The following are excerpted from recent reports provided by the Energy Information Administration (EIA). For more information, visit www.eia.gov

U.S. renewable diesel production and biodiesel production declined in 1Q25

Released June 4, 2025

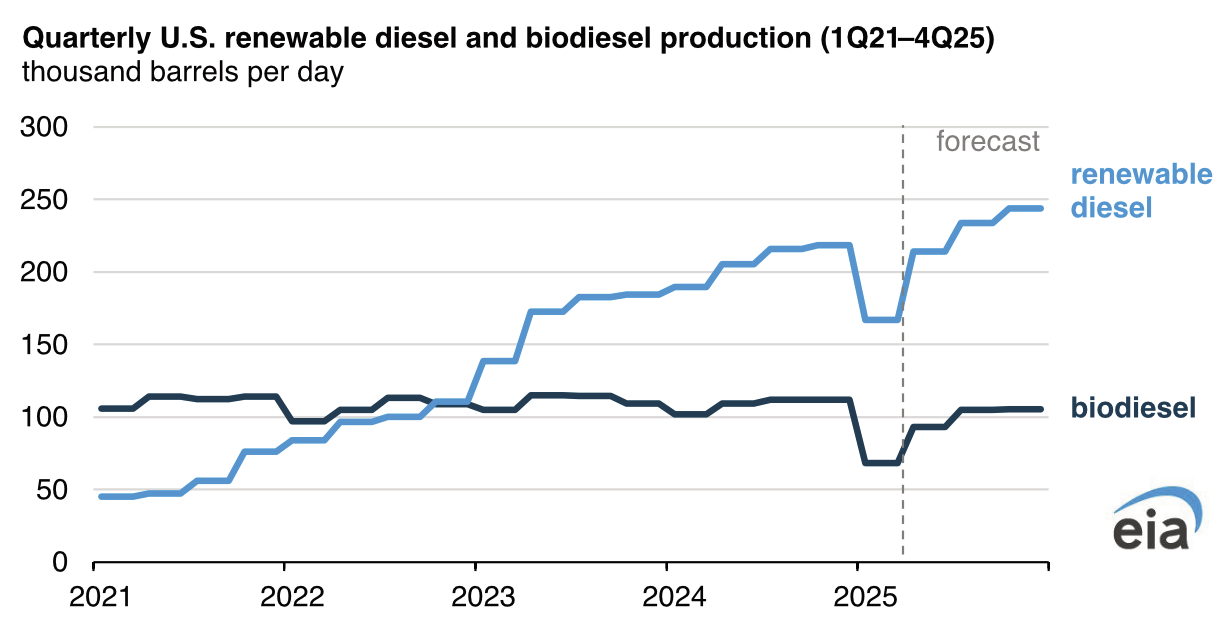

U.S. production of renewable diesel and biodiesel fell sharply in the first quarter of 2025 (1Q25) because of uncertainty related to federal biofuel tax credits and negative profit margins. We forecast production of both fuels to increase as the year progresses but biodiesel production to remain less than in 2024.

In January 2025, U.S. production of biodiesel fell to 60,000 barrels per day (b/d), the least since January 2015, and about 40% less than in January 2024. U.S. biodiesel producers only partially ramped up production in February and March, bringing the quarterly production to about 70,000 b/d, a decrease of more than 30% from 1Q24.

U.S. renewable diesel production averaged about 170,000 b/d in 1Q25, down 12% from 1Q24. The decrease in renewable diesel production was not as large on a percentage basis as the decrease in biodiesel production, mostly because renewable diesel production increased at a greater rate than biodiesel production in 2024. Reduced output at renewable diesel plants was partially offset by the nearly 20% increase in renewable diesel production capacity since 1Q24. However, compared with 4Q24, when renewable diesel production capacity was comparable to current levels, 1Q25 production was down almost 25%.

Poor profitability in 1Q25 contributed to production declines. Diamond Green Diesel, Phillips 66, and Marathon all reported operating losses from renewable diesel in the quarter. In addition, trade press has suggested negative margins for biodiesel.

