up in an entrepreneurial family and was taught to care about our clients just like you do today. We always looked at ways to deliver professional service while showing our appreciation for their business.

When it comes to electronic payments, all four major brands (Visa, MasterCard, Discover and American Express) are publicly traded companies that operate around the globe. As mentioned above, they have a lot to prove as they trade in public markets where good news and big profits are constantly on display for stockholders and investors.

In April of this year, the payment landscape drastically changed for the worse for heating fuel dealers operating in the U.S. After more than 15 years, they are no longer eligible to participate in a reduced Visa Credit interchange category, resulting in a significant increase in fees, the likes of which this industry has never seen before. To further compound the issue, in conjunction with the elimination of the discounted program for fuel dealers, Visa simultaneously released its largest general rate increase in the last 25-plus years, magnifying the processing expenses associated with accepting Visa Credit Cards. And to top it off, Visa consumer credit cards represent the largest pool of card types in the marketplace.

To illustrate what this really means for the average fuel dealer accepting Visa consumer credit cards, it will cost an additional $3 per transaction based on an average transaction size of $400. What cost dealers approximately $6 on April 1, today costs them roughly $9 for accepting the very same card. The pre-increase VISA credit card cost of $6 was already three times the cost of running a MasterCard or Discover credit card, and now we’re looking at $9.

It is unfathomable to simply accept this as the new norm. This industry cannot just take it on the chin because big business needs to report larger earnings to Wall Street.

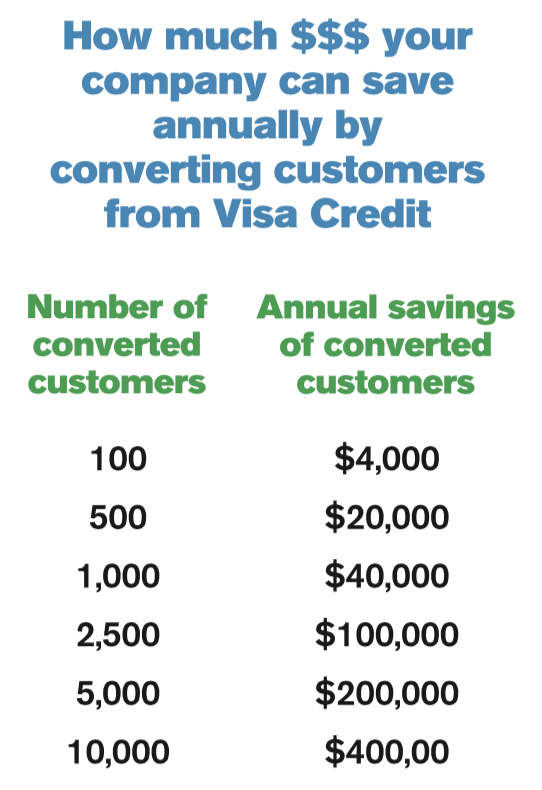

Consider this: for every 100 customers you convert from using a Visa credit card to a MasterCard, Discover, Visa debit or Echeck/ACH, you will perpetually save $4,000 a year. Converting 2,500 customers equates to an annual savings of $100,000 while 5,000 customer conversions yields an annual savings of $200,000.

Once again, the time has come for the heating fuels industry to be innovative and approach this in a strategic manner that empowers the industry to fight against these exorbitant rate increases. The time has come to creatively outmaneuver these burdensome expenses while embracing the opportunity to engage with customers and build loyalty, stickiness and added value that truly differentiates you from your competition.

It is no easy task but I can assure you, if handled properly, the byproducts of executing a well thought out plan will yield great dividends to your organization and the entire industry. Let us once again come together and rise above the tsunami of big business.

Larry Richmond is a Cashflow Automation Specialist and President of Richmond Financial Services (RFS). He can be reached at 617-843-5700 x200 or larry@richmondfs.com.