All

EIA: Shutdown to Change Supply Patterns for East Coast

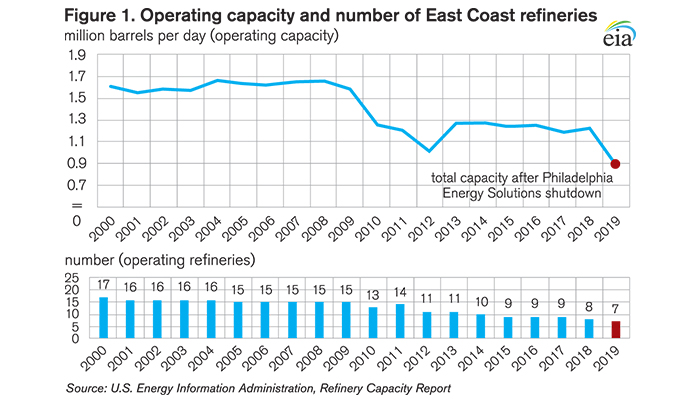

On Friday, June 21, the Philadelphia Energy Solutions (PES) 335,000 barrels per day (b/d) refinery in South Philadelphia experienced a major fire and explosion. The resulting damage to the refinery and preexisting financial strains led PES to announce its intention to shut down operations at the refinery. The closure of the Philadelphia refinery would decrease the number of operating East Coast refineries to seven and total operating capacity to 889,000 b/d (Figure 1). The U.S. Energy Information Administration (EIA) estimates closing the Philadelphia refinery would reduce East Coast gasoline supplies by approximately 160,000 b/d and distillate supplies by approximately 100,000 b/d. The potential shutdown of the largest refinery by capacity on the U.S. East Coast is likely to reconfigure petroleum product supply chains in the Central Atlantic.

The U.S. East Coast (defined as Petroleum Administration for Defense District, or PADD, 1) is the largest regional consumer of petroleum products in the United States. Because the East Coast consumes significantly more petroleum products than regional refineries can produce, the region relies on imports and supplies brought up from the U.S. Gulf Coast by pipeline. The announced shutdown of the PES refinery would increase the region’s reliance on supply from other areas. For example, in April 2019, the East Coast represented 36% (3.3 million b/d) of total motor gasoline consumption and 71% (659,000 b/d) of U.S. total motor gasoline imports. For distillate, the East Coast represented 31% (1.2 million b/d) of distillate consumption and 79% (96,000 b/d) of distillate imports. The region also received 1.3 million b/d of gasoline and 691,000 b/d of distillate by pipeline from the Gulf Coast in April.

Like any unplanned disruption to petroleum product supplies, the immediate source of resupply will be inventories located within the affected markets, in this case markets supplied by refineries in the Philadelphia area. Motor gasoline inventories in the Central Atlantic (PADD 1B) were 31.9 million barrels as of 7:00am on Friday, June 21, the morning after the disruption occurred, which was 2% lower than the five-year (2014-18) average level for that time of year. Inventories of distillate in the Central Atlantic were 23.8 million barrels, 7.6% lower than the five-year average. One week later, Central Atlantic gasoline inventories for the week ending June 28 were down by 1.7 million barrels to 30.2 million barrels. However, distillate inventories had increased 1.1 million barrels to 24.9 million barrels.

Refineries in the Philadelphia area distribute to markets in the immediate Philadelphia metro area. They also distribute by pipeline to areas north to New York Harbor via the Colonial and Energy Transfer Partners (formerly Sunoco) pipelines: west to Pittsburgh via a Buckeye Partners pipeline: and northeast to Buffalo and Utica, New York, via Energy Transfer Partners and Buckeye Partners pipelines (Figure 2).