Another reason U.S. production of biomass-based diesels declined in 1Q25 was uncertainty about federal biofuel tax credits. Before 2025, producers and importers of biomass-based diesel received a $1 per gallon (gal) blender’s tax credit (BTC) for each gallon blended with petroleum diesel. Under the Inflation Reduction Act, the BTC was slated to be replaced with the Section 45Z Clean Fuel Production Credit in 2025. This new credit would change the flat $1/gal tax credit to a value based on the carbon intensity of the feedstocks used. However, delays in releasing final guidance for the tax credit has left biofuel producers unsure about their profitability, causing some producers to idle operations.

We forecast production of renewable diesel and biodiesel to increase as the year progresses to meet existing RFS mandates.

Complete report: https://www.eia.gov/todayinenergy/archive.php

Short Term Energy Outlook

Released June 10, 2025

Forecast overview

Trade policy assumptions. The U.S. macroeconomic outlook we use in the Short-Term Energy Outlook (STEO) is based on S&P Global’s macroeconomic model. S&P Global’s most recent model reflects the tariffs announced in April and includes the 90-day temporary suspension of tariffs granted to certain countries. S&P Global finalized its most recent model before the U.S. Court of International Trade ruled on May 28 to temporarily halt the implementation of all reciprocal tariffs. As a result, our macroeconomic forecast assumes lower tariffs on China’s products compared with last month’s STEO and 10% tariffs on countries subject to the 90-day temporary suspension. These differences in tariff rates likely have offsetting effects on the macroeconomic forecast.

U.S. crude oil production. We forecast U.S. crude oil production will decline from an all-time high of 13.5 million barrels per day (b/d) in the second quarter of 2025 (2Q25) to about 13.3 million b/d by 4Q26 because of decreasing active drilling rigs and declining oil prices. Last month, active rigs decreased by much more than we had expected in our May STEO, based on data from Baker Hughes. With fewer active drilling rigs, we forecast U.S. operators will drill and complete fewer wells through 2026. On an annual basis, we now forecast crude oil production will average a bit more than 13.4 million barrels per day in 2025 and a bit less than 13.4 million b/d in 2026.

