DISCLAIMER: This article highlights key provisions in the 500-page tax reform bill. It is not a comprehensive explanation of changes to the tax code, nor is it intended for use as tax guidance or advice. Readers should consult with a qualified tax professional on how this new law affects their interests.

The final version of the Tax Cuts & Jobs Act (TCJA) was approved by the House of Representatives on December 19, 2017 by a vote of 227-203. The bill was then passed in the Senate the following day by a vote of 51-48. Senate rules necessitated minor tweaks and one last vote occurred in the House. President Trump signed the bill into law on December 22. The TCJA makes the most significant reforms to the U.S. tax code in a generation and the biggest tax cuts in American history. Below is a summary of some key provisions that may be of interest to NEFI members, as well as all fuel dealers and their associates throughout the U.S.

Business Tax Provisions

Corporate Tax Rate & AMT: The final TCJA permanently lowers the corporate tax rate from 35% to 21% in 2018. It also repeals the corporate Alternative Minimum Tax (AMT).

Treatment of Pass-throughs: For pass-through businesses (i.e., sole proprietorships, LLCs, partnerships, single member LLCs, and S-corporations) the new law offers a 20% deduction on income beginning in 2018. The deduction expires on December 31, 2025. Limitations on W-2 wage income and for specified service businesses are phased in for incomes above $157,000 for individuals and $315,000 for couples. The law sets the top tax rate for pass-through businesses at 29.6%. According to lawmakers, this was included to “deter high-income taxpayers from attempting to convert wages or other compensation for personal services to income eligible for the 20-percent deduction under the provision.” At the request of NEFI and other small-business advocates, the final version of the TCJA makes trusts and estates eligible for the deduction. It also expands eligibility to include certain qualified income from publicly traded partnerships and exempts them from wage limits (but not limits for specified service business). IMPORTANT: The TCJA’s pass-through provisions are extensive and complex. As stated in the disclaimer above, NEFI recommends that pass-through businesses seek guidance from a qualified tax professional on these matters.

Depreciation & Expensing: The TCJA allows for full and immediate expensing of equipment and other eligible property purchased after September 27, 2017 and before January 1, 2023. After that, the percentage of cost that can be immediately deducted gradually phases down over five-years. The law also replaces the “original use” requirement with “first use” language, thereby allowing used property to be eligible for the first-year depreciation deduction. The expensing limit under Section 179 is increased from $500,000 to $1,000,000, and the phase-out threshold from $2 million to $2.5 million. The definition of eligible business property under Section 179 is expanded to include roofing, HVAC appliances, fire protection and alarm systems, and security systems.

Business Interest Deduction: Businesses with up to $25 million in gross receipts may continue expensing interest and use the cash method of accounting. Businesses with over $25 million in gross receipts are generally limited to a net interest deduction of 30% of their adjusted taxable income. The restriction does not apply to regulated public utilities and certain other types of trades or businesses.

Other Business Tax Provisions of Interest: The Last-in/First-out (LIFO) accounting method is preserved. Proposals that would have scaled back some tax breaks for oil and gas production have been dropped. Section 1031 “like-kind” exchanges are limited to real estate. For most corporations, net operating loss (NOL) deduction is limited to 80% of taxable income, beginning in 2018, and carryback provisions have been eliminated. NOLs can be carried forward indefinitely. Rules governing the deduction of meals and entertainment expenses have been changed, and many Employee Fringe Benefits are scaled back, suspended or repealed.

Tax Provisions for Individuals & Families

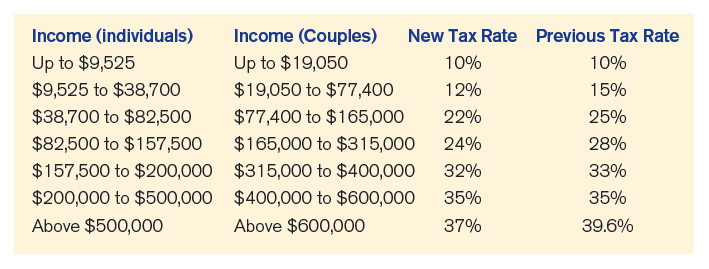

Individual Tax Rates: The final TCJA keeps seven brackets, with lower rates effective in 2018. These lower rates (see table below), like many of the individual tax provisions, expire after December 31, 2025.

Standard Deduction: The TCJA doubles the standard deduction from $6,350 to $12,000 for individuals and from $12,700 to $24,000 for couples, and eliminates the personal exemption. As a result, most individuals and families will no longer itemize, thereby simplifying their annual tax filings. Supporters claim these reforms will allow for “postcard-sized” filings for many American families.

