How geopolitical uncertainty is impacting oil and gas prices

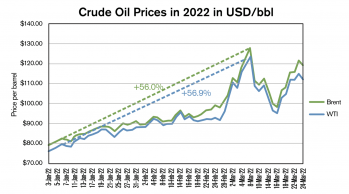

In March, Russia’s invasion of Ukraine sent energy prices to their highest levels since the 2008 recession. Both WTI and Brent crude oil futures crossed the $100 per barrel (bbl) mark and went on to reach new multi-year highs of $130.50/bbl for WTI futures and $139.13/bbl for Brent on March 7. Prices had since come off as of this writing in late March, but were still trading at strong levels as markets continued to show high volatility, with front-month WTI futures at about $112/bbl and Brent about $119/bbl (as of March 24).  On February 24, Russia launched an all-out attack on Ukraine by land, air, and sea, making it the biggest attack on a European country since World War II. In response, the United States, United Kingdom, and European Union imposed sanctions against Russia. Some targeted the Russian energy sector, as the country is the world’s third-largest oil producer (behind the U.S. and Saudi Arabia) and largest exporter of oil. The U.S. has banned all Russian oil and gas imports, and the U.K. is planning to phase out Russian oil imports by the end of 2022. At the time of this writing, EU countries were debating whether to follow the U.S. and ban Russian oil imports. Views among foreign ministers were split, with Germany stating that the EU’s dependency on Russian oil is too high to impose an immediate ban. The bloc gets about 27% of its crude oil or about 2.3 million barrels per day (mb/d) from Russia, which accounts for almost half of Russian exports. In addition, Russian natural gas supplies account for about 40% of the EU’s gas imports.

On February 24, Russia launched an all-out attack on Ukraine by land, air, and sea, making it the biggest attack on a European country since World War II. In response, the United States, United Kingdom, and European Union imposed sanctions against Russia. Some targeted the Russian energy sector, as the country is the world’s third-largest oil producer (behind the U.S. and Saudi Arabia) and largest exporter of oil. The U.S. has banned all Russian oil and gas imports, and the U.K. is planning to phase out Russian oil imports by the end of 2022. At the time of this writing, EU countries were debating whether to follow the U.S. and ban Russian oil imports. Views among foreign ministers were split, with Germany stating that the EU’s dependency on Russian oil is too high to impose an immediate ban. The bloc gets about 27% of its crude oil or about 2.3 million barrels per day (mb/d) from Russia, which accounts for almost half of Russian exports. In addition, Russian natural gas supplies account for about 40% of the EU’s gas imports.

With multiple, particularly European, countries working on easing out of their dependency on Russian imports, the primary issue that has arisen is that it’s not easy to find substitutes for the large volume of natural gas that Europe gets from Russia. This caused natural gas prices in Europe to hit an all-time high of €345 per megawatt-hour in early March. Most liquefied natural gas (LNG) supplies are tied to long-term contracts, and it would be extremely difficult to quickly satisfy the European demand. Consequently, this could prompt countries to switch from natural gas to heating oil and to possibly speed up conversion to renewable energy. The European Commission has said that it plans to make Europe completely independent from Russian fossil fuels before 2030 by investing in renewable energy and LNG import infrastructure. The EU aims to cut its dependency on Russian gas by two-thirds by the end of 2022 and end all Russian fossil fuel imports by 2027. ULSD (HO) futures have also seen a jump in prices, hitting $4.6709 per gallon on March 9 due in part to increased demand from oil switching. The Biden administration has been working with gas and oil suppliers from the Middle East, North Africa, and Asia to try to fill this gap in the European market. There have been talks that the U.S. will supply 15 billion cubic meters of LNG to the European market.

Adding more pressure to crude oil and distillate prices, global oil inventories have remained at very low levels even prior to the Russia-Ukraine conflict as a result of heavy backwardation in futures forward curves, which provides economic disincentives for storage operations. The U.S. has seen its lowest levels of distillate stockpiles since the shale boom, due to increased demand, relatively low refinery production and rising crude oil prices. The current geopolitical climate and potential for oil switching, along with low inventory levels, could cause energy prices to continue to increase. In its March 2022 Short-Term Energy Outlook (STEO), the Energy Information Administration revised its Brent crude oil price forecast for the second quarter of 2022 up from $87/bbl in the February STEO to $116/bbl. Morgan Stanley raised its third quarter Brent crude oil price forecast by $20 to $120/bbl.

With uncertainty over the geopolitical climate and highly volatile energy markets, it is difficult to predict how oil and distillate prices will move. One certainty is that the EU would have to turn to other oil and gas exporters to replace Russian imports. European officials have released documents showing that significant new supplies of LNG could come from the U.S., Qatar, and Egypt, but that Europe would likely have to compete with other major LNG consumers such as China, South Korea, and Japan, which might push prices even higher.

Anja Ristanovic is a Financial Analyst at risk management consultancy Hedge Solutions. She can be reached at 800-709-2949.

The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.