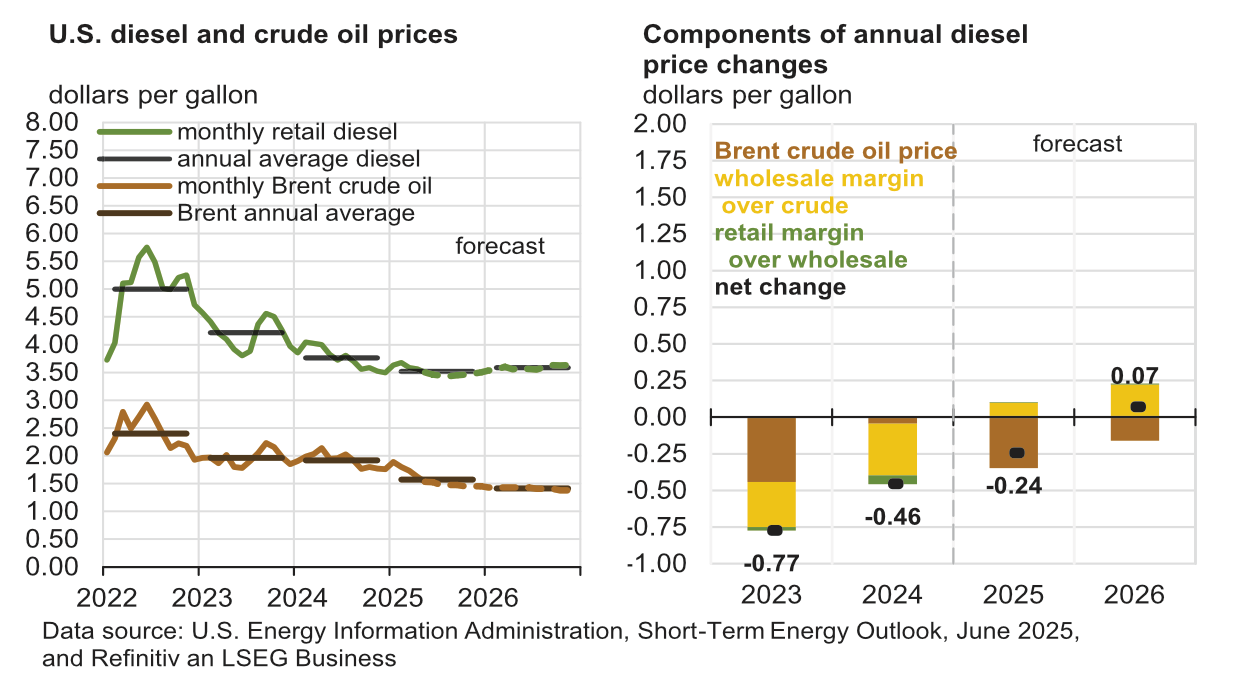

Global oil prices. We expect rising global oil inventories will drive crude oil prices lower over the forecast period. The Brent crude oil spot price fell for the fourth consecutive month in May, averaging $64 per barrel (b), down $4/b from April. We forecast that the Brent price will fall to an average of $61/b by the end of this year and average $59/b in 2026.

U.S. retail gasoline prices. Lower crude oil prices result in lower retail gasoline prices in our forecast. Regular grade retail gasoline prices in our forecast average $3.14 per gallon in 3Q25, 7% less than the same time last year. We expect that retail gasoline prices will decrease across the United States through the end of 2026 except for on the West Coast, where refinery capacity reductions are expected to contribute to a 4% annual price increase next year.