Individual AMT: Unlike for corporations, the AMT for individuals is preserved. Through December 31, 2025, the TCJA increases income exemptions from $54,300 to $70,300 for individuals and from $84,500 to $109,400 for couples. It increases the phase-out threshold for individuals and couples to $500,000 and $1 million, respectively.

Estate, Gift and GST Taxes: Estate, gift and generation-skipping transfer (GST) taxes are retained. However, through December 31, 2025, the exemptions are doubled from $5.6 to $11.2 million for individuals and from $11.2 to $22.4 million for couples. Sec. 1014 step-up in basis is preserved.

State & Local Tax Deduction: The TCJA limits the state and local tax (SALT) deduction to no more than $10,000 in a combination of state and local property taxes and income or sales taxes.

Mortgage Interest Deduction: The final TCJA caps the mortgage interest deduction at $750,000, down from $1 million. It disallows the deduction for interest on home equity loans until 2026.

Obamacare Individual Mandate: Beginning January 1, 2019, the TCJA eliminates the tax penalty under the Affordable Care Act for individuals who fail to purchase and maintain health insurance.

Child Tax Credits: The child tax credit is increased from $1,000 to $2,000, and income eligibility is increased from $75,000 to $200,000 for single parents and from $110,000 to $400,000 for married couples. Up to $1,400 is now refundable. The TCJA offers a new $500 tax credit for qualified adult dependents. These provisions expire after December 31, 2025.

Other Individual Tax Provisions of Interest: The final TCJA keeps some other popular tax breaks, such as the medical expense deduction (reduced from 10% to 7.5% for 2017 and 2018), charitable deductions, the adoption tax credit, and many education and retirement savings tax breaks.

International Tax Provisions

Like the base legislation, the final TCJA moves the U.S. to a territorial system that exempts U.S. corporations from taxes on most of their future foreign profits. The new law establishes a one-time “repatriation tax” for companies that move an estimated $2.6 trillion in previous overseas profits back into the U.S., at rates of 15.5% for cash assets and 8% for illiquid assets. It establishes other reforms to the tax treatment of multinational and foreign-based companies, but these rules do not apply to most NEFI members.

Industry-Specific Tax Breaks

Electric Vehicle Tax Credit: The TCJA preserves a tax credit of up to $7,500 for the purchase of a new plug-in electric motor vehicle. The underlying House bill would have eliminated this tax credit. The proposal was not included in the Senate bill and was rejected in conference, so the tax credit is preserved.

Biodiesel Tax Credit and other “Tax Extenders”: The final TCJA does not extend some three-dozen recently expired business and individual tax breaks, known as “tax extenders.” These include the biodiesel blenders’ tax credit; tax incentives for the installation of energy efficient residential and commercial property (including the Sections 25C and 25D credits); and the Alternative Fuel Excise Tax Credit for the use of propane in motor vehicles, forklifts and lawnmowers, commonly referred to as the propane autogas tax credit. A bipartisan measure (S.2556) has been offered in the Senate that would retroactively extend these and other expired tax provisions. Supporters hope the bill might be included in must-pass legislation sometime in January 2018. NEFI has advocated vigorously for an extension of the biodiesel tax credit and supports this legislation. We will continue to monitor developments closely.

Expanded Oil & Gas Drilling

Also of interest to NEFI members, the final version of the TCJA opens up areas of the 19.6-million-acre Arctic National Wildlife Refuge (ANWR) to oil and gas exploration and recovery. This provision applies specifically to ANWR’s coastal plain, known as the Section 1002 area. The U.S. Geological Survey estimates the area may hold up to 11.8 billion barrels of technically recoverable oil, making it the biggest onshore conventional oil field in North America. These reports are nearly 20 years old, however. Some experts predict Section 1002 could hold up to 20 billion barrels of recoverable oil.

The new law requires at least two area-wide lease sales within the 1.57-million-acre Section 1002 area over the next 10 years. Each sale must contain at least 400,000 acres and have the highest potential for oil and gas production, but surface development cannot exceed 2,000 acres (equal to one ten-thousandth of all federal land in ANWR). The Secretary of Interior is further required to issue any necessary rights-of-way or easements for the exploration, development, production, or transportation associated with oil and gas under the program. It also makes a 50% revenue-sharing commitment to the State of Alaska.

Strategic Petroleum Reserve

The TCJA directs the Secretary of Energy to draw down and sell off a total of seven million barrels of crude oil from the Strategic Petroleum Reserve (SPR) between fiscal years 2026 and 2027. This approximately 1% of total SPR is valued at around $400 million in today’s market. The Secretary of Energy is required to suspend the drawdown or sale of crude oil after the date on which a total of $600 million has been deposited in the general fund of the Federal Treasury.