Replacement supplies for these markets will come from various sources. The three other operating refineries in the Philadelphia area that produce transportation fuels — the PBF Delaware City refinery, the Monroe Energy Trainer refinery, and the PBF Paulsboro refinery, with a combined atmospheric crude oil distillation capacity of 532,200 b/d — are likely to increase utilization and provide some limited additional supplies to the pipeline systems. Markets in Western Pennsylvania may also draw on supplies provided by refineries and distribution systems in Ohio and the rest of the Midwest. Markets farther north in upstate New York may find resupply from refineries in Canada and terminals in southern New York, although the transportation logistics are more challenging than via pipeline from Philadelphia. However, most of the lost supply to these markets and the region as a whole is likely to be replaced through imports and increased shipments on the Colonial Pipeline.

The East Coast can import gasoline supplies from the actively traded Atlantic Basin, which is supplied by refineries in Eastern Canada, Northwest Europe, the Mediterranean, and India. In 2018, the East Coast imported 586,000 b/d of motor gasoline, with the largest monthly volumes occurring in the summer driving season months. These imports can arrive at terminals in New York Harbor and then be distributed from there by pipeline, barge, or truck. As part of the most recent wave of refinery closures on the East Coast between 2010 and 2013, several former refinery sites—such as the former Sunoco refinery in Eagle Point, New Jersey, opposite the Delaware River from Philadelphia—were converted to product import, storage, and distribution terminals. Imports of petroleum products to these terminals are likely to increase as a result of the PES refinery shutdown.

The loss of distillate supplies from the PES refinery would also increase distillate imports, which, on the East Coast, typically increase with the winter demand for heating oil in northeastern states. This past winter, the East Coast imported a high of 337,000 b/d of distillate in February, the largest monthly amount thus far in 2019. Historically, the largest single source of winter distillate imports into the East Coast is from refineries in Eastern Canada, although the East Coast can draw on a diversity of distillate suppliers in Europe, the Middle East, India, and Latin America.

Besides imports, increased shipments from refineries in the U.S. Gulf Coast to the Philadelphia area by pipeline and by coastwise-compliant shipping may be possible but have limitations. The Colonial Pipeline, which runs from the U.S. Gulf Coast through Philadelphia and on to New York Harbor, typically runs at maximum capacity already. Additional supplies from Colonial Pipeline into the Philadelphia area will depend on the extent to which imports can replace volumes from Colonial Pipeline in New York Harbor, allowing the supplies that would have bypassed Philadelphia to remain there instead. Although shipments on coastwise-compliant vessels from the U.S. Gulf Coast to the Central Atlantic are rare and typically cost more than imports from Canada or Europe, they remain an option.

Refineries on the East Coast have been closing steadily during the past 20 years, with total East Coast refinery capacity in 2018 down 24% compared with 2000, and each closure resulted in supply chain adjustments. Changes to a supply chain always involve costs, including the costs of acquiring imports, of new or longer transportation routes, and of adapting or building infrastructure. These costs are likely to be reflected in Central Atlantic wholesale and retail petroleum product prices. The increase in costs may be more acute in the short term as the supply chain adjusts and temporary shortfalls arise. Over time, however, the new supply chain patterns will become established and new pricing norms will develop. Furthermore, falling crude oil prices could counteract any retail price effects from the PES closure.

In the two weeks following the outage, the retail price of regular gasoline in the Central Atlantic increased 6 cents from $2.74 per gallon (gal) on June 17 to $2.80/gal on July 1. The New York City average retail regular gasoline price also increased by 3 cents after the outage, from $2.74/gal on June 17 to $2.77/gal on July 1.

Related Posts

Why Quality Matters in Your Biofuel Blends

Why Quality Matters in Your Biofuel Blends

Posted on June 25, 2025

Incorporating Higher Blends of Biofuels

Incorporating Higher Blends of Biofuels

Posted on May 14, 2025

NORA Programs at Eastern Energy Expo

NORA Programs at Eastern Energy Expo

Posted on May 13, 2025

March Short-Term Energy Outlook

March Short-Term Energy Outlook

Posted on April 28, 2025

Enter your email to receive important news and article updates.