Complete report: https://www.eia.gov/outlooks/steo/

In 2024, the United States produced more energy than ever before

Released June 9, 2025

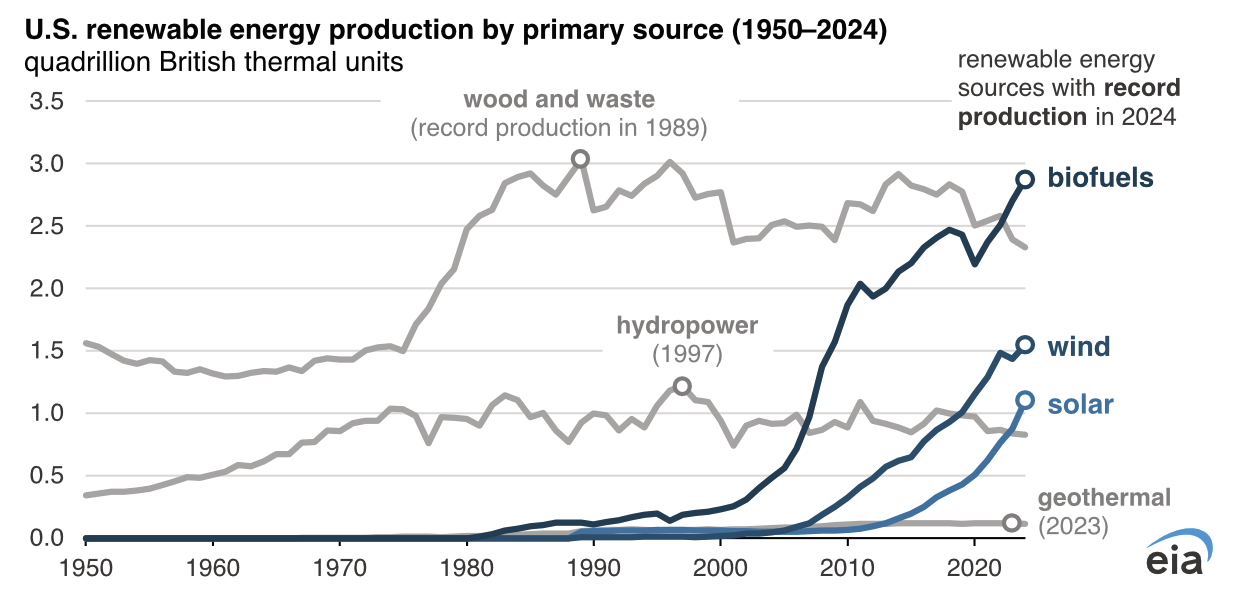

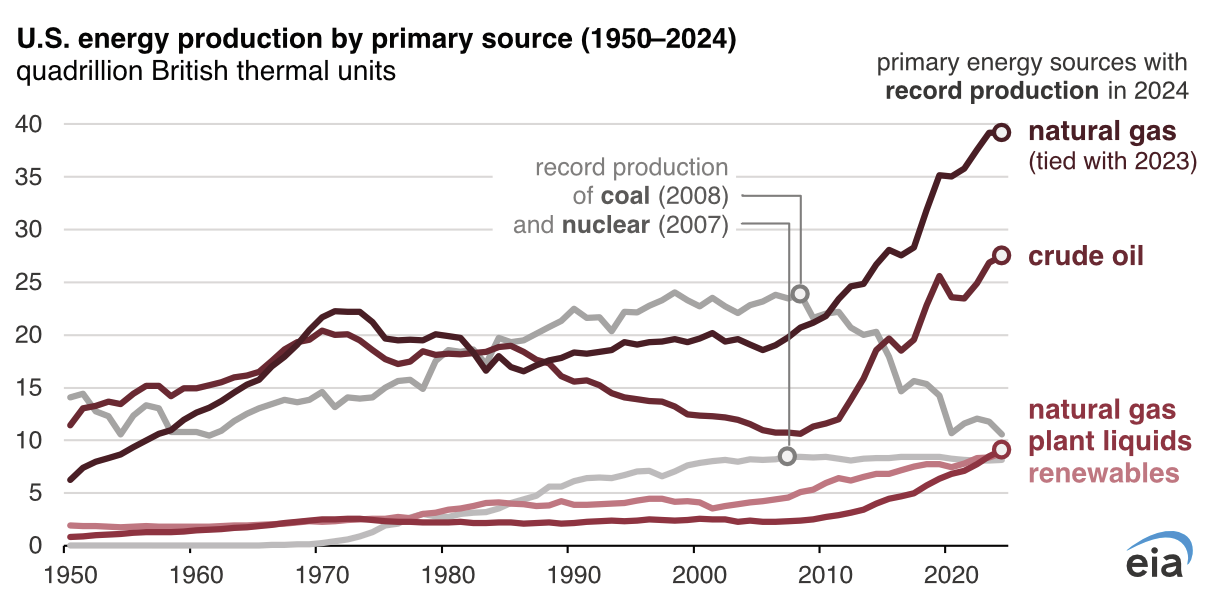

In 2024, the United States produced a record amount of energy, according to data in our Monthly Energy Review. U.S. total energy production was more than 103 quadrillion British thermal units in 2024, a 1% increase from the previous record set in 2023. Several energy sources—natural gas, crude oil, natural gas plant liquids, biofuels, solar, and wind—each set domestic production records last year.

Natural gas accounted for about 38% of U.S. total energy production in 2024 and has been the largest source of U.S. domestic energy production every year since 2011, when it surpassed coal. U.S. dry natural gas production was nearly 38 trillion cubic feet, about the same as in 2023.

Domestic crude oil accounted for about 27% of U.S. total energy production in 2024, as the United States continues to be the world’s top crude oil-producing country. U.S. crude oil production was a record 13.2 million barrels per day in 2024, 2% more than the previous record set in 2023. Almost all of the production growth came from the Permian region that spans parts of New Mexico and Texas.

Coal accounted for about 10% of U.S. total energy production in 2024. At 512 million short tons, last year’s coal production was the lowest annual output since 1964. Coal was the largest source of U.S. energy production from 1984 through 2010.

Natural gas plant liquids (NGPL), which includes fuels such as ethane and propane that are associated with natural gas processing, accounted for about 9% of U.S. total energy production in 2024. NGPL production was a record 4 trillion cubic feet in 2024, up 7% from 2023. Domestic NGPL production have increased every year since 2005 as U.S. natural gas production and processing capacity have increased.

Biofuels, wind, and solar production each set records in 2024, contributing to record total renewable energy production in the United States. In 2024, U.S. total biofuels production, which includes ethanol, renewable diesel, biodiesel, and other biofuels such as sustainable aviation fuel (SAF), was a record 1.4 million barrels per day, up 6% from previous records set in 2023.

In 2024, U.S. solar and wind production increased by 25% and 8%, respectively, as new generators came online. Output from other energy sources that are primarily used for electric power generation either peaked decades ago (hydropower and nuclear) or fell slightly from their 2023 values (geothermal).

Complete report: https://www.eia.gov/todayinenergy/detail.php?id=65445