Loss of tax credits for imported biofuels and lower domestic consumption blamed for significant decrease.

The U.S. Energy Information Administration’s “Today in Energy” analysis of September 4, 2025 reported the following:

U.S. imports of biodiesel and renewable diesel significantly decreased in the first half of 2025 (1H25) compared with the same period in previous years. This decline is primarily due to the loss of tax credits for imported biofuels and generally lower domestic consumption of these fuels, the EIA reported.

Renewable diesel and biodiesel are biomass-based diesel fuels that can replace petroleum-based distillate and be used to comply with the Renewable Fuel Standard (RFS) blending requirements for refiners administered by the U.S. Environmental Protection Agency.

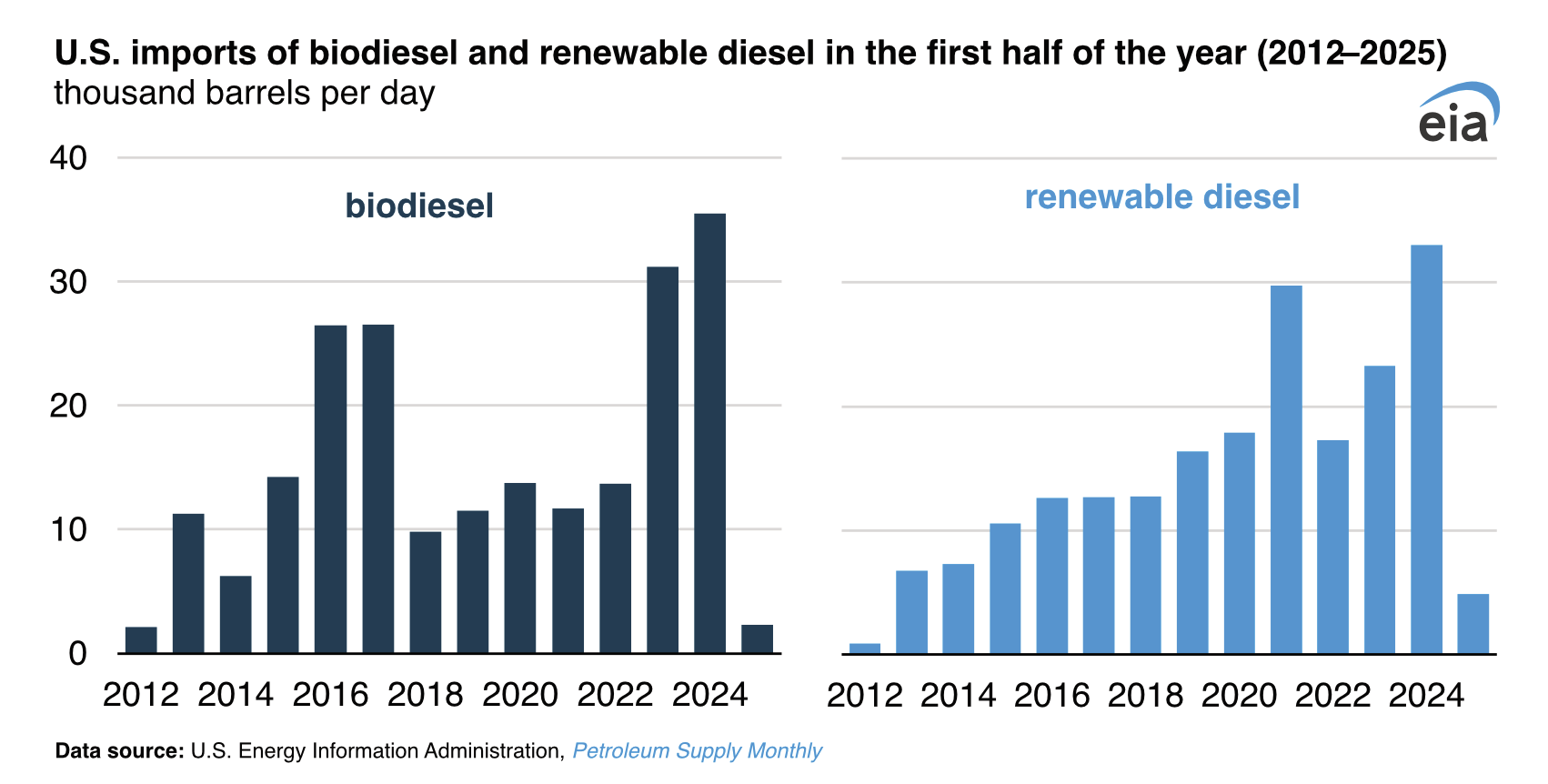

In 1H25, U.S. biodiesel imports averaged 2,000 barrels per day (b/d), a sharp drop from 35,000 b/d in 1H24. Renewable diesel imports averaged 5,000 b/d, down from 33,000 b/d in 1H24. These import levels were the lowest for the first half of any year since 2012, when U.S. biodiesel consumption was less than half of 2024 levels and renewable diesel consumption was negligible.

One key reason for the sharp drop in biodiesel and renewable diesel imports in early 2025 is the loss in tax credits for imported biofuels. Before 2025, both imported and domestically produced bio-diesel and renewable diesel received a $1 per gallon blender’s tax credit (BTC). The Inflation Reduction Act replaced the BTC with the Section 45Z Clean Fuel Production Credit in 2025, which only applies to domestic production. This tax credit change placed imports at a relative economic disadvantage.

A second reason biodiesel and renewable diesel imports dropped in 1H25 was low U.S. consumption of these fuels because of uncertainty around blending requirements and negative profit margins for blending biofuels. Compared with 1H24, U.S. consumption of renewable diesel was down about 30 percent in 1H25, and biodiesel consumption was down about 40 percent. This lower consumption reduced demand for both imported and domestically produced biofuels.

The combination of poor blending margins and the relative economic disadvantage for imported biofuels led domestic blenders to rely on domestically produced biofuels for the smaller amounts they were blending. As a result, international biofuel producers found fewer profitable opportunities to send product to the United States. For example, Neste, the producer of all of the renewable diesel imported to the United States, reported a lower share of exports going to the United States in 1H25 than in 1H24. Looking ahead, the EIA expects U.S. consumption of biodiesel and renewable diesel to increase as the year progresses to meet existing RFS mandates, but imports of the fuels will likely remain low because of the change in tax policy.

Although the EIA does not explicitly forecast biodiesel and renewable diesel imports in the Short-Term Energy Outlook (STEO), they do forecast U.S. net imports. The EIA is now assuming low imports for both products in the forecast period and forecast U.S. biodiesel net imports in 2025 and 2026 to be their lowest since 